- New investor Redmile Group enters Sensorion’s capital –

existing investors Invus and Sofinnova Partners re-invest

significantly

- New financing will enable the Company to extend its cash runway

until the end of September 2024

- Redmile Group to become a board member as part of the private

placement, in replacement of Bpifrance Investissement whose

permanent representative was Mr. Jean-François Morin

Regulatory News:

Sensorion (FR0012596468 – ALSEN) a pioneering

clinical-stage biotechnology company which specializes in the

development of novel therapies to restore, treat and prevent within

the field of hearing loss disorders, today announced a €35 million

private placement financing reserved to the categories of

beneficiaries (the “Private Placement”) and secured through

the execution by the Company of definitive agreements with Redmile

Group, a US-based healthcare investor, and Sensorion’s existing

shareholders, Invus and Sofinnova Partners for (i) the subscription

by such investors of 107,142,856 ordinary shares newly issued by

the Company (the “New Shares”) at a price per New Share of

€0.28 (the “Subscription Price”) and (ii) the subscription

by Redmile Group of 17,857,143 pre-funded warrants (bons de

souscription d’actions préfinancés) (the "Warrants") against

payment of a pre-funded amount per Warrant of €0.18 (the

“Pre-funded Amount”), one (1) Warrant giving right to one

(1) ordinary share at an exercise price corresponding to the

Subscription Price less the Pre-funded Amount (the “Warrant

Shares”). The Subscription Price for the New Shares represents

a 3.95% discount to the average of the closing prices of the shares

during 5 consecutive trading days (i.e June 27th,28th,29th,30th and

July 3rd 2023) chosen from among the last thirty trading sessions,

which was €0.2915, in accordance with the 13th resolution of the

shareholders’ meeting of the Company held on May 24th, 2023. The

Private Placement is expected to close on August 8th, 2023.

Nawal Ouzren, Chief Executive Officer of Sensorion, said:

“We are thrilled to announce today’s successful capital raise of

EUR 35 million. We are excited to welcome among our shareholders a

new US-based healthcare investor, Redmile Group. At the same time,

the renewed confidence of Invus and Sofinnova Partners means that

Sensorion now has three influential reference shareholders with a

long-term vision. With this strengthened investor base in both the

US and Europe, we now look forward to further develop our first

gene therapy program OTOF-GT into the clinic and accelerate our

second program GJB2-GT preclinical IND enabling activities. This

capital increase will boost our relentless efforts in building a

comprehensive franchise in the treatment of hearing loss caused by

genetic mutations. Last but not least, I would like to thank

Institut Pasteur for their team’s scientific leadership and support

for our gene therapy projects.”

Khalil Barrage, ad interim Chair, Sensorion, said: “We

are very pleased to welcome Redmile Group in Sensorion. We look

forward to partnering with them to build a leading inner ear gene

therapy franchise”.

Redmile Group, said: “We believe gene therapy is a

potentially curative approach for indications with high unmet

medical need. We are pleased to be partnering with the Sensorion

team to advance these programs towards patients with genetic

hearing loss.”

Jean-François Morin, Investment Director at Innobio,

Bpifrance Investissement, said: “ It has been an honour to

represent Bpifrance Investissement at the board of directors of

Sensorion. Over the years Sensorion has been able to develop an

impressive franchise in the treatment of hearing loss caused by

genetic mutations through its collaboration with the Institut

Pasteur. Today, Sensorion is the only European biotech with

multiple gene therapy programs in the field of hearing loss. We are

very proud of this accomplishment. At Bpifrance Investissement and

in particular in our Venture Fund, Innobio, it is our mission to

support companies with high innovation profile and excellence in

development execution. Redmile together with Invus and Sofinnova

Partners will undoubtedly help the Company to pave the way to

success.”

Sensorion Next clinical milestones:

H2 2023 – SENS-401 CIO: NOTOXIS preliminary results H2 2023 –

OTOF-GT: CTA Approvals H1 2024 – SENS-401 in combination with

cochlear implantation: final proof-of-concept clinical data readout

H1 2024 – OTOF-GT: first patient inclusion

Half-year 2023 results is expected to be published by the

Company on September 20th, 2023. Existing cash (and cash

equivalents) of the Company as of June 30th, 2023 amounts, on a

non-audited basis, to €14,4 millions.

Impact on cash flow and use of proceeds

The Company intends to use the net proceeds from the Private

Placement, which amount to circa €33 million (based on the

aggregate Subscription Price and the Pre-funded Amount), to finance

the clinical development of OTOF-GT, the preclinical IND enabling

activities for GJB2-GT as well as for other R&D and corporate

overhead expenses.

Based on its forecasted expenses, cash balance as of June 30th,

2023 as well as the net proceeds from the Private Placement, the

Company believes that, it will able to finance its operations

through the end of September 2024. The company continues to pursue

non-dilutive financing for the other assets.

Main terms of the Private

Placement

Sensorion’s Board of Directors using the delegation of powers

granted by the 13th resolution of the shareholders' general meeting

held on May 24th, 2023 (capital increase with cancellation of

preferential subscription rights in favor of categories of persons

with specific characteristics) and in accordance with article L.

225-138 et seq. of the French Commercial Code (code de commerce),

has decided on August 3, 2023 to complete the issuance of the New

Shares and the Warrants. The New Shares were issued at a price of

€0.28, which represents a 3.95% discount to average of the closing

prices of the shares during 5 consecutive trading days (i.e. June

27th,28th,29th,30th and July 3rd 2023) chosen from among the last

thirty trading sessions, which was €0.2915, in accordance with the

13th resolution of the shareholders’ meeting of the Company held on

May 24th, 2023 and a 12.5% discount to the share price of the last

trading session preceding the Board of Directors held on August

3rd, 2023.

The issuance of the 107,142,856 New Shares will result in an

immediate capital increase of €29,999,999.68 (divided into a

nominal amount of €10,714,285.60 and a total issuance premium of

€19,285,714.08 and corresponding to a nominal value of 10 cent

(€0.1) plus an issuance premium of €0.18 per New Share),

representing approximately 134% of the Company’s share capital and

voting rights outstanding before the Private Placement. In

addition, the exercise of the Warrants and the correlative issuance

of the Warrant Shares, may result in a capital increase up to

€1,785,714.30 (nominal value), representing, together with the

issuance of the New Shares, approximately 156% of the Company’s

share capital and voting rights outstanding before the Private

Placement.

Redmile Group, who is a new shareholder to the Company, will

participate in the Private Placement by acquiring (i) 46,428,571

New Shares for an aggregate Subscription Price of €12,999,999.88

and (ii) 17,857,143 Warrants corresponding to the total number of

Warrants issued in the Private Placement for an aggregate

Pre-funded Amount of €3,214,285.74. The issuance of the Warrants to

the sole benefit of Redmile Group is intended to allow Redmile to

acquire up to 17,857,143 Warrants Shares upon obtaining from the

French Ministry of Economy through an authorization request or

prior notification, in accordance with French regulations regarding

the control of foreign investments in France1, the authorization

(express or tacit) to proceed with the crossing of 25% of the share

capital and/or voting rights of the Company (the “FDI

Clearance”).

Invus and Sofinnova Partners who are existing shareholders and

are also represented on the Board of Directors of the Company, will

participate in the Private Placement for subscription amounts of

€10 million and €7 million respectively, representing,

respectively, 28% and 20% of the aggregate gross amount of the

Private Placement. It is specified that Invus and Sofinnova

Partners, who are also members of Sensorion’s Board of Directors

did not take part in the vote of the Private Placement at the Board

of Directors’ meeting held on August 3rd, 2023.

Following the settlement-delivery expected to occur on August

21st, 2023, the Company's total share capital will be

€18,708,079.40 divided into 187,080,794 ordinary shares, each with

a par value of €0.10 and following, and subject to, the exercise of

Warrants and the issuance of the Warrant Shares, the Company's

total share capital will be increased, and fixed, at €20,493,793.70

divided into 204,937,937 ordinary shares, each with a par value of

€0.10. The New Shares, and as the case may be, the Warrant Shares,

will be fungible with the existing ordinary shares of the Company

and will be admitted to trading on Euronext Growth in Paris under

the ISIN FR0012596468.

Warrant Terms

Each of the Warrants will entitle the holder to subscribe for

one Warrant Share, at an exercise price equal to the Subscription

Price, including issue premium. The terms and conditions of the

Warrants provide that, on the settlement date of the Private

Placement, Redmile Group, as subscriber of all the Warrants, shall

pay the Pre-Funded Amount to the Company2.

The Warrants may be exercised at any time until December 15th,

2023 upon FDI Clearance (if applicable) against payment of the

remaining exercise price, less the Pre-funded Amount.

The Warrants are not transferrable to any third party, except to

any affiliate of the holder. The Warrants will not be listed.

Shareholding Structure after the

Private Placement

On an illustrative basis, a shareholder holding 1% of the

Company's share capital before the Private Placement and who did

not participate in the Private Placement will hold 0.43% of the

Company's share capital after the issuance of the New Shares and

0.39% of the Company's share capital upon issuance of the Warrant

Shares.

To the Company's knowledge, the shareholding structure, on a

non-diluted base, before and after the Private Placement and after

issuance of all the Warrants Shares, breaks down as follows:

Shareholding Structure as of July 31 2023 (non diluted)

Shareholding Structure POST Money(non diluted)

Shareholding Structure POST Money(After Redmile BSA

exercise) Number ofshares Number ofshares (%) Number ofVoting

Rights Number ofVoting Rights (%) Number ofshares Number ofshares

(%) Number ofVoting Rights Number ofVotingRights (%) Number

ofshares Number ofshares (%) Number ofVotingRights Number

ofVotingRights (%) Redmile Group LLC

46,428,571

24.8%

46,428,571

24.8%

64,285,714

31.4%

64,285,714

31.4%

Invus Public Equities

26,490,415

33.14%

26,490,415

33%

62,204,700

33.3%

62,204,700

33.2%

62,204,700

30.4%

62,204,700

30.4%

Sofinnova Partners

15,469,458

19.35%

15,469,458

19%

40,469,458

21.6%

40,469,458

21.6%

40,469,458

19.7%

40,469,458

19.8%

WuXi App Tec

5,249,608

6.57%

5,249,608

7%

5,249,608

2.8%

5,249,608

2.8%

5,249,608

2.6%

5,249,608

2.6%

3SBio

4,055,150

5.07%

4,055,150

5%

4,055,150

2.2%

4,055,150

2.2%

4,055,150

2.0%

4,055,150

2.0%

Innobio

3,499,874

4.38%

3,499,874

4%

3,499,874

1.9%

3,499,874

1.9%

3,499,874

1.7%

3,499,874

1.7%

SONOVA AG

2,941,176

3.68%

2,941,176

4%

2,941,176

1.6%

2,941,176

1.6%

2,941,176

1.4%

2,941,176

1.4%

Inserm Transfert Initiative

982,911

1.23%

982,911

1%

982,911

0.5%

982,911

0.5%

982,911

0.5%

982,911

0.5%

Cochlear

533,755

0.67%

533,755

1%

533,755

0.3%

533,755

0.3%

533,755

0.3%

533,755

0.3%

Sub Total Institutional Shareholders

59,222,347

74.09%

59,222,347

74%

166,365,203

88.9%

166,365,203

89%

184,222,346

89.9%

184,222,346

90.0%

Officers

160,000

0.20%

160,000

0%

160,000

0.09%

160,000

160,000

0.1%

160,000

0.1%

Directors

0

0.00%

0

0%

-

-

-

-

0.0%

-

0.0%

Employees & consulting

0

0.00%

0

0%

-

-

-

-

0.0%

-

0.0%

Treasury shares

158,634

0.20%

158,634

0.00

-

158,634

0.1%

-

0.0%

-

-

-

Free Float

20,396,957

25.52%

20,396,957

26%

20,396,957

10.90%

20,396,957

20,396,957

10.0%

20,396,957

10.0%

TOTAL

79,937,938

79,779,304

100%

187,080,794

187,082,160

204,937,937

100.0%

204,779,303

100.0%

Governance

The Board of Directors has, during its meeting held on August

3rd, 2023, decided the appointment (through cooptation) of Redmile

Group, as member of the Board of Directors in replacement of

Bpifrance Investissement, represented by Mr. Jean-François Morin,

who has resigned from its position as board member.

The Company is currently searching for a high profile executive

with Gene Therapy experience to chair the board of directors as an

independent member. Further information will be provided in due

course.

Settlement of the Private Placement

The admission of the New Shares to trading on the Euronext

Growth market in Paris is scheduled for the time of settlement and

delivery, which is expected to take place on August 8th, 2023.

The New Shares and, as the case may be, the Warrants Shares

(upon exercise of the Warrants in compliance with their terms) will

be immediately assimilated to the Company's existing shares already

traded on Euronext Growth in Paris, and will be able to be traded,

from their issuance, on the same listing line (ISIN code:

FR0012596468).

The Private Placement has not given rise to a prospectus

submitted for approval by the AMF.

Risk Factors

The Company draws the public’s attention to the risk factors

related to the Company and its activities presented in section I.3

of the Rapport financier annuel for the year ended December 31st,

2022, which is available free of charge on the website of the

Company (www.sensorion-pharma.com).

In addition, investors are invited to consider the following

risks: (i) shareholders stake in the Company will be diluted

further to the issuance of the New Shares and Warrants Shares (in

case of exercise of the Warrants) without any possibility for the

shareholders to participate to the Private Placement, (ii) FDI

Clearance could be subject to specific undertakings which may

constitute a constraint for the activities of the Company, (iii)

the market price for the Company's shares may fluctuate and fall

below the subscription price of the shares issued pursuant to the

Private Placement, (iv) the volatility and liquidity of the

Company's shares may fluctuate significantly, (v) sales of the

Company’s shares (including the New Shares and Warrant Shares) may

occur on the market and have a negative impact on the market price

of the shares, and (vi) the Company’s shareholders could undergo a

potentially material dilution resulting from any future capital

increases (including as a consequence of the exercise of all or

part of the Warrants) that are needed to finance the Company.

About Sensorion

Sensorion is a pioneering clinical-stage biotech company, which

specializes in the development of novel therapies to restore, treat

and prevent hearing loss disorders, a significant global unmet

medical need.Sensorion has built a unique R&D technology

platform to expand its understanding of the pathophysiology and

etiology of inner ear related diseases, enabling it to select the

best targets and mechanisms of action for drug candidates.

It has two gene therapy programs aimed at correcting hereditary

monogenic forms of deafness, developed in the framework of its

broad strategic collaboration focused on the genetics of hearing

with the Institut Pasteur. OTOF-GT targets deafness caused by

mutations of the gene encoding for otoferlin and GJB2-GT targets

hearing loss related to mutations in GJB2 gene to potentially

address important hearing loss segments in adults and children. The

Company is also working on the identification of biomarkers to

improve diagnosis of these underserved illnesses.

Sensorion’s portfolio also comprises clinical-stage small

molecule programs for the treatment and prevention of hearing loss

disorders.

Sensorion’s clinical-stage portfolio includes one Phase 2

product: SENS-401 (Arazasetron) progressing in a planned Phase 2

proof of concept clinical study of SENS-401 in Cisplatin-Induced

Ototoxicity (CIO) and, with partner Cochlear Limited, in a study of

SENS-401 in patients scheduled for cochlear implantation. A Phase 2

study of SENS-401 was also completed in Sudden Sensorineural

Hearing Loss (SSNHL) in January 2022.

www.sensorion.com

Label: SENSORION ISIN: FR0012596468 Mnemonic:

ALSEN

Disclaimer

This press release contains certain forward-looking statements

concerning Sensorion and its business. Such forward looking

statements are based on assumptions that Sensorion considers to be

reasonable. However, there can be no assurance that such

forward-looking statements will be verified, which statements are

subject to numerous risks, including the risks set forth in the

2022 full year financial report published on March 30, 2023, and

available on our website and to the development of economic

conditions, financial markets and the markets in which Sensorion

operates. The forward-looking statements contained in this press

release are also subject to risks not yet known to Sensorion or not

currently considered material by Sensorion. The occurrence of all

or part of such risks could cause actual results, financial

conditions, performance or achievements of Sensorion to be

materially different from such forward-looking statements. This

press release and the information that it contains do not

constitute an offer to sell or subscribe for, or a solicitation of

an offer to purchase or subscribe for, Sensorion shares in any

country. The communication of this press release in certain

countries may constitute a violation of local laws and regulations.

Any recipient of this press release must inform oneself of any such

local restrictions and comply therewith.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy ordinary shares of the Company, and

shall not constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that jurisdiction.

This announcement is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017, as amended (the

“Prospectus Regulation”).

In France, the Private Placement described above took place

solely as a placement to a category of institutional investors, in

accordance with Article L. 225-138 of the “Code de commerce” and

applicable regulations.

With respect to Member States of the European Economic Area

(including France), no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release which would require the publication of a prospectus

(pursuant to article 3 of the Prospectus Regulation) in any Member

State.

This press release and the information it contains is not an

offer to sell, nor the solicitation of an offer to subscribe for or

buy, New Shares, Warrants or Warrant Shares in the United States or

any other jurisdiction where restrictions may apply including

notably Canada, Australia or Japan. Securities may not be offered

or sold in the United States absent registration under the

Securities Act or an exemption from registration thereunder.

Sensorion does not intend to register the New Shares under the

Securities Act or conduct a public offering of the New Shares in

France, the United States, or in any other jurisdiction.

This communication is being distributed only to, and is directed

only at (a) persons outside the United Kingdom, (b) persons who

have professional experience in matters relating to investments

falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the "Order"), and (c)

high net worth entities, and other persons to whom it may otherwise

lawfully be communicated, falling within Article 49(2) of the Order

(all such persons together being referred to as "relevant

persons"). Any investment or investment activity to which this

communication relates is available only to relevant persons and

will be engaged in only with relevant persons. Any person who is

not a relevant person should not act or rely on this communication

or any of its contents.

This distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

__________________________

1 Article L. 151-3 and seq., R. 151-3 and seq. of the French

code monétaire et financier and Decree no. 2020-892 of July 22,

2020.

2 It being specified that the Warrants will be repurchased by

the Company in view of cancelling them upon the holder’s option in

the event the FDI Clearance has not been obtained by December 15,

2023 at the latest.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803449197/en/

Investor Relations Noémie Djokovic, Investor Relations

and Communications Associate ir.contact@sensorion-pharma.com

Press Relations Ulysse Communication Pierre-Louis Germain

/ 00 33 (0)6 64 79 97 51 plgermain@ulysse-communication.com Bruno

Arabian / 00 00(0)6 87 88 47 26

barabian@ulysse-communication.com

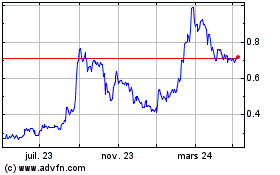

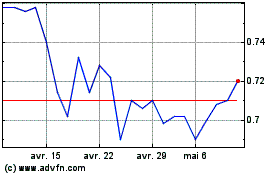

Sensorion (EU:ALSEN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Sensorion (EU:ALSEN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024