Better Choice Company (NYSE: BTTR) (“Better Choice” or “the

Company”), a pet health and wellness company, Chairman, Michael

Young, today is issuing a letter to shareholders as the Company

continues to make progress towards the closing of its acquisition

of SRx Health Solutions Inc. (‘SRx Health’), a leading provider of

innovative healthcare solutions, in an all-stock transaction for

approximately $125 million.

Shareholders are encouraged to listen to the

fireside chat hosted on October 15, 2024 at 4:30 p.m. ET by the

management teams of Better Choice and SRx Health, which can be

accessed by visiting https://ir.betterchoicecompany.com/.

Better Choice Shareholders,

We believe that our transformational acquisition

of SRx Health will position Better Choice as a leading global

health and wellness company, providing better products and

solutions for pets, people, and families. The combination of the

two companies is expected to generate significant cash flow, yield

operational efficiencies, and cost savings, while providing large

growth opportunities that will drive sustainable organic growth for

each respective business. We expect the transaction to close in

late Q4 of this year or early Q1 of 2025.

To date, each business has generated steady

sales growth and cash flow.

Better Choice has established its premium pet

food brand Halo through our omni-channel distribution model. Gross

sales of the brand totaled approximately USD$49 million in 2023,

approximately half of which was e-commerce and 28% was

international, driven by growth in China. For the second quarter of

2024, Better Choice generated close to break-even adjusted EBITDA

of less than $(0.03) million4, which reflects our success in

stabilizing the business and resetting it to profitable growth.

SRx Health generated approximately CAD$180

million in revenue and generated positive adjusted EBITDA in 20235.

Today, SRx operates one of the largest specialty pharmacy networks

in Canada with 36 specialty pharmacy locations, 40 specialty

health/infusion clinics, 4 clinical trial sites, and 2 wholesale

distribution facilities. As one of only a few specialty pharma

operators with a network that extends across Canada, SRx Health is

one of the most comprehensive providers of specialty healthcare in

the country.

The combined companies for the trailing twelve

months have generated USD$235 million in revenue, increasing

approximately 25% quarter-over-quarter.

From an operational perspective, we expect to

achieve immediate cost savings estimated to be approximately

USD$1.7 million annually, with potential for further upside as we

continue to integrate the two companies. There are also new

verticals and geographic expansion opportunities as a combined

entity versus stand alone. As an example, our plan is to expand

into veterinary medicine in 2025 with our new initiative Better Pet

Rx. By leveraging the expertise of SRx Health’s management team,

with their pre-existing relationships in pharma, and their robust

infrastructure, Better Choice can complement the Halo portfolio of

premium and super-premium pet food products by expanding into this

new, large and growing market to support Halo’s momentum forward.

Additionally, there are new markets that each respective business

has not yet explored, including the United States in the case of

SRx Health, and European Union and Asia-Pacific regions in the case

of both Better Choice and SRx Health, which regions represent new

and untapped large total addressable markets.

On a pro forma basis, we project 2025 combined

revenue and EBITDA to be over USD$270 million and over USD$10

million, respectively1.

Pro forma fully diluted shares outstanding

including shares to be issued to SRx Health is 22,911,334 shares,

with insiders owning approximately 75% of the outstanding shares.

From a valuation perspective, net tangible book value is $4.072 per

share and net current asset value per share is $3.943, both well

above the current price of our equity.

As we near the closing of the transaction in the

coming months we will ask the Better Choice and SRx Health

shareholders to vote.

We sincerely appreciate your unwavering support

and trust as we strive to build a global health and wellness brand

by 2025, paving the way for a promising future together.

Thank you,

Michael YoungChairman of Better Choice

Company

About Better Choice Company

Inc.

Better Choice Company Inc. is a rapidly growing

pet health and wellness company committed to leading the industry

shift toward pet products and services that help dogs and cats live

healthier, happier, and longer lives. We take an alternative,

nutrition-based approach to pet health relative to conventional dog

and cat food offerings and position our portfolio of brands to

benefit from the mainstream trends of growing pet humanization and

consumer focus on health and wellness. We have a demonstrated,

multi-decade track record of success selling trusted pet health and

wellness products and leverage our established digital footprint to

provide pet parents with the knowledge to make informed decisions

about their pet’s health. We sell the majority of our dog food, cat

food and treats under the Halo brand, which is focused,

respectively, on providing sustainably sourced kibble and canned

food derived from real whole meat, and minimally processed raw-diet

dog food and treats. For more information, please

visit https://www.betterchoicecompany.com.

About SRX Health

SRx operates as a Canadian healthcare service

provider specializing in the Specialty Pharmacy segment of the

pharmaceutical industry. Distinguishing itself as a National

Specialty Pharmacy provider, SRx concentrates on overseeing a

patient's healthcare journey, spanning from acute pharmaceutical

needs to chronic and rare disease management. This unique focus

positions SRx to deliver a more holistic and integrated solution,

catering to the requirements of both patients and key healthcare

stakeholders. Our all-encompassing end-to-end offerings include

wholesale/distribution facilities, patient support programs,

infusion clinics, retail pharmacies, co-designed clinical programs,

clinical trials, and diagnostic services.

Our strategic growth plan is forward-thinking

and revolves around fostering increased collaboration with

pharmaceutical manufacturers and prescribers. With a specific

emphasis on the expanding market of chronic and rare diseases, we

target specialty drugs associated with closed and limited

distribution networks. The objective is to broaden their

distribution and improve accessibility. Our overarching goal is to

elevate our current presence from 34 to 100 specialty pharmacy

locations across mid-sized population centers throughout Canada,

thereby enhancing the scope of healthcare services and establishing

new industry benchmarks. In the subsequent phase of SRx's

evolution, we aim to extend our reach beyond the borders of Canada.

Leveraging our comprehensive approach, we aspire to simplify

healthcare on a global scale. For more information on SRx, please

visit https://www.srxhealth.ca.

Forward Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “believe,” “may,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “could,” “target,” “potential,” “is

likely,” “will,” “expect” and similar expressions, as they relate

to us, are intended to identify forward-looking statements. The

Company has based these forward-looking statements largely on our

current expectations and projections about future events and

financial trends that we believe may affect our financial

condition, results of operations, business strategy and financial

needs. Some or all of the results anticipated by these

forward-looking statements may not be achieved. Further information

on the Company’s risk factors is contained in our filings with the

SEC. Any forward-looking statement made by us herein speaks only as

of the date on which it is made. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

|

(1) |

|

The pro forma financial information presented in this press release

is based on management's assumptions and is not audited. Key

assumptions include organic growth of 30%+, new pharma

collaborations and patient support program wins, and operating

leverage unlock. These pro forma figures are based on the company's

historical financial statements as of December 31, 2023, and should

be read in conjunction with the company's audited financial

statements. |

|

(2) |

|

Net tangible book value per share

as of 6/30/24 is determined by dividing our total tangible assets,

less total liabilities, by 2.7 million shares outstanding

immediately after the Offering assuming exercise of all 1,028,000

pre-funded warrants sold (the “Pre-Funded Warrants”), on a

pro-forma and as adjusted basis giving effect to the above

referenced items. |

|

(3) |

|

Net current asset value per share

as of 6/30/24 is determined by dividing total current assets, less

total current liabilities, by 2.7 million shares outstanding

immediately after the Offering assuming exercise of all the

Pre-Funded Warrants, on a pro-forma and as adjusted basis giving

effect to the above referenced items. |

|

(4) |

|

Adjusted EBITDA is a non-GAAP

measure. Reconciliation of Adjusted EBITDA to net income (loss),

the most directly comparable GAAP financial measure, is set forth

in a reconciliation table accompanying the Company’s second quarter

2024 earnings release published August 12, 2024. |

|

(5) |

|

Results of SRx Health

consolidated financial statements for the year ended September 30,

2023, prepared in accordance with IFRS. Pro Forma Adjusted EBITDA

is a non-GAAP measure. Reconciliation of Pro Forma Adjusted EBITDA

to net loss, the most directly comparable GAAP financial measure,

is set forth in a reconciliation table accompanying the Company’s

press release published September 3, 2024. Management is still

analyzing the financial statement impact upon conversion from IFRS

to GAAP. |

| |

|

|

Company Contact:Better Choice Company, Inc.Kent

Cunningham, CEO

Investor Contact:KCSA Strategic

CommunicationsValter Pinto, Managing DirectorT:

212-896-1254Valter@KCSA.com

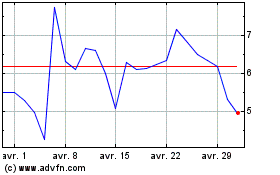

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025