Quarterly Financial Information as of December 31, 2017 IFRS -

Regulated Information - Audited

Cegedim returned to positive revenue and

margin growth in 2017

- The business model transformation continues, in line with Group

expectations

- Good sales momentum

- Improved profitability

- Cautiously optimistic for 2018

|

Disclaimer: The following terms "business model

transformation" and "BPO" are defined in the Glossary.

Starting June 30, 2017, the Group has decided to

implement recommendation ANC 2013-03 of France's national

accounting standards board, which allows companies to incorporate

the income of equity-accounted affiliates in the consolidated

operating result. Cegedim's 2016 financial statements have been

restated as indicated in the accounting principles of our Half-Year

Report. Cegedim announced on December 14 that

it had signed a contract for the definitive sale of its Cegelease

and Eurofarmat businesses. As a result, the consolidated 2017

financial statements are presented according to IFRS 5,

"Non-current assets held for sale and discontinued". In

practice the contribution from these businesses until the effective

disposal, if any, to each line of: Cegedim's Consolidated

Income Statement (before non-controlling interests) has been

grouped under the line "Earnings from discontinued operations"; in

accordance with IFRS 5,and their share of net income has been

excluded from Cegedim's adjusted net income; Cegedim's

consolidated cash flow statement has been grouped under the line

"Cash flow of discontinued operations". These

adjustments have been applied to all periods presented to ensure

consistency of information. In addition, the contribution of

Cegelease and Eurofarmat to each line of Cegedim's Consolidated

Balance Sheet has been grouped under the lines "Assets held for

sale" and "Liabilities associated with assets held for sale".

|

| Conference CALL on September 21, 2017, at 6:15PM

CET |

|

FR: +33 1 72 72 74 03 |

USA: +1 844 286 0643 |

UK: +44 (0) 207 1943 759 |

PIN

Code: 41900137# |

| The webcast is available at the following

address: www.cegedim.com/webcast |

Boulogne-Billancourt, France, March 20, 2018 after the market

close

Cegedim, an innovative technology and

services company, posted consolidated FY 2017 revenues from

continuing activities of €457.4 million, up 6.6% on a reported

basis and 5.9% like for like compared with the same period in

2016. EBITDA came to €77.5 million in 2017, up 35.0% year on

year. EBITDA margin improved significantly to 16.9% in 2017,

compared with 13.4% a year earlier.

2017 represents another positive milestone in

the Group's transformation. The revamp of its business model

continues, capacity for innovation has been bolstered and the

organizational structure has been adjusted to make it even more

agile. The disposal of Cegelease end-February 2018, completes the

refocus initiated in 2015. 2017 results reflect the combined impact

of good sales momentum and improved profitability.

Both operating divisions saw like-for-like

revenue growth. Health Insurance, HR and e-services division

revenues rose by 8.5% and Healthcare professionals division

revenues increased by 1.4%.

EBITDA growth is mainly due to the significant

recovery posted by the Healthcare professionals division, itself

mostly due to a favorable base effect

Simplified income statement

|

|

2017 |

2016 |

Chg. |

|

|

€m |

% |

€m |

% |

% |

|

Revenue |

457.4 |

100.0 |

429.3 |

100.0 |

+6.6% |

|

EBITDA |

77.5 |

16.9 |

57.4 |

13.4 |

+35.0% |

|

Depreciation |

(40.1) |

(8.8) |

(34.3) |

(8.0) |

+17.0% |

|

EBIT before special items |

37.4 |

8.2 |

23.1 |

5.4 |

+61.8% |

|

Special items |

(18.9) |

(4.1) |

(24.1) |

(5.6) |

(21.8)% |

|

EBIT |

18.5 |

4.1 |

(1.0) |

(0.2) |

n.m. |

|

Cost of net financial debt |

(6.7) |

(1.5) |

(26.0) |

(6.1) |

(74.1)% |

|

Tax expenses |

(4.7) |

(1.0) |

(2.3) |

(0.5) |

+101.2% |

|

Consolidated profit from continuing activities |

7.1 |

1.5 |

(29.5) |

(6.9) |

n.m. |

|

Net earnings from activities held for sale |

4.1 |

0.0 |

(1.1) |

(0.3) |

n.m. |

|

Net earnings from activities sold |

0.0 |

0.9 |

3.8 |

0.9 |

- |

|

Profit attributable to the owners of the parent |

11.1 |

2.4 |

(26.7) |

(6.2) |

n.m. |

|

EPS before special items |

0.9 |

- |

(1.5) |

- |

n.m. |

|

Earnings per share |

0.8 |

- |

(1.9) |

- |

n.m. |

Consolidated revenues from continuing activities for 2017

amounted to €457.4 million, a 6.6% increase as reported. Excluding

an unfavorable currency translation effect of 0.9% and a 1.6% boost

from acquisitions, revenues rose 5.9%.

Both of the divisions grew their like-for-like revenues. Health

insurance, HR and e-services division revenues rose by 8.5%, and

Healthcare professionals division revenues rose by 1.4%.

EBITDA increased significantly by €20.1

million, or 35.06%, to €77.5 million. The margin also rose, to

16.9% from 13.4% in 2016. The EBITDA performance was chiefly the

result of lower purchased used and stable external expenses

combined with a lower increase of personnel costs compare to

revenue increase.

Depreciation and amortization costs rose

€14.3 million to €40.1 million in 2017 compared with €34.3 million

in 2016. Most of the increase was due to the €4.2 million increase

in the amortization of R&D expenses over the period.

EBIT from recurring operations rose €14.3

million, or 61.8%, to €37.4 million. The margin improved to 8.2% in

2017 from 5.4% in 2016.

Exceptional items amounted to a charge of

€18.9 million compared with a charge of €24.1 million in 2016. This

decrease is chiefly due to the €3.1 million decline in

restructuring costs over the period, to the fact that in 2017 there

was no fine relating to the former activity sold in 2007, partially

offset by a €1.8 million increase in the allowance for legacy

software in the United States and France.

Net cost of financial debt fell by €19.3

million, or 74.1%, to €6.7 million compared with €26.0 million in

2016. The decline reflects the positive impact of refinancing

carried out in the first half of 2016.

Tax costs came to a charge of €4.7

million compared with a €2.3 million charge in 2016. The increase

was chiefly due to an increase of €2.5 million at income taxes.

Thus, the profit attributable to the owners of

the parent came to a profit of €11.1 million compared to a loss of

€26.7 million in 2016. The consolidated net result from

continuing activities came to a profit of €7.1 million compared

with a loss of €29.5 million in 2016. Net profit before special

items came to €0.9 profit per share compared with a €1.5 loss a

year earlier. Earnings per share were a €0.8 profit compared

with a €1.9 loss in 2016.

Analysis of business trends by division

|

|

|

Revenue |

|

EBIT before special items |

|

EBITDA |

| In €

million |

|

FY 2017 |

FY 2016 |

|

FY 2017 |

FY 2016 |

|

FY 2017 |

FY 2016 |

| Health insurance, HR and

e-services |

|

291.1 |

262.4 |

|

28.4 |

28.6 |

|

48.1 |

43.9 |

| Healthcare

professionals |

|

162.5 |

163.6 |

|

10.4 |

(0.8) |

|

25.0 |

12.8 |

| Corporate and others |

|

3.9 |

3.3 |

|

(1.3) |

(4.7) |

|

4.4 |

0.7 |

|

Cegedim |

|

457.4 |

429.3 |

|

37.4 |

23.1 |

|

77.5 |

57.4 |

- Health insurance, HR and e-services

The division's 2017 revenues came to €291.1

million, up 10.9% on a reported basis. The November 2016

Futuramedia acquisition in France made a positive

contribution of 2.6%. Currency translation had a negative impact of

0.2%. Like-for-like revenues rose 8.5% over the period. The

division represented 63.6% of consolidated revenues from continuing

activities, compared with 61.1% over the same period a year

earlier.EBITDA rose in 2017, up 9.5%, to €48.1 million,

compared with €43.9 million in 2016. EBITDA margin was 16.5% in 17,

a decrease of 0.2 point compared with 2016.

The businesses that made the biggest

contributions to this growth in revenue and EBITDA were C-MEDIA,

merger of RNP and Futuramedia (ad at point of sales in pharmacies

and health & wellness shops), Cegedim SRH (HR management

solutions), Cegedim e-business (digitalization and data exchange),

sales statistics for pharmaceutical products, and - in the field of

health insurance - third-party payment flow management. EBITDA

growth was partly offset by the health insurance software and

services businesses' switch to SaaS format and by the launch of BPO

offerings.

The division's 2017 revenues came to €162.5

million, down 0.7% on a reported basis. Currencies had a negative

impact of 2.2%. There was virtually no impact from acquisitions or

divestments. Like-for-like revenues rose 1.4% over the

period.The division represented 35.5% of consolidated Group

revenues from continuing activities, compared with 38.1% over the

same period a year earlier.EBITDA grew significantly by

€95.4%, to €25.04 million, compared with €12.8 million in 2016.

EBITDA margin was 15.4%, up 7.6 points compared with 2016.

The slight revenue growth combined with the

sharp increase in EBITDA reflect the positive base effect on the

computerization of doctors in the United States, Belgium and

France, and of pharmacists in France. After a rather mixed start to

the year, business in the United Kingdom saw a return to fourth

quarter revenue growth rates.

The division's 2017 revenues came to €3.9

million, up 17.2% on a reported basis and like for like. There was

no currency impact and no acquisitions or divestments. The division

represented 0.8% of consolidated revenues from continuing

activities in 2017 and 2016.EBITDA increased significantly

by €3.7 million, to €4.4 million compared with a €00.7 million in

2016.The positive EBITDA trend was principally due to a

favorable base effect.

Financial resources

Acquisition goodwill represented €167.8

million at December 3, 2017 compared with €199.0 million at

end-2016. The €31.2 million decrease, equal to 15.7%, was mainly

attributable to the classification as assets held for sale of €28.3

million in acquisition goodwill linked to the disposal of Cegelease

and Eurofarmat. Acquisition goodwill represented 22.5% of the total

balance sheet at December 31, 2017, compared with 28.1% on December

31, 2016.

Cash and equivalents decreased by €2.1

million to €18.7 million at December 31, 2017. This drop was

principally due to the classification as assets held for sale of

€5.2 million in cash linked to the sale of Cegelease.

Shareholders' equity rose €8.4 million to

€197.3 million at December 31, 2017. This trend reflects the

results of the €11.1 million net earnings profit attributable to

owners of the parent partially offset by a €2.6 million decrease in

group exchange gain/losses. Shareholders' equity represented 26.4%

of the total balance sheet at end-December 2017, compared with

26.6% at end-December 2016.

Net financial debt amounted to €236.2

million at end-December 2017, up €9.3 million compared with

end-December 2016. It represented 119.7% of Group shareholders'

equity at December 31, 2017, compared with 120.1% at

December 31, 2016.

Free cash flow from operation came to an

inflow of €13.4 million compared with an outflow of €2.4 million.

This €15.8 million euros increase came mainly from an increase from

cash-flow before taxes and interest and a decrease in corporate tax

paid partially offset by an increase in working capital

requirement.

Outlook

- Cautiously optimistic for 2018

With a position in structurally buoyant markets

and its strategic refocus complete, Cegedim boasts solid

fundamentals, a balanced portfolio of complementary offerings, a

diversified client-base, a widespread geographic footprint and the

strength of an integrated group. This should enable it to continue

its growth momentum and reach a new stage in its development, so it

can deliver lasting, profitable growth.

To continue the initiatives it successfully

implemented in 2017, Cegedim will maintain a strategy primarily

focused on organic growth and driven by a robust innovation

policy.

The Group is cautiously optimistic for 2018 and

expects moderate organic revenue growth and a similar increase in

EBITDA.

In 2018, the Group does not expect any

significant acquisitions and is not issuing any earnings estimates

or forecasts.

- Potential impact of Brexit

In 2017, the UK accounted for 10.9% of

consolidated Group revenues from continuing activities and 14.0% of

consolidated Group EBIT.

Cegedim deals in local currency in the UK, as it

does in every country where it is present. Thus Brexit is unlikely

to have a material impact on Group EBIT.

With regard to healthcare policy, the Group has

not identified any major European programs at work in the UK and

expects UK policy to be only marginally affected by Brexit.

The figures cited above include guidance on

Cegedim's future financial performances. This forward-looking

information is based on the opinions and assumptions of the Group's

senior management at the time this press release is issued and

naturally entails risks and uncertainty. For more information on

the risks facing Cegedim, please refer to points 2.4, "Risk factors

and insurance", and 3.7, "Outlook", of the 2016 Registration

Document filed with the AMF on March 29, 2017, under number

D.17-0255.

Additional information

| The

Audit Committee met on March 20, 2018. The Board of Directors,

chaired by Jean-Claude Labrune, approved the consolidated financial

statement for 2017 at its meeting on March 20, 2017. The audit of

the financial statements has been completed. The audit report will

be issued once the requisite procedures for the filing of the

registration document are completed. The 2017 Registration Document

will be available in a few days' time on our website and on Cegedim

IR, the Group's financial communications app. This press

release is available in French and English. In the event of any

difference between the two versions, the original French version

takes precedence. This press release may contain inside

information. It was sent to Cegedim's authorized distributor on

March 20, 2018, no earlier than 5:45pm Paris time. |

Financial calendar

| |

March 21, 2018, at 11:00 am CET April 26,

2018, after the market close June 19, 2018, at 9:30 am

CET |

Analyst

meeting (SFAF) in Cegedim's auditorium First-quarter 2018 revenues

Cegedim shareholders' meeting |

| March 20, 2018, at 6:15pm (Paris

time) |

| The Group will hold a conference call hosted by Jan

Eryk Umiastowski, Cegedim Chief Investment Officer and Head of

Investor Relations. The webcast is available at the following

address: www.cegedim.fr/webcast The presentation on FY 2017

earnings is available: on the website and on the Group's financial

communications app, Cegedim IR. |

|

Contact Numbers : |

France : +33 1 72 72 74 03 United States :

+1 844 286 0643 UK and others : +44 (0)207 1943

759 |

PIN Code: 41900137# |

Appendices

Highlights

Apart from the items cited below, to the best of

the company's knowledge, there were no events or changes during the

period that would materially alter the Group's financial

situation.

- Non-recourse factoring agreement

On May 22, 2017, the Group signed a factoring

agreement with a French bank. The non-recourse agreement. The

amount of trade receivables sold under the agreement came to €38.0

million at December 31, 2017 over an €38.0 million authorized

- Partial interest rate hedging

Cegedim carried out two zero-premium swap

agreements on February 17 and May 11, 2017 under which it receives

the 1-month Euribor rate if it exceeds 0%, receives nothing

otherwise, and pays:

- A fixed rate of 0.2680% on a notional amount of €50 million

starting February 28, 2017, and maturing on February 26, 2021.

- A fixed rate of 0.2750% on a notional amount of €30 million

starting May 31, 2017, and maturing on December 31, 2020.

As part of the BPO contract Cegedim signed with

the Klesia group in September 2016, the two companies created an

economic interest group (GIE), held 50/50. In January 2017, Cegedim

lent Isiaklé €9 million.

On February 10, 2017, Cegedim was ordered to pay

€4,636,000 to the Tessi company for failing to meet certain

obligations with respect to an asset sale made on July 2, 2007. The

sum was paid on July 21, 2017. Cegedim has appealed the ruling.

Cegedim has decided to appeal this decision.

On February 23, 2017, Cegedim acquired UK

company B.B.M. Systems with a 2016 revenues of around €0.7 million

and earned a profit.

On May 3, 2017, Cegedim acquired UK company

Adaptive Apps. Its 2016 revenues came to around €1.5 million and

earned a profit.

Cegedim, jointly with IMS Health, is being sued

by Euris for unfair competition. Cegedim has filed a motion

claiming that IMS Health should be the sole defendant. After

consulting with its external legal counsel, the Group has decided

not to record any provisions.

On October 20, 2017, the court of Nîmes ordered

Alliadis to pay a fine of €2 million as part of a case involving a

pharmacist from Remoulins. A subsequent hearing on November 24 set

the fine at €187,500.

Significant post-closing transactions and events

To the best of the company's knowledge, apart

from the items cited below, there were no events or changes after

the accounts were closed that would materially alter the Group's

financial situation.

- Sale of Cegedim shares held by Bpifrance

Bpifrance Participations sale of 1,682,146 shares in Cegedim via

an accelerated bookbuilding process to French and international

institutional investors at a price of 35 euros per share on

February 13, 2018. In the context of the transaction, the

shareholders' agreement dated 28 October 2009 between M.

Jean-Claude Labrune, FCB (family holding controlled by M.

Jean-Claude Labrune) and Bpifrance as well as the concert between

the parties have been terminated. As a consequence Anne-Sophie

Herelle and Bpifrance Participations represented by Marie

Artaud-Dewitte have resigned from the board of directors on

February 15, 2018. Position held since the Valerie Raoul-Desprez

resignation in March 2017.

Cegedim's free-float increases to reach now 44% of capital (vs.

32% before the transaction).

- Completed disposal of the Cegelease and Eurofarmat

On February 28, 2018, Cegedim announces that it

has completed the disposal of Cegelease and Eurofarmat to

FRANFINANCE (Société Générale Group for an amount of €57.5

million.

The parties have decided that Cegelease and the

Cegedim Group will continue to collaborate in France under the

current terms as part of a six-year collaboration agreement.

The selling price is €57.5 million, plus reimbursement of the

shareholder's loan account, which amounted to €13 million. Of this

amount, Cegedim will use €30 million to pay down its debt.

The businesses revenue and consolidated EBITDA came to

respectively to €13 million and €5.8 million in 2017 and €12.5

million and €5.4 million, in 2016.

Balance sheet as December 31, 2017

- Assets as of December 31, 2017

|

In thousands of euros |

12.31.2017 |

12.31.2016 |

|

Goodwill on acquisition |

167,758 |

198,995 |

|

Development costs |

22,887 |

12,152 |

|

Other intangible fixed assets |

122,962 |

127,293 |

|

Intangible fixed assets |

145,849 |

139,445 |

|

Property |

544 |

459 |

|

Buildings |

4,127 |

4,712 |

|

Other tangible fixed assets |

28,057 |

26,548 |

|

Construction work in progress |

444 |

508 |

|

Tangible fixed assets |

33,172 |

32,227 |

|

Equity investments |

913 |

1,098 |

|

Loans |

12,986 |

3,508 |

|

Other long-term investments |

6,454 |

4,126 |

|

Long-term investments - excluding equity shares in equity method

companies |

20,353 |

8,733 |

|

Equity shares in equity method companies |

10,072 |

9,492 |

|

Government - Deferred tax |

27,271 |

28,784 |

|

Accounts receivable: Long-term portion |

210 |

29,584 |

|

Other receivables: Long-term portion |

|

0 |

|

Financial instruments |

622 |

- |

|

Non-current assets |

405,308 |

447,260 |

|

Services in progress |

78 |

1,034 |

|

Goods |

3,567 |

6,735 |

|

Advances and deposits received on orders |

325 |

1,773 |

|

Accounts receivables: Short-term portion |

118,170 |

167,361 |

|

Other receivables: Short-term portion |

71,220 |

53,890 |

|

Cash equivalents |

8,000 |

8,000 |

|

Cash |

10,718 |

12,771 |

|

Prepaid expenses |

8,989 |

10,258 |

|

Current Assets |

221,068 |

261,823 |

|

Asset of activities held for sale |

119,847 |

|

|

Total Assets |

746,223 |

709,082 |

- Liabilities and shareholders' equity as of December 31,

2017

|

In thousands of euros |

12.31.2017 |

12.31.2016 |

|

Share capital |

13,337 |

13,337 |

|

Group reserves |

177,881 |

204,723 |

|

Group exchange gains/losses |

(5,008) |

(2,391) |

|

Group earnings |

11,147 |

(26,747) |

|

Shareholders' equity. Group share |

197,357 |

188,921 |

|

Minority interests (reserves) |

(25) |

9 |

|

Minority interests (earnings) |

14 |

14 |

|

Minority interests |

(11) |

23 |

|

Shareholders' equity |

197,346 |

188,944 |

|

Long-term financial liabilities |

250,830 |

244,013 |

|

Long-term financial instruments |

928 |

1,987 |

|

Deferred tax liabilities |

6,362 |

6,453 |

|

Non-current provisions |

25,445 |

23,441 |

|

Other non-current liabilities |

56 |

13,251 |

|

Non-current liabilities |

283,621 |

289,145 |

|

Short-term financial liabilities |

4,040 |

3,582 |

|

Short-term financial instruments |

2 |

11 |

|

Accounts payable and related accounts |

46,954 |

62,419 |

|

Tax and social liabilities |

83,118 |

78,810 |

|

Provisions |

3,025 |

3,297 |

|

Other current liabilities |

65,098 |

82,874 |

|

Current liabilities |

202,236 |

230,993 |

|

Liabilities of activities held for sale |

63,020 |

|

|

Total Liabilities |

746,223 |

709,082 |

Income statements as of December 31, 2017

|

In thousands of euros |

12.310.2017 |

12.31.2016 |

|

Revenue |

457,441 |

429,251 |

|

Purchased used |

(33,788) |

(35,277) |

|

External expenses |

(122,453) |

(123,100) |

|

Taxes |

(7,257) |

(7,415) |

|

Payroll costs |

(215,434) |

(202,657 |

|

Allocations to and reversals of provisions |

(2,684) |

(4,545) |

|

Change in inventories of products in progress and finished

products |

0 |

1,034 |

|

Other operating income and expenses |

(621) |

(1,276) |

|

Income of equity-accounted affiliates (1) |

2,291 |

1,368 |

|

EBITDA |

77,496 |

57,383 |

|

Depreciation expenses |

(40,075) |

(34,254) |

|

Operating income before special items |

37,420 |

23,129 |

|

Depreciation of goodwill |

- |

- |

|

Non-recurrent income and expenses |

(18,874) |

(24,124 |

|

Other exceptional operating income and expenses |

(18,874) |

(24,124 |

|

Operating income |

18,547 |

(996) |

|

Income from cash and cash equivalents |

631 |

1,094 |

|

Gross cost of financial debt |

(8,938) |

(29,264 |

|

Other financial income and expenses |

1,573 |

2,142 |

|

Cost of net financial debt |

(6,734) |

(26,027) |

|

Income taxes |

(4,002) |

(1,473) |

|

Deferred taxes |

(699) |

(863) |

|

Total taxes |

(4,701) |

(2,336) |

|

Share of profit (loss) for the period of equity method

companies |

(51) |

(115) |

|

Profit (loss) for the period from continuing activities |

7,061 |

(29,473) |

|

Profit (loss) for the period from discontinued activities |

- |

(1,096) |

|

Profit (loss) for the period from activities held for sale |

4,099 |

3,838 |

|

Consolidated profit (loss) for the period |

11,160 |

(26,731) |

|

Consolidated Net income (loss) attributable to owners of the

parent |

11,147 |

(26,746) |

|

Minority interests |

14 |

14 |

|

Average number of shares excluding treasury stock |

13,979,390 |

13,960,024 |

|

Current Earnings Per Share (in euros) |

0.9 |

(1.5) |

|

Earnings Per Share (in euros) |

0.8 |

(1.9) |

|

Dilutive instruments |

Néant |

Néant |

|

Earning for recurring operation per share (in euros) |

0.8 |

(1.9) |

(1) Restatement of the Income of

equity-accounted affiliates

|

In thousands of euros |

12.31.2017 reported |

Income of equity-accounted affiliates |

Activities held for sale |

12.31.2016 restated |

|

EBITDA |

61,410 |

1,368 |

(5,395) |

57,383 |

|

Operating income before special items |

27,072 |

1,368 |

(5,311) |

23,129 |

|

Operating income |

2,948 |

1,368 |

(5,311) |

(996) |

Consolidated cash flow statement as of December 31,

2017

|

In thousands of euros |

12.31.2017 |

12.31.2016 |

|

Consolidated profit (loss) for the period |

11,160 |

(26,733) |

|

Share of earnings from equity method companies |

(2,241) |

(1,253) |

|

Depreciation and provisions |

64,435 |

56,133 |

|

Capital gains or losses on disposals |

(534) |

(548) |

|

Cash flow after cost of net financial debt and taxes |

72,821 |

27,598 |

|

Cost of net financial debt |

6,427 |

25,772 |

|

Tax expenses |

6,628 |

4,083 |

|

Operating cash flow before cost of net financial debt and

taxes |

85,877 |

57,454 |

|

Tax paid |

(1,819) |

(5,687) |

|

Change in working capital requirements for operations:

requirement |

(10,574) |

- |

|

Change in working capital requirements for operations: surplus |

- |

6,801 |

|

Cash flow generated from operating activities after tax paid and

change in working capital requirements (A) |

73,484 |

58,569 |

|

Of which net cash flows from operating activities of held for

sales |

4,299 |

4,021 |

|

Acquisitions of intangible assets |

(48,372) |

(46,622) |

|

Acquisitions of tangible assets |

(12,251) |

(15,209) |

|

Acquisitions of long-term investments |

- |

- |

|

Disposals of tangible and intangible assets |

529 |

848 |

|

Disposals of long-term investments |

1,046 |

- |

|

Change in loans made and cash advance |

(10,749) |

(1,277) |

|

Impact of changes in consolidation scope |

(1,855) |

(21,425) |

|

Dividends received from outside Group |

893 |

2,026 |

|

Net cash flows generated by investment operations (B) |

(70,759) |

(81,659) |

|

Of which net cash flows connected to investment operations of

activities held for sales |

(674) |

(828) |

|

Dividends paid to parent company shareholders |

- |

- |

|

Dividends paid to the minority interests of consolidated

companies |

(70) |

(87) |

|

Capital increase through cash contribution |

- |

- |

|

Loans issued |

10,500 |

190,000 |

|

Loans repaid |

(3,241) |

(340,292) |

|

Interest paid on loans |

(5,996) |

(33,029) |

|

Other financial income and expenses paid or received |

(821) |

(112) |

|

Net cash flows generated by financing operations (C) |

372 |

(183,520 |

|

Of which net cash flows related to financing operations of

activities held for sales |

270 |

(16) |

|

Change In Cash without impact of change in foreign currency

exchange rates (A + B + C) |

3,098 |

(206,610) |

|

Impact of changes in foreign currency exchange rates |

(821) |

(787) |

|

Change in cash |

2,276 |

(207,398 |

|

Opening cash |

20,722 |

228,120 |

|

Closing cash |

22,998 |

20,722 |

The change in WRC is positively impacted by the

factoring and negatively by Cegeelase acquisition of intangible

assets and by the Tessi's fine.

| BPO

(Business Process Outsourcing): BPO is the contracting of

non-core business activities and functions to a third-party

provider. Cegedim provides BPO services for human resources,

Revenue Cycle Management in the US and management services for

insurance companies, provident institutions and mutual insurers.

Business model transformation: Cegedim decided in fall 2015

to switch all of its offerings over to SaaS format, to develop a

complete BPO offering, and to materially increase its R&D

efforts. This is reflected in the Group's revamped business model.

The change has altered the Group's revenue recognition and

negatively affected short-term profitability Corporate and

others: This division encompasses the activities the Group

performs as the parent company of a listed entity, as well as the

support it provides to the three operating divisions. EPS:

Earnings Per Share is a specific financial indicator defined by the

Group as the net profit (loss) for the period divided by the

weighted average of the number of shares in circulation.

Operating expenses: Operating expenses is defined as

purchases used, external expenses and payroll costs. Revenue at

constant exchange rate: When changes in revenue at constant

exchange rate are referred to, it means that the impact of exchange

rate fluctuations has been excluded. The term "at constant exchange

rate" covers the fluctuation resulting from applying the exchange

rates for the preceding period to the current fiscal year, all

other factors remaining equal. Revenue on a like-for-like

basis: The effect of changes in scope is corrected by restating

the sales for the previous period as follows: by removing the

portion of sales originating in the entity or the rights acquired

for a period identical to the period during which they were held to

the current period; similarly, when an entity is transferred, the

sales for the portion in question in the previous period are

eliminated. Life-for-like data (L-f-l): At constant scope

and exchange rates. Internal growth: Internal growth covers

growth resulting from the development of an existing contract,

particularly due to an increase in rates and/or the volumes

distributed or processed, new contracts, acquisitions of assets

allocated to a contract or a specific project. |

|

External growth: External growth covers acquisitions during

the current fiscal year, as well as those which have had a partial

impact on the previous fiscal year, net of sales of entities and/or

assets. EBIT: Earnings Before Interest and Taxes. EBIT

corresponds to net revenue minus operating expenses (such as

salaries, social charges, materials, energy, research, services,

external services, advertising, etc.). It is the operating income

for the Cegedim Group. EBIT before special items: This is

EBIT restated to take account of non-current items, such as losses

on tangible and intangible assets, restructuring, etc. It

corresponds to the operating income from recurring operations for

the Cegedim Group. EBITDA: Earnings before interest, taxes,

depreciation and amortization. EBITDA is the term used when

amortization or depreciation and revaluations are not taken into

account. "D" stands for depreciation of tangible assets (such as

buildings, machines or vehicles), while "A" stands for amortization

of intangible assets (such as patents, licenses and goodwill).

EBITDA is restated to take account of non-current items, such as

losses on tangible and intangible assets, restructuring, etc. It

corresponds to the gross operating earnings from recurring

operations for the Cegedim Group. Adjusted EBITDA :

Consolidated EBITDA adjusted, for 2016, for the €4.0m of

negative impact from impairment of receivables in the Healthcare

Professional division Net Financial Debt: This represents

the Company's net debt (non-current and current financial debt,

bank loans, debt restated at amortized cost and interest on loans)

net of cash and cash equivalents and excluding revaluation of debt

derivatives. Free cash flow: Free cash flow is cash

generated, net of the cash part of the following items: (i) changes

in working capital requirements, (ii) transactions on equity

(changes in capital, dividends paid and received), (iii) capital

expenditure net of transfers, (iv) net financial interest paid and

(v) taxes paid. EBIT margin: EBIT margin is defined as the

ratio of EBIT/revenue. EBIT margin before special

items: EBIT margin before special items is defined as the ratio

of EBIT before special items/revenue. Net cash: Net cash is

defined as cash and cash equivalent minus overdraft. |

Glossary

| About

Cegedim: Founded in 1969, Cegedim is an innovative technology and

services company in the field of digital data flow management for

healthcare ecosystems and B2B, and a business software publisher

for healthcare and insurance professionals. Cegedim employs more

than 4,200 people in more than 10 countries and generated revenue

of €457 million in 2017. Cegedim SA is listed in Paris (EURONEXT:

CGM).To learn more, please visit: www.cegedim.comAnd follow Cegedim

on Twitter: @CegedimGroup, LinkedIn and Facebook. |

| Aude

BalleydierCegedim Media Relations and Communications

ManagerTel.: +33 (0)1 49 09 68 81aude.balleydier@cegedim.com |

Jan Eryk

UmiastowskiCegedimChief Investment Officerand head of

Investor RelationsTel.: +33 (0)1 49 09 33

36janeryk.umiastowski@cegedim.com |

Marina RosoffFor

Madis Phileo Media RelationsTel: +33 (0)6 71 58

00 34marina@madisphileo.com |

Follow Cegedim:

|

Attachment:

http://www.globenewswire.com/NewsRoom/AttachmentNg/88826aea-b20f-4ecb-97cb-84e07e0430ae

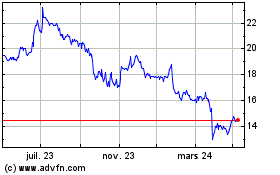

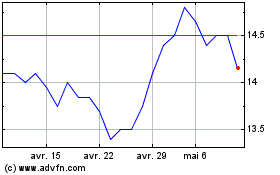

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024