FedEx Profit Tops Expectations--4th Update

17 Décembre 2015 - 5:01AM

Dow Jones News

By Laura Stevens and Josh Beckerman

FedEx Corp. on Wednesday said that this year's peak holiday

season is its busiest ever, and the pace has been consistent since

Cyber Monday.

"There's no sign it's going to let up," FedEx Ground Chief Henry

Maier said during the company's quarterly earnings call following

the announcement of a 4% increase in profit for the quarter ended

Nov. 30.

Company executives said that the boom in e-commerce has resulted

in a higher than expected number of packages during this holiday

season. On Monday, the company picked up more than 26 million

packages globally, executives said, and demand has been

particularly high in the Northeast.

Shares of the delivery company rose 5% to $156.25 in after-hours

trading on the New York Stock Exchange, after the company beat Wall

Street's expectations.

Some e-commerce shippers are doing better than others this

holiday season, said Chief Executive Fred Smith. Some retailers

hadn't done a good job of forecasting demand.

"The people that have the real problem in the e-commerce

business by and large are those that view the transportation

companies as some sort of utility or a vendor and they make some

really, really bad decisions," Mr. Smith said. He didn't

elaborate.

The FedEx executives said the company has been able to divert

volume in the Northeast and that its technology in sorting hubs

gives it a competitive advantage. The company also is running its

network around the clock during the holidays. FedEx also is capping

volume when necessary, which is likely to mean that those poor

planners might not get all their packages shipped in time.

Additionally, despite rate increases designed to encourage

retailers to ship smaller packages, oversize packages have

accounted for a large slice of volume this year--nearly 10% of home

deliveries. That will affect future pricing decisions, according to

the company.

For the quarter, Ground's average daily volume rose 9%, while

revenue increased 32% to $4.05 billion, in part due to the purchase

of logistics provider Genco. The company said it would again invest

$1.6 billion in its Ground network to accommodate growth next year,

backing away from a plan to decrease spending going forward.

Both United Parcel Service Inc. and FedEx have been hoping to

avoid a repeat of 2013, when millions of packages failed to reach

their destinations in time for Christmas as online shoppers were

placing orders at the last minute. Last year, UPS overran on costs

as it staffed up too much for the holidays.

Previously, FedEx had said it expected volume to grow 12% to 317

million packages over the holidays. The executives Wednesday didn't

quantify the increase in volume.

Separately, the company said its deal to acquire Dutch parcel

firm TNT Express NV is on track. It expects final approval from

European regulators in January, and for the deal to close in the

first half of next year. It still needs approval from seven

countries, including Brazil and China.

In addition, FedEx said it settled a dispute with former drivers

regarding their employee status for $25 million net of taxes. FedEx

has been involved in several class-action suits regarding its

former practice of classifying some of its U.S. delivery drivers as

independent contractors rather than employees. It stopped using the

disputed model in 2011.

FedEx reported a profit of $691 million, or $2.44 a share, up

from year-earlier earnings of $663 million, or $2.31 a share.

Excluding certain items, profit rose to $2.58 a share from $2.16.

Revenue increased 4% to $12.5 billion.

At the FedEx Express segment, revenue fell 6% to $6.59 billion

as lower fuel surcharges and unfavorable currency rates more than

offset base yield growth. However, operating income increased 26%

to $622 million as executives said restructuring of that division

to improve profitability was ahead of schedule.

In September, FedEx lowered its earnings guidance for the year,

projecting weak demand in its freight segment and higher costs in

its ground segment.

On Wednesday, it reaffirmed its outlook for adjusted earnings of

$10.40 to $10.90 a share, "despite weakness in industrial

production."

Write to Laura Stevens at laura.stevens@wsj.com and Josh

Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

December 16, 2015 22:46 ET (03:46 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

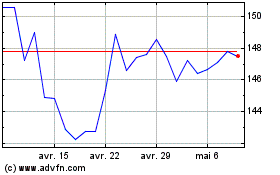

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

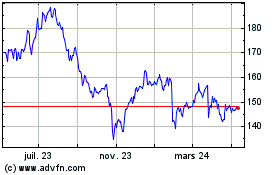

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024