false

0001270436

0001270436

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Registrant Name |

Cohen

& Co Inc. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 26, 2024

Cohen & Company

Inc.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-32026 |

|

16-1685692 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia,

Pennsylvania |

|

19104 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

COHN |

|

The NYSE

American Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

As previously disclosed, on June 25, 2007,

Cohen & Company Inc. (formerly Alesco Financial Inc.), a Maryland corporation (the “Company”), entered into

the Junior Subordinated Indenture (the “Indenture”), by and between the Company and Wells Fargo Bank, N.A., as trustee (the

“Trustee”), pursuant to which the Company issued an aggregate of $28,995,000 of the Company’s Junior Subordinated Notes,

which mature on July 30, 2037 (the “Notes”), in a private placement under Rule 144A under the Securities Act of

1933, as amended.

On January 26, 2024, the Company and the

Trustee entered into Supplemental Indenture No. 1 to Junior Subordinated Indenture (the “Supplemental Indenture”), which

amended the Indenture to provide that the benchmark to determine the interest rates applicable to the Notes will be based on the Secured

Overnight Financing Rate (SOFR), as provided in the Adjustable Interest Rate (LIBOR) Act. Prior to the execution of the Supplemental Indenture,

the benchmark to determine the interest rates applicable to the Notes under the Indenture was based on the London Interbank Offered Rate

(“LIBOR”). The Supplemental Indenture was made effective as of July 1, 2023, the first date following the cessation of

the publication of LIBOR. Except as described herein, no other changes were made to the Indenture pursuant to the Supplemental Indenture.

The foregoing description of the Supplemental

Indenture is not complete and is qualified in its entirety by reference to the full text of the Supplemental Indenture, a copy of which

is filed as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated in this Item 4.1 by reference.

* Filed electronically herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COHEN & COMPANY INC. |

| |

|

|

| Date: January 29, 2024 |

By: |

/s/ Joseph W. Pooler, Jr. |

| |

|

Name: |

Joseph W. Pooler, Jr. |

| |

|

Title: |

Executive Vice President, Chief Financial Officer and

Treasurer |

| |

|

|

Exhibit 4.1

SUPPLEMENTAL INDENTURE NO. 1 TO JUNIOR

SUBORDINATED

INDENTURE

THIS SUPPLEMENTAL INDENTURE NO. 1 (this “Supplemental

Indenture”), is entered into as of January 26, 2024 and is made effective as of July 1, 2023 (the “Effective

Date”), by and between Cohen & Company Inc. (formerly Alesco Financial Inc.) (the “Issuer”) and

Wells Fargo Bank, N.A. (the “Trustee”). Capitalized terms used herein but otherwise not defined shall have the meanings

ascribed to such terms in the Indenture (as defined below). Each of the Issuer and the Trustee may be referred to herein as a “Party,”

and, together, as the “Parties.”

RECITALS:

WHEREAS, the Issuer is a party to that certain

Junior Subordinated Indenture, dated as of June 25, 2007, by and between the Issuer and the Trustee (the “Indenture”);

WHEREAS, Schedule A of the Indenture provides for

a methodology to calculate interest rates under the Indenture if LIBOR is not available;

WHEREAS, the Issuer believes that Schedule A of

the Indenture is not clear and does not provide a practicable replacement benchmark rate for LIBOR;

WHEREAS, the Adjustable Interest Rate (LIBOR) Act

(the “LIBOR Act”) was enacted by Congress to provide for a process for transitioning from LIBOR to rates based on the

Secured Overnight Financing Rate (“SOFR”) in contracts which lack a clear process to replace LIBOR upon its scheduled

cessation after June 30, 2023; and

WHEREAS, the Parties, with the consent of the holder

of the Notes and the holder of the Preferred Securities having been obtained, desire to amend Schedule A of the Indenture, effective as

of the Effective Date, to provide a clear process under the Indenture for transitioning from LIBOR to SOFR as if the transition had occurred

by operation of law under the LIBOR Act.

NOW, THEREFORE, in consideration of the mutual

covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged, the Parties, intending to be legally bound, agree as follows:

1. Amendment

to Article I of the Indenture. Effective as of the Effective Date, the following definition is hereby added to Article I

of the Indenture:

“LIBOR Act” shall mean the Adjustable

Interest Rate (LIBOR) Act, codified at 12 U.S.C. §§ 5801 et seq., and any successor legislation thereto and any regulations

promulgated thereunder.”

2. Amendment

and Restatement of Schedule A of the Indenture. Effective as of the Effective Date, Schedule A of the Indenture is amended and restated

in its entirety to read as set forth on Exhibit A attached hereto.

3. No

Other Changes. Except as expressly amended by this Supplemental Indenture, all of the terms and conditions of the Indenture shall

continue in full force and effect and shall be unaffected by this Supplemental Indenture.

4. Waiver

of Requirements Under the Indenture. The Parties hereby waive any requirements under the Indenture to, in connection with this Supplemental

Indenture, deliver or obtain any Opinion of Counsel or an Officer’s Certificate or for the Supplemental Indenture to be authorized

by a Board Resolution.

5. Entire

Agreement. This Supplemental Indenture constitutes the sole and entire agreement of the Parties with respect to the subject matter

hereof and supersedes all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral,

with respect to such subject matter.

6. Amendment.

This Supplemental Indenture may not be amended or modified except by a written agreement executed by the Parties.

7. Governing

Law; Submission to Jurisdiction; Waiver of Jury Trial. This Indenture and the rights and

obligations of each of the Holders, the Company and the Trustee shall be construed and enforced in accordance with and governed by the

laws of the State of New York without reference to its conflict of laws provisions (other than Section 5-1401 of the General Obligations

Law). ANY LEGAL ACTION OR PROCEEDING BY OR AGAINST ANY PARTY HERETO OR WITH RESPECT TO OR ARISING OUT OF THIS INDENTURE

MAY BE BROUGHT IN OR REMOVED TO THE COURTS OF THE STATE OF NEW YORK, IN AND FOR THE COUNTY OF NEW YORK, OR OF THE UNITED STATES

OF AMERICA FOR THE SOUTHERN DISTRICT OF NEW YORK (IN EACH CASE SITTING IN THE BOROUGH OF MANHATTAN). BY EXECUTION AND DELIVERY OF THIS

INDENTURE, EACH PARTY ACCEPTS, FOR ITSELF AND IN RESPECT OF ITS PROPERTY, GENERALLY AND UNCONDITIONALLY, THE JURISDICTION OF THE AFORESAID

COURTS (AND COURTS OF APPEALS THEREFROM) FOR LEGAL PROCEEDINGS ARISING OUT OF OR IN CONNECTION WITH THIS INDENTURE.

8. Headings.

The sections and other headings contained in this Supplemental Indenture are for reference purposes only and shall not affect the meaning

or interpretation of this Supplemental Indenture.

9. Binding

Effect. This Supplemental Indenture shall be binding upon and inure to the benefit of the Parties and their respective heirs, successors

and permitted assigns.

10. Counterparts.

This Supplemental Indenture may be executed in counterparts, each of which shall be deemed an original, but all of which together shall

be deemed to be one and the same agreement. A signed copy of this Supplemental Indenture delivered by facsimile, e-mail or other means

of electronic transmission shall be deemed to have the same legal effect as delivery of a signed copy of this Supplemental Indenture.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the Parties have executed this

Supplemental Indenture No. 1 to the Junior Subordinated Indenture on the date first written above.

| |

ISSUER: |

| |

|

| |

Cohen & Company Inc. |

| |

By: |

/s/ Joseph

W. Pooler. Jr. |

| |

Name: |

Joseph W. Pooler, Jr. |

| |

Title: |

Executive Vice President, Chief Financial |

| |

|

Officer and Treasurer |

| |

Wells Fargo Bank, N.A. |

| |

By |

Computershare Trust Company, N.A., |

| |

|

as agent and attorney-in-fact |

| |

|

|

| |

By: |

/s/ Michael G. Oller, Jr. |

| |

Name: |

Michael G. Oller, Jr. |

| |

Title: |

Vice President |

Exhibit A

Schedule A to Indenture

DETERMINATION OF LIBOR

With respect to the Securities, the London interbank offered rate (“LIBOR”)

shall be determined by the Calculation Agent in accordance with the following provisions (in each case rounded to the nearest .000001%):

(1) On

the second LIBOR Business Day (as defined below) prior to an Interest Payment Date occurring after the expiration of the Fixed Rate Period

(each such day, a “LIBOR Determination Date”), LIBOR for any given security shall for the following interest payment

period equal the rate, as obtained by the Calculation Agent from Bloomberg Financial Markets Commodities News, for three (3)-month Eurodollar

deposits that appears on Reuters Screen LIBOR 01 (as defined in the International Swaps and Derivatives Association, Inc. 2000 Interest

Rate and Currency Exchange Definitions, as the same may be amended from time to time), or such other page as may replace such Page LIBOR

01 (as any such replacement may be amended from time to time), as of 10:00 A.M. (New York City time) on such LIBOR Determination

Date.

(2) If,

on any LIBOR Determination Date, LIBOR does not appear on Reuters Screen LIBOR 0l or such other page as may replace such Page LIBOR

0l, the Securities shall not bear interest in respect of LIBOR but shall instead bear interest in accordance with the terms and conditions

of the LIBOR Act.

(3) As

used herein: “LIBOR Business Day” means a day on which commercial banks are open for business (including dealings in foreign

exchange and foreign currency deposits) in London.

v3.24.0.1

Cover

|

Jan. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity File Number |

1-32026

|

| Entity Registrant Name |

Cohen

& Co Inc.

|

| Entity Central Index Key |

0001270436

|

| Entity Tax Identification Number |

16-1685692

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Cira Centre

|

| Entity Address, Address Line Two |

2929 Arch Street, Suite 1703

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19104

|

| City Area Code |

215

|

| Local Phone Number |

701-9555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COHN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

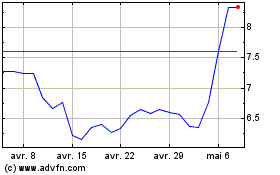

Cohen & (AMEX:COHN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cohen & (AMEX:COHN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024