false

0001725872

0001725872

2024-10-24

2024-10-24

0001725872

us-gaap:CommonStockMember

2024-10-24

2024-10-24

0001725872

BMTX:WarrantsToPurchaseCommonStockMember

2024-10-24

2024-10-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 24, 2024

BM TECHNOLOGIES,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38633 |

|

82-3410369 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

201 King of Prussia Road, Suite 650,

Wayne, PA 19087 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including

area code: (877) 327-9515

Not Applicable

Former name or former address, if changed since

last report

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

BMTX |

|

NYSE American LLC |

| Warrants to purchase Common Stock |

|

BMTX.W |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

On October 25, 2024, BM Technologies, Inc., a Delaware corporation

(the “Company”) and First Carolina Bank, a North Carolina state-chartered bank (“Parent”), issued

a joint press release announcing the execution of an Agreement and Plan of Merger (the “Merger Agreement”) among the

Company, Parent and Double Eagle Acquisition Corp, Inc. (“Merger Sub”), providing for the acquisition of the Company

by Parent pursuant to a merger of Merger Sub with and into the Company with the Company continuing as the surviving corporation and a

wholly owned subsidiary of Parent (the “Merger”).

A copy of the press release is attached hereto as Exhibit 99.1 and

incorporated herein by reference. The terms of the Merger Agreement will be described in a subsequent filing on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Forward-Looking Statements

Certain statements in this communication are “forward-looking

statements” within the meaning of federal securities laws and are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, the Company’s current expectations,

assumptions, plans, strategies and anticipated results. Because forward-looking statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements,

which are neither statements of historical fact nor guarantees or assurances of future performance.

There are a number of risks, uncertainties and conditions that may

cause the Company’s actual results to differ materially from those expressed or implied by these forward-looking statements, including

but not limited to: (i) uncertainties as to the timing of the Merger; (ii) the risk that the Merger may not be completed on the anticipated

terms in a timely manner or at all; (iii) the failure to satisfy any of the conditions to the consummation of the Merger, including receiving,

on a timely basis or otherwise, the required approvals of the Merger by the Company’s stockholders; (iv) the possibility that competing

offers or acquisition proposals for the Company will be made; (v) the possibility that any or all of the various conditions to the consummation

of the Merger may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental

entities (or any conditions, limitations or restrictions placed on such approvals); (vi) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger Agreement, including in circumstances which would require the Company

to pay a termination fee; (vii) the effect of the announcement or pendency of the transactions contemplated by the Merger Agreement on

the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and

others with whom it does business, or its operating results and business generally; (viii) risks related to diverting management’s

attention from the Company’s ongoing business operations; (ix) the risk that stockholder litigation in connection with the transactions

contemplated by the Merger Agreement may result in significant costs of defense, indemnification and liability; (x) certain restrictions

during the pendency of the Merger that may impact the Company’s ability to pursue certain business opportunities or strategic transactions;

(xi) uncertainty as to the timing of completion of the Merger; (xii) risks that the benefits of the Merger are not realized when and as

expected; (xiii) legislative, regulatory and economic developments; and (xiv) (A) the risk factors described in Part I, Item 1A of Risk

Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and (B) the other risk factors identified

from time to time in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). Filings

with the SEC are available on the SEC’s website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability

to control or predict. These forward-looking statements necessarily involve assumptions on the Company’s part. These forward-looking

statements may include words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “project,” “should,” “may,” “will,” “might,” “could,”

“would” or similar expressions. All forward-looking statements attributable to the Company or persons acting on the Company’s

behalf are expressly qualified in their entirety by the cautionary statements that appear throughout this communication. Furthermore,

undue reliance should not be placed on forward-looking statements, which are based on the information currently available to the Company

and speak only as of the date they are made. The Company disclaims any intention or obligation to update or revise publicly any forward-looking

statements.

Participants in the Solicitation

The Company and its directors, executive officers

and other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of

proxies from stockholders of the Company in favor of the proposed transaction. Information about the Company’s directors and executive

officers is set forth in the Company’s Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Shareholders, which was filed

with the SEC on April 29, 2024. To the extent holdings of the Company’s securities by its directors or executive officers

have changed since the amounts set forth in such 2024 proxy statement, such changes have been or will be reflected on Initial Statements

of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information concerning

the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s

stockholders generally, will be set forth in the Company’s proxy statement relating to the proposed transaction when it becomes

available.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect

of the proposed acquisition of the Company by Parent. In connection with the proposed transaction, the Company intends to file relevant

materials with the SEC, including the Company’s proxy statement in preliminary and definitive form. INVESTORS AND STOCKHOLDERS OF

THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE COMPANY’S PROXY STATEMENT (WHEN THEY ARE

AVAILABLE), BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, PARENT AND THE PROPOSED TRANSACTION. Investors

and stockholders of the Company are or will be able to obtain these documents (when they are available) free of charge from the SEC’s

website at www.sec.gov, or free of charge from the Company by directing a request to the Company at 201 King of Prussia Road, Suite 650,

Wayne, PA 19087, Attention: Investor Relations or at tel: (877) 327-9515.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there

be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BM TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ Luvleen Sidhu |

| |

|

Name: |

Luvleen Sidhu |

| |

|

Title: |

Chief Executive Officer |

| |

|

| Date: October 25, 2024 |

|

4

Exhibit 99.1

BM Technologies to

be Acquired by First Carolina Bank for $67 Million

BM Technologies

Stockholders to Receive $5.00 Per Share in Cash, Representing 55% Premium to Market

RADNOR, PA, October 25,

2024 - BM Technologies, Inc. (NYSE American: BMTX) (“the Company” or “BMTX”), one of the largest digital banking

platforms, today announced it has entered into a definitive agreement to be acquired by First Carolina Bank (“FCB” or “First

Carolina”) pursuant to which First Carolina will purchase all outstanding BMTX shares of common stock for $5.00 per share in an

all-cash transaction with an equity value of approximately $67 million.

Under the terms of the

agreement, BM Technologies stockholders will receive $5.00 per share in cash, which represents a 55% premium to the trading price per share of BM Technologies common stock as of October 24, 2024 and a 90% premium to market as of August 14, 2024,

the day before BM Technologies disclosed that it had received inbound interest. Upon completion of the transaction, BM Technologies will

become a wholly owned subsidiary of First Carolina Bank and shares of BM Technologies’ common stock will no longer be listed on

the New York Stock Exchange. BM Technologies will continue operating under the BM Technologies name and be led by Jamie Donahue, current

President and Chief Technology Officer of BMTX.

Luvleen Sidhu, Founder,

Chair and CEO of BMTX said, “We are excited to announce this transaction with our partner bank, First Carolina. This transaction

not only delivers a significant premium to our stockholders but will also bring enhanced banking services and technology to all current

BMTX customers as well as current and future FCB customers. After closing, I look forward to supporting Jamie and the FCB team in integrating

BMTX successfully and supporting their future growth plans while exploring new opportunities for the next phase of my career.”

Ron Day, CEO of First

Carolina Bank, stated, “Currently serving over 700 campuses, BMTX gives our bank a nationwide deposit gathering business and the

opportunity to expand banking relationships with the institutions and their students across the United States. We believe this is a game-changing

combination, and we are thrilled for the employee, customer, and shareholder bases of both companies.”

The merger agreement

has been approved by both the Boards of BMTX and First Carolina Bank and is subject to stockholder approval by stockholders of BMTX. The

parties expect the transaction to close in the first quarter of 2025, subject to the satisfaction of customary closing conditions.

Advisors

White & Case LLP

acted as legal counsel to BMTX and Janney Montgomery Scott advised and provided a Fairness Opinion to the board of directors of BMTX.

About BM Technologies, Inc.

BM Technologies, Inc. (NYSE American: BMTX) -

formerly known as BankMobile - is among the largest digital banking platforms in the country. It is focused on technology, innovation,

easy-to-use products, and education with the mission to financially empower millions of Americans by providing a more affordable, transparent,

and consumer-friendly banking experience. BM Technologies, Inc. (BMTX) is a technology company and is not a bank, which means it provides

banking services through its partner bank. More information can be found at www.bmtx.com.

About First Carolina Bank

First Carolina Bank is a North Carolina state-chartered

bank headquartered in Rocky Mount, North Carolina, with approximately $3.1 billion in total assets as of September 30, 2024. First Carolina

Bank has full-service banking offices in: Rocky Mount, Raleigh, Wilmington, Cary and Reidsville, North Carolina; Virginia Beach, Virginia;

Columbia and Greenville, South Carolina; and Atlanta, Georgia. To learn more about First Carolina Bank, please visit our website at www.firstcarolinabank.com.

Forward Looking Statements

Certain statements in this communication are “forward-looking

statements” within the meaning of federal securities laws and are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, the Company’s current expectations,

assumptions, plans, strategies and anticipated results. Because forward-looking statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements,

which are neither statements of historical fact nor guarantees or assurances of future performance.

There are a number of risks, uncertainties and conditions that may

cause the Company’s actual results to differ materially from those expressed or implied by these forward-looking statements, including

but not limited to: (i) uncertainties as to the timing of the Merger; (ii) the risk that the Merger may not be completed on the anticipated

terms in a timely manner or at all; (iii) the failure to satisfy any of the conditions to the consummation of the Merger, including receiving,

on a timely basis or otherwise, the required approvals of the Merger by the Company’s stockholders; (iv) the possibility that competing

offers or acquisition proposals for the Company will be made; (v) the possibility that any or all of the various conditions to the consummation

of the Merger may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental

entities (or any conditions, limitations or restrictions placed on such approvals); (vi) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger Agreement, including in circumstances which would require the Company

to pay a termination fee; (vii) the effect of the announcement or pendency of the transactions contemplated by the Merger Agreement on

the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and

others with whom it does business, or its operating results and business generally; (viii) risks related to diverting management’s

attention from the Company’s ongoing business operations; (ix) the risk that stockholder litigation in connection with the transactions

contemplated by the Merger Agreement may result in significant costs of defense, indemnification and liability; (x) certain restrictions

during the pendency of the Merger that may impact the Company’s ability to pursue certain business opportunities or strategic transactions;

(xi) uncertainty as to the timing of completion of the Merger; (xii) risks that the benefits of the Merger are not realized when and as

expected; (xiii) legislative, regulatory and economic developments; and (xiv) (A) the risk factors described in Part I, Item 1A of Risk

Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and (B) the other risk factors identified

from time to time in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). Filings with

the SEC are available on the SEC’s website at http://www.sec.gov.

Many of these circumstances

are beyond the Company's ability to control or predict. These forward-looking statements necessarily involve assumptions on the Company’s

part. These forward-looking statements may include words such as “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “plan,” “project,” “should,” “may,” “will,”

“might,” “could,” “would,” or similar expressions. All forward-looking statements attributable to

the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements that

appear throughout this communication. Furthermore, undue reliance should not be placed on forward-looking statements, which are based

on the information currently available to the Company and speak only as of the date they are made. The Company disclaims any intention

or obligation to update or revise publicly any forward-looking statements.

The Company and its directors,

executive officers and other members of management and employees, under SEC rules, may be deemed to be “participants” in the

solicitation of proxies from stockholders of the Company in favor of the proposed transaction. Information about the Company’s directors

and executive officers is set forth in the Company’s Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Shareholders,

which was filed with the SEC on April 29, 2024. To the extent holdings of the Company’s securities by its directors or executive

officers have changed since the amounts set forth in such 2024 proxy statement, such changes have been or will be reflected on Initial

Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information

concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of

the Company’s stockholders generally, will be set forth in the Company’s proxy statement relating to the proposed transaction

when it becomes available.

Additional Information

and Where to Find It

This communication may

be deemed to be solicitation material in respect of the proposed acquisition of the Company by Parent. In connection with the proposed

transaction, the Company intends to file relevant materials with the SEC, including the Company’s proxy statement in preliminary

and definitive form. INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING

THE COMPANY’S PROXY STATEMENT (WHEN THEY ARE AVAILABLE), BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY,

PARENT AND THE PROPOSED TRANSACTION. Investors and stockholders of the Company are or will be able to obtain these documents (when they

are available) free of charge from the SEC’s website at www.sec.gov, or free of charge from the Company by directing a request to

the Company at 201 King of Prussia Road, Suite 650, Wayne, PA 19087, Attention: Investor Relations or at tel: (877) 327-9515.

No Offer or Solicitation

This communication is

not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Contact Information

Investors:

Ajay Asija, Chief Financial Officer

BM Technologies, Inc.

aasija@bmtx.com

3

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BMTX_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

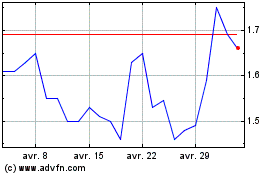

BM Technologies (AMEX:BMTX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

BM Technologies (AMEX:BMTX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024