Valeo Plans EUR500 Million Five-Year Bond, To Buy Back 2013 Bond

09 Janvier 2012 - 12:09PM

Dow Jones News

French car parts maker Valeo SA (FR.FR) is planning a EUR500

million, five-year bond, one of the banks running the deal said

Monday.

Pending initial price guidance, one of the banks said the deal

would price in the 6% area.

At the same time, the company is offering to buy back its EUR600

million bond maturing June 24, 2013, of which EUR400 million is

outstanding. The amount to be purchased will be determined by the

company at the expiry of the offer on Jan. 16.

The purchase price will be 130 basis points over the midswaps

curve on Jan. 17, one of the banks managing the offer said.

BNP Paribas SA, Credit Agricole SA, Mitsubishi UFJ Financial

Group, Societe Generale SA and Citigroup Inc. are bookrunners on

the five-year deal and managers of the buyback offer.

-By Serena Ruffoni, Dow Jones Newswires; +44 (0) 207 842 9349;

serena.ruffoni@dowjones.com

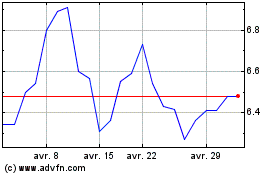

Valeo (PK) (USOTC:VLEEY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Valeo (PK) (USOTC:VLEEY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024

Real-Time news about Valeo SE (PK) (OTCMarkets): 0 recent articles

Plus d'articles sur Valeo S.A. ADS