Form POS EX - Post-effective amendment adding exhibits to registration statement [Rule 462(d)]

10 Janvier 2024 - 6:56PM

Edgar (US Regulatory)

As filed with the U.S. Securities and Exchange

Commission on January 10, 2024

Registration No. 333-271026

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

| Pre-Effective Amendment No. __ |

¨ |

| |

|

| Post-Effective Amendment No. 1 |

x |

| (Check appropriate box or boxes) |

|

Virtus Stone Harbor Emerging Markets Income

Fund

(formerly known as Stone Harbor Emerging Markets Income Fund)

(Exact Name of Registrant as Specified in Charter)

101 Munson Street

Greenfield, MA 01301-9683

(Address of Principal Executive Offices)

(866) 270-7788

(Registrant’s Telephone Number, Including

Area Code)

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel

and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and Address of Agent for Service)

Copies to:

Mark D. Perlow, Esq.

Dechert LLP

One Bush Street, Suite 1600

San Francisco, CA 94104

Approximate date of proposed public offering: As

soon as practicable after the effective date of this Registration Statement.

It is proposed that this filing will become effective immediately

pursuant to Rule 462(d) under the Securities Act of 1933, as amended.

This Amendment to the Registration Statement on Form N-14 of Virtus

Stone Harbor Emerging Markets Income Fund is being filed to add Exhibit (12) to the Registration Statement. Parts A and B are incorporated

herein by reference to the definitive Information Statement/Prospectus filed pursuant to Rule 424(b)(3) on November 15, 2023 (Accession

No. 0001104659-23-118327; File No. 333-271026).

VIRTUS STONE HARBOR EMERGING MARKETS INCOME

FUND

PART C

OTHER INFORMATION

Reference

is made to Article VIII, Sections 1 through 4, of the Registrant’s Amended and Restated Agreement and Declaration of Trust,

which is incorporated by reference herein.

Insofar as indemnification for liabilities arising

under the Securities Act of 1933, as amended (the “Act”), may be permitted to trustees, officers and controlling persons of

the Registrant by the Registrant pursuant to the Trust’s Agreement and Declaration of Trust, its Bylaws or otherwise, the Registrant

is aware that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in

the Act and, therefore, is unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the Registrant of expenses incurred or paid by trustees, officers or controlling persons of the Registrant in the successful defense

of any action, suit or proceeding) is asserted by such trustees, officers or controlling persons in connection with the securities being

registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to

a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and

will be governed by the final adjudication of such issue.

Reference is made to Section 6 of the Form of

Underwriting Agreement filed as Exhibit (h)(1), which is incorporated herein by reference.

The Investment Advisory Agreement,

Subadvisory Agreements, Custody Agreement, Foreign Custody Manager Agreement, Sub-Administration and Accounting Services Agreement and

Transfer Agency and Shareholder Services Agreement, each as amended, respectively provide that the Registrant will indemnify the other

party (or parties, as the case may be) to the agreement for certain losses. Similar indemnities to those listed above may appear in other

agreements to which the Registrant is a party.

The Registrant, in conjunction

with Virtus Alternative Investment Advisers, Inc. (“VAIA”), the Registrant’s Trustees, and other registered investment

management companies managed by VAIA or their affiliates, maintains insurance on behalf of any person who is or was a Trustee, officer,

employee, or agent of the Registrant, or who is or was serving at the request of the Registrant as a trustee, director, officer, employee

or agent of another trust or corporation, against any liability asserted against such person and incurred by him or arising out of his

position. However, in no event will Registrant maintain insurance to indemnify any such person for any act for which the Registrant itself

is not permitted to indemnify him.

Insofar as indemnification

for liability arising under the Securities Act of 1933, as amended (the “Act”), may be permitted to trustees, officers and

controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the

opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses

incurred or paid by a trustee, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such trustee, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

| 5(a). | Article III (Shares) and Article V (Shareholders’ Voting Powers and Meetings)

of the Amended and Restated Agreement and Declaration of Trust, as set forth in Exhibit 1. |

| 5(b). | Article 10 (Shareholders’ Voting Powers and Meetings) of the Amended and Restated

Bylaws, as set forth in Exhibit 2. |

| 9(e). |

Amendment to Custody Agreement by and among DSE, ZTR, VGI, Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund (“AIO”), Virtus AllianzGI Convertible & Income 2024 Target Term Fund (“CBH”), Virtus AllianzGI Convertible & Income Fund (“NCV”), Virtus AllianzGI Convertible & Income Fund II (“NCZ”), Virtus AllianzGI Diversified Income & Convertible Fund (“ACV”), Virtus AllianzGI Equity & Convertible Income Fund (“NIE”), Virtus Dividend, Interest & Premium Strategy Fund (“NFJ” and together with AIO, CBH, NCV, NCZ, ACV and NIE, “VCEFII”), and The Bank of New York Mellon dated May 7, 2021, filed via EDGAR (as Exhibit 9.e) with Form N-14 8C (File No. 333-271026) on March 31, 2023, and incorporated herein by reference. |

| 9(k). |

Joinder

Agreement and Amendment to Foreign Custody Manager Agreement between VAST, Virtus Equity Trust (“VET”), Virtus Opportunities

Trust (“VOT” and with VET, “Virtus Mutual Funds”), Virtus Asset Trust (“VAT”), Virtus Retirement

Trust (“VRT”), Virtus Variable Insurance Trust (“VVIT”), DSE, VGI, ZTR and The Bank of New York Mellon

dated as of December 1, 2018, filed via EDGAR (as Exhibit 9(j)) to VET’s Form N-14 (File No. 333-228766)

on December 12, 2018, and incorporated herein by reference. |

| 9(l). |

Form of

Amendment to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR and The Bank of New

York Mellon dated as of March 8, 2019, filed via EDGAR (as Exhibit g.2.e) with Post-Effective Amendment No. 82 to

VVIT’s Registration Statement (File No. 033-05033) on April 22, 2019, and incorporated herein by reference. |

| 9(m). |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR and The Bank of New York Mellon

dated as of May 22, 2019, filed via EDGAR (as Exhibit g.2.f) with Post-Effective Amendment No. 123 to VET’s

Registration Statement (File No. 002-16590) on June 12, 2019, and incorporated herein by reference. |

| 9(n). |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR and The Bank of New York Mellon

dated September 1, 2019, filed via EDGAR (as Exhibit g.2.g) with Post-Effective Amendment No. 105 to the Registration

Statement (File No. 033-65137) on September 30, 2019, and incorporated herein by reference. |

| 9(o). |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR and The Bank of New York Mellon

dated November 18, 2019, filed via EDGAR (as Exhibit g.2.h) with Post-Effective Amendment No. 109 to the Registration

Statement (File No. 033-65137) on January 22, 2020, and incorporated herein by reference. |

| 9(p). |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR, VATS Offshore Fund Ltd. (“VATS”)

and The Bank of New York Mellon dated as of August 27, 2020, filed via EDGAR (as Exhibit g.2.i) with Post-Effective Amendment

No. 135 to VET’s Registration Statement (File No. 002-16590) on October 19, 2020, and incorporated herein by

reference. |

| 9(q). |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, DSE, VGI, ZTR, VATS and The Bank of New York

Mellon dated as of November 13, 2020, filed via EDGAR (as Exhibit g.2.l) with Post-Effective Amendment No. 136 to

VET’s Registration Statement (File No. 002-16590) on December 7, 2020, and incorporated herein by reference. |

| 9(r). |

Amendment

to Foreign Custody Manager Agreement between Registrant, Virtus Mutual Funds, VAT, VRT, VVIT, VGI, ZTR, VATS, Investment Trust,

VST, DSE, VCEFII and The Bank of New York Mellon dated as of May 7, 2021, filed via EDGAR (as Exhibit g.2.k) with Post-Effective

Amendment No. 121 to VOT’s Registration Statement (File No. 033-65137) on September 27, 2021, and incorporated

herein by reference.

|

| 9(s) |

Amendment

to Foreign Custody Manager Agreement between VAST, Virtus Mutual Funds, VAT, VRT, VVIT, VATS, Virtus Investment Trust (“Investment

Trust”), Virtus Strategy Trust (“VST”), DSE, VGI, ZTR, VCEFII, and The Bank of New York Mellon dated as of July 26,

2021, filed via EDGAR (as Exhibit 9(bb)) to VOT’s Form N-14 (File No. 333-261341) on November 24, 2021,

and incorporated herein by reference.

|

| 9(t) |

Amendment

and Joinder to Foreign Custody Manager Agreement between VAST, The Merger Fund® (“TMF”), The Merger

Fund® VL (“TMFVL”), Virtus Event Opportunities Trust (“VEOT”), Virtus Mutual Funds, VAT,

VRT, VVIT, VATS, Investment Trust, VST, DSE, VGI, ZTR, VCEFII and The Bank of New York Mellon dated as of February 12,

2022, filed via EDGAR (as Exhibit g.2.m) with Post-Effective Amendment No. 127 to VOT’s Registration Statement (File

No. 033-65137) on April 5, 2022, and incorporated herein by reference. |

| 9(u). |

Amendment

and Joinder to Foreign Custody Manager Agreement between Registrant, TMF, TMFVL, VEOT, Virtus Mutual Funds, VAT, VRT, VVIT, VATS, Investment

Trust, VST, VGI, ZTR, Registrant, EDI (VGI, ZTR, EDF and EDI collectively, “VCEF”), VCEFII and The Bank of New York

Mellon dated as of April 4, 2022, filed via EDGAR (as Exhibit g.2.n) with Post-Effective Amendment No. 127 to VOT’s

Registration Statement (File No. 033-65137) on April 5, 2022, and incorporated herein by reference. |

| 9(v). |

Amendment

and Joinder to Foreign Custody Manager Agreement between Registrant, TMF, TMFVL, VEOT, Virtus Mutual Funds, VAT, VRT, VVIT, VATS, Investment

Trust, VST, Closed-End Funds, VCEFII and The Bank of New York Mellon dated as of September 30, 2022, filed via EDGAR (as Exhibit g.2.o)

with Post-Effective Amendment No. 52 to the Registration Statement (File No. 333-191940) on December 12, 2022, and

incorporated herein by reference. |

| 16. |

Power of Attorney for Donald C. Burke, Sarah E. Cogan, Deborah A. DeCotis, F. Ford Drummond, Sidney E. Harris, John R. Mallin, Connie D. McDaniel, Philip R. McLoughlin, Geraldine M. McNamara, R. Keith Walton, and Brian T. Zino (filed herewith). |

| (1) | The undersigned Registrant agrees that prior to any public reoffering

of the securities registered through the use of a prospectus that is a part of this Registration Statement by any person or party who

is deemed to be an underwriter within the meaning of Rule 145(c) of the Securities Act of 1933, the reoffering prospectus will

contain the information called for by the applicable registration form for reofferings by persons who may be deemed underwriters, in

addition to the information called for by the other items of the applicable form. |

| (2) | The undersigned Registrant agrees that every prospectus that

is filed under paragraph (1) above will be filed as a part of an amendment to the Registration Statement and will not be used until

the amendment is effective, and that, in determining any liability under the Securities Act of 1933, each post-effective amendment shall

be deemed to be a new Registration Statement for the securities offered therein, and the offering of the securities at that time shall

be deemed to be the initial bona fide offering of them. |

| (3) | The undersigned Registrant agrees to file a post-effective amendment

to this Registration Statement which will include the tax opinion required by Item 12. |

SIGNATURES

As required by the Securities

Act of 1933, this registration statement has been signed on behalf of the Registrant, in the City of Hartford and the State of Connecticut

on the 10th day of January, 2024.

| VIRTUS STONE HARBOR EMERGING MARKETS INCOME FUND |

| |

|

|

| By: |

/s/ George R. Aylward |

|

| |

George R. Aylward |

|

| |

President & Chief Executive Officer |

|

As required by the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the 10th day of January, 2024.

| Signature |

|

Title |

| |

|

|

| /s/ George R. Aylward |

|

Trustee, President and Chief Executive Officer |

| George R. Aylward |

|

(principal executive officer) |

| |

|

|

| /s/ W. Patrick Bradley |

|

Chief Financial Officer and Treasurer |

| W. Patrick Bradley |

|

(principal financial and accounting officer) |

| |

|

|

| * |

|

Trustee |

| Donald C. Burke |

|

|

| |

|

|

| * |

|

Trustee |

| Sarah E. Cogan |

|

|

| |

|

|

| * |

|

Trustee |

| Deborah A. DeCotis |

|

|

| |

|

|

| * |

|

Trustee |

| F. Ford Drummond |

|

|

| |

|

|

| * |

|

Trustee |

| Sidney E. Harris |

|

|

| |

|

|

| * |

|

Trustee |

| John R. Mallin |

|

|

| |

|

|

| * |

|

Trustee |

| Connie D. McDaniel |

|

|

| |

|

|

| * |

|

Trustee and Chairman |

| Philip R. McLoughlin |

|

|

| |

|

|

| * |

|

Trustee |

| Geraldine M. McNamara |

|

|

| |

|

|

| * |

|

Trustee |

| R. Keith Walton |

|

|

| |

|

|

| * |

|

Trustee |

| Brian T. Zino |

|

|

| |

|

|

| *By: |

/s/ George R. Aylward |

|

| |

*George R. Aylward, Attorney-in-Fact,

pursuant to a power of attorney |

|

EXHIBIT INDEX

| Exhibit |

Item |

| |

|

| 12 |

Tax opinion and consent of Dechert LLP |

| |

|

| 16 |

Power of Attorney for Donald C. Burke, Sarah E. Cogan, Deborah A. DeCotis, F. Ford Drummond, Sidney E. Harris, John R. Mallin, Connie

D. McDaniel, Philip R. McLoughlin, Geraldine M. McNamara, R. Keith Walton, and Brian T. Zino |

Exhibit 12

|

Three Bryant Park

1095 Avenue of the Americas

New York, NY 10036-6797

+1 212 698 3500 Main

+1 212 698 3599 Fax

www.dechert.com

|

| |

|

December 15, 2023

Board of Trustees

Virtus Stone Harbor Emerging Markets Total Income Fund

101 Munson Street

Greenfield, Massachusetts 01301

Board of Trustees

Virtus Stone Harbor Emerging Markets Income Fund

101 Munson Street

Greenfield, Massachusetts 01301

Dear Ladies and Gentlemen:

You

have requested our opinion regarding certain federal income tax consequences to Virtus Stone Harbor Emerging Markets Total Income Fund,

a Massachusetts business trust (the “Acquired Fund”) and to Virtus Stone Harbor Emerging Markets Income Fund, a Massachusetts

business trust (the “Acquiring Fund”), and to the holders of shares of beneficial interest of the Acquired Fund (the “Acquired

Fund Shareholders”), in connection with the transfer of substantially all of the assets, as defined in the Agreement and Plan of

Reorganization (the “Plan”), dated as of May 23, 2023, executed by the Acquiring Fund and by the Acquired Fund,

of the Acquired Fund (the “Assets”) to the Acquiring Fund in exchange solely for shares of beneficial interest of the Acquiring

Fund (the “Acquiring Fund Shares”), cash in lieu of fractional shares, and the assumption of the stated liabilities, as defined

in the Plan, of the Acquired Fund (the “Liabilities”) by the Acquiring Fund, followed by the distribution of the Acquiring

Fund Shares received by the Acquired Fund in complete liquidation and termination of the Acquired Fund (the “Reorganization”),

all pursuant to the Plan.

|

Page 2

Virtus Stone Harbor Emerging Markets Total Income Fund –

Virtus Stone Harbor Emerging Markets Income Fund

December 15, 2023 |

For purposes of this opinion, we have examined

and relied upon (1) the Plan, (2) the Registration Statement filed on Form N-14 in connection with the Reorganization,

(3) facts and representations contained in the letter dated on or about the date hereof addressed to us from the Acquiring Fund,

(4) the facts and representations contained in the letter dated on or about the date hereof addressed to us from the Acquired Fund,

and (5) such other documents and instruments as we have deemed necessary or appropriate for purposes of rendering this opinion.

This opinion is based upon the Internal Revenue

Code of 1986, as amended (the “Code”), United States Treasury Regulations, judicial decisions, and administrative rulings

and pronouncements of the Internal Revenue Service, all as in effect on the date hereof. This opinion is conditioned upon the Reorganization

taking place in the manner described in the Plan.

Based upon the foregoing, it is our opinion that

for federal income tax purposes, with respect to the Acquired Fund and the Acquiring Fund:

| 1. | The acquisition by the Acquiring Fund of the Assets in exchange solely

for the Acquiring Fund Shares and the assumption of the Liabilities by the Acquiring Fund

followed by the distribution of Acquiring Fund Shares to the Acquired Fund Shareholders in

exchange for their Acquired Fund shares in complete liquidation and termination of the Acquired

Fund will constitute a tax-free reorganization under Section 368(a) of the Code. |

| 2. | The Acquired Fund will not recognize gain or loss upon the transfer of

the Assets to Acquiring Fund in exchange solely for the Acquiring Fund Shares and the assumption

of the Liabilities by the Acquiring Fund, except that the Acquired Fund may be required to

recognize gain or loss with respect to contracts described in Section 1256(b) of

the Code or stock in a passive foreign investment company, as defined in Section 1297(a) of

the Code. |

| 3. | The Acquired Fund will not recognize gain or loss upon the distribution

to the Acquired Fund Shareholders of the Acquiring Fund Shares received by the Acquired Fund

in the Reorganization. |

|

Page 3

Virtus Stone Harbor Emerging Markets Total Income Fund –

Virtus Stone Harbor Emerging Markets Income Fund

December 15, 2023 |

| 4. | The Acquiring Fund will recognize no gain or loss upon receiving the Assets

in exchange solely for the issuance of the Acquiring Fund Shares and the assumption of the

Liabilities. |

| 5. | The Acquiring Fund’s adjusted tax basis of the Assets received by

the Acquiring Fund in the Reorganization will be the same as the adjusted tax basis of those

Assets in the hands of the Acquired Fund immediately before the Reorganization. |

| 6. | The Acquiring Fund’s holding period of the Assets received by the

Acquiring Fund in the Reorganization will include the period during which those Assets were

held by the Acquired Fund (except where investment activities of the Acquiring Fund have

the effect of reducing or eliminating a holding period with respect to an Asset). |

| 7. | The Acquired Fund Shareholders will recognize no gain or loss upon receiving

Acquiring Fund Shares solely in exchange for their Acquired Fund shares (except with respect

to cash received in lieu of fractional shares). |

| 8. | An Acquired Fund Shareholder’s aggregate tax basis of the Acquiring

Fund shares received by the Acquired Fund Shareholder in the Reorganization will be the same

as the aggregate tax basis of the Acquired Fund shares surrendered by the Acquired Fund Shareholder

in exchange therefor (reduced by any amount of tax basis allocable to fractional shares for

which cash is received). |

| 9. | An Acquired Fund Shareholder’s holding period of the Acquiring Fund

Shares received by the Acquired Fund Shareholder in the Reorganization will include the period

during which the Acquired Fund shares surrendered in exchange therefor were held by the Acquired

Fund Shareholder, provided that the Acquired Fund Shareholder held such Acquired Fund shares

as a capital asset on the date of Reorganization. |

(continued)

|

Page 4

Virtus Stone Harbor Emerging Markets Total Income Fund –

Virtus Stone Harbor Emerging Markets Income Fund

December 15, 2023 |

We express no opinion as to the federal income

tax consequences of the Reorganization except as expressly set forth above, or as to any transaction except those consummated in accordance

with the Plan. Without limiting the foregoing, we express no opinion as to the federal income tax consequences of the Reorganization

to the Acquired Fund with respect to contracts described in Section 1256(b) of the Code or stock in a passive foreign investment

company, as defined in Section 1297(a) of the Code.

| |

Very truly yours, |

|

| |

|

|

| |

/s/ Dechert LLP |

|

Exhibit 16

POWER OF ATTORNEY

I, the undersigned member

of the Board of Trustees of Virtus Stone Harbor Emerging Markets Income Fund (the “Trust”), hereby constitute and appoint

George R. Aylward, Julia Short and Jennifer Fromm, or any of them, as my true and lawful attorneys and agents with full power to sign

for me in the capacity indicated below, on any or all Registration Statements, amendments thereto, including without limitation a Registration

Statement on Form N-14, and such other filings as may be appropriate, with the Securities and Exchange Commission under the Securities

Act of 1933 and/or the Investment Company Act of 1940 relating to the merger of Virtus Stone Harbor Emerging Markets Total Income Fund

with and into Virtus Stone Harbor Emerging Markets Income Fund and hereby ratify and confirm my signature as it may be signed by said

attorneys and agents.

I hereby declare that a photostatic,

xerographic or other similar copy of this original instrument shall be as effective as the original.

IN WITNESS WHEREOF, this 24th day of March, 2023.

| |

|

/s/ Donald C. Burke |

| George R. Aylward, Trustee |

|

Donald C. Burke, Trustee |

| |

|

|

| /s/ Sarah E. Cogan |

|

/s/ Deborah A. DeCotis |

| Sarah E. Cogan, Trustee |

|

Deborah A. DeCotis, Trustee |

| |

|

|

| /s/ F. Ford Drummond |

|

/s/ Sidney E. Harris |

| F. Ford Drummond, Trustee |

|

Sidney E. Harris, Trustee |

| |

|

|

| /s/ John R. Mallin |

|

/s/ Connie D. McDaniel |

| John R. Mallin, Trustee |

|

Connie D. McDaniel, Trustee |

| |

|

|

| /s/ Philip McLoughlin |

|

/s/ Geraldine M. McNamara |

| Philip McLoughlin, Trustee |

|

Geraldine M. McNamara, Trustee |

| |

|

|

| /s/ R. Keith Walton |

|

/s/ Brian T. Zino |

| R. Keith Walton, Trustee |

|

Brian T. Zino, Trustee |

All signatures need not appear on the same copy

of this Power of Attorney.

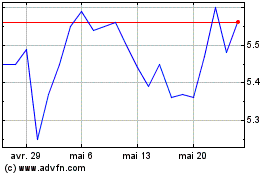

Virtus Stone Harbor Emer... (NYSE:EDF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Virtus Stone Harbor Emer... (NYSE:EDF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024