0001604738falsetrue00016047382023-11-092023-11-090001604738us-gaap:CommonStockMember2023-11-092023-11-090001604738ainc:PreferredStockPurchaseRightMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 9, 2023

ASHFORD INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nevada | | 001-36400 | | 84-2331507 |

(State or other jurisdiction of incorporation

or organization) | | (Commission

File Number) | | (IRS employer

identification number) |

| 14185 Dallas Parkway | | | | |

| Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AINC | | NYSE American LLC |

| Preferred Stock Purchase Rights | | | | NYSE American LLC |

ITEM 7.01 REGULATION FD DISCLOSURE

On November 9, 2023, Ashford Inc. (the “Company”) held an earnings conference call for its third quarter ended September 30, 2023. A copy of the conference call transcript is attached hereto as Exhibit 99.1. On November 8, 2023, the Company filed a Form 8-K that included the actual earnings release text and supplemental tables.

The information in this Form 8-K and Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101).

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 9, 2023 | | | | | | | | |

| ASHFORD INC. |

| | |

| By: | /s/ ALEX ROSE |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

ASHFORD

Third Quarter 2023 Conference Call

November 9, 2023

11 a.m. CT

Introductory Comments – Jordan Jennings

Good day and welcome to today’s conference call to review results for Ashford for the third quarter of 2023 and to update you on recent developments. On the call today will be: Deric Eubanks, Chief Financial Officer, and Eric Batis, Executive Vice President of Operations. The results as well as notice of the accessibility of this conference call on a listen-only basis over the Internet were distributed yesterday in a press release.

At this time, let me remind you that certain statements and assumptions in this conference call contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Such forward-looking statements are subject to numerous assumptions, uncertainties and known or unknown risks, which could cause actual results to differ materially from those anticipated. These factors are more fully discussed in the Company’s filings with the Securities and Exchange Commission. The forward-looking statements included in this conference call are only made as of the date of this call and the Company is not obligated to publicly update or revise them.

In addition, certain terms used in this call are non-GAAP financial measures, reconciliations of which are provided in the Company’s earnings release and accompanying tables or schedules, which have been filed on Form 8-K with the SEC on November 8, 2023, and may also be accessed through the Company’s website at www.ashfordinc.com. Each listener is encouraged to review those reconciliations provided in the earnings release together with all other information provided in the release. Also, unless otherwise stated, all reported results discussed in this call compare the third quarter ended September 30, 2023 with the third quarter ended September 30, 2022.

I will now turn the call over to Deric.

Introduction – Deric Eubanks

Thanks Jordan, and welcome everyone to our call to discuss our financial results for the third quarter of 2023. I’ll start by giving you an overview of our operations, strategy, and financial results for the quarter, and then Eric will provide an update regarding our operating businesses. After that, we will open it up for Q&A.

The key themes we are going to highlight today are:

•First, the lodging industry has continued to perform well, and for the quarter we reported revenue growth over the prior year at most of our portfolio companies, however, our margins have been negatively impacted as our businesses resume more normalized staffing levels;

•Second, we continue to see an attractive pace of capital raising through Ashford Securities and have raised approximately $540 million of capital since its launch in 2021; and

•Third, we’re excited to provide an update on our newest advised platform, the Texas Strategic Growth Fund. The Texas Strategic Growth Fund is a private investment vehicle focused on investing in all types of commercial real estate in Texas.

As of September 30, 2023, our two publicly-traded REIT platforms, Ashford Trust and Braemar, had ownership interests in 116 hotels with approximately 27,000 rooms and approximately $7.9 billion of gross assets. Braemar’s resort portfolio continues to see some stabilization in both demand and pricing as leisure guests now have more options for travel, while its urban hotels continue to recover nicely as both corporate and group demand continues to strengthen.

Ashford Trust continues to focus on deleveraging its balance sheet and extending its debt maturities and ended the quarter with $271 million of net working capital. To date, Ashford Trust has issued approximately $77 million of its non-traded preferred stock, and we believe this is an attractive source of capital for that platform. Ashford Trust recently announced the planned conversion of its Crowne Plaza La Concha Hotel in Key West, Florida to a Marriott Autograph Collection® property in early 2024 and the planned conversion of the Le Pavillon Hotel in New Orleans, Louisiana to a Tribute Portfolio property, also part of the Marriott brand family. Both of these announcements illustrate how Ashford Trust can unlock embedded value in its high-quality geographically diversified portfolio. Ashford Trust continues to focus on paying off its corporate financing primarily through select asset sales, refinancing and extending upcoming debt maturities, and raising capital through its non-traded preferred stock offering.

Our newest advised platform is the Texas Strategic Growth Fund, which we launched late last year. We recently made a $2.5 million investment into this fund and that capital, along with other capital raised from outside investors, was used to make an equity investment in a multi-family property in San Antonio, TX.

Our strategy and structure are designed for growth. We have a powerful ecosystem of businesses that all benefit as we grow our assets under management. Our size and scale in the lodging industry also bring benefits to third-party owners and other capital providers as we are one of the largest owners and fee payers for the major hotel brands. We believe we have a superior strategy and structure that is unique within the hospitality space, and we are excited about the potential growth of our platform. Over the past few years, we have completed numerous bolt-on acquisitions for our operating businesses, and we continue to look for attractive opportunities to strategically and accretively grow our business.

I will now turn to our financial results for the quarter.

Net loss attributable to common stockholders for the third quarter was $(12.0) million.

Adjusted EBITDA was $11.8 million for the third quarter.

Adjusted net income for the third quarter was $7.8 million, and adjusted net income per diluted share was $0.96.

Total advisory fee revenue from Braemar in the third quarter increased 5.8% over the prior year quarter.

Our share count currently stands at 8.2 million fully diluted shares outstanding, which is comprised of 3.1 million common shares outstanding, 0.2 million common shares earmarked for issuance under our deferred compensation plan, 4.2 million common shares associated with our Series D convertible preferred stock, and the remaining 0.7 million shares are for acquisition related shares and restricted stock.

I will now turn the call over to Eric to discuss our operating businesses in more detail.

Products & Services – Eric Batis

Thank you, Deric.

We are excited to provide third quarter updates on our Products & Services businesses. Our strategy is to acquire exceptional businesses and create shareholder value by implementing best operating practices, executing accretive add-on acquisitions, and utilizing our unique ability to refer these businesses to our advised REITs.

In the third quarter, the Products & Services businesses posted strong top-line performance, with three businesses achieving greater than 15% revenue growth over the prior year quarter. We are excited about these market share gains, particularly for our businesses with recurring clients as we look to optimize expenses in future quarters.

The first business I’d like to discuss is INSPIRE, our leading single-source solution for meeting and event needs with an integrated suite of audio-visual services, including show and event, hospitality, and creative services. INSPIRE executed four new hospitality contracts during the third quarter which are expected to contribute $2.2 million of annual audio-visual revenue. INSPIRE generated $30.6 million of audio-visual revenue in the third quarter, a 17.1% increase over the prior year quarter, and $0.8 million of Adjusted EBITDA. The third quarter is historically the lowest margin quarter of the year for INSPIRE due to seasonality, but we are pleased with the continued revenue growth.

Remington is a dynamic hotel management company, providing best-in-class management and expertise to hotels across the country. In the third quarter, Remington executed four new third-party hotel management agreements representing $1.1 million of annual revenue. Remington also generated third quarter hotel management fee revenue and Adjusted EBITDA of $12.4 million and $4.7 million, respectively, representing a 37.8% Adjusted EBITDA margin. Remington’s margin has decreased compared to the prior year quarter due to an increase in lower margin ancillary revenue, and lower incentive management fees, which were elevated in 2022 due to hotels outperforming budget throughout the pandemic recovery.

At the end of the third quarter, Remington managed 121 properties that were open and operating. Remington managed 72 properties for Ashford’s advised REITs, Ashford Hospitality Trust and Braemar Hotels & Resorts. Remington also managed 49 third-party properties for 30 different ownership groups, 13 of which have hired Remington to manage two or more of their hotels. These ownership groups include real estate funds, family offices, high net worth individuals, private equity groups and developers. Remington’s managed portfolio operates in 26 states and Washington, D.C. across 26 brands, including 13 independent and boutique properties.

Earlier this week, Remington announced its expansion into the Caribbean market. The company has begun managing Croc’s Resort & Casino in Costa Rica, marking Remington's first property in the region. Remington Hospitality is broadening its international portfolio with one additional signed contract in Costa Rica and two in the Dominican Republic. We look forward to providing additional updates on future calls.

RED Hospitality & Leisure is a leading provider of watersports activities and destination services in the U.S. Virgin Islands, Puerto Rico, Florida Keys, Turks & Caicos, and Hawaii. In the third quarter, RED generated $8.4 million of revenue, representing a 26.7% increase over the prior year quarter, and $0.9 million of Adjusted EBITDA. RED has continued to see demand level off from its post-COVID peak in the Florida Keys market, causing less high margin incremental passenger revenue to be captured.

Earlier this year, RED acquired Alii Nui and Maui Dive Shop in Hawaii establishing a strategic foothold in the market. RED’s operations in Hawaii were significantly impacted by the Maui wildfires in August 2023. RED expects demand to ramp back up through the end of 2023 and into early 2024 as Maui recovers and tourism demand normalizes. Our hearts go out to the people impacted by this tragedy.

The next business I will discuss is Premier, which provides comprehensive and cost-effective design, development, architecture, procurement, and project management services. Premier generated $7.4 million of design and construction fee revenue in the third quarter, representing 18.4% growth over the prior year quarter. Premier also generated $2.7 million of Adjusted EBITDA, resulting in a 36.9% Adjusted EBITDA margin. During the quarter, Premier executed five new third-party contracts representing $0.5 million of expected fee revenue. Premier plans to further grow ground-up development, general contracting, architecture, and design project opportunities to diversify its revenue streams.

We are very pleased with the ongoing success of Ashford Securities’ fundraising efforts. Through the third quarter, Ashford Securities has raised approximately $540 million of capital since 2021. Ashford Securities is currently in the market with a redeemable non-traded preferred stock offering for Ashford Trust and has continued to build momentum by growing our institutional, broker/dealer, and RIA relationships. Since the launch of the Ashford Trust non-traded preferred stock offering, Ashford Securities has placed approximately $76.8 million of capital. This is an attractive source of capital for Ashford Trust to both improve its balance sheet and for potential growth.

Ashford Securities is also raising capital for a growth-oriented investment product focused on commercial real estate in Texas. As of the end of the third quarter, Ashford Securities has raised over $5.6 million of capital including an investment by Ashford Inc. of $2.5 million and signed dealer agreements with 19 firms to distribute this product. Additionally, during the third quarter, the fund made its first acquisition.

We continue to maintain a focus on growing our Products & Services platform through two primary initiatives: third-party sales and strategic acquisitions, while we continue to pursue opportunities to meaningfully scale across all our portfolio companies.

That concludes our prepared remarks, and we will now open up the call for Q&A.

Operator to end call after Q&A – do not go back to management.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ainc_PreferredStockPurchaseRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

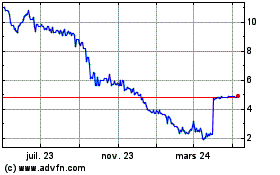

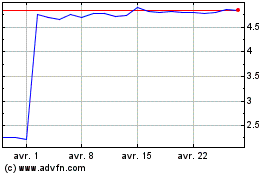

Ashford (AMEX:AINC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ashford (AMEX:AINC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024