Bonduelle - Quarter 3 FY 2018-2019 Revenue: limited sales growth for Q3 driven by foreign exchanges and external growth

02 Mai 2019 - 6:00PM

Bonduelle - Quarter 3 FY 2018-2019 Revenue: limited sales growth

for Q3 driven by foreign exchanges and external growth

BONDUELLE

A French SCA (Partnership Limited by Shares) with

a capital of 56 942 095 EurosHead Office: La Woestyne 59173

Renescure, FranceRegistered under number: 447 250 044

(Dunkerque Commercial and Companies Register)

Quarter 3 FY 2018-2019

Revenue(January 1 - March 31, 2019)

Limited sales growth for Q3 driven by

foreign exchanges and external growth

The Bonduelle Group's revenue stands for Q3 of

financial year 2018-2019 at 675.6 million of euros, an increase of

+0.4% on reported figures and -2.-% on a like for like basis*. The

change in the scope of consolidation linked with the acquisition of

the Del Monte business activities early July 2018, made a positive

contribution of +1.2% to the variation of the total revenue over

the period. The exchange rate effects, mainly the strengthening of

the US and Canadian dollars, favourable during this quarter,

contributed to a 1.2% growth.Over the 9 first months of this FY,

the revenue stands at 2,082.2 million of euros, a decrease of 0.5%

on reported figures and 1.3% on a like for like basis*.

Activity by Geographic

Region

|

Total consolidated revenue(in €

millions) |

9 months 2018-2019 |

9 months 2017-2018 |

Variation Reported figures |

Variation Like for like

basis* |

3rd quarter 2018-2019 |

3rd quarter 2017-2018 |

Variation Reported figures |

Variation Like for like

basis* |

|

Europe Zone |

956.2 |

951.8 |

+0.5% |

+0.6% |

313.9 |

318.5 |

-1.5% |

-1.3% |

|

Non-Europe Zone |

1,126.1 |

1,141.4 |

-1.3% |

-3.-% |

361.7 |

354.4 |

+2.-% |

-2.7% |

|

Total |

2,082.2 |

2,093.2 |

-0.5% |

-1.3% |

675.6 |

672.9 |

+0.4% |

-2.-% |

Activity by Operating

Segments

|

Total consolidated revenue(in €

millions) |

9 months 2018-2019 |

9 months 2017-2018 |

Variation Reported figures |

Variation Like for like

basis* |

3rd quarter 2018-2019 |

3rd quarter 2017-2018 |

Variation Reported figures |

Variation Like for like

basis* |

|

Canned |

774.9 |

753.2 |

+2.9% |

+1.7% |

241.6 |

230.8 |

+4.7% |

+2.3% |

|

Frozen |

497.5 |

478.2 |

+4.-% |

+5.1% |

175.- |

161.9 |

+8.1% |

+7.9% |

|

Fresh processed |

809.9 |

861.8 |

-6.-% |

-7.6% |

259.- |

280.3 |

-7.6% |

-11.4% |

|

Total |

2,082.2 |

2,093.2 |

-0.5% |

-1.3% |

675.6 |

672.9 |

+0.4% |

-2.-% |

Zone EuropeThe Europe Zone,

representing 45.9% of the group's revenue over the first 9 months,

recorded an overall aggregated growth of +0.5% on reported figures

and +0.6% on a like for like basis*.Over quarter 3, the revenue is

down -1.5% based on reported figures and -1.3% on a like for like

basis*. It is attributable primarily to the Easter consumption

shift taking place in quarter 4 against quarter 3 of last financial

year, particularly affecting the limited shelf life product

category (bagged, ready-to-eat salads, and prepared salads).

Despite that calendar effect, the retail sales for the Bonduelle

and Cassegrain brands in cans and frozen and the food service sales

reported revenue growth over the period.

Non-Europe ZoneThe revenue of

the Non-Europe Zone, representing 54.1% of the group's revenue over

the period, was down -1.3% on reported data and -3.-% on a like for

like basis*, and the ones for Q3 at +2.-% and -2.7%

respectively.Over quarter 3, the frozen food activities in North

America continued to experience the growth observed last quarter,

thanks to the delivery catch-ups of some industrial contracts

planned for the beginning of the year coupled with sales of fruit

and vegetables for the Del Monte brand, activity acquired at the

beginning of the financial year, fuelling the canned operating

segment growth. Fresh activities in North America remained lower

over quarter 3, due to the rationalization of the business

portfolio and the sourcing diversification of a major client, as

mentioned last quarter.Finally, the robust sales increase observed

in Russia was sustained over quarter 3 thanks to the innovations in

the canned segment for the Bonduelle brand (olive product category

and young corn) coupled with the encouraging development of the

frozen business segment.

Highlights

The Bonduelle Group has successfully

issued a private bond placement in the United States

(USPP)Looking for maturity of its debt instruments and the

refinancing of the EuroPP, maturing on March 11, 2019, the

Bonduelle Group issued on May 2, 2019 a private bond investment in

the United States for a total amount of 140 million of euros with a

10 year maturity, consequently taking the average maturity of the

group's overall debt to over 4 years.Operating on the USPP market

since 2000, the Bonduelle Group has successfully issued this

private placement with attractive terms among a pool of existing

investors who confirmed their confidence in the group. Largely

oversubscribed, this transaction enables the group to significantly

reduce the cost of its debt.The Bonduelle Group has been advised by

Natixis, acting as agent and by Willkie Farr & Gallagher acting

as legal advisor.

Outlooks

Given the evolution of the activity recorded in

the third quarter and the result of the commercial negotiations at

the beginning of the year, the Bonduelle Group aims to achieve for

the full fiscal year 2018-2019 ending June 30, 2019 stable sales

and operating income at constant currency exchange rates compared

to last year.

* at constant currency exchange rate and scope

of consolidation basis. The revenues in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows:

- For businesses acquired (or gain of control) during the current

period, revenue generated since the acquisition date is excluded

from the organic growth calculation;

- For businesses acquired (or gain of control) during the prior

fiscal year, revenue generated during the current period up until

the first anniversary date of the acquisition is excluded;

- For businesses divested (or loss of control) during the prior

fiscal year, revenue generated in the comparative period of the

prior fiscal year until the divestment date is excluded;

- For businesses divested (or loss of control) during the current

fiscal year, revenue generated in the period commencing 12 months

before the divestment date up to the end of the comparative period

of the prior fiscal year is excluded.

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com.

Next financial events:

- 2018-2019 Financial Year Revenue:

August 5,

2019 (after stock exchange trading session)- 2018-2019 Annual

Results:

September 30, 2019 (prior to stock exchange trading session)

About

Bonduelle

Bonduelle, a family

business, was established in 1853. Its mission is to be the world

reference in "well-living" through plant-based food. Prioritizing

innovation and long-term vision, the group is diversifying its

operations and geographical presence. Its vegetables, grown over

more than 130,000 hectares all over the world, are sold in 100

countries under various brand names and through various

distribution channels and technologies. An expert in agro-industry

with 55 industrial sites or owned agricultural production sites,

Bonduelle produces quality products by selecting the best crop

areas close to its customers.Bonduelle is listed on Euronext

compartment AEuronext indices: CAC MID & SMALL - CAC FOOD

PRODUCERS - CAC ALL SHARESBonduelle is part of the Gaïa

non-financial performance index and employee shareholder index

(I.A.S.)Code ISIN : FR0000063935 - Code Reuters : BOND.PA - Code

Bloomberg : BON FP

Find out about the

group’s current events and news on Twitter @Bonduelle_Group, and

its financial news on @BonduelleCFO

- Quarter 3 FY 2018-2019 Revenue

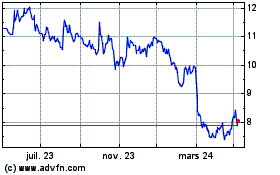

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

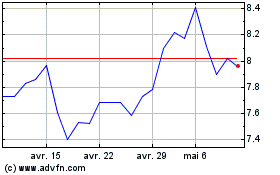

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024