ALSTOM SA: Moody's Investors Service confirms Alstom's Baa3 long-term issuer rating. Credit outlook lowered to negative from stable. Alstom reaffirms its commitment to an Investment Grade rating.

12 Octobre 2023 - 9:12PM

ALSTOM SA: Moody's Investors Service confirms Alstom's Baa3

long-term issuer rating. Credit outlook lowered to negative from

stable. Alstom reaffirms its commitment to an Investment Grade

rating.

Moody's Investors Service confirms

Alstom's Baa3 long-term issuer rating

Credit outlook lowered to negative from

stable

Alstom reaffirms its commitment to an

Investment Grade rating

12 October 2023 – The credit

rating agency Moody’s Investors Service has on 12 October decided

to confirm Alstom’s Baa3 long-term issuer rating. It has lowered

its credit outlook to Negative from Stable. The details of the

action taken by Moody’s are as follows:

|

Alstom |

Moody’s rating |

|

Outlook |

Negative (vs Stable) |

|

Issuer rating |

Baa3 (unchanged) |

|

Senior Unsecured |

Baa3 (unchanged) |

|

Short-term rating |

P-3 (unchanged) |

Source :Moody’s

Investors Service.

Moody’s methodology:

Moody’s is using the Global Manufacturing

Companies rating methodology (published in 2021) to rate Alstom.

Under this methodology, some factors (using Moody’s specific

calculation) are weighted in order to assess the final rating of

the Group.

Factors that could lead to a

downgrade:

|

Factors |

Moody’s trigger |

|

Moody’s adjusted EBITA Margin |

<5% |

|

Moody’s adjusted leverage Gross Debt / EBITDA |

3.75x |

|

Liquidity |

FCF<0 |

|

Financial policy |

Less conservative |

Source :Moody’s Investors Service.

Factors that could lead to an

upgrade:

|

Factors |

Moody’s trigger |

|

Moody’s adjusted EBITA Margin |

>6% |

|

Moody’s adjusted leverage Gross Debt / EBITDA |

<2.75x |

|

Liquidity |

FCF>0 |

|

Financial policy |

Conservative |

Source :Moody’s Investors Service.

Alstom anticipates the change in credit outlook

will have no impact on its ability to access short-term financing

and contract execution. The Group reaffirms its commitment to an

Investment Grade rating. On 4 October 2023, the Group confirmed its

mid-term targets regarding sales growth, book-to-bill,

profitability and cash generation.

Alstom will publish its full set of results for

the first half of fiscal year 2023/24 on 15 November 2023 followed

by an analyst and investor call hosted by Chairman & CEO, Henri

Poupart-Lafarge, and CFO, Bernard Delpit.

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel.: +33 (0) 7 63 63 09 62

coralie.collet@alstomgroup.com Thomas ANTOINE - Tel. :

+33 (0) 6 11 47 28 60thomas.antoine@alstomgroup.com

Investor relations:Martin VAUJOUR – Tel. : +33 (0)

6 88 40 17 57martin.vaujour@alstomgroup.com Estelle MATURELL

ANDINO – Tel.: +33 (0)6 71 37 47 56

estelle.maturell@alstomgroup.com |

|

- Alstom Rating - 121023 - EN

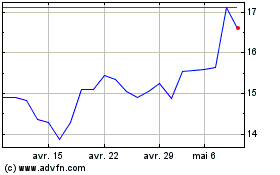

Alstom (EU:ALO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alstom (EU:ALO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024