The text of the overview of the share

buyback program authorized by the shareholders at their Combined

Ordinary and Extraordinary General Meeting of May 29, 2019 is a

free translation from the French language and is supplied solely

for information purposes. Only the original version in the French

language has legal force.

Regulatory News:

Pursuant to Articles L. 225-209 et seq of the French Commercial

Code, Articles 241-1 et seq. of the General Regulation of the

French Financial Markets Authority (AMF - Autorité des Marchés

Financiers), Regulation (EU) n° 596/2014 of April 16, 2014,

Delegated Regulation (EU) 2016/1052 of March 8, 2016 and the market

practices accepted by the AMF, this overview contains information

on the objectives and terms of the Publicis Groupe S.A. (Paris:PUB)

[Euronext Paris FR0000130577, CAC 40] share buyback program

in accordance with the authorization granted by the shareholders

under the 22nd resolution adopted at the Combined General Meeting

dated May 29, 2019.

Issuer: Publicis Groupe S.A., a French Company with a Management

Board and a Supervisory Board, with share capital of 94,227,499.60

euro and its principal office at 133 Avenue des Champs-Elysées,

75008 Paris, France, registered with the Paris Trade and Companies

Registry under number 542,080,601. Stock Exchange: Euronext Paris

LEI : 2138004KW8BV57III342. ISIN: FR0000130577.

Number of shares and fraction of capital held directly or

indirectly by the issuer

As of May 31, 2019, the Company’s capital was made up of

235,568,749 shares of which 3,715,429 were held by the Company,

representing 1.58% of its capital.

Allocation of equity held on May 31, 2019 according to

objectives

- 167,500 shares allocated for encouraging the secondary market

or liquidity of Publicis Groupe S.A. shares pursuant to a liquidity

agreement;

- 23,328 shares allocated for payments or exchanges in

connection with external growth transactions; and

- 3,524,601 shares allocated to allow allotment or sale of

shares to employees and/or corporate officers of the Company and/or

its Group.

Characteristics of the 2019-2020 share buyback

program

Buyback program objectives

The objectives of the program authorized by the shareholders at

their General Meeting of May 29, 2019 (22th resolution) are as

follows:

- Allotting or selling shares to employees and/or corporate

officers of the Company and/or of its Group, in accordance with the

requirements and procedures prescribed by applicable statutes and

regulations, in particular as part of a plan for sharing in the

Company’s expansion, by allotting free shares or granting stock

options, or through company savings plans or inter-company savings

plans, or by any other method of compensation in shares;

- Delivering shares to honor obligations in connection with

instruments or securities that may confer entitlement to equity

rights, whether by redemption, conversion, exchange, presentation

of a warrant or by any other means;

- Conserving and subsequently delivering shares as a means of

exchange in merger or spin-off transactions or as a contribution,

as payment in the case of external growth transactions;

- Encouraging the secondary market or the liquidity of Publicis

Groupe S.A. shares through the intermediary of an investment

services provider acting in the name and on behalf of the Company

in compliance with market practices accepted by the AMF and

pursuant to a liquidity agreement complying with the code of ethics

recognized by the AMF or any other applicable provision;

- Cancelling all or part of the shares thus acquired, in

accordance with legal provisions in force, and pursuant to

authorization granted by an extraordinary general shareholders’

meeting.

This program is also intended to enable the Company to trade in

its own shares for any other purpose that is currently authorized

or may be authorized in the future by the laws and regulations in

force. In such a case, the Company will inform its shareholders by

issuing a press release.

Maximum number of shares that may be

acquired

The maximum number of shares that can be purchased must not at

any time exceed 10% of the shares making up the share capital. This

percentage shall apply to the share capital as adjusted to reflect

transactions affecting the share capital carried out subsequent to

this shareholders’ meeting.

The Company’s total amount used for share buyback under this

authorization will not exceed one billion nine hundred ninety nine

million six hundred twenty three thousand three hundred

(1,999,623,300) euro net of costs.

Pursuant to the provisions of Article L. 225-209 of the French

Commercial Code, when shares are redeemed to promote liquidity of

the Company’s shares in accordance with the requirements of the

general regulations of the AMF, the number of shares taken into

account to calculate the 10% limit is equal to the number of shares

purchased, less the number of shares resold during the

authorization period. Moreover, the number of treasury shares held

to be used for payment or exchange in merger or spin-off

transactions or as a contribution will not exceed 5% of the capital

as assessed on the date of the operation. In the event that the

Company avails itself of this authorization it is specified that

the number of treasury shares should be taken into account so that

the Company always remains within the limit of a maximum number of

treasure shares equal to 10% of share capital.

Maximum purchase price

The maximum unit purchase price will be eighty-five (85) euro,

excluding acquisition costs, it being specified that this price

will not apply to share buyback used for allocating free shares or

when options are exercised to employees and/or officers of the

Company and the Group.

In the event of a change in the par value of shares or any

transaction having an impact on shareholders’ equity, the general

shareholders’ meeting delegates to the Management Board the power

to adjust the aforementioned purchase price in order to take into

account the impact of such transactions on the share price.

Redemption terms and conditions

The Company will be entitled to purchase its own shares, and

sell or transfer shares redeemed, directly or through an investment

service provider, in one or more transactions, at any time and by

any means authorized by the regulations in force, or that may come

into force in the future, on regulated stock markets, multilateral

trading facilities (MTFs), through systematic internalizers or over

the counter, and, notably, by buying or selling blocks of shares

(without limitation on the portion of the program that may be

carried out in block transactions), sale and repurchase agreements,

through takeover bids or securities exchange bids, by using option

mechanisms, derivative financial instruments, warrants or, more

generally, securities granting entitlement to shares in the

Company. The Company may also be entitled to hold and/or cancel

shares redeemed subject to authorization by an extraordinary

general shareholders’ meeting, in compliance with applicable

regulations.

The general shareholders’ meeting granted the Management Board

all powers, including the right to sub-delegate its authority, as

permitted by laws and regulations and in accordance with the

Company’s Articles of Incorporation, to determine the modes and

conditions of implementation, to allocate or reallocate the shares

acquired to the various objectives in view in compliance with

applicable laws and regulations, to execute all instruments, enter

into all agreements, carry out all formalities, and, more

generally, to do everything necessary to implement this

resolution.

According to the 23th resolution adopted by shareholders at

their General Meeting of May 29, 2019, shareholders authorized the

Management Board, for a period of 26 months, to reduce the capital

should the need arise, by cancelling, in one or more transactions,

of up to a maximum of 10% of share capital as authorized by law (it

being specified that said maximum applies to the Company's stated

capital as adjusted, if applicable, to account for transactions

with an impact on stated capital that are carried out after the

date of this Shareholders' Meeting) for each twenty-four month

period, of all or part of Publicis Groupe S.A. shares acquired

within the framework of the share buyback programs authorized by

the general Shareholders' Meeting.

Program term

The program was authorized for a period of eighteen months as

from May 29, 2019, i.e., until November 28, 2020.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a

global leader in marketing, communication, and digital

transformation, driven through the alchemy of data, creativity,

media and technology, uniquely positioned to deliver personalized

experience at scale. Publicis Groupe offers its clients a seamless

end-to-end service to address all their marketing and

transformation challenges. Publicis Groupe is organized across

Solutions hubs: Publicis Communications (Publicis Worldwide,

Saatchi & Saatchi, Leo Burnett, BBH, Marcel, Fallon, MSL,

Prodigious), Publicis Media (Starcom, Zenith, Spark Foundry,

Performics, Digitas), Publicis Sapient and Publicis Health.

Epsilon, the data-driven marketing and tech company and its

platform Conversant, is positioned at the center of the group

fueling all the group’s operations. Present in over 100 countries,

Publicis Groupe employs nearly 84,000 professionals.

www.publicisgroupe.com | Twitter:@PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190814005638/en/

Delphine Stricker Corporate Communications + 33 (0)6 38 81 40 00

delphine.stricker@publicisgroupe.com

Alessandra Girolami Investor Relations + 33 (0)1 44 43 77 88

alessandra.girolami@publicisgroupe.com

Chi-Chung Lo Investor Relations + 33 (0)1 44 43 66 69

chi-chung.lo@publicisgroupe.com

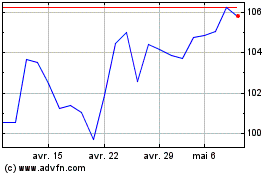

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024