- 2023 sales of €2.8 million, i.e. 17 Aeson® implants, including

11 in the last quarter

- 2024 sales forecast of around €14 million

- Active exploration of financing options to extend, in the

short-term, the Company's financial horizon beyond May 2024.

- 12-month financing requirements estimated at around €45

million

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), today reports its annual results for the year

ending December 31, 2023, and provides an update on its progress

and prospects for 2024.

The annual financial statements were approved by the Board of

Directors on April 22, 2024, on a going concern basis. On April 30,

2024, the Company will publish its 2023 Universal Registration

Document, including the annual financial report and the statutory

auditor’s report, whose audit procedures are being finalized.

Readers’ attention is drawn to the fact that the Company’s cash

runway extends to mid-May 2024. Should the financings anticipated

by the CARMAT not materialize by that date, the Company would then

have to make significant adjustments to his annual financial

statements.

Stéphane Piat, Chief Executive Officer of CARMAT,

commented: "In many respects, 2023 has been a structuring year

for CARMAT, crowned in December by the symbolic milestone of 50

CARMAT heart implants since the start of our clinical experience,

and by the opening of a second production building in

Bois-d'Arcy.

Backed by a first-class industrial tool, sized to support our

growth, we can now look forward with confidence to the commercial

deployment of our therapy. The momentum in Aeson® sales that began

in the last quarter of 2023, with 11 implantations, has continued

since the start of 2024, at an average rate of around 3 implants

per month.

To date, we are on track with our targets for the training of

additional hospitals, and implants as part of the EFICAS study. Our

geographical deployment is continuing, and 25 of the 39 hospitals

trained to commercial implants have already referred patients to

CARMAT, confirming the medical community's strong interest in our

therapy and its potential. All these advances enable us to

anticipate a substantial gradual growth in our sales over the

coming months, and revenue of around €14 million for 2024.

I would like to thank all our teams for their resilience,

particularly over the past two challenging years. I would also like

to express my gratitude to our shareholders, both historical and

more recent, whose trust enables us to make progress towards our

goal of making CARMAT a leading player in the treatment of advanced

heart failure."

Simplified income statement (€

millions)

2023

2022

Revenue

2.8

0.3

Net operating expense

-52.5

-51.9

Net financial expense

-3.1

-3.8

Net non-recurring income

-

-

Research and innovation tax credit

+1.7

+2.1

Net loss

-53.9

-53.7

Revenues of €2.8 million corresponded to the sale of 17 Aeson®

artificial hearts, including 7 in a commercial set-up in Germany

and Italy, and 10 in the EFICAS clinical trial in France.

As a result of a tight cost control, the operating loss for the

year was contained at €52.5 million, on par with that of 2022

(€51.9 million).

In 2023, CARMAT has dedicated most of its efforts and

resources to:

- sales development, supported by the

training of new hospitals (33 centers trained for commercial

implants by December 31, 2023), and by preparations for the

introduction of Aeson® in 8 additional countries;

- the extension of its Bois-d'Arcy

manufacturing site, enabling it to reach a capacity of 500 hearts

per year by early 2024;

- the acceleration of the EFICAS study in

France (10 implantations in 2023, including 7 in the last quarter);

and

- ongoing discussions with the FDA with a

view to bringing Aeson® to the US market in 2027.

Taking into account net financial expense (-€3.1 million),

non-recurring items and the research tax credit (+€1.7 million),

the net loss for 2023 is €53.9 million, virtually unchanged from

2022.

As of December 31, 2023, the Company's cash position stood at

€8.0 million (versus €51.4 million at the end of 2022), reflecting

the following cash flows:

(€ millions)

2023

2022

Cash flow from operating activities

-53.5

-54.4

Cash flow from investment activities

-4.9

-2.0

Cash flow from financing activities

+15.0

+68.6

Change in cash position

-43.4

+12.2

Cash flow from operating and investing activities in 2023 stood

at -€58.4 million, up €2 million on 2022, due to higher industrial

capital expenditure, associated with the extension of the Company's

manufacturing capacity.

In terms of financing, in 2023 the Company received:

- €7 million as part of a private placement

in October 2023 with 3 of the Company's core shareholders (Lohas,

Sante Holdings and Therabel Invest);

- €5.8 million under the €13.2 million1 mixed

financing granted to CARMAT in April 2023 as part of the "France

2030" plan;

- €2.2 million under the €2.5 million grant

awarded to CARMAT at the end of 2022 as a winner of the European

Union's2 "EIC Accelerator" program; and

- the second €0.7 million tranche of the

total €1.4 million grant (known as "CAP23")3 awarded to CARMAT

under the "Plan de Relance pour l'industrie - Secteurs

Stratégiques" call for projects.

In April 2023, CARMAT also made the first half-yearly repayment

of €0.7 million due under its PGE (government-backed loan)

contracted with BNP Paribas in 2020.

Net financial debt

As of December 31, 2023, taking into account the debt

rescheduling agreement signed4 in March 2024 with its financial

creditors, CARMAT's net financial debt5 was as follows:

(€ millions)

31.12.2023

+ Long-term financial liabilities

57.4

+ Short-term financial liabilities

0.2

- Cash and cash equivalents

-8.0

Net financial debt

49.6

This agreement, successfully negotiated by the Company with its

three bank creditors (the European Investment Bank - "EIB", BNP

Paribas - "BNPP", and Bpifrance - "BPI"), enables CARMAT to

alleviate its short-term cash constraints, in particular by

reducing the cash flows associated with repayment of the said loans

by more than €30 million, compared with the initial schedules, over

the period 2024-2025. As a result of this agreement, short-term

financial liabilities at December 31, 2023 are limited to €0.2

million. Through the equitization6 of the EIB loan, this agreement

should also significantly limit cash flows linked to repayments

over the 2026-2028 period.

Financing horizon

Given in particular the capital increase of €16.5 million (gross

amount) carried out in January 2024, CARMAT's financial resources

allow the Company, according to its current business plan, to

finance its activities until mid-May 2024. The Company estimates

its 12-month financing needs at around €45 million.

CARMAT is working very actively on initiatives aimed at

strengthening its equity capital and cash position in the short

term.

The Company thus anticipates a gradual extension of its

financing horizon to 12 months, in several stages: a forthcoming

capital increase, supported by historical shareholders, which

should enable it to strengthen its cash position and thus pursue

its activities beyond May 2024; then other additional initiatives

(including one or more further capital increases) enabling it to

further extend its financing horizon, bearing in mind that the

expected growth in the Company's sales should strengthen CARMAT's

attractiveness to investors, and thus facilitate the securing of

new financing in the future. It should also be noted that the

Company applies strict financial discipline, aimed at reducing its

cash burn on operations and capital expenditure by around 20%

between 2023 and 2024.

CARMAT is constantly pursuing an active investor relations

policy, and seeking new financing (equity, public support or other

types of financing) both in France and abroad. It believes it can

count, to a certain extent, on the support of some of its key

shareholders.

Based on these considerations, the going concern assumption was

adopted by the Board of Directors, which approved the financial

statements for 2023. However, there is no guarantee that the

anticipated financing will be available. This creates a significant

degree of uncertainty that could jeopardize the Company's ability

to continue as a going concern and could lead to the Company being

placed in receivership (“redressement judiciaire”) in the short to

medium term.

Milestone of 50 Aeson® implants since inception reached in

2023

Since the 1st implant in December 2013, CARMAT technology has

been widely disseminated through clinical trials and then

commercially: by December 31, 2023, 50 patients had benefited from

the Aeson® heart since the Company's inception, in 8 different

countries, bringing the cumulative experience to over 22

patient-years. By the end of 2023, 13 patients were living with the

Aeson® device.

With strong support from leading cardiologists in Europe and the

United States, Aeson® is gradually becoming a benchmark solution

for transplant-eligible patients awaiting the availability of a

human heart.

Early sales momentum

CARMAT's revenue of €2.8 million in 2023 corresponds to the sale

of 17 Aeson® prostheses, including 11 in the last quarter,

demonstrating a solid start to the sales momentum (with a rate of

around one implant per week achieved in the last quarter),

underpinned by CARMAT's ability to roll out its therapy on a large

scale industrially and commercially.

It should be noted that sales of Aeson® were limited during the

first half of 2023 by the low number of prostheses available over

the period, due to supplier supply problems which delayed the

ramp-up of production as initially planned by the Company.

Production rates gradually returned to normal from the summer

onwards.

By December 31, 2023, 33 hospitals in 11 different countries had

been trained and were therefore ready to carry out Aeson® implants

on a commercial basis.

Acceleration of the EFICAS study in France

The EFICAS study aims to gather additional data on the efficacy

and safety of the Aeson® heart, as well as medico-economic data to

support the device's value proposition and reimbursement. It is due

to include 52 patients eligible for transplantation in France and

should be completed in 2025.

10 patients were included in 2023 in this clinical study (in 6

different hospitals in Paris, Lille, Lyon, Le Plessis-Robinson and

Montpellier), including 7 during the fourth quarter of the year,

bringing the total number of inclusions in this study to 11

patients by December 31, 2023.

At the same date, 8 French hospitals7 had already been trained

for implantations within the framework of the study.

This is an essential study for the future marketing and

reimbursement of Aeson® in France, but also to support the

application for PMA (marketing authorization) in the United States,

which the Company anticipates, at this stage, during the latter

part of 2026.

As a reminder, CARMAT has received €13 million from the French

national innovation8 fund to partially finance this study.

Manufacturing capacity increased to 500 hearts per

year

In 2023, CARMAT continued to invest in its industrial

facilities, particularly with the opening of a second production

building at Bois-d'Arcy, enabling it to increase its manufacturing

capacity to 500 hearts per year from early 2024, corresponding to

potential annual sales of around €100 million.

The Company has also continued to implement its multi-year

roadmap aimed at strengthening its base of industrial suppliers and

subcontractors, with a view to reinforcing continuity of supply and

reducing Aeson®’s manufacturing cost.

Strengthening Aeson® reliability

In 2023, Aeson® continued to demonstrate a safety profile that

clearly sets it apart from all other mechanical circulatory

assistance systems: since its inception, Aeson® has not given rise

to any gastrointestinal bleedings or disabling strokes.

At the end of the year, CARMAT also implemented a software

enhancement for Aeson®, which significantly strengthens the safety

profile of its device: from now on, for many potential malfunctions

linked to the prosthesis's electronic components, the Aeson®

software will automatically "correct" said faults by appropriately

adapting the artificial heart's operation, so that the patient's

support is not impacted.

Secured non-dilutive financing of €13 million as part of the

"France 2030" plan

In April 2023, the Company was awarded a total of €13.2 million

in blended financing (including €7.9 million in grants and €5.3

million in repayable advances) as part of the "France 2030" plan.

The aim is to support the increase in annual production capacity of

Aeson® artificial hearts to 1,000 per year within 5 years, and to

reduce the production cost of the prosthesis. This financing is

structured in tranches available according to the progress of the

project over the period 2023-2026. A total of €5.8 million was

perceived in 2023 by CARMAT.

Adapting governance

The Combined General Meeting of May 11, 2023 approved the

appointment of Therabel Invest, represented by Mr. Laurent Kirsch,

as a director of the Company, for a 3-year term. Mr. Laurent Kirsch

brings to the Board his extensive experience of the healthcare

industry, including at international level, as well as his

financial expertise. At the date of publication of this press

release, the Board of Directors, chaired by Alexandre Conroy,

comprised 12 directors, 7 of whom were independent.

Since the beginning of 2024, CARMAT has implanted 11 Aeson®

hearts, at a rate of around 3 per month.

Strong momentum in EFICAS study implants

Sales momentum is particularly strong in the EFICAS study in

France, with 8 implants since January 1, 2024, in 7 different

hospitals, which is fully in line with the target of around 30

implantations by 2024.

To date, 19 implants have already been carried out since the

start of the study, in which 10 centers are now taking part (two

more than at the end of 2023: CHU Dijon-Bourgogne and CHU de

Nantes), confirming the expected completion of the study in H1

2025, in line with the objective10.

Ongoing commercial deployment

Since the beginning of the year, 6 new hospitals have been

trained, bringing to 39 the number of centers able to carry out

Aeson® commercial implants in 14 different countries. This confirms

the Company's target of around fifty trained centers by the end of

the year.

To date, of these 39 centers, 12 have already carried out at

least one commercial implant of Aeson® and 25 have already referred

patients for a potential implantation, confirming the strong

interest of the medical community in the therapy.

3 commercial implants have been completed since January 1, 2024,

including 2 in Germany and 1 for the first time in Poland, in

April.

In addition to the three countries already commercially active

(Germany, Italy and Poland), 5 others are now fully activated and

ready to carry out implants (Switzerland, Austria, Slovenia, Greece

and Israel). In 2024, the Company anticipates the activation of

several other European countries, either through direct sales or

through distributors with whom distribution contracts have already

been signed or are in the process of being signed.

Based on these encouraging indicators, the Company anticipates a

substantial gradual sales growth over the year, and revenue of

around €14 million for 2024.

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release and the information contained herein do not

constitute an offer to sell or subscribe, nor a solicitation of an

order to buy or subscribe to CARMAT shares in any country. This

press release may contain forward-looking statements by the company

regarding its objectives and prospects. These forward-looking

statements are based on the current estimates and anticipations of

the company's management and are subject to risk factors and

uncertainties such as the company's ability to implement its

strategy, the pace of development of CARMAT's production and sales,

the pace and results of ongoing or planned clinical trials,

technological evolution and competitive environment, regulatory

changes, industrial risks, and all risks associated with the

company's growth management. The company's objectives mentioned in

this press release may not be achieved due to these elements or

other risk factors and uncertainties.

Significant and specific risks of the company are those

described in its universal registration document filed with the

French Financial Markets Authority (Autorité des marchés financiers

- the “AMF”) under number D.23-0323 and in its amendment

filed with the AMF on January 17, 2024 under number D.23-0323-A1.

Readers' attention is particularly drawn to the fact that the

company's current cash runway is limited to mid-May 2024. Readers

and investors are also advised that other risks, unknown or not

considered significant and specific, may or could exist.

Aeson® is an active implantable medical device commercially

available in the European Union and other countries recognizing CE

marking. The Aeson® total artificial heart is intended to replace

the ventricles of the native heart and is indicated as a bridge to

transplant for patients suffering from end-stage biventricular

heart failure (INTERMACS classes 1-4) who cannot benefit from

maximal medical therapy or a left ventricular assist device (LVAD)

and who are likely to undergo a heart transplant within 180 days of

implantation. The decision to implant and the surgical procedure

must be carried out by healthcare professionals trained by the

manufacturer. The documentation (clinician manual, patient manual,

and alarm booklet) should be carefully read to understand the

features of Aeson® and the information necessary for patient

selection and proper use (contraindications, precautions, side

effects). In the United States, Aeson® is currently exclusively

available as part of an Early Feasibility Study approved by the

Food & Drug Administration (FDA).

1 Mixed financing of €13.2 million, including a €7.9 million

grant and a €5.3 million conditional advance, to be received in

several instalments over the period 2023-2026, depending on the

achievement of operational milestones. 2 The final balance of this

grant (€0.4 million) is expected in 2024. 3 The final balance of

this grant (€0.35 million) is expected in 2024. 4 The financial

debt rescheduling agreement entered into by the Company in March

2024, with the banks BNP Paribas and Bpifrance (for the PGEs) and

with the European Investment Bank, is detailed in the Company's

press release of March 22, 2024. 5 Financial liabilities include

the principal (€30 million) and interest due on the EIB (European

Investment Bank) loan, the outstanding principal (€9.5 million) and

interest due on the two state-guaranteed loans (PGE), as well as

interest on the €14.5 million repayable advance obtained from

Bpifrance, and on the €2.3 million repayable advance received in

2023 as part of the "France 2023 (Santé)" Plan. Long-term financial

liabilities correspond to those with maturities in excess of 12

months. The characteristics and conditions of the loans (before the

March 2024 rescheduling agreement) and the repayable advance from

Bpifrance are described in Section 3 of the Company's 2022

universal registration document. 6 For further details on

equitization, please refer to the press release mentioned in note

4. 7 AP-HP GHU Pitié Salpêtrière, Hôpital Européen Georges

Pompidou, CHU de Rennes, CHU de Strasbourg, Hospices Civils de

Lyon, CHRU de Lille, Hôpital Marie-Lannelongue and CHU de

Montpellier. 8 This funding is received as and when the sites are

set up as part of the study. 9 Data as of April 23, 2024. 10 As a

reminder, the EFICAS study involves a total of 52 implantations of

Aeson®.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423648307/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1

39 45 64 50 contact@carmatsas.com

Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com

NewCap Financial Communication & Investor

Relations

Dusan Oresansky Jérémy Digel Tel.: +33 1 44 71 94

92 carmat@newcap.eu

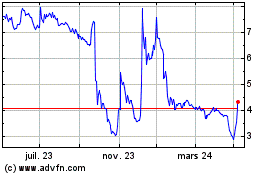

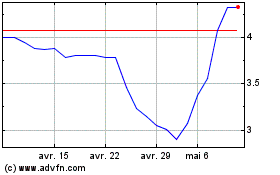

Carmat (EU:ALCAR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Carmat (EU:ALCAR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024