FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Dated September

8, 2023

Commission

File Number: 001-04546

UNILEVER PLC

(Translation

of registrant's name into English)

UNILEVER HOUSE, BLACKFRIARS, LONDON, ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in

paper

as

permitted by Regulation S-T Rule 101(b)(1):_____

Indicate

by check mark if the registrant is submitting the Form 6-K in

paper

as

permitted by Regulation S-T Rule 101(b)(7):_____

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No .X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- _______

Exhibit

99 attached hereto is incorporated herein by

reference.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

UNILEVER

PLC

|

|

|

|

|

|

|

|

/S/ M VARSELLONA

|

|

BY M VARSELLONA

|

|

CHIEF LEGAL OFFICER AND GROUP SECRETARY

|

Date: 8

September, 2023

EXHIBIT INDEX

------------------------

|

EXHIBIT

NUMBER

|

EXHIBIT

DESCRIPTION

|

|

99

|

Notice

to London Stock Exchange dated 8 September 2023

|

|

|

Share Buy-Back Programme

|

Exhibit

99

Share Buy-Back Programme - Commencement of Fourth

Tranche

London -

Unilever PLC announces the commencement of the fourth and final

tranche of its programme to buy back shares with an aggregate

market value equivalent of up to €3

billion.

On 10 February 2022, Unilever PLC announced its fourth quarter and

full year 2021 results and a share buyback programme of up to

€3 billion to be conducted over the next two years (the

"Programme").

On 23 March 2022, Unilever PLC announced the commencement of the

first tranche of the Programme for an aggregate market value

equivalent to €750 million.

On 6 September 2022, Unilever PLC announced the commencement of the

second tranche of the Programme for an aggregate market value

equivalent to €750 million.

On 17 March 2023, Unilever PLC announced the commencement of the

third tranche of the Programme for an aggregate market value

equivalent to €750 million.

Unilever PLC now announces the commencement of the fourth and final

tranche of the Programme (the "Fourth Tranche") for an aggregate

market value equivalent to €750 million which will be bought

back in the form of Unilever PLC ordinary shares.

The purpose of the Fourth Tranche is to reduce the capital of

Unilever PLC and it will take place within the limitations of the

authority granted to the Board of Unilever PLC by its general

meeting, held on 3rd May 2023, pursuant to which the maximum number

of shares to be bought back by Unilever PLC is

253,000,000.

The Fourth Tranche will commence on 8 September 2023 and will end

on or before 22 December 2023.

Unilever PLC has entered into non-discretionary instructions with

Merrill Lynch International to conduct the Fourth Tranche on its

behalf and to make trading decisions under the Fourth Tranche

independently of Unilever PLC.

Unilever PLC

Unilever House

100 Victoria Embankment

London EC4Y 0DY

United Kingdom

Press-Office.London@Unilever.com

CAUTIONARY STATEMENT

This announcement may contain forward-looking statements, including

'forward-looking statements' within the meaning of the United

States Private Securities Litigation Reform Act of 1995, including

with relation to Unilever's share buyback programme, its purpose

and timetable. Words such as 'will', 'aim', 'expects',

'anticipates', 'intends', 'looks', 'believes', 'vision', or the

negative of these terms and other similar expressions of future

performance or results, and their negatives, are intended to

identify such forward-looking statements. These forward-looking

statements are based upon current expectations and assumptions

regarding anticipated developments and other factors affecting the

Unilever Group (the 'Group'). They are not historical facts, nor

are they guarantees of future performance or outcomes.

Because these forward-looking statements involve risks and

uncertainties, there are important factors that could cause actual

results to differ materially from those expressed or implied by

these forward-looking statements. These forward-looking statements

speak only as of the date of this announcement. Except as required

by any applicable law or regulation, the Group expressly disclaims

any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Group's expectations with regard thereto

or any change in events, conditions or circumstances on which any

such statement is based.

Further details of potential risks and uncertainties affecting the

Group are described in the Group's filings with the London Stock

Exchange, Euronext Amsterdam and the US Securities and Exchange

Commission, including in the Annual Report on Form 20-F 2022 and

the Unilever Annual Report and Accounts 2022 available on our

corporate website www.unilever.com.

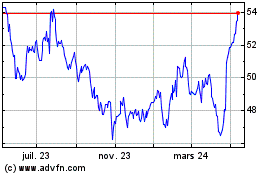

Unilever (NYSE:UL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

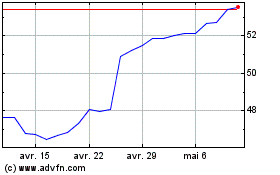

Unilever (NYSE:UL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024