Veolia Picks Potential Buyers For UK Water, US Solid Waste Units

16 Mai 2012 - 7:15PM

Dow Jones News

Antoine Frerot, Chief Executive of French waste and water

utility Veolia Environnement SA (VE), said it has selected

potential buyers for its U.K. water and U.S. solid waste units,

without identifying any.

During the company's annual shareholders meeting, Frerot said

the company plans to sell the assets this summer. He also said the

company started negotiations with an investor to sell its

transportation unit Veolia Transdev since February, though he

didn't identify the investor either.

People familiar with the negotiations recently told Dow Jones

Newswires three groups submitted indicative offers for the U.K. and

U.S. units. First group is led by AXA Private Equity, while the

second is led by GS Infrastructure Partners, a unit of Goldman

Sachs Group Inc. (GS), and the third is led by London-based Icon

Infrastructure.

The company's Chief Executive said he doesn't expect the company

will post a net loss in 2012, though this year and next will be

"demanding."

Veolia's Chief Financial Officer Pierre-Francois Riolacci said

the company has managed to cut its costs by EUR75 million this

year.

Separately, Veolia's shareholders appointed Jacques

Aschenbroich, the chief executive of auto part maker Valeo SA

(FR.FR), as Veolia's board member.

-By Inti Landauro, Dow Jones Newswires; +33 1 4017 1740;

inti.landauro@dowjones.com

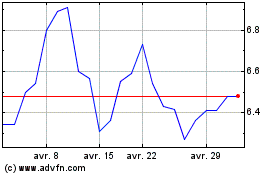

Valeo (PK) (USOTC:VLEEY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Valeo (PK) (USOTC:VLEEY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Valeo SE (PK) (OTCMarkets): 0 recent articles

Plus d'articles sur Valeo S.A. ADS