false

0001471727

Better Choice Co Inc.

0001471727

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 13,

2024

Better

Choice Company Inc.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

001-40477 |

|

83-4284557 |

(State

or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

12400

Race Track Road

Tampa,

Florida 33626

(Address

of Principal Executive Offices) (Zip Code)

(Registrant’s

Telephone Number, Including Area Code): (212) 896-1254

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value share |

|

BTTR |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

On

August 13, 2024, Better Choice Company Inc., a Delaware corporation (the “Company”), announced its financial results

for the second quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| August

23, 2024 |

Better Choice Company Inc. |

| |

|

|

| |

By: |

/s/

Carolina Martinez |

| |

Name: |

Carolina

Martinez |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

BETTER

CHOICE COMPANY INC. ANNOUNCES SECOND QUARTER 2024 RESULTS

Net

Income Increased 190% to $2.7 million Year-Over-Year

EPS

Growth of 170% to $2.98 Year-Over-Year

Adjusted

EBITDA Increased 98% to less than $(0.1) million1 Year-Over-Year

Recognized

$3.6 million Gain on Extinguishment of Debt

TAMPA,

FL, August 13, 2024 — Better Choice Company Inc. (NYSE American: BTTR) (the “Company” or “Better Choice”),

a pet health and wellness company, today announced its results for the second quarter ended June 30, 2024 (“Q2 2024”).

SECOND

QUARTER 2024 FINANCIAL HIGHLIGHTS

| |

● |

Revenue

increased 8% to $8.5 million from the first quarter 2024 |

| |

● |

Gross

margin increased 403 basis points year-over-year (“YOY”) to 38% |

| |

● |

Operating

loss improved 72% YOY to $(0.7) million |

| |

● |

Operating

margin improved 1,605 basis points YOY to (8)% |

| |

● |

Net

income increased 190% YOY to $2.7 million |

| |

● |

Earnings

per share (“EPS”) improved 170% YOY to $2.98 |

| |

● |

$3.6

million one-time gain on extinguishment of debt |

| |

● |

Adjusted

EBITDA increased 98% YOY to less than $(0.1) million1 |

SIX

MONTHS 2024 FINANCIAL HIGHLIGHTS

| |

● |

Gross

margin increased 114 basis points YOY to 36% |

| |

● |

Operating

loss improved 45% YOY to $(3.2) million |

| |

● |

Operating

margin improved 101 basis points YOY to (19)% |

| |

● |

Net

loss improved 97% YOY to $(0.2) million |

| |

● |

EPS

improved 98% YOY to $(0.21) |

| |

● |

Adjusted

EBITDA improved 60% YOY to $(1.4) million1 |

“Our

second quarter performance demonstrates that our efforts to stabilize operations, revamp channel strategy, and instill greater financial

governance are taking shape. We believe there is significant runway for increased Halo growth at both Chewy and Amazon as we continue

to shift our investment, move to full funnel activation, and improve our storytelling and share of voice,” commented Chief Executive

Officer, Kent Cunningham. “We see increased opportunity for the Halo brand across the roughly $50 billion US & Canada pet food

markets and the $30 billion represented across the Asia-Pacific region. Halo sits at the intersection of the two megatrends fueling market

growth: Humanization and Premiumization. Whether the pet parent is a clean food consumer seeking all-natural nutrition that is minimally

processed and responsibly sourced, or seeking a dietary solution to address allergies, skin and coat issues, digestive or other health

concerns, Halo provides products that deliver visible results.”

Nina

Martinez, Chief Financial Officer, also commented, “The company’s positive financial results are a testament to the strong

underlying performance and operating leverage we are seeing in the business. The sales momentum and significant adjusted EBITDA1

improvement we saw in the second quarter truly reflect our strategic pivots are working. Our International channel generated 27%

top line growth from the first quarter, and 7% year-to-date growth YOY. Our Digital channel, comprising of our E-commerce platforms and

legacy Direct-to-Consumer channel, generated 11% topline growth as the Halo brand gains momentum domestically as well. The YOY topline

softness was expected internally as we have made purposeful strategic exits of several unprofitable brick and mortar customers, as well

as the closing of our legacy Halo Pets Direct-to-Consumer channel that was trending as a double digit negative EBITDA1 channel.

While these actions negatively impacted our YOY topline, the positive impact to our bottom line was critical as we significantly improved

the financial shape of the business and we are beating all internal targets. Supplier input costs are coming down and we are unlocking

profit through global volumes, as is reflected in our gross margin improvement. We’ve tightened operating expenses and have unlocked

significant profit levers through the channel strategy shifts. Our ability to improve working capital, improve margins, and accelerate

free cash flow provide confidence in our ability to deliver on our near and long-term goals.”

1

Adjusted EBITDA is a non-GAAP measure. Reconciliation of Adjusted EBITDA and to net income (loss), the most directly comparable

GAAP financial measure, is set forth in the reconciliation table accompanying this release.

Better

Choice Company Inc.

Unaudited

Condensed Consolidated Statements of Operations

(Dollars

in thousands)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net sales | |

$ | 8,542 | | |

$ | 10,536 | | |

$ | 16,445 | | |

$ | 19,773 | |

| Cost of goods sold | |

| 5,289 | | |

| 6,948 | | |

| 10,578 | | |

| 12,944 | |

| Gross profit | |

| 3,253 | | |

| 3,588 | | |

| 5,867 | | |

| 6,829 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 3,977 | | |

| 6,173 | | |

| 9,057 | | |

| 12,669 | |

| Total operating expenses | |

| 3,977 | | |

| 6,173 | | |

| 9,057 | | |

| 12,669 | |

| Loss from operations | |

| (724 | ) | |

| (2,585 | ) | |

| (3,190 | ) | |

| (5,840 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (180 | ) | |

| (379 | ) | |

| (542 | ) | |

| (608 | ) |

| Gain on extinguishment of debt | |

| 3,561 | | |

| — | | |

| 3,561 | | |

| — | |

| Total other income (expense), net | |

| 3,381 | | |

| (379 | ) | |

| 3,019 | | |

| (608 | ) |

| Income (loss) before income taxes | |

| 2,657 | | |

| (2,964 | ) | |

| (171 | ) | |

| (6,448 | ) |

| Income tax expense | |

| 3 | | |

| — | | |

| 5 | | |

| — | |

| Net income (loss) | |

$ | 2,654 | | |

$ | (2,964 | ) | |

$ | (176 | ) | |

$ | (6,448 | ) |

| Weighted average number of shares outstanding, basic | |

| 890,756 | | |

| 694,356 | | |

| 838,062 | | |

| 693,561 | |

| Weighted average number of shares outstanding, diluted | |

| 890,756 | | |

| 694,356 | | |

| 838,062 | | |

| 693,561 | |

| Net income (loss) per share, basic | |

$ | 2.98 | | |

$ | (4.27 | ) | |

$ | (0.21 | ) | |

$ | (9.30 | ) |

| Net income (loss) per share, diluted | |

$ | 2.98 | | |

$ | (4.27 | ) | |

$ | (0.21 | ) | |

$ | (9.30 | ) |

Better

Choice Company Inc.

Unaudited

Condensed Consolidated Balance Sheets

(Dollars

in thousands, except share amounts)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,293 | | |

$ | 4,455 | |

| Accounts receivable, net | |

| 4,325 | | |

| 4,354 | |

| Inventories, net | |

| 3,825 | | |

| 6,611 | |

| Prepaid expenses and other current assets | |

| 771 | | |

| 812 | |

| Total Current Assets | |

| 12,214 | | |

| 16,232 | |

| Fixed assets, net | |

| 179 | | |

| 230 | |

| Right-of-use assets, operating leases | |

| 92 | | |

| 120 | |

| Goodwill | |

| 405 | | |

| — | |

| Other assets | |

| 195 | | |

| 155 | |

| Total Assets | |

$ | 13,085 | | |

$ | 16,737 | |

| Liabilities & Stockholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 6,108 | | |

$ | 6,928 | |

| Accrued and other liabilities | |

| 1,361 | | |

| 2,085 | |

| Credit facility, net | |

| 1,582 | | |

| 1,741 | |

| Term loan, net | |

| — | | |

| 2,881 | |

| Operating lease liability | |

| 59 | | |

| 57 | |

| Total Current Liabilities | |

| 9,110 | | |

| 13,692 | |

| Non-current Liabilities | |

| | | |

| | |

| Operating lease liability | |

| 37 | | |

| 67 | |

| Total Non-current Liabilities | |

| 37 | | |

| 67 | |

| Total Liabilities | |

| 9,147 | | |

| 13,759 | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock, $0.001 par value, 200,000,000 shares authorized, 916,329 & 729,026 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 325,455 | | |

| 324,319 | |

| Accumulated deficit | |

| (321,518 | ) | |

| (321,342 | ) |

| Total Stockholders’ Equity | |

| 3,938 | | |

| 2,978 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 13,085 | | |

$ | 16,737 | |

Better

Choice Company Inc.

Non-GAAP

Measures

Adjusted

EBITDA

We

define Adjusted EBITDA as EBITDA further adjusted to eliminate the impact of certain items that we do not consider indicative of our

core operations. Adjusted EBITDA is determined by adding the following items to net (loss) income: interest expense, tax expense, depreciation

and amortization, share-based compensation, gain on extinguishment

of debt, loss on disposal of assets, transaction-related expenses, and other non-recurring

expenses.

We

present Adjusted EBITDA as it is a key measure used by our management and board of directors to evaluate our operating performance, generate

future operating plans and make strategic decisions regarding the allocation of capital. We believe that the disclosure of Adjusted EBITDA

is useful to investors as this non-GAAP measure forms the basis of how our management team reviews and considers our operating results.

By disclosing this non-GAAP measure, we believe that we create for investors a greater understanding of and an enhanced level of transparency

into the means by which our management team operates our company. We also believe this measure can assist investors in comparing our

performance to that of other companies on a consistent basis without regard to certain items that do not directly affect our ongoing

operating performance or cash flows.

Adjusted

EBITDA does not represent cash flows from operations as defined by GAAP. Adjusted EBITDA has limitations as a financial measure and you

should not consider it in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Because

of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow

metrics, net (loss) income, gross margin, and our other GAAP results.

The

following table presents a reconciliation of net income (loss), the closest GAAP financial measure, to EBITDA and Adjusted EBITDA for

each of the periods indicated (in thousands):

Reconciliation

of Net Income (Loss) to EBITDA and Adjusted EBITDA

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) | |

$ | 2,654 | | |

$ | (2,964 | ) | |

$ | (176 | ) | |

$ | (6,448 | ) |

| Interest expense, net | |

| 180 | | |

| 379 | | |

| 542 | | |

| 608 | |

| Income tax expense | |

| 3 | | |

| — | | |

| 5 | | |

| — | |

| Depreciation and amortization | |

| 34 | | |

| 421 | | |

| 68 | | |

| 845 | |

| EBITDA | |

| 2,871 | | |

| (2,164 | ) | |

| 439 | | |

| (4,995 | ) |

| Non-cash share-based compensation (a) | |

| 159 | | |

| 284 | | |

| 678 | | |

| 1,145 | |

| Gain on extinguishment of debt | |

| (3,561 | ) | |

| — | | |

| (3,561 | ) | |

| — | |

| Loss on disposal of assets | |

| — | | |

| — | | |

| — | | |

| 11 | |

| Transaction-related expenses (b) | |

| 131 | | |

| — | | |

| 489 | | |

| — | |

| Non-recurring strategic branding initiatives (c) | |

| 43 | | |

| 18 | | |

| 69 | | |

| 33 | |

| Co-manufacturing partner transition (d) | |

| — | | |

| 6 | | |

| — | | |

| 6 | |

| Other single occurrence expenses (e) | |

| 327 | | |

| 31 | | |

| 457 | | |

| 189 | |

| Adjusted EBITDA | |

$ | (30 | ) | |

$ | (1,825 | ) | |

$ | (1,429 | ) | |

$ | (3,611 | ) |

| (a)

Non-cash expenses related to equity compensation awards. Share-based compensation is an important part of the Company’s compensation

strategy and without our equity compensation plans, it is probable that salaries and other compensation related costs would be higher. |

| (b)

Legal fees, professional fees, and other expenses for transaction-related business matters |

| (c)

Single occurrence expenses related to marketing agency and design, strategic re-branding initiatives, Elevate® launch, product

innovation and reformulations |

| (d)

Single occurrence expenses related to the transition of our largest dry kibble co-manufacturing supplier |

| (e)

Single occurrence expenses related to employee severance, executive recruitment, and other non-recurring professional fees |

About

Better Choice Company Inc.

Better

Choice Company Inc. is a pet health and wellness company focused on providing pet products and services that help dogs and cats live

healthier, happier and longer lives. We offer a broad portfolio of pet health and wellness products for dogs and cats sold under our

Halo brand across multiple forms, including foods, treats, toppers, dental products, chews, and supplements. We have a demonstrated,

multi-decade track record of success and are well positioned to benefit from the mainstream trends of growing pet humanization and consumer

focus on health and wellness. Our products consist of kibble and canned dog and cat food, freeze-dried raw dog food and treats, vegan

dog food and treats, oral care products and supplements. Halo’s core products are made with high-quality, thoughtfully sourced

ingredients for natural, science-based nutrition. Each innovative recipe is formulated with leading veterinary and nutrition experts

to deliver optimal health. For more information, please visit https://www.betterchoicecompany.com.

Forward

Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words

“believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “could,” “target,” “potential,” “is likely,”

“will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

The Company has based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Some or all

of the results anticipated by these forward-looking statements may not be achieved. Further information on the Company’s risk factors

is contained in our filings with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict

all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by law.

Company

Contact:

Better

Choice Company Inc.

Kent

Cunningham, CEO

Investor

Contact:

KCSA

Strategic Communications

Valter

Pinto, Managing Director

T:

212-896-1254

Valter@KCSA.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

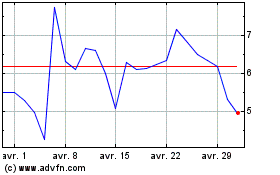

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024