Touax: 2023 RESULTS

PRESS

RELEASE Paris, 21

March 2024 – 17 h 45

YOUR OPERATIONAL LEASING SOLUTION FOR

SUSTAINABLE TRANSPORTATION

2023 RESULTS

A profitable and resilient business model

within the context of rising interest rates and normalisation of

the containerised traffic

- Business

volume of €157.1m, down slightly (-€4.3m) due to the normalisation

of the container market

- Limited

impact on EBITDA (€55.3m, -€2.6m) thanks to growth of other

activities (freight railcars, river barges, modular

buildings)

- Group share

of net profit: €3.6m

|

« TOUAX’s results in 2023 confirm the

resilience of its business model despite the normalisation of the

container market, after two exceptional years in 2021 and 2022. The

almost-stability of our EBITDA demonstrates the quality of our

international network, combined with the diversification of our

activities, which enable us to benefit from growth opportunities

while limiting the impact of economic cycles. With its position in

a fast-growing market at the heart of sustainable transport

infrastructure, a solid financial structure and long-term partners

and investors, the group is well positioned to pursue its growth »

remarked Fabrice and Raphaël Walewski, Touax SCA’s managing

partners.

Consolidated EBITDA at end-December 2023 amounts

to €55.3 million, a -€2.6 million decrease, due to a slight

contraction in business volumes (decrease of restated revenues from

activities by -€4.3 million). The group share of net profit amounts

to €3.6 million (vs. €7.5 million in 2022), mainly impacted by the

lower contribution of the container business and the increase in

financial expenses due to higher interest rates (-€5.6

million).

In 2023 TOUAX SCA completed two financing

operations (Euro PP bond and banking club deal), totalling €45

million and extending the debt maturity to 2027.

The net book value per share is €10.97. Based on

the market value of the assets, the revalued NAV1 per share came to

€20.59, as of December 31, 2023.

At the Annual General Meeting, the managing

partners will propose a dividend of 12 cents per share

(corresponding to c.25% of net profit for the year), up 20% on last

year.

The consolidated financial statements for the

period ended December 31, 2023, were approved by the Management

Board on March 20, 2024, and were submitted to the Supervisory

Board on March 21, 2024. The auditing of these statements is

underway.

KEY ACCOUNTING ITEMS

|

Key figures |

2023 |

2022 |

|

(in € million) |

|

Restated Revenue(*) from activities |

157.1 |

161.5 |

|

Of which Freight railcars |

58.3 |

56.1 |

|

Of which River barges |

15.0 |

17.5 |

|

Of which Containers |

66.9 |

81.4 |

|

Of which Miscellaneous and eliminations |

16.9 |

6.4 |

|

EBITDA |

55.3 |

57.9 |

|

Operating income |

28.3 |

31.1 |

|

Financial result |

-21.0 |

-15.4 |

|

Profit before taxes |

7.3 |

15.7 |

|

Corporate tax |

-1.5 |

-6.3 |

|

Consolidated net profit (loss) (Group’s

share) |

3.6 |

7.5 |

|

Earnings per share (€) |

0.52 |

1.07 |

|

Total non-current assets |

406.3 |

394.6 |

|

Total assets |

563.4 |

571.7 |

|

Total shareholders’ equity |

147.6 |

153.7 |

|

Net financial debt (a) |

285.7 |

273.0 |

|

Operating cash flow (b) |

21.1 |

-1.5 |

|

Loan to Value ratio (c) |

59.1% |

59.5% |

|

(a) including €231.8m in debt without recourse at 31 Dec.

2023. |

|

|

|

The Net financial debt takes into account the mark-to-market values

of debt derivatives |

|

|

|

(b) including €29.6m of net equipment acquisitions (€60.0m end of

Dec 2022) |

|

|

|

c) Loan to Value ratio : Ratio of consolidated gross financial

debt to total assets less goodwill and intangible fixed assets |

(*) The key indicators in the

Group’s activity report are presented differently from the IFRS

income statement, to enable an understanding of the activities’

performance. As such, no distinction is made in third-party

management, which is presented solely in agent form.This

presentation has no impact on EBITDA, operating income, or net

income. The accounting presentation of revenue from activities is

presented in the appendix to the press release.

A SLIGHT DECLINE IN RESTATED REVENUE

FROM ACTIVITES AS THE CONTAINER MARKET NORMALISES

Restated revenue from activities over 2023

totalled €157.1 million (€159.6 million at constant scope and

currency), down by -2.7% compared with 2022 (-1.2% at constant

scope and currency).

The owned activity, which came

to €147.9 million at the end of 2023, is down by -€2.6 million. The

leasing revenues continue to grow over the year (+€3.9 million;

+5.8%) confirming their recurring contribution to group revenues.

The freight railcar (88.7%), river barge (100%) and container

(95.1%) average utilisation rates were at a high level in 2023.

Ancillary services declined by -€4.9 million, impacted by the

normalisation of container pick-up charges related to the container

sales activity, and by the lower chartering activity on the Rhine

basin (whose impact on the profitability is limited). Sales of

owned equipment also declined by -€1.6 million (-2.7%), with a

significant drop in sales of owned containers (-€11 million) but

partly offset by sales within Modular Buildings activity.

The management activity amounts

to €9.2 million with a decrease of -€1.7 million over the year,

impacted by lower syndication volumes but partially compensated by

commissions on the sale of investor equipment.

ANALYSIS OF CONTRIBUTION BY

DIVISION

The restated revenue from the Freight

Railcars division reached €58.3 million in 2023, an

increase of +€2.0 million (+3.8%).Leasing income rose by +6% (+€3.1

million) to €55.3 million over the year, supported by an average

utilisation rate rising to 88.7% in 2023 (87.6% in 2022) and with

new asset acquisition generating additional revenue. Sales of owned

equipment decreased by -€1.1 million.

The restated revenue from the River

Barges division is down by -€2.4 million to €15 million,

impacted by the lower chartering activity on the Rhine basin after

the dynamism of 2022 (-€2.9 million). The leasing revenue is up by

+6% (+€0.4 million) taking advantage from investments made in

Europe in 2022 and the full invoicing of barge rentals in South

America in 2023.

The restated revenue from the

Containers division came to €66.9 million at the

end of December 2023, a decrease of -€14.5 million (-17.8%) due to

the normalisation of the sector after two exceptional years in 2021

and 2022. This change is mainly due to the decline of revenue from

the sale of new containers (-€11 million for sales of owned

equipment and -€2.8 million for ancillary services), with a fall in

price in 2023. However, the leasing revenue took advantage of

recurrent investments and increases by +€1.2 million. The

management activity is down by -€1.9 million, with a fall in

syndication fees (-€1.4 million) and management fees (-€0.9

million, due to the decline in the fleet). Meanwhile, commissions

on sales of investor equipment rose by +€0.4 million.

Revenue from the Modular

Buildings division presented under "Miscellaneous”

strongly increased in 2023 to €16.9 million (+€10.5 million) with

more orders delivered following the end of the Covid crisis.

A PROFITABILITY MAINLY IMPACTED BY THE

RISING OF INTEREST RATES

EBITDA came to

€55.3 million, a decrease of -€2.6 million (-4.5%).

EBITDA in the Freight Railcars

division rose to €31.4 million (+3%) compared with €30.6 million in

2022, supported by higher leasing revenue. However, the operating

expenses are also higher due to the +€0.9 million increase in

maintenance and repair costs.The River Barges

division posted an EBITDA of €5.3 million over the year, giving a

slight increase of +€0.3 million (+6%). EBITDA in the

Containers division fell by a substantial -€7.6

million to €15.2 million (-33%) with the contraction of container

sales. This unfavourable trend was partially offset by the recovery

in sales for the Modular Buildings division.

The group’s depreciation and amortization

increased by +€2.6 million with the new investments made in 2022

and 2023.

Operating income reached

€28.3million, down by -€2.8 million compared with 2022, after

taking into account the net exceptional income of €2.4 million

(linked on the one hand to accounting income of €3.5 million

relating to the purchase in January 2023 of minority interests in

the Modular Buildings business in Africa, and on the other hand to

a $1.0 million conviction in the United States for the former

subsidiary of Modular Buildings for an old dispute).

Financial income came to

-€21 million, compared with -€15.4 million in 2022. The

increase in net interest expense is 85% explained by the interest

rate rising, partially offset by hedging in place. As the net debt

only slightly increases, the volume effect is limited on the

financial income.

Corporate income tax amounted to -€1.5million,

+€4.8 million compared with 2022 when an exceptional tax provision

of €3.8 million was accounted (no cash impact) in the Containers

division.

Net income Group share amounted

to €3.6 million (compared with €7.5 million in 2022), mainly

explained by the increase of interest rates, while our diversified

business model limits cycle impacts of our activities.

A BALANCED FINANCIAL

STRUCTURE

The strength of the TOUAX’s balance sheet is

reflected in the Loan to Value ratio of 59.1% as

of end-December 2023, compared with 59.5% in 2022. The financial

structure has been reinforced by the debt refinancing carried out

by the parent company Touax SCA, providing greater certainty over

the debt profile until mid-2027 (EuroPP issuance of €5.4 million

and implementation of a club-deal bank financing of €40

million).

Shareholders' equity amounts to

€147.6 million, compared with 153.7 million euros at the end of

December 2022. At the group level, the allocation of the full-year

profit of €3.6 million was offset by distributions (dividend and

payment to general partners) totalling -€1.5 million, by a negative

change in reserves mainly due to translation adjustments and

decrease in hedge value amounting to -€5.2 million, and by a -€1.7

million reduction in minority interests in the Freight Railcars

business.

The level of cash on the

balance sheet at 31 December 2023 remains comfortable, at €39.0

million.

FAVOURABLE OUTLOOK AT THE HEART OF

SUSTAINABLE TRANSPORT INFRASTRUCTURE

In the short term TOUAX remains cautious with

the current economic challenges: uneven growth by geographical

area, high interest rates, major geopolitical risks.

Despite turbulences, trade volumes remain at a

satisfactory level 2. The year-end utilisation rates (88% for

freight railcars, 100% for river barges and 97% for containers)

demonstrate the resilience of the economies and markets where the

group operates.

In an uncertain environment, the flexibility

provided by our leasing solutions is sought by our clients and

creates investment opportunities.

The requirement for fleet renewal and fleet

modernization remain important, particularly as part of our

customers objectives for reducing CO2 emissions. With its expertise

in the intermodal, rail and river transport sectors, TOUAX benefits

from a unique position at the heart of sustainable transport

infrastructure, and increases its commitment to Corporate and

Social Responsibility, for a low-carbon economy.

The strengthening of TOUAX's CSR commitment has

been confirmed by the increase in its extra-financial ratings.

TOUAX was awarded the EcoVadis3 2023 Gold Medal (72/100) and now

belongs to the top 5% of companies in all sectors.

On the asset management business for third-party

investors, committed funds from infrastructure funds (available in

2024) have reached €134 million and will support TOUAX’s

growth.

UPCOMING EVENTS

- March 22, 2024:

Video conference

call to present the annual results in English

- May 15,

2024: Q1

2024 revenue from activities

- June 12, 2024:

Annual

General Meeting

TOUAX Group leases out

tangible assets (freight railcars, river barges and containers) on

a daily basis worldwide, both on its own account and for investors.

With €1.2 billion of assets under management, TOUAX is one of the

leading European players in the leasing of such equipment.

TOUAX is listed on the

EURONEXT stock market in Paris - Euronext Paris Compartment C (ISIN

code: FR0000033003) - and is listed on the CAC® Small, CAC® Mid

& Small and EnterNext©PEA-PME 150 indices.

For further

information please visit: www.touax.com

Contacts :

TOUAX SEITOSEI

● ACTIFINFabrice & Raphaël

WALEWSKI Ghislaine

Gasparettotouax@touax.com ggasparetto@actifin.frwww.touax.com Tel :

+33 1 56 88 11 22

+33 1 46 96 18 00

APPENDICES

1 – Analysis of revenue from

activities

|

Restated Revenue from activities |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

TOTAL 2023 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

TOTAL 2022 |

|

(in € thousand) |

|

Leasing revenue on owned equipment |

17,139 |

17,510 |

17,412 |

18,985 |

71,046 |

15,509 |

16,909 |

17,178 |

17,530 |

67,126 |

|

Ancillary services |

5,030 |

4,271 |

5,299 |

5,124 |

19,724 |

5,732 |

4,884 |

7,390 |

6,607 |

24,613 |

|

Total leasing activity |

22,169 |

21,781 |

22,711 |

24,109 |

90,770 |

21,241 |

21,793 |

24,568 |

24,137 |

91,739 |

|

Sales of owned equipment |

13,053 |

16,895 |

13,024 |

14,206 |

57,178 |

14,862 |

14,249 |

15,392 |

14,282 |

58,785 |

|

Total sales of equipment |

13,053 |

16,895 |

13,024 |

14,206 |

57,178 |

14,862 |

14,249 |

15,392 |

14,282 |

58,785 |

|

Total of owned activity |

35,222 |

38,676 |

35,735 |

38,315 |

147,948 |

36,103 |

36,042 |

39,960 |

38,419 |

150,524 |

|

Syndication fees |

0 |

544 |

-2 |

667 |

1,209 |

0 |

2,522 |

65 |

150 |

2,737 |

|

Management fees |

1,021 |

1,018 |

1,024 |

1,018 |

4,081 |

978 |

986 |

1,083 |

1,655 |

4,702 |

|

Sales fees |

861 |

1,710 |

674 |

643 |

3,888 |

336 |

1,349 |

801 |

999 |

3,485 |

|

Total of management activity |

1,882 |

3,272 |

1,696 |

2,328 |

9,178 |

1,314 |

4,857 |

1,949 |

2,804 |

10,924 |

|

Other capital gains on disposals |

1 |

1 |

-1 |

0 |

1 |

0 |

0 |

6 |

2 |

8 |

|

Total Others |

1 |

1 |

-1 |

0 |

1 |

0 |

0 |

6 |

2 |

8 |

|

Total Revenue from activities |

37,105 |

41,949 |

37,430 |

40,643 |

157,127 |

37,417 |

40,899 |

41,915 |

41,225 |

161,456 |

2 - Table showing the transition from

summary accounting presentation to restated

presentation

|

Revenue from activities |

2023 |

Restatement |

Restated 2023 |

2022 |

Restatement |

Restated 2022 |

|

(in € thousand) |

|

Leasing revenue on owned equipment |

71,046 |

|

71,046 |

67,126 |

|

67,126 |

|

Ancillary services |

23,867 |

-4,143 |

19,724 |

32,729 |

-8,116 |

24,613 |

|

Total leasing activity |

94,913 |

-4,143 |

90,770 |

99,855 |

-8,116 |

91,739 |

|

Sales of owned equipment |

57,178 |

|

57,178 |

58,785 |

|

58,785 |

| Total

sales of equipment |

57,178 |

0 |

57,178 |

58,785 |

0 |

58,785 |

|

Total of owned activity |

152,091 |

-4,143 |

147,948 |

158,640 |

-8,116 |

150,524 |

|

Leasing revenue on managed equipment |

36,669 |

-36,669 |

0 |

44,399 |

-44,399 |

0 |

|

Syndication fees |

1,209 |

|

1,209 |

2,737 |

|

2,737 |

|

Management fees |

1,563 |

2,518 |

4,081 |

1,285 |

3,417 |

4,702 |

|

Sales fees |

3,888 |

|

3,888 |

3,485 |

|

3,485 |

|

Total of management activity |

43,329 |

-34,151 |

9,178 |

51,906 |

-40,982 |

10,924 |

| Other capital

gains on disposals |

1 |

|

1 |

8 |

|

8 |

|

Total Others |

1 |

0 |

1 |

8 |

0 |

8 |

|

Total Revenue from activities |

195,421 |

-38,294 |

157,127 |

210,554 |

-49,098 |

161,456 |

3 - Breakdown of restated revenue from

activities by division

|

Restated revenue from activities |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

TOTAL 2023 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

TOTAL 2022 |

|

(in € thousand) |

|

Leasing revenue on owned equipment |

11,124 |

11,615 |

11,856 |

12,443 |

47,038 |

10,544 |

11,142 |

11,292 |

11,768 |

44,746 |

|

Ancillary services |

1,938 |

1,937 |

2,082 |

2,308 |

8,265 |

1,858 |

1,177 |

1,820 |

2,564 |

7,419 |

|

Total leasing activity |

13,062 |

13,552 |

13,938 |

14,751 |

55,303 |

12,402 |

12,319 |

13,112 |

14,332 |

52,165 |

|

Sales of owned equipment |

76 |

132 |

133 |

86 |

427 |

110 |

238 |

369 |

833 |

1,550 |

| Total

sales of equipment |

76 |

132 |

133 |

86 |

427 |

110 |

238 |

369 |

833 |

1,550 |

|

Total of owned activity |

13,138 |

13,684 |

14,071 |

14,837 |

55,730 |

12,512 |

12,557 |

13,481 |

15,165 |

53,715 |

|

Syndication fees |

0 |

0 |

0 |

295 |

295 |

0 |

446 |

1 |

0 |

447 |

|

Management fees |

538 |

553 |

586 |

576 |

2,253 |

466 |

451 |

507 |

557 |

1,981 |

|

Total of management activity |

538 |

553 |

586 |

871 |

2,548 |

466 |

897 |

508 |

557 |

2,428 |

|

Total Freight railcars |

13,676 |

14,237 |

14,657 |

15,708 |

58,278 |

12,978 |

13,454 |

13,989 |

15,722 |

56,143 |

|

Leasing revenue on owned equipment |

1,878 |

1,886 |

1,880 |

1,894 |

7,538 |

1,619 |

1,789 |

1,869 |

1,821 |

7,098 |

|

Ancillary services |

2,072 |

1,629 |

2,090 |

1,567 |

7,358 |

1,807 |

2,385 |

3,788 |

2,319 |

10,299 |

|

Total leasing activity |

3,950 |

3,515 |

3,970 |

3,461 |

14,896 |

3,426 |

4,174 |

5,657 |

4,140 |

17,397 |

|

Sales of owned equipment |

0 |

5 |

0 |

47 |

52 |

0 |

0 |

0 |

16 |

16 |

| Total

sales of equipment |

0 |

5 |

0 |

47 |

52 |

0 |

0 |

0 |

16 |

16 |

|

Total of owned activity |

3,950 |

3,520 |

3,970 |

3,508 |

14,948 |

3,426 |

4,174 |

5,657 |

4,156 |

17,413 |

|

Management fees |

11 |

14 |

20 |

31 |

76 |

14 |

5 |

11 |

11 |

41 |

|

Total of management activity |

11 |

14 |

20 |

31 |

76 |

14 |

5 |

11 |

11 |

41 |

|

Total River Barges |

3,961 |

3,534 |

3,990 |

3,539 |

15,024 |

3,440 |

4,179 |

5,668 |

4,167 |

17,454 |

|

Leasing revenue on owned equipment |

4,133 |

4,004 |

3,671 |

4,643 |

16,451 |

3,342 |

3,973 |

4,013 |

3,935 |

15,263 |

|

Ancillary services |

1,020 |

705 |

1,127 |

1,249 |

4,101 |

2,070 |

1,325 |

1,779 |

1,722 |

6,896 |

|

Total leasing activity |

5,153 |

4,709 |

4,798 |

5,892 |

20,552 |

5,412 |

5,298 |

5,792 |

5,657 |

22,159 |

|

Sales of owned equipment |

10,211 |

10,949 |

8,994 |

9,656 |

39,810 |

13,205 |

12,575 |

12,967 |

12,085 |

50,832 |

| Total

sales of equipment |

10,211 |

10,949 |

8,994 |

9,656 |

39,810 |

13,205 |

12,575 |

12,967 |

12,085 |

50,832 |

|

Total of owned activity |

15,364 |

15,658 |

13,792 |

15,548 |

60,362 |

18,617 |

17,873 |

18,759 |

17,742 |

72,991 |

|

Syndication fees |

0 |

544 |

-2 |

372 |

914 |

0 |

2,076 |

64 |

150 |

2,290 |

|

Management fees |

472 |

451 |

418 |

411 |

1,752 |

498 |

530 |

565 |

1,087 |

2,680 |

|

Sales fees |

861 |

1,710 |

674 |

643 |

3,888 |

336 |

1,349 |

801 |

999 |

3,485 |

|

Total of management activity |

1,333 |

2,705 |

1,090 |

1,426 |

6,554 |

834 |

3,955 |

1,430 |

2,236 |

8,455 |

|

Total Containers |

16,697 |

18,363 |

14,882 |

16,974 |

66,916 |

19,451 |

21,828 |

20,189 |

19,978 |

81,446 |

|

Leasing revenue on owned equipment |

4 |

5 |

5 |

5 |

19 |

4 |

5 |

4 |

6 |

19 |

|

Ancillary services |

0 |

0 |

0 |

0 |

0 |

-3 |

-3 |

3 |

2 |

-1 |

|

Total leasing activity |

4 |

5 |

5 |

5 |

19 |

1 |

2 |

7 |

8 |

18 |

|

Sales of owned equipment |

2,766 |

5,809 |

3,897 |

4,417 |

16,889 |

1,547 |

1,436 |

2,056 |

1,348 |

6,387 |

| Total

sales of equipment |

2,766 |

5,809 |

3,897 |

4,417 |

16,889 |

1,547 |

1,436 |

2,056 |

1,348 |

6,387 |

|

Total of owned activity |

2,770 |

5,814 |

3,902 |

4,422 |

16,908 |

1,548 |

1,438 |

2,063 |

1,356 |

6,405 |

|

Other capital gains on disposals |

1 |

1 |

-1 |

0 |

1 |

0 |

0 |

6 |

2 |

8 |

|

Total Others |

1 |

1 |

-1 |

0 |

1 |

0 |

0 |

6 |

2 |

8 |

|

Total Miscellaneous & eliminations |

2,771 |

5,815 |

3,901 |

4,422 |

16,909 |

1,548 |

1,438 |

2,069 |

1,358 |

6,413 |

|

Total Restated revenue from activities |

37,105 |

41,949 |

37,430 |

40,643 |

157,127 |

37,417 |

40,899 |

41,915 |

41,225 |

161,456 |

1 The market value is calculated by independent

experts, based 50% on the replacement value and 50% on the

value-in-use for railcars, the value-in-use for containers and the

replacement value for river barges with the exception of a

long-term contract in South America for which the value-in-use was

used. This market value is substituted for the net book value when

calculating the net asset value.

2 Clarkson forecasts January 2024: +5.5%

(including 2% related to Red Sea re-routing) in percentage of

containerised traffic (TEU-miles) vs. +1.6% in 20233 EcoVadis:

evaluation of the main CSR impacts according to four themes:

Environment, Social & Human Rights, Ethics and Responsible

Purchasing

- ENG TOUAX Press release - FY 2023 VF

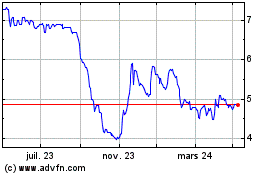

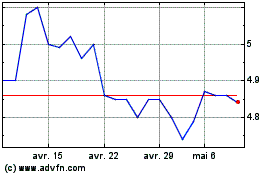

Touax (EU:TOUP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Touax (EU:TOUP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024