Elliott Says Pernod's New Goals Could Be More Ambitious

08 Février 2019 - 9:45AM

Dow Jones News

By Cristina Roca

Elliott Management Corp. (ELLA.XX) said Friday that the

financial targets of Pernod Ricard SA (RI.FR) could be more

ambitious, after the spirits maker set out fresh mid-term guidance

yesterday during half-year earnings reporting.

The U.S. activist fund, which late last year disclosed that it

had built a stake in Pernod, has been pushing for changes to the

company's operational strategy and governance, saying it lags

behind peers such as Diageo PLC (DGE.LN).

Elliott said on Friday that Pernod's new plan "is a first small

step in starting to address the company's shortcomings in

operational efficiency."

Pernod, the owner of Absolut vodka, raised its full-year

operating profit guidance yesterday and said that as part of its

mid-term plan, it will target sales growth of 4%-7% between fiscal

2019 and 2021.

It will also increase its operating leverage by 50 to 60 basis

points per year between fiscal 2019 and 2021 and gradually increase

its dividend distribution to around 50% of profit from recurring

operations by fiscal 2020, up from a distribution of 41% for fiscal

2018, it said.

In an interview with the Wall Street Journal published Thursday,

Pernod Chief Executive Alexandre Ricard hit back at Elliott, saying

the business is going in the right direction.

However on Friday, Elliott said that it believes these targets

could go further, and that the steps proposed by Pernod lack

specificity and clarity. "Necessary enhancements to the company's

board and corporate governance have yet to be addressed," the

activist investor said.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

February 08, 2019 03:30 ET (08:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

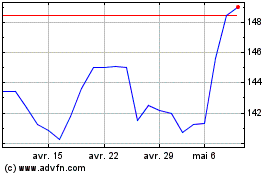

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024