U.S. Dollar Weakens Amid Risk Appetite

04 Juin 2018 - 10:28AM

RTTF2

The U.S. dollar slipped against its major opponents in the

European session on Monday amid risk appetite, as easing political

tensions in Italy and Spain and fresh deal-making news sapped

demand for safe-haven assets.

Trade fears persisted after the weekend trade talks between the

U.S. and China ended without a breakthrough. China warned Sunday

that it will withdraw from commitments made so far on trade if U.S.

President Donald Trump carries out his threat to impose tariffs on

the Asian country.

Meanwhile, Group of Seven finance ministers ended their annual

meeting Saturday with U.S. allies united in condemning Washington's

aggressive protectionism.

The leaders of the G-7 nations,including the U.S., are scheduled

to meet in Charlevoix, Canada, on Friday and Saturday.

On the economic front, the U.S. factory orders are due at 10 am

ET.

The currency traded mixed against its major counterparts in the

Asian session. While it fell against the euro and the pound, it

held steady against the franc. Against the yen, it rose.

The greenback slipped to 0.7660 against the aussie, a level

unseen since April 23. Next key support for the greenback is likely

seen around the 0.775 level.

The greenback dropped to 11-day lows of 1.1737 against the euro

and 1.3399 against the pound, from its early highs of 1.1657 and

1.3340, respectively. If the greenback continues its fall, 1.19 and

1.35 are possibly seen as its next support levels against the euro

and the pound, respectively.

The greenback hit more than a 4-week low of 0.7048 against the

kiwi and a 4-day low of 1.2905 against the loonie, reversing from

its previous highs of 0.6977 and 1.2964, respectively. The next

possible support for the greenback is seen around 0.72 against the

kiwi and 1.27 against the loonie.

Reversing from an early high of 0.9894 against the franc, the

greenback dropped to a 4-day low of 0.9836. The greenback is seen

finding support around the 0.97 region.

The greenback retreated to 109.37 against the yen, from a weekly

high of 109.77 seen at 8:45 pm ET. The greenback is poised to

challenge support around the 108.00 level.

Data from the Bank of Japan showed that Japan monetary base rose

8.1 percent on year in May, coming in at 492.969 trillion yen.

That follows the 7.8 percent increase in April.

In the New York session, U.S. factory orders and durable goods

orders for April are scheduled for release.

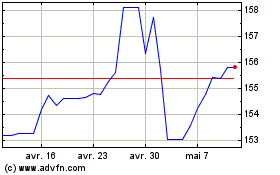

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024