UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under § 240.14a-12 |

AIM

ImmunoTech Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The

below post-trial brief of AIM ImmunoTech Inc. (the

“Company”), dated November 16, 2023, was filed by the Company and its directors in the matter of Ted Kellner v.

AIM ImmunoTech Inc., et al., Case No. 2023-0879-LWW (Del. Ct. Ch. 2023). The Company uploaded a copy of the post-trial brief to the

website https://www.safeguardaim.com/ for the convenience of stockholders. Copies of all filings by parties to the litigation in the

Delaware Court of Chancery are available from the Court’s docket.

IN

THE COURT OF CHANCERY OF THE STATE OF DELAWARE

TED

D. KELLNER,

Plaintiff,

v.

AIM

IMMUNOTECH INC., THOMAS EQUELS,

WILLIAM MITCHELL,

STEWART

APPELROUTH, and NANCY K. BRYAN,

Defendants.

|

C.A.

No. 2023-0879-LWW

|

AIM

IMMUNOTECH INC.,

Counterclaim

Plaintiff,

v.

TED

D. KELLNER,

Counterclaim

Defendant.

|

|

DEFENDANTS’

POST-TRIAL BRIEF

|

Stefan

Atkinson, P.C.

Mary

T. Reale

Mason

E. Reynolds

KIRKLAND

& ELLIS LLP

601

Lexington Avenue

New

York, NY 10022

Michael

F. Williams, P.C.

Don

Hong

KIRKLAND

& ELLIS LLP

1301

Pennsylvania Avenue, N.W.

Washington,

D.C. 20004

Dated:

November 16, 2023 |

William

R. Denny (No. 2580)

Matthew

F. Davis (No. 4696)

Nicholas

D. Mozal (No. 5838)

Caneel

Radinson-Blasucci (No. 6574)

POTTER

ANDERSON & CORROON LLP

1313

North Market Street

Wilmington,

DE 19899

(302)

984-6000

Attorneys

for AIM ImmunoTech Inc.,

Thomas

K. Equels, William Mitchell,

Stewart

Appelrouth, and Nancy K. Bryan

|

TABLE

OF CONTENTS

Table

of Authorities

| Cases |

|

Page(s) |

| |

|

|

| AB

Value Partners, LP v. Kreisler Mfg. Corp., |

|

|

| 2014

WL 7150465 (Del. Ch. Dec. 16, 2014) |

|

19 |

| |

|

|

| Accipiter

Life Scis. Fund v. Helfer, |

|

|

| 905

A.2d 115 (Del. Ch. 2006) |

|

33 |

| |

|

|

| BlackRock

Credit Allocation Income Tr. v. Saba Cap. Master Fund, Ltd., |

|

|

| 224

A.3d 964 (Del. 2020) |

|

37 |

| |

|

|

| Boilermakers

Loc. 154 Ret. Fund v. Chevron Corp., |

|

|

| 73

A.3d 934 (Del. Ch. 2013) |

|

20 |

| |

|

|

| Carlton

Invs. v. TLC Beatrice Int’l Holdings, Inc., |

|

|

| 1997

WL 305829 (Del. Ch. May 30, 1997) |

|

38 |

| |

|

|

| Cirillo

Fam. Tr. v. Moezinia, |

|

|

| 2018

WL 3388398 (Del. Ch. July 11, 2018) |

|

38 |

| |

|

|

| Citron

v. Fairchild Camera and Instrument Corp., |

|

|

| 569

A.2d 53 (Del. 1989) |

|

4 |

| |

|

|

| Coster

v. UIP Cos., |

|

|

| 2022

WL 1299127 (Del. Ch. May 2, 2022) (Coster III) |

|

33 |

| |

|

|

| Coster

v. UIP Cos., |

|

|

| 300

A.3d 656 (Del. 2023) (Coster IV) |

|

33 |

| |

|

|

| In

re Dollar Thrifty, Inc. S’holder Litig., |

|

|

| 14

A.3d 573 (Del. Ch. 2010) |

|

19 |

| |

|

|

| Franz

Mfg. Co. v. EAC Indus., |

|

|

| 501

A.2d 401 (Del. 1985) |

|

20 |

| |

|

|

| Glassman

v. Crossfit, Inc., |

|

|

| 2012

WL 4859125 (Del. Ch. Oct. 12, 2012) |

|

28 |

| |

|

|

| Grunstein

v. Silva, |

|

|

| 2011

WL 378782 (Del. Ch. Jan. 31, 2011) |

|

38 |

| |

|

|

| Hamilton

P’rs, L.P. v. Englard, |

|

|

| 11

A.3d 1180 (Del. Ch. 2010) |

|

2 |

| |

|

|

| Jorgl

v. AIM ImmunoTech Inc., |

|

|

| 2022

WL 16543834 (Del. Ch. Oct. 28, 2022) |

|

passim |

| |

|

|

| Lerman

v. Diagnostic Data, Inc., |

|

|

| 421

A.2d 906 (Del. Ch. 1980) |

|

19 |

| |

|

|

| Linton

v. Everett, |

|

|

| 1997

WL 441189 (Del. Ch. July 31, 1997) |

|

19 |

| Mentor

Graphics v. Quickturn Design Sys., |

|

|

| 728

A.2d 25 (Del. Ch. 1998) |

|

33 |

| |

|

|

| Mercier

v. Inter-Tel (Del.), Inc., |

|

|

| 929

A.2d 786 (Del. Ch. 2007) |

|

19 |

| |

|

|

| Mesa

Petroleum Co. v. Unocal Corp., |

|

|

| 1985

WL 44692 (Del. Ch. Apr. 22, 1985) |

|

19 |

| |

|

|

| Paramount

Commc’ns Inc. v. QVC Network Inc., |

|

|

| 637

A.2d 34 (Del. 1994) |

|

19 |

| |

|

|

| Rosenbaum

v. CytoDyn Inc., |

|

|

| 2021

WL 4775140 (Del. Ch. Oct. 13, 2021) |

|

passim |

| |

|

|

| In

re Rural/Metro Corp. S’holders Litig., |

|

|

| 102

A.3d 205 (Del. Ch. 2014) |

|

39 |

| |

|

|

| In

re Shawe & Elting LLC, |

|

|

| 2015

WL 4874733 (Del. Ch. Aug. 13, 2015) |

|

39 |

| |

|

|

| Sternlicht

v. Hernandez, |

|

|

| 2023

WL 3991642 (Del. Ch. June 14, 2023) |

|

31 |

| |

|

|

| Strategic

Inv. Opportunities LLC v. Lee Enters., Inc., |

|

|

| 2022

WL 453607 (Del. Ch. Feb. 14, 2022) |

|

passim |

| |

|

|

| Temple

v. Raymark Indus., Inc., |

|

|

| 551

A.2d 67, 69 (Del. Super. 1988) |

|

4 |

| |

|

|

| Unitrin,

Inc. v. Am. Gen. Corp., |

|

|

| 651

A.2d 1361 (Del. 1995) |

|

34 |

| |

|

|

| Winner

Acceptance Corp. v. Return on Capital Corp., |

|

|

| 2008

WL 5352063 (Del. Ch. Dec. 23, 2008) |

|

38 |

| |

|

|

| Other

Authorities |

|

|

| |

|

|

| 17

CFR 240.13d-101 |

|

31 |

| |

|

|

| 17

CFR 240.14a-101 |

|

31 |

Preliminary

STATEMENT

Trial

confirmed that the same group that attempted a hostile takeover of AIM last year is trying again, but with Ted Kellner as the new “face”

of their efforts. Trial also confirmed that the group violated AIM’s advance notice bylaws by concealing and making false statements.

Plaintiff thus did not prove that he complied with the bylaws.

Perhaps

recognizing this failure, Plaintiff asks the Court to strike down the bylaws. But, again, he did not meet his burden. Far from it, trial

showed that the bylaws conform to market practice and contain features designed to address AIM-specific matters, as expressly permitted

by Delaware law. And the directors testified that they, with the assistance of counsel, acted reasonably in amending the bylaws to protect

stockholders.

Alternatively,

Plaintiff claims that the board breached its fiduciary duties in rejecting Kellner’s notice. But he did not prove this theory either.

The directors testified that they, again with assistance of counsel, reasonably determined that Kellner’s notice fell woefully

short of the amended bylaws’ disclosure requirements. They each determined that rejecting Kellner’s notice would prevent

an uninformed vote and protect AIM and its stockholders from identified harms. The Board thus acted to protect stockholders in accordance

with their fiduciary duties, not in breach of them.

As

detailed herein, the Court should deny Kellner’s claims and enter judgment for Defendants.

factual

background

Defendant

AIM ImmunoTech Inc. (“AIM” or the “Company”) is a publicly traded Delaware corporation that researches and develops

drug treatments for various diseases, including late-stage cancers and long COVID. PTO ¶10; JX1241.

AIM’s

board (the “Board”) comprises four directors: Defendants Tom Equels, Nancy Bryan, William Mitchell, and Stewart Appelrouth.

PTO ¶¶10-14.

Equels

has served on the Board since 2008. He became CFO in 2013 and CEO in 2016. PTO ¶11; Equels 494:15-19. When Equels became CEO, AIM

was in a dire position: it had received a delisting notice from the New York Stock Exchange and faced dissolution or bankruptcy. Equels

495:5-18.

In

Tudor’s words, “current management (took over in 2016) has done a good job saving the company by strengthening the balance

sheet, refocusing the direction and progressing programs.” JX205.0001-2. Equels led those efforts. Mitchell 635:22-636:12; Appelrouth

Dep. 16:18-17:4; JX0205.0002.1 He changed AIM’s financial plan, “raised money,” and “began a repurposing

of Ampligen in oncology.” Equels 496:14-497:5; see also Mitchell 634:13-636:12. AIM is now solvent and boasts $20 million

in liquidity. Equels 497:10-11, 565:8-10.2 Under Equels’ leadership, AIM has secured government-funded clinical trials

for its lead product, Ampligen. Equels 496:14-24, 500:24-501:12; JX1241; see also Equels 499:23-500:9 (referencing https://aimimmuno.com/immuno-oncology-2/).

Bryan

joined the Board in 2023. PTO ¶14. Bryan has over two decades of experience in the biotech and pharma industry, including commercializing

products. Bryan 651:23-653:2. She serves as President and CEO of BioFlorida—a non-profit life sciences industry organization—and

has held leadership roles at major industry players like Merck, GlaxoSmithKline, and Bayer. JX0678.0002; Bryan 651-54. Bryan qualifies

as an independent director under the Exchange Act and the NYSE rules. JX0678.0002.3

Dr.

Mitchell is the Board’s Chairman. PTO ¶12. He is a physician who holds a Ph.D. in biochemistry, teaches medicine, and has

extensive scientific knowledge about AIM’s products, including decades of research on Ampligen. Mitchell 629-32.

Appelrouth

joined the Board in 2016. PTO ¶13. He is a partner at a global accounting firm, and serves on multiple Board committees. Appelrouth

683.

Plaintiff

Ted Kellner is an AIM stockholder and retired portfolio manager. PTO ¶8. Kellner has worked with others to take over the Company

for nearly two years.

1 Kellner

does not explain why his criticism of Equels’s compensation is relevant to this case. Defendants note that, after Bryan joined

the Board, AIM reduced the independent directors’ annual compensation. JX0678.0002.

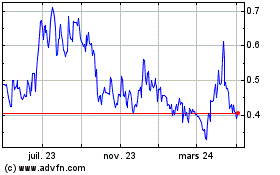

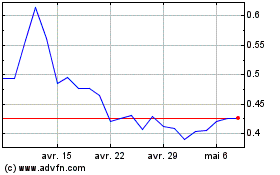

2 As

a microcapitalized company trading as a penny stock subject to aggressive naked short activity, AIM’s discounted share value

likely reflects market manipulation rather than AIM’s value as a going concern. See generally Hamilton P’rs, L.P. v.

Englard, 11 A.3d 1180, 1189 n.3 (Del. Ch. 2010).

3 Kellner

claimed that Bryan is Equels’s “long-time friend” and “beholden” to him. PPTB 19. Bryan explained that

is wrong. Bryan 653:15-654:8, 656:11-20.

| |

B. |

Kellner

Joins Two 2022 Takeover Attempts. |

In

2021, Deutsch convinced Kellner to invest in AIM and introduced Kellner to Franz Tudor. Kellner 220:11-13, 230:14-18 Deutsch 172:13-15;

JX0169.008-10. Tudor is a white-collar criminal. PTO ¶17; JX71. After AIM declined to hire him as a consultant, Tudor commenced

a campaign of interference with AIM’s business, going so far as to falsely suggest to third parties, including a facility running

clinical trials for Ampligen, that he was associated with AIM. Equels 501-05; JX362.0004-5; JX0061; JX0062; JX0065; JX0068; JX0074; JX0075;

JX0079; JX0172; JX0255; Jorgl v. AIM ImmunoTech Inc., 2022 WL 1654384, at *3 (Del. Ch. Oct. 28, 2022). Tudor’s conduct became

so disruptive that AIM sought and obtained an injunction against him in Florida, enjoining Tudor from contacting AIM’s business

relations. JX0362.0005-06 & .0042-48; JX0096; JX0092, Jorgl v. AIM ImmunoTech Inc., 2022 WL16543834, at *3 (Del. Ch. Oct.

28, 2022).

Deutsch

and Tudor coordinated an onslaught of harassing and disparaging messages to AIM and its IR firms. Deutsch 172:7-10, 212:14-17; Equels

504:24-505:1; JX0074; JX0075; JX0077; JX0078; JX0172. Their communications became so frequent, “frantic, abusive, [and] profane”

that, to protect AIM’s employees, Equels instructed employees to decline calls from Tudor and Deutsch. Equels 510:4-15.4

In

November 2021, Kellner, Deutsch, and Tudor began discussing their plans for AIM. JX0022; JX0101; JX0116; Deutsch 177:4-10, 178:3-17;

Tudor 444-46. In 2022, they launched two attempted takeovers.

| |

|

1. |

The

First Takeover Attempt |

To

hide their agreements, arrangements, and understandings (“AAUs”), Kellner, Deutsch, and Tudor sought another stockholder

to be the “face” for their nominations. Walter Lautz played that role. Tudor had communicated with Lautz in December 2021about

“ousting[]” the Board. JX0124; JX0125; JX0131.

On

April 1, Tudor texted Deutsch that “[m]y BMY guy [Daniel Ring] can be on the AIM [Board]” but noted that “we will need

a shareholder to make the nomination.” JX197; Deutsch 182:22-183; Kellner 278:8-17. Tudor assured Deutsch that he would “get

everything together.” JX197.

Tudor

also identified Lautz’s other nominee, Robert Chioini. Chioini does not own or intend to purchase AIM stock. Chioini 11:20-22,

41:6-7, 43. Tudor worked with Chioini at Rockwell Medical Technologies, Inc. Chioini 69:1-6. Rockwell fired Chioini because he “lacked

key attributes necessary to oversee the growth and long-term success of the [c]ompany.” JX0028; Chioini 46:6-9 (acknowledging public

Rockwell press release announcing his termination). Kellner failed to disclose this fact in his eventual nomination notice.

4

Kellner misrepresents documents in claiming Defendants call stockholders “trolls” or “stalkholders.” PPTB

at 9. Instead, they describe Tudor’s and Deutsch’s conduct. See JX1113 (Equels stating Basta and Tudor were “‘Trolling’

you and AIM” and “trying to provoke a knee-jerk response”); JX1114 (Equels stating Deutsch “Could be part of

trolling campaign But just in case talk with him again”).

Tudor

introduced Lautz to Chioini and Ring via email on April 18, 2022. JX0198.0002; JX0131.0002; JX0203. That same day, Tudor sent Lautz a

draft nomination notice, and Lautz, without editing it or even speaking to Chioini or Ring (JX0420 at 29:25-30:3, 48:23-49:6),5

submitted the notice to AIM purporting to nominate Chioini and Ring. JX0200; JX0201.

On

April 19, Deutsch texted Tudor to “write me a little thing on AIM.” JX0197. That same day, Deutsch forwarded to Kellner an

e-mail that Tudor had drafted. JX205.0001; Kellner 292:2-8. Kellner printed the e-mail and hand-marked it extensively. JX205.0001.

Tudor’s

e-mail praised Ampligen and “current management,” but criticized the Board’s competence. JX0205.0001-2; Kellner 283:6-284:10.

The e-mail prompted Kellner to consider his interest in AIM. Kellner 288. In his handwritten notes, he stated “we”—Tudor,

Deutsch, and himself—collectively own “15-18%” of AIM’s stock. Kellner 253:15-19, 291:16-20, 323:4-7; JX0277

(Kellner notes that “we [i.e., Kellner, Deutsch, and Tudor] collectively [own] 20%” of AIM’s stock.).6

On

April 28, AIM rejected Lautz’s nomination notice for failure to comply with the Exchange

Act. JX0232; JX0235.

| |

2. |

The

Second 2022 Takeover Attempt |

| |

a. |

Jorgl

Becomes The New “Face.” |

Undeterred,

Kellner, Deutsch, Tudor, and Chioini tried again. But they needed a new “face.” Lautz declined to front a second try. JX0274.0001;

Chioini 74-76. Tudor forwarded the e-mail to Chioini and his Rockwell co-founder, Michael Xirinachs. JX274; Chioini 76:9-77:5. Xirinachs,

like Tudor, is a convicted white-collar criminal. JX0016; JX0397.

Lautz’s

failure inspired Kellner and his confederates to plan the “AIM deal” more carefully. JX239.

5

The Court should overrule Plaintiff’s hearsay objection under Ct. Ch. R. 32 and DRE 802 to JX0420. Lautz’s 2022 deposition

qualifies under the “former testimony” exception. Lautz was unavailable pursuant to DRE 804(a)(5). He failed to appear for

deposition prior to the trial, although Defendants timely served a foreign subpoena on October 12, 2023. D.I. 259. He gave his testimony

in the Jorgl Action in compliance with law, and a predecessor in interest to Plaintiff, namely Jorgl, using the same counsel, had an

opportunity and similar motive to develop Lautz’s testimony. DRE 804(b)(1); Citron v. Fairchild Camera and Instrument Corp.,

569 A.2d 53 (Del. 1989) (admission “largely turned upon factual findings concerning the relationships of the parties and the issues

in the two actions”); Temple v. Raymark Indus., Inc., 551 A.2d 67, 69 (Del. Super. 1988) (“if it appears that in the

former suit a party having a like motive to cross-examine about the same matters as the present party would have, was accorded an adequate

opportunity for such examination, the testimony may be received against the present party”) (citations omitted)).

6

Kellner strained to testify that the “we” meant himself, Deutsch, and Deutsch’s “network,” even going

as far as to suggest that his handwritten notes had nothing to do with the underlying document. Kellner 253:22-24, 288:1-290:5.

On

May 3, Chioini invited Tudor and Xirinachs to a teleconference with counsel at Baker & Hostetler LLP (“BakerHostetler”)

regarding a “Proxy contest.”7 JX240; Chioini 73-74. Chioini does not “recall cancelling the meeting.”

Chioini 73:19-22.

Thereafter,

Xirinachs communicated frequently with Chioini and BakerHostetler. Among other things, Xirinachs and Chioini received and commented on

multiple drafts of the nomination notice (before the group even found a stockholder to submit it). JX990; JX1000; JX1020; JX392. Chioini

claimed attorney-client privilege on common interest grounds over most of these communications. JX0392; JX0401; JX0416; JX990; JX1000;

JX1020; JX0454; Harrington 426-27.

On

May 4, Tudor authored an e-mail criticizing Equels and telegraphed the group’s “fight” plans for the 2022 annual meeting.

JX248; Kellner 298:20-21. Deutsch forwarded the message to Kellner. Id. In response, Kellner decried AIM’s “poor management”

and contemplated “replac[ing]” the directors:

JX248;

Kellner 298:1-22, 299:10-11, 16-18, 300:1-3. Tudor echoed that sentiment, writing to AIM

that they would now “get gloves off.” JX2055.0001; Kellner 302.

On

June 2, Tudor requested that Deutsch forward an e-mail to Kellner regarding the 2022 annual meeting. JX265; Kellner 309:8-313:23. Tudor

explained to Deutsch and Kellner that he had “a shareholder who is wil[ling] [sic] to have their name as the lead but so

far have not been able to find anyone to front the $150k.” JX265. Tudor “strongly believe[d] [that] we [i.e., Kellner,

Deutsch, Tudor, Chioini, and Xirinachs] could get the votes to change the [Board].” JX265; Kellner 313:10-13. Tudor further explained

to Deutsch and Kellner that he had “2 strong candidates to run and get control of” AIM’s Board. JX265; Kellner 311:15-18.

And Tudor identified the annual meeting date, window for making nominations, and the directors’ personal information. Kellner 310:24-313.

Tudor continued that he had “spoken with legal counsel” and that the group, if successful, would have its legal fees reimbursed.

JX265; Kellner 312:5-9.

7

BakerHostetler represented Jonathan Jorgl in the second takeover attempt and now represents Kellner.

On

June 4, Kellner and Deutsch discussed Tudor’s role in the takeover. JX433; Kellner 316-19. Kellner had spoken to Tudor about AIM

days before. Kellner 316:18-317:2. Deutsch reassured Kellner that Tudor was “all in” on the proxy contest. JX 433; Kellner

318:14-17. Kellner, in turn, reassured Deutsch that Kellner was all in too. JX 433; Kellner 319:7-11. Indeed, Tudor, Deutsch, and Kellner’s

“plan[ ]” was to “get a lawyer” and to “proceed [with the] vote [for a] new board.” JX0278; Kellner

322:20-321:2.

Still,

the group needed a “face” and another nominee because Ring dropped out. On June 21, Lautz texted Tudor and asked, “were

you able to find someone to be the face of the activist?” JX0280 (emphasis added). Tudor responded, “We are

still looking.” Id. (emphasis added).

The

next day, Chioini recruited Michael Rice to be his co-nominee. Chioini 78:4-22. Chioini emailed Tudor Rice’s contact information,

JX284, and Tudor sent Rice a write-up about AIM. JX0283. Rice was a co-founder of Rockwell Medical’s investor relations firm, LifeSci

Advisors, through which he had developed a relationship with Chioini. JX0404 at 34.

Rice

solved the group’s problem by getting what Chioini called a “body” to make the nominations. JX0291. That body was Jonathan

Jorgl, who could not yet nominate directors because, like Chioini, he did not own AIM stock. Rice Dep. 62:3-63:5. So, on June 27, Jorgl

bought 1,000 shares. Jorgl Dep. 33:4-6; id. 18:6-10. With guidance from Rice, Chioini, and Xirinachs, Jorgl then transferred those

shares into his name of record, and the group continued planning to unseat AIM’s Board. JX288; JX290; JX294; JX295; JX312; JX313;

JX317; JX320; JX321. Jorgl’s arrival gave Chioini and Rice cause to “celebrate winning board seats [and] taking control of

the [C]ompany.” JX294.

Xirinachs

was part of what Kellner would refer to as the “Jorgl team.” JX467. Xirinachs, along with Tudor, Chioini, and Rice, planned

and implemented Tudor, Deutsch, and Kellner’s nomination scheme. JX288; JX327; JX222; JX239; JX240; JX242; JX265; JX274; Rice 473:7-21

(agreeing Tudor and Xirinachs were involved in proxy contest in 2022).

| |

b. |

The

Group Reaches an Agreement on Attorneys’ Fees. |

Between

June 23 and June 30, Chioini and Xirinachs continued to communicate frequently with BakerHostetler about AIM and “board nominations.”

JX1020. Several of these emails included drafts of “AIM Nomination Letter” and a summary of information required by the advance

notice bylaws. Id. Chioini withheld these emails and attachments from production on privilege grounds based on common interest.

JX0392; Harrington 424-27; JX0454. On June 28, Kellner’s assistant emailed Deutsch, Tudor, and Mark Darnieder (Kellner’s

friend and consultant) requesting a call regarding the “AIM situation.” JX0302; JX0303.

On

July 6, BakerHostetler sent Jorgl a draft engagement letter which stated it had included Xirinachs in its conflict check. JX316; JX1200.

Jorgl balked at signing the engagement letter and requested that it be revised to make “clear [Jorgl] was not responsible for the

retainer or the fees,” but that the fees “would be paid by a third party.” JX320. On July 7, Chioini reassured Jorgl

that he “would not be on the hook” for any costs and that “[w]e are paying [the] fees.” JX317 (emphasis

added); JX320.

| |

c. |

Jorgl

Submits His Nomination Notice. |

On

July 8, Jorgl submitted a notice purporting to nominate Chioini and Rice (the “Jorgl Notice.”). JX322. Tudor kept Kellner

and Deutsch informed about the nomination. JX303; Kellner 325:12-326:16. On July 9, Tudor told Kellner that Tudor made the nominations:

JX325

(emphasis added).

Kellner

says that, by “Franz,” he meant “Jorgl.” Kellner 239:18-240:5. But even Kellner does not believe that. In August

2022, Kellner drafted an update to the “Beta Fund Investment Club”8 that claimed, “a couple of weeks ago”—i.e.,

July 20229—“Todd Deutsch … and Franz Tudor commenced a proxy to replace all of [AIM’s] directors.”

(the “Draft 2022 Update”):

In

AIM’s case, there is now a legal suit,which I am a part of, to replace management. AIM has a drug that, in my opinion, has significant

potential in cancer research called Ampligen. My view, along with two others joining me in the proxy battle, is that management has done

an abominable job, which I knew going into the investment, and they continued to mismanage the company throughout 2021 and 2022. A couple

of weeks ago, Todd Deutsch, who is known to several of you, and a gentleman named Franz Tudor, commenced a proxy to replace all of the

directors and ultimately management. I am now a party to that proxy fight, which will hopefully commence with the replacement of the

management team in the text twelve months. More on that as time progresses.

JX522.00003.

| d. | Xirinachs

Continues Working Behind the Scenes While the Group Conceals His Involvement. |

Xirinachs

was part of what Kellner would refer to as the “Jorgl team.” JX467. Xirinachs, along with Tudor, Chioini, and Rice, planned

and implemented Tudor, Deutsch, and Kellner’s nomination scheme. JX288; JX327; JX222; JX239; JX240; JX242; JX265; JX274; Rice 473:7-21

(agreeing Tudor and Xirinachs were involved in proxy contest in 2022). One business day after Jorgl submitted the group’s nomination

notice, Xirinachs wrote to Chioini about “our slate,” and outlined the group’s plans:

The

way I hope this all plays out is we get control of AIM—We figure out just what they have or don’t have, decide if it is something

we want to pursue, then hire the right people to move it forward, how much $$ are we throwing at it. In the meantime, we continue to

look for opportunities to either acquire, (to spin off at a later time), license technology, or possibly merge with. In 2 1/2 short months

we should be good to go.

JX327.

To

further conceal his own involvement, Xirinachs used Paul Tusa and his shell company, River Rock Advisors LLC, as a façade through

which Xirinachs was to fund the nomination efforts. JX329; Chioini 83-84. But neither Tusa nor River Rock contributed any funds to the

nomination efforts. Tusa 113:3-12. Xirinachs did, however, give Tusa $5,000 to keep River Rock’s bank account open to keep up appearances.

JX0421 (Tusa 2022 Dep.) 31:15-32:19. One day after discussing “our slate,” Xirinachs emailed Chioini and Tusa about the “AIM

Immunotech deal,” telling Chioini that Tusa is “aware of our plans regarding AIM … .” JX0329; Chioini

85-86. And on July 20, 2020, Xirinachs asked Tusa to sign a conflict-of-interest form for “our Attorneys,” BakerHostetler.

JX346 (emphasis added). Tusa became uncomfortable with the arrangement and backed out. Tusa 109:1-110:10.

8 The

Beta Fund Investment Club is an investment portfolio that Kellner managed for his college fraternity brothers.

JX951.

9 Because

Kellner failed to produce this document in the Jorgl Action, the only available version was one forwarded and re-dated in

December 2022. The metadata confirms it was drafted in August. JX0951.0005-6.A

Thereafter,

AIM’s Board rejected Jorgl’s Notice. JX331. AIM informed Jorgl of the rejection (JX344) and litigation ensued.

Jorgl,

Rice, Chioini, and River Rock entered into a “Group Agreement” as of July 27, relating to the proxy contest. JX1215. Notwithstanding

Xirinachs’s significant role and the fact he was funding River Rock, the group continued to conceal his involvement. They only

revealed Xirinachs’s role when forced to in discovery.

On

September 15, the group issued a proxy statement claiming that on September 14, the Group Agreement was amended “as a result”

of the fact that Xirinachs had “paid certain expenses on behalf of River Rock … and agreed to be jointly responsible for

expenses [related to the Jorgl nomination attempt] with Mr. Chioini going forward.” JX397. These late-executed agreements merely

memorialize—for the purpose of obscuring the real timeline—certain arrangements and understandings between Kellner, Jorgl,

Chioini, Rice, Tusa, River Rock, and Xirinachs that existed well before July 8, 2022.

| C. | The

Group Begins Planning a 2023 Proxy Contest Immediately After the 2022 Annual

Meeting. |

On

October 27, 2022, Kellner organized a breakfast with Tudor, Chioini, Rice, and Jorgl for November 3. JX451; Kellner 342:10-342:3. One

day later, the Court denied Jorgl’s motion for a preliminary injunction. Jorgl, 2022 WL 1654384. The Court noted Kellner’s

involvement in the nomination efforts, including his conversations with Tudor and Deutsch during the nomination attempts. Id. at

*3, *7, *13 & n.82.

Kellner

canceled the breakfast but still attended AIM’s 2022 annual meeting and, later that evening, he wrote to Tudor and Deutsch, asking

for a call with the “Jorgl team” to discuss “next steps” toward a 2023 proxy contest. JX467.00002; Kellner 342:13-14;

344:17-344:23. Kellner was “hoping” the Jorgl team was “fully committed” to trying again. Kellner 343:22-344:7;

JX467.00002.

They

were. The same day, Chioini confirmed that “[w]e do intend to contest next year and will submit our nomination well in advance

of the deadline to avert any antics like this year.” JX468.00001. Chioini copied Rice on the message, and forwarded it to Xirinachs.

Chioini 97:2-98:8, 99:21-100:7; JX468.00001.

| D. | Chioini

and Rice Determine in December 2022 to Mount a “Better Organized” Proxy Contest

in 2023 and “Come Out Guns Blazing.” |

On

November 13, Chioini instructed BakerHostetler to send AIM a letter seeking his and Rice’s appointment to the Board. JX499.00003;

Chioini 20:7-21. In the letter, Chioini and Rice claimed their appointment to the Board would “avoid[] continued conflict and another

proxy contest.” Id.

Chioini

directed John Harrington to follow-up, Harrington 431:15-432:3, and on December 5, Harrington called AIM’s counsel, Michael Pittenger.

Pittenger took notes during the call. JX825.00006. Harrington does not dispute the accuracy of Pittenger’s notes. Harrington 391:14-392:8;

406:11-22, 410:18-412:14.

Harrington

told Pittenger that Chioini and Rice wanted to “avoid another proxy contest” and that they would be amenable to putting “mutually

agreeable directors” on the Board to do so. Harrington 407:12-408:9; Pittenger 709:3-711:21 JX0825.00006. Harrington conveyed that

his clients were “strongly motivated and committed,” Harrington 393:3-10, and “impatient,” and if an agreement

could not be reached before the holidays they would be “better organized next year” and were “ready to come out guns

blazing,” Pittenger 709:3-711:21; JX825.00006.10 Harrington said he was seeking to convey that Chioini and Rice were

“committed” to putting “energy and effort into achieving a goal….” Harrington 393-94 (emphasis

added). Pittenger promptly reported Harrington’s statements to Equels. JX825.00005.11

| E. | Kellner

and at Least Two Other Investors Agree in Late 2022 to Run a Proxy Contest in 2023. |

In

December 2022, Chioini spoke with Kellner about a 2023 proxy contest. JX541.00002. Kellner said he was “very interested in working

with [Chioini and Rice] to remove [the Board]” and “want[ed] to keep in touch.” JX541.00002. Chioini relayed the message

to Harrington. Id.; Chioini 25:20-26:3; 26:13-27:8.

Following

his conversation with Chioini, Kellner revised his draft update and sent it to the Beta Fund investors. Kellner 347:15-347:21; JX0557.

Kellner stated with respect to AIM that “[t]wo other investors are joining me in a proxy battle to replace an inept management

team. More on that as time progresses.” JX0557.00002. The update confirms that, by December 2022, Kellner had an AAU with at least

two other investors to run a 2023 proxy contest to take control of AIM. JX0541.0002; Kellner 347:15-347:21. Kellner, of course, was cagey

about who those “other investors” were, and—incredibly— contends the August draft Beta Fund update and the December

email were “mistakes.” Kellner 362-363.

10 Contrary to Kellner’s suggestion,

PPTB 13, Harrington does not dispute that he could have said “guns-blazing,” Harrington 417:1-18.

11 Kellner has claimed the call was protected

by Rule 408. PPTB 12-13. He also asserted privilege at trial over the message Chioini told Harrington to convey during the call. Chioini

104-105. But Harrington “was not thinking [about] … Rule 408” when he made the call. Harrington 415:10-23. This “sword

and shield” approach of allowing Harrington to testify about his mandate, while precluding Chioini from testifying about it, was

improper.

In

January 2023, Kellner and Deutsch discussed their “AIM game plan” and how they could “get the ball rolling.”

Deutsch 199:23-200:5; JX0570.0002. The next month, on February 15, BakerHostetler attorneys emailed Tudor and Gary Woodfield, Deutsch’s

attorney in the lawsuit AIM filed against the group in the Middle District of Florida, with the subject line “Re: AIM Immunotech

– Question re Share Ownership,” which Woodfield forwarded to Kellner and Deutsch. JX605.00001.

| F. | AIM

Amends Its Advance Notice Bylaw Provisions. |

Meanwhile,

AIM considered amending its bylaws for various reasons, including that they were outdated, did not cohere with the DGCL or the SEC’s

universal proxy rules, and contained inconsistent terminology. Equels 519:20-21; Pittenger at 713:9-714:7, 715:14-22, 716:11-19; JX0646.0002.

In January 2023, Rodino asked Pittenger if he could prepare proposed amended bylaws. Pittenger 713:9-10.

On

March 17, Potter provided the Board a memorandum summarizing the proposed changes. JX635; Pittenger 714:12-716:19. The memorandum also

explained the fiduciary duties implicated in the Board’s decision to amend the bylaws. JX635. Counsel wanted the directors “to

know what the duties and potential standards of review were in that context so that they would focus on the right issues and questions

and make the types of determinations they needed to make before they decided whether or not to amend the bylaws.” Pittenger 715:15-22.

On

March 20, the Board convened to discuss the proposed amendments. JX0646.0001. Before this meeting, every director read the memorandum,

proposed amendments, and a redline showing proposed changes to AIM’s prior bylaws. JX0644; JX0647.0001; Pittenger 717:23-718:1;

Equels 525:22-24; Appelrouth 687:17-688:2; Mitchell 636:18-637:7.

At

this meeting, the Board also discussed AIM’s experience with the misleading tactics employed in the 2022 nomination effort. Pittenger

718:11-16. Given that experience, the Board wanted to “better ensure that [all] stockholders seeking to propose business or make

nominations cannot attempt to engage in the types of manipulative, misleading, and improper conduct” deployed in 2022. JX0647.0002;

Pittenger 717:13-719:8.

The

Board asked questions during the meeting, JX0646.0002, and Equels proposed two changes to the advance notice provisions: (1) limiting

the look-back period to 24-months; and (2) requiring full legal names of those involved with any nomination. See infra at 32-34.

Counsel

implemented these revisions, and on March 28, the Board unanimously adopted them as AIM’s new bylaws (the “Amended Bylaws”).

JX0647.0002; JX0657.0001; JX0664.0001. The Amended Bylaws’ advance notice provisions require nominating stockholders to disclose

in their nomination notice, among other things: (i) ownership of AIM securities (including derivative and synthetic ownership) by the

nominating stockholder, other AIM stockholders on whose behalf the nominations are made, and the nominees; (ii) AAUs between the nominating

party, the nominees, and others related to the nominations, including those concerning funding of the nominations; (iii) information

about the nominees; (iv) information concerning potential conflicts of interest; and (v) other stockholders known to support the nominations.

JX0686.0002-4. The Amended Bylaws further require that each nominee complete and sign a director questionnaire. JX0686.0004.

The

Board determined that these provisions were “in the best interests of the Company and its stockholders[.]” JX0647.0002. They

further concluded they were “reasonably designed to facilitate orderly stockholder meetings and election contests and to ensure

fully and timely disclosures of material information relation to stockholder proposals and nominations,” and “were not preclusive

or unreasonably restrictive of the ability of stockholders to … nominate directors, or to solicit stockholders support (including

through a proxy solicitation).” JX0647.0002.

Expert

testimony confirms that the Board’s determinations are “consistent with market practice.” Rock Expert Report ¶22;

Rock 791:20-793:12; cf. Freedman 866:7-21.

| G. | The

Group Launches Its Third Take Over Attempt. |

Meanwhile,

the group continued to plan its third takeover attempt.

| 1. | The

group further cements its plans in spring 2023. |

Kellner

contends that he did not have any AAUs regarding the 2023 nomination until July 17, 2023, JX.0870.00007, and says that he only “had

periodic communications about AIM with Chioini and Kellner’s friend and co-investor, Deutsch” about AIM. Kellner PTB at 19.

Trial showed otherwise.

Throughout

Spring 2023, Kellner, Deutsch, Tudor, Chioini, and Rice met, communicated, and further developed their AAUs regarding the 2023 proxy

contest:

| ● | Chioini

admits to speaking with Deutsch in the Spring 2023 and recalls that “Deutsch was not

happy with” AIM’s board. Chioini 29:1-29:7. |

| ● | Deutsch

recalls that “after speaking to Mr. Kellner and seeing our investment continue to disintegrate,

we decided, okay, let’s – we need to talk about this.” Deutsch 188:16-189:6. |

| ● | On

April 20, Kellner texted Deutsch: “Can we put that call together between you Gary [lawyer]

me and Robb [Chioini] today or tomorrow Todd?” JX713.00002. At this time, the group

wanted to learn “what had happened in the past” and “get as much information

as we can” to “learn what [their] risk-reward was going for.”12

Deutsch 192:20-194:20. |

| ● | In

April or May 2023, Kellner and Tudor met face-to-face in Florida. Tudor Dep. 37:20-40:19. |

| ● | On

May 19, Kellner texted Deutsch: “Please reach out to [Chioini] to hear what his plan

and that of Teresa [at BakerHostetler] is regarding AIM. Time is becoming critical in moving

this ball forward. Let’s please talk later today.” JX0740.00002. |

| ● | On

May 19, Kellner texted Chioini and Deutsch: “Todd will call you momentarily Robb.”

JX0745.00002. |

The

AIM conversations culminated in late June 2023, when Kellner asked his assistant to “arrange a series of private jet stops”

to pick up Chioini, Deutsch, and Darnieder to attend a meeting in BakerHostetler’s Washington D.C. office to discuss the 2023 proxy

contest; Rice also joined virtually. Kellner 352:1-352:22; 354:18-355:7; JX0765.

The

meeting occurred on July 11. Kellner 352:10-22. Chioini and Rice have both claimed privilege over the discussions at the July 11 meeting,

demonstrating that Rice had some form of AAUs with the others at the time sufficient to warrant invocation of privilege. Chioini Dep.

138:10-16; Rice Dep. 158:14-160:24.

| 2. | Kellner’s

Attempted Nomination. |

On

July 24, Kellner requested a form of D&O questionnaire and form of representation and agreement.

JX0821.00002.

12

This did not concern the Florida litigation. Deutsch 194:17-20.

Consistent

with market practice, the Amended Bylaws require stockholder nominees to submit a director questionnaire with their nomination notice.

Rock 792:4-6. Under the Amended Bylaws, AIM had five business days to respond. JX0686.0004. AIM and its counsel determined it was necessary

to revise the D&O Questionnaire so it would apply to stockholder nominees and to update it. Pittenger 732:10-735:2; JX0821. Kellner

flags this so-called “delay.” But, as Pittenger explained, updates were needed because “AIM had not previously had

a D&O questionnaire provision in its bylaws” and the existing questionnaire “was geared towards sitting directors”

so “it didn’t make a lot of sense for stockholders making nominations to fill out that form.” Pittenger 732:10-735:2.

Counsel thus updated the form to, among other things, facilitate compliance by such nominees. JX0821; JX0834; JX0841; JX0844. On July

31, Rodino sent the materials to BakerHostetler. JX1226.

Meanwhile,

on July 27, Kellner and Deutsch filed a Schedule 13D with the SEC. JX0831. The 13D disclosed that “Mr. Kellner intends to provide

notice to [AIM] of his intent to nominate directors for election at the 2023 annual meeting of stockholders.” JX0831.00005.

Equels

was aware of the Schedule 13D filing and Kellner’s request for the D&O questionnaire, Equels 540:20-541:6, 595:17-598:18, and,

on July 31, had his receptionist email the Board to arrange time to speak about a “second attempt of hostile takeover.” JX842.

Kellner has fixated on the July 31 email to suggest that the Board “deemed Kellner’s Notice dead on arrival.” PPTB

22. But Kellner’s 13D filing and request for the D&O questionnaire made clear that a “takeover” was Kellner’s

intention.

On

August 3, BakerHostetler emailed AIM a copy of a letter from Kellner, dated August 4, stating Kellner’s intent to nominate himself,

Chioini, and Deutsch at AIM’s 2023 annual stockholders meeting (the “Kellner Notice”). JX0870; JX0875.

| 3. | The

Board Considers the Kellner Notice. |

The

Board met on three occasions to discuss the Kellner Notice: August 8, 21, and 22. Crucially, the Board made no decision on Kellner’s

Notice until it was evaluated by its counsel and the Board had a chance to discuss its contents. Equels 625:23-627:1; Appelrouth 692:7-639:8.13

13 Kellner accuses the Board of only “pretend[ing]

to deliberate about the Notice,” pointing primarily to a draft AIM press release. PPTB 25. But that press release was a “contingency-type

preparation” reflecting “the fact that [the Board] would need to assess and make [a] determination” about the Kellner

Notice. Equels 626:15-627:4; see also Pittenger 737:4-738:6.

At

the Board’s first meeting, Equels and counsel provided information regarding the 2022 takeover attempt, the Amended Bylaws’

requirements and the process for evaluating the Kellner Notice. JX882. The Board also decided to hire legal counsel at Potter Anderson

and Kirkland & Ellis LLP “to help do the evaluation whether the nomination notice complied with the advance notice bylaws.”

Bryan 660:18-660:23; JX0882.00003. As the directors testified, it made sense to rely on counsel to investigate Kellner’s Notice

because “they’re the professionals” and had “the best information” to assist the Board in “mak[ing]

the right decision.” Appelrouth 694:18-695:10; Bryan 667:14-22; Equels 546:5-14.

The

Board and counsel met again on August 21. Pittenger 740:11-740:13; JX907. In advance of the meeting, counsel distributed presentation

materials to the Board that (i) provided a chronological overview of the Kellner Notice and related events preceding it; (ii) explained

the Board’s fiduciary duties in connection with considering the Kellner Notice; and (iii) analyzed whether the Kellner Notice complied

with the Bylaws. JX907; Pittenger 741:18-742:9.

At

the August 21 meeting, Equels and counsel discussed the pertinent factual background to Kellner’s Notice and the Board’s

“need to carefully review and evaluate [Kellner Notice] to determine whether it complies with [the Bylaws].” JX911.00002-3.

As with the August 8 meeting, Equels and counsel provided fairly extensive background because Bryan was relatively new to the board and

had less familiarity with the 2022 nomination efforts and litigation. Pittenger 739:22-740:1.

Counsel

from Potter and Kirkland also provided a “fairly lengthy” and “extremely thorough” presentation that was circulated

to the Board before the meeting. JX0907; Pittenger 742:6-8. Counsel, again, advised the Board on its fiduciary duties. JX0907.0010-14.

Among other things, counsel explained to the Board that, even if the Kellner Notice did not comply with the Amended Bylaws, the Board

“still has to exercise its fiduciary duties to decide whether to accept or reject the notice.” Pittenger 747:1-3.

Counsel

also elaborated on the presentation slides analyzing the Kellner Notice, including their findings that the Notice did not comply with

the Amended Bylaws in numerous respects. Pittenger 741:18-742:9; Bryan 662:3-14; JX0911.0004-8. As the minutes show, counsel carefully

explained the deficiencies they had identified.

After

nearly two hours, the Board opted not to vote on Kellner’s Notice but instead recessed to give everyone “the opportunity

to reflect on the information that [they] had.” Bryan 665:19-24; Appelrouth 694:5-17.

The

Board reconvened the next morning on August 22. At the reconvened meeting, the Board asked additional questions and counsel advised on

the available actions, including the option for the Board to accept the notice “if the directors did not believe the defects were

significant enough for rejection.” JX0911.0009. After careful deliberation, and relying on the advice of counsel, the Board determined

that the Kellner Notice failed to comply with the Amended Bylaws in numerous ways, including as discussed further below.14

Appelrouth 694:7-695:10; JX0911.0009-10. Specifically, the reasons the Board found the Kellner Notice not in compliance with the Amended

Bylaws included:

failure

to disclose or false or misleading disclosures regarding AAUs that Messrs. Chioini, Kellner and Deutsch have and had amongst themselves

and others, such as Messrs. Tudor, Xirinachs, Lautz, Jorgl, Rice and Tusa, River Rock Associates LLC and BakerHostetler, relating to

(a) the 2022 nomination efforts by the conspirator group, (b) their late 2022 plans to carry out a proxy contest in 2023, and (c) the

2023 nomination efforts;

JX0911.0009.

The

many ways in which Kellner’s Notice failed to comply with the Amended Bylaws are described in more detail in the Argument section

below.

After

the Board determined that Kellner’s notice did not comply with the Amended bylaws, the Board considered whether to accept or reject

it. Pittenger 748:4-11. Counsel “provided the board with various factors they could … consider.” Pittenger 748:11-12.

“The board discussed those, and Mr. Equels made a lot of points about those as well.” Pittenger 748:13-14.

Among

other things, the Board considered potential harms to stockholders should the Board accept Kellner’s notice. As Pittenger testified,

“[t]hey were trying to do a hostile takeover without paying a control premium” and “if elected, they would seek to

have AIM reimburse the approximately $2 million of expenses in fees from the prior year’s failed efforts and failed litigation.”

Pittenger 749:4-11. The Board also considered that Kellner’s notice implicated “many of the same players” who had tried

to conceal from stockholders the participation of convicted criminals in funding and orchestrating takeover attempts of AIM. JX0911.0009-10;

Pittenger 748:17-749:3. The Board also determined that the Kellner Notice’s significant deficiencies undermined the purpose of

AIM’s advance notice bylaws: “to ensure that the Board received full and truthful disclosures” and that the “Company’s

stockholders have complete and accurate information from the nominating stockholder and nominees to cast informed votes.” JX0911.0002,

9-10.

14 Kellner complains that AIM did not

reach out to address the allegations of noncompliance before the Board voted to reject his notice. PPTB 25-26. Kellner, however, submitted

his Notice via email at 7:52 p.m. on August 3, the evening before the August 4 submission deadline. JX0870. It was too late for Kellner

to correct any deficiencies.

After

thorough deliberation, the Board determined to protect the Company and its stockholders from these harms and reject the Kellner Notice.

JX0911.0009-10; Bryan 667:9-667:22; Equels 553:15-554:6.

On

August 23, AIM’s counsel sent a letter to Kellner’s counsel notifying Kellner that the Kellner Notice did not comply with

the Amended Bylaws and explaining the Board’s reasons for rejecting it. JX0378; Pittenger 749:20-24.

This

lawsuit followed. A three-day trial concluded on November 1.

ARGUMENT

| I. | THE

AMENDED BYLAWS ARE VALID |

| A. | The

Directors Complied With Their Fiduciary Duties When Amending The Bylaws. |

Should

the Court decide to consider the Board’s adoption of the Amended Bylaws under enhanced scrutiny, Defendants’ conduct readily

meets that standard. Enhanced scrutiny requires Defendants to (1) “identify the proper corporate objectives served by their actions,”

and (2) “justify their actions as reasonable in relation to those objectives.” Strategic Inv. Opportunities LLC v. Lee

Enters., Inc., 2022 WL 453607, at *16 (Del. Ch. Feb. 14, 2022). Plaintiff argues that Defendants’ “sole purpose”

in amending the bylaws was to entrench themselves, and that the amendments were not “tailored to any remotely legitimate interest.”

PPTB 32-38. As explained below, those arguments fail.

| 1. | The

Amended Bylaws Address Proper Corporate Objectives. |

The

trial evidence establishes that the Board amended the advance notice provisions to further legitimate corporate aims, including to:

|

● | “[F]acilitate

orderly stockholder meetings and election contests and to ensure full and timely disclosures

of material information relating to stockholder proposals and nominations”; JX0647.0002; |

| ● | Provide

“additional clarity” to the AAU provisions so that future stockholders would

be less likely to try to “evade” or “misconstrue” the disclosure

requirements; Pittenger 728; see also JX0647.0002; |

| ● | Require

director nominees to fill out a Company D&O questionnaire, consistent with “recent

generations of advance notice bylaws”; Pittenger 729; see also JX0973 (Rock

Report) ¶¶57, 67. |

| ● | Require

disclosure of known supporters of the stockholder nominator and nominees, consistent with

Delaware caselaw; Pittenger 729 (referencing Rosenbaum v. CytoDyn Inc., 2021 WL 4775140

(Del. Ch. Oct. 13, 2021) (finding known supporter disclosure requirements “vitally

important”)); see also JX0633.0005, .0011; and |

| ● | Require

disclosures related not only to beneficial ownership of AIM stock but also to synthetic and

derivative ownership, which provisions are “very common” in advance notice bylaws;

Pittenger 730-731. |

These

are proper corporate objectives that serve the stockholders and the Company. See JX0973 (Rock Report) ¶¶23-30, 48-54,

60-79; accord Jorgl, 2022 WL 16543834, at *14-16; Lee Enters., 2022 WL 453607, at *14-16; CytoDyn, 2021 WL 4775140,

at *17-18.

Trial

also showed that two additional provisions Plaintiff challenges served proper corporate objectives: (1) requiring the disclosure of AAUs

concerning nominations not only in connection with the upcoming annual meeting but during the prior 24 months, and (2) requiring disclosure

of the “full legal name (and any alias names),” as opposed to just “the name,” of the nominating stockholder,

the nominees, and the persons with whom they have AAUs. Pittenger 721; JX0647.

With

respect to the first, AIM’s counsel agreed that under the initial draft of the Amended Bylaws, “it wasn’t clear if

[the bylaws were] just seeking present, current [AAUs] that are still in effect or whether it [went] back in time. And if it did go back

in time, [whether] it [went] back to the beginning of time.” Pittenger 722. The Board selected the 24-month lookback period to

resolve that ambiguity because “a year might be too short,” but the Board did not want the period to “go on forever.”

Pittenger 724; Equels 529. Additionally, the 24-month lookback period was implemented to prevent future attempts, akin to what Jorgl

tried with respect to Tudor in 2022, to conceal AAUs with persons who played an integral role in orchestrating the nominations under

the pretense that such persons “dropped out” of the nomination efforts. Pittenger 723.15

The

second change was adopted so the Board and stockholders would have more specific and accurate information about the identities of nominating

stockholders, nominees, and others to facilitate the Board’s “diligence that [it] would need … to do in making its

recommendations to stockholders about particular candidates.” Pittenger 722. The utility of this amendment is apparent from the

2022 nomination efforts, where AIM “had some difficulty figuring out” the identity of one of the people being nominated.

Pittenger 721-722.

15 Kellner argues the “bespoke”

nature of the 24-month period makes it improper. But as Professor Rock testified, the mere fact that a provision is novel does not mean

it is inconsistent with market practice. Rock 807:13-808:1. Unrebutted, Professor Rock has confirmed that this past experience with activists

is a proper reason to amend corporate bylaws. Rock Expert Report ¶ 29. Even Freedman agrees that “the enactment of bylaws is

a form of private ordering.” Freedman Dep. 57:19-21.

In

response, Plaintiff argues that Defendants amended the bylaws “for the purpose of entrenchment and preventing shareholder

choice.” PPTB 32-33. But this theory fails. On the law, Plaintiff cites a slew of inapposite cases for the proposition that

Defendants amended the bylaws to “make compliance impossible or extremely difficult.” Id. But in the cited cases,

the boards’ intent to thwart imminent stockholder votes was clear because the boards’ actions made compliance with

advance notice provision deadlines objectively impossible.16 Those facts bear no resemblance to the circumstances here.

The Amended Bylaws do not exclude any record stockholder from nominating directors, nor are they impossible to comply with; they

merely require truthful and accurate disclosure of material information.

Plaintiff

has not established his entrenchment theory. Plaintiff did not seek in discovery or present at trial any evidence establishing that AIM’s

compensation is material to any of the directors such that they were motivated to amend the bylaws to entrench themselves. The evidence

shows that the Board amended AIM’s advance notice provisions for the proper purpose of ensuring full and accurate disclosures of

material information in connection with stockholder proposals and nominations.

| 2. | The

Amended Bylaws Were Reasonable in Relation to the Board’s Proper Objectives. |

Plaintiff

contends that the Amended Bylaws “were not reasonably tailored to any cognizable threat.” PPTB 38. But the evidence establishes

that the Amended Bylaws are reasonable in relation to the Board’s specific objectives. See Mercier v. Inter-Tel (Del.), Inc.,

929 A.2d 786, 808 (Del. Ch. 2007); Paramount Commc’ns Inc. v. QVC Network Inc., 637 A.2d 34, 45 (Del. 1994) (response satisfies

proportionality if it falls “within a range of reasonableness.”). A reasonable response reflects “a logical and reasoned

approach [to] advancing a proper objective” under the circumstances. In re Dollar Thrifty, Inc. S’holder Litig., 14

A.3d 573, 598 (Del. Ch. 2010).

The

Board reasonably adopted state-of-the-art advance notice provisions that are “consistent with market practice either because they

[are] ubiquitous, as with regard to the AAU provision and the D&O questionnaire provision, or because they [are] … state of

the art [and have] found market acceptance” as with the known supporter and 13D disclosure provisions. Rock 803:17-804:9. These

amendments promote well-informed elections and are “not unreasonable.” Jorgl, 2022 WL 16543834, at *15-16; accord

CytoDyn, 2021 WL 4775140, at *14; JX0973 (Rock Report) ¶64.

16 Even though Plaintiff cites these cases

in his argument that the Amended Bylaws are “facially invalid,” the cases all concern as-applied challenges to advance

notice bylaws. See AB Value Partners, LP v. Kreisler Mfg. Corp., 2014 WL 7150465, at *3 (Del. Ch. Dec. 16, 2014); Mesa Petroleum

Co. v. Unocal Corp., 1985 WL 44692, at *6 (Del. Ch. Apr. 22, 1985); Lerman v. Diagnostic Data, Inc., 421 A.2d 906, 914 (Del.

Ch. 1980); Linton v. Everett, 1997 WL 441189, at *10 (Del. Ch. July 31, 1997).

Additionally,

as discussed below, the disclosure requirements are not unduly burdensome. And they do not specifically “target” any particular

stockholder. Although some of the changes were informed by the conspirators’ misdeeds in connection with the 2022 nominations and

the concern that other stockholders could use “the same playbook” in the future (Pittenger 727-728; see also JX0647.0002),

the provisions apply equally to all stockholders. Indeed, before approving the amendments, the Board expressly concluded “that

the proposed amendments were not preclusive or unreasonably restrictive of the ability of stockholders to make proposals, to nominate

directors, or to solicit stockholder support.” JX0647.0002.

| B. | Kellner

Failed to Prove That the Amended Bylaws Are “Facially” Invalid. |

As

stated in Defendants’ Pretrial Brief, Plaintiff’s “facial” challenge to the Amended Bylaws is really an as-applied

challenge because it is based on the bylaws’ adoption and use. DPTB, 34-35. On that basis alone, the Court should not grant relief

under Plaintiff’s Count I.

But

even if the Court concludes that Plaintiff’s facial challenge is properly alleged, it still falls short because AIM’s bylaws

are presumed valid, Franz Mfg. Co. v. EAC Indus., 501 A.2d 401, 407 (Del. 1985), and Plaintiff has failed the “stringent

task” of showing that the “bylaws cannot operate validly in any conceivable circumstance.” Boilermakers Loc. 154

Ret. Fund v. Chevron Corp., 73 A.3d 934, 940 (Del. Ch. 2013).

Plaintiff’s

only arguments unrelated to the adoption or use of the Amended Bylaws is that they are “draconian and unreasonably vague.”

PPTB 39. These arguments fail.

| 1. | The

Amended Bylaws Are Not Draconian. |

| a. | The

Amended Bylaws Are Not Preclusive. |

Plaintiff

argues that the Amended Bylaws are “draconian” because they “preclude every reasonable prospect of election competition

(i.e., are preclusive) and bind shareholders to vote for Defendants (i.e., are coercive).” PPTB 39. That argument

fails.

First,

Plaintiff’s chief point in support of this contention appears to be that AIM’s advance notice provisions are long. See

PPTB 40, 42. But as Professor Rock explained at trial, the length of the Amended Bylaws does not render them “more burdensome

to comply” with, “[i]t just makes it harder to evade the clear meaning of the bylaw.” Rock 823; see also Pittenger

730 (Section 1.4(3)(B) is “very long” because it describes “complex concepts,” which the bylaws must “adequately

describe[]”). Enhancing the clarity and specificity of the bylaws was a goal of the Board, in part, because in 2022, the Company’s

more general articulation of similar disclosure requirements became a target for manipulation and intentional misinterpretation. Pittenger

728.

Second,

the provisions Plaintiff contends are unreasonably burdensome request information that (1) is commonly requested in public company advance

notice provisions, and (2) this Court has identified as being material to voting stockholders. For example, Plaintiff attacks the Amended

Bylaws’ definition of “Stockholder Associated Person” (“SAP”), the AAU provision (Section 1.4(c)(1)(D)),

the beneficial, synthetic, and derivative ownership disclosure requirement (Section 1.4(c)(3)(B)), and the known supporter requirement

(Section 1.4(c)(4)). PPTB 16-17, 39-42. At trial, Professor Rock explained that all of these provisions are consistent with market practice.

Rock 797:4-7, 800:22-803:11; JX0973 (Rock Report) ¶67. Moreover, as to “known supporter” provisions, this Court has

already determined that the information required of such bylaws is “vitally important” to voting stockholders. CytoDyn

Inc., 2021 WL 4775140, at *19; accord Jorgl, 2022 WL 16543834, at *13-15.

Plaintiff

repeatedly characterizes the SAP definition as one link in a “daisy chain” that the bylaws use to “‘glom[] definition

upon definition.” PPTB 40-41. But Plaintiff misinterprets the daisy chain concept. In Williams, the Court considered a poison

pill provision providing that “stockholders act[ed] in concert with one another by separately and independently ‘Acting in

Concert’ with the same third party”—thereby linking (like a chain of daisies) persons who may have never met, spoken

to, or known of each other. Id. at *11. But the AAU provision, which Plaintiff cites twice as an example of daisy chaining, does

not require the nominator and nominees to disclose AAUs between persons wholly “unlinked” to them. Rather, the nominator

and nominees are required to disclose any AIM nomination-related AAUs among, on the one hand, themselves or persons with whom they

have a discernable connection—family members, SAPs, persons acting in concert with SAPs, etc.—and, on the other hand,

any other person or entity. In other words, in the Amended Bylaws, there is always an anchor tying the required disclosure back

to the nominator or nominees such that they are never asked to disclose information about which they could not possibly have or obtain

knowledge.

Finally,

Plaintiff failed to prove that provisions requesting disclosure of compensation arrangements (Section 1.4(c)(1)(J)) and dates of

first contact with the nominating stockholder and SAPs (Section 1.4(c)(1)(H)) are somehow “indeterminate beyond reasonable comprehension.”

PPTB 42. Plaintiff provides no support for his position that information regarding compensation agreements between the nominating stockholder

and nominee or their affiliates would be impossible or difficult to collect. PPTB 42. Likewise, Plaintiff provides no reason why a nominating

stockholder or SAP would not be able to determine, from any number of sources, including, for example, e-mails, phone and text records,

or calendars, the dates (or at the very least, the approximate dates) they first had contact with their nominees regarding director nominations

or AIM. Moreover, these provisions too are common. See, e.g., JX0622.0006 (Article I Section 1.12(b)(iii)(C)); JX0615.0010 (Article

II Section 11(f)(ii)); JX0667.0012 (Article I Section 11(b)).

Plaintiff’s

assertion that the Amended Bylaws are preclusive is unfounded and should be rejected.

| b. | The

Amended Bylaws Are Not Coercive. |

Plaintiff’s

coercion argument is premised on his faulty preclusion argument. He asserts that stockholders are coerced to voting for the board’s

nominees because stockholders are allegedly precluded from making nominations. PPTB 39. But as stated above, the Amended Bylaws are not

preclusive. Any stockholder of record who complies with the reasonable conditions of the advance notice provisions may nominate an alternative

slate for AIM’s stockholders to consider and possibly elect.

| 2. | The

Amended Bylaws Are Unambiguous. |

Plaintiff

also asserts that the Amended Bylaws “are too vague to be valid.” PPTB 43. Specifically, Plaintiff states that the bylaws

are ambiguous in their use of the terms “agreements,” “arrangements,” “understandings,” and “promises”

that are “written or oral.” Id. As this Court has already found, words like “arrangement” and “understanding”

have “commonly accepted meanings” that are “not odd or technical, but common sense.” Jorgl, 2022 WL 16543834,

at *12. In fact, in Jorgl, the Court explained that the words “arrangement or understanding” mean “any advance

plan, measure taken, or agreement—whether explicit, implicit, or tacit—with any person towards the shared goal of the nomination.”

Id.

Plaintiff’s

attempts to manufacture confusion where the bylaws are precise should be rejected.

*

* *

Plaintiff

failed to show that the Amended Bylaws are impossible to comply with in every conceivable circumstance. The Amended Bylaws are consistent

with market practice and seek information that is material to voting stockholders. The Amended Bylaws are valid on their face Defendants

should prevail on Plaintiff’s Count I.

| II. | THE

KELLNER NOTICE DID NOT COMPLY WITH THE AMENDED BYLAWS |

Plaintiff

bears the burden on his claim that the Kellner Notice complies with the Amended Bylaws. See, e.g., Jorgl, 2022 WL 16543834,

at *13-14. He cannot carry it.

| A. | The Kellner

Notice Violates the AAU Provisions. |

Section

1.4(c)(1)(D) of the Amended Bylaws requires nomination notices to disclose AAUs that the “Holder,”17 any “Stockholder

Associated Person,”18 or the proposed nominees have with each other or other persons (including persons acting in

concert with them) “existing presently or existing during the prior twenty-four (24) months relating to or in connection with”

AIM director nominations. JX0686 (§1.4(c)(1)(D)).19

As

noted above, in Jorgl, the Court explained that the phrase “arrangement or understanding,” as it relates to nominations,

requires disclosure of “any advance plan, measure taken, or agreement—whether explicit, implicit, or tacit—with any

person towards the shared goal of the nomination.” Jorgl, 2022 WL 16543834, at *11-12. A “quid pro quo” is not

required, but mere discussions or sharing of information “is not alone sufficient” to form an “arrangement or understanding.”

Id. While the Amended Bylaws added the word “agreements” and the parenthetical “(whether written or oral, and

including promises)” to the phrase, those additions merely enhanced clarity; they did not make compliance any more burdensome.

See id. at *11-12 (interpreting “arrangements” and “understanding” to include “agreements”

and to include “explicit, implicit, or tacit” arrangements or understandings).

The

Kellner Notice failed to disclose or contained false disclosures about AAUs relating to (1) the 2022 nomination efforts, (2) plans in

late 2022 to nominate directors and run a proxy contest in 2023, and (3) Kellner’s 2023 purported nominations.

17 Defined as the nominating stockholder and each beneficial owner on whose behalf the nomination

is made. JX0686 (§1.4 (i)(6)).

18 Defined, in relation to any Holder, as “(i) any person acting in concert with such

Holder with respect to the Stockholder Proposal or the Corporation, (ii) any person controlling, controlled by, or under common control

with such Holder or any of their respective Affiliates and Associates, or a person acting in concert therewith with respect to the Stockholder

Proposal or the Corporation, and (iii) any member of the immediate family of such Holder or an Affiliate or Associate of such Holder.”

JX0686 (§1.4 (i)(8)).

19 Sections 1.4(E) also contains provisions requiring disclosure of certain AAUs, including

a 10-year look back. See JX0686 (§1.4(c)(1)(E)).

| 1. | Undisclosed

AAUs Relating to the 2022 Nomination Efforts |

The

Kellner Notice omitted or falsely described AAUs relating to the 2022 nomination efforts. See JX0378.0003-05. It did “not

mention[] or acknowledge[]” AAUs that Chioini, Kellner, and Deutsch have and had among themselves and others, including Tudor,

Xirinachs, Lautz, Jorgl, Rice, Tusa, and River Rock relating to the 2022 nominations. Id. at .0003-04. While the Kellner Notice

contains sections called “Statement relating to” the roles of each of these persons in the 2022 nomination efforts (in many

cases arguing that they were not involved or that they first had AAUs long after they orchestrated, coordinated, or promised to fund

the efforts), those sections are, at best, misleading.

| a. | The

Kellner Notice Misrepresents Tudor’s Involvement in the Jorgl Nomination Efforts. |

The

Kellner Notice asserts that Tudor was not materially involved in the Jorgl nomination efforts. JX0875.0008-.09. Trial showed this was

false. Tudor (1) planned the nominations with Kellner and Deutsch, (2) selected Chioini and thereafter closely coordinated with Chioini

and Rice, (3) continued planning the nominations with Chioini and Xirinachs, including at least one call with their counsel, (4) engaged

in a months-long effort with Chioini to find a new “face” and funding for the nomination efforts, and (5) kept Deutsch and

Kellner updated on the progress of the efforts, which Tudor, Kellner, and Deutsch all viewed as their nomination and proxy contest. See,

e.g., JX0238-43; JX0245; JX0246; JX0248; JX0252; JX0265; JX0271; JX274; JX0276; JX0280; JX0283; JX0284; JX0286; JX0293; JX302;

JX0303; JX0307; JX0325; see also Chioini 69, 71-73. In addition, Rice testified that Tudor was involved in the 2022 proxy contest.

Rice Dep. 106:6-107:5.

Kellner’s

contention that Tudor “did not have any material involvement in Mr. Jorgl’s nomination notice and related effort” is

not credible. In fact, in July and August 2022, Kellner believed that Tudor was behind the nominations, but now—incredibly—claims

that he was just mistaken. Kellner’s handwritten notes of his July 9, 2022 call with Tudor—the day after Jorgl submitted

the nomination notice—show that Tudor confirmed to Kellner that the nominations of Chioini and Rice were Tudor’s nominations.

JX0325; Kellner 325:12-327:11. Tudor would have had no way of knowing on July 9 that the nomination notice was submitted unless he was

still actively involved in the nomination efforts because there was no public announcement regarding the nominations until after AIM

filed the Florida lawsuit against the group (including Kellner and Tudor) on July 15. JX0343, JX0347. Moreover, as discussed below, Kellner’s

contemporaneous writing in August 2022 showed his knowledge that Deutsch and Tudor were actually the ones behind the 2022 nomination

efforts. JX0522.0003

| b. | The Kellner

Notice Misrepresents Xirinachs’s Involvement in the Jorgl Nomination Efforts. |

The

Kellner Notice also falsely asserted that Xirinachs had no AAUs with Chioini or others before Jorgl submitted his nomination notice on

July 8, 2022. JX0875.0007 (denying Xirinachs had any role, other than “numerous conversations” with Chioini, before July

8 and stating that “[t]he ultimate [AAU that Xirinachs would provide funding] came about shortly after the submission of the July

8, 2022 notice.”). These statements are belied by, among other evidence,

| ● | The

“common interest” privilege that Chioini and Xirinachs continue to assert with

respect to their frequent pre-July 8 communications in which they worked with counsel to

plan the nomination process, including Xirinachs receiving numerous drafts of the Jorgl nomination

notice (without Jorgl himself even being copied) (JX312; JX0392; JX0401; JX0416; JX990; JX1000;

JX1020.0003; Harrington 425:21-426:1); |

| | | |

| ● | Xirinachs’s

involvement before July 8 being so significant that BakerHostetler included him in its pre-July

8 conflicts check; JX1200; |

| | | |

| ● | Xirinachs’s

significant assistance to Jorgl in acquiring record ownership of AIM shares; JX288; JX290;

JX294; JX295; JX312; JX313; JX317; JX320; JX321; |

| | | |

| ● | Xirinachs’s

significant assistance to Jorgl in acquiring record ownership of AIM shares; (JX0288; JX0295;

JX0311; JX0313); |

| | | |

| ● | Chioini’s

assurance to Jorgl before July 8 that Jorgl would not be responsible for expenses of the

nomination efforts and that “we” (which included Xirinachs) would cover them;

JX0317.0002; JX0320; Rice Dep. 102:16-20, 135:15-137:8; and |

| | | |

| ● | The

fact that Tudor disclosed to Kellner on July 9, 2022, that Xirinachs was involved in the

nomination efforts. Kellner 257:22-258:3. |

Moreover,

just one or two business days after Jorgl submitted his nomination notice, Xirinachs was communicating with Chioini about “our”

plans for AIM and “our slate.” JX0329.0002 JX0327. Those plans did not magically materialize over the weekend. The efforts

of Chioini and others throughout trial to contend that the group’s frequent use of terms like “we” and “our”—

in reference to their proxy contest, slate, plans for AIM, and funding arrangements— were meant to be singular (not plural) are

simply not credible. Chioini had AAUs with Xirinachs before July 8, 2022, concerning nominations that Kellner has not disclosed in his

notice.

| c. | The Kellner

Notice Misrepresents AAUs with Respect to the Funding of the 2022 Nominations. |

The

Kellner Notice also misleads concerning AAUs with respect to the funding of the 2022 nominations, including when and with whom those

AAUs were formed.

For

example, the evidence shows that, by July 8, 2022, there was an AAU that Xirinachs would help fund the proxy contest. As noted, Chioini

told Jorgl that Jorgl would not be financially responsible and “[w]e are paying fees.” JX0317.0002; JX320. Chioini admits

that, by that point, he had been urging Xirinachs to provide funding for weeks (Chioini 36:13-16, 72:5-11, 77:11-13, 81:10-13 ). And,

as shown above, Chioini had been closely coordinating with Xirinachs, including via numerous purportedly privileged communications, since

early May. JX0317; JX0392; JX1000; JX1020.

As

another example, Xirinachs’s efforts to add Tusa/RiverRock to the group to make it appear they, rather than Xirinachs, were the

funding source are also telling. The plan all along was for Xirinachs and Chioini (i.e., the “we” in Chioini’s

communication to Jorgl) to provide funding. JX0317.0002. Just two business days after the Jorgl notice was submitted, Xirinachs brought

Tusa and RiverRock into the mix to obfuscate the funding source JX0328. RiverRock was an entity with almost no funds. Xirinachs funded

RiverRock’s payment obligations from the outset, and there never was any expectation that Tusa or River Rock would actually pay.

The Kellner notice falsely states that “Mr. Tusa’s financial circumstances changed and, ultimately, River Rock did not end