UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 40-F

| | | | | |

| [ ] | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

| | or |

| [X] | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

| | | | | | | | | | | | | | |

| For the fiscal year ended | March 31, 2023 | | Commission File Number | 001-40673 |

____________________

Cybin Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Ontario | 2834 | N/A |

| (Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification | (I.R.S. Employer Identification Number) |

| Code Number) | |

100 King Street West, Suite 5600

Toronto, Ontario, Canada M5X 1C9

(908) 764-8385

(Address and telephone number of Registrant’s principal executive offices)

____________________

CT Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3133

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

____________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, no par value | CYBN | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

| | | | | |

| [X] Annual information form | [X] Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As at March 31, 2023, the Cybin Inc. had 195,328,733 common shares outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. [ X ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. [ ]

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.1[ ]

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-(b).2 [ ]

EXPLANATORY NOTE

Cybin Inc. (the “Company” or the “Registrant”) is a Canadian issuer that is permitted, under the multijurisdictional disclosure system adopted in the United States, to prepare this Annual Report on Form 40-F (this “Annual Report”) pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the Securities Act of 1933, as amended. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

FORWARD LOOKING STATEMENTS

This Annual Report, including the documents incorporated by reference herein, may contain “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws (collectively referred to herein as “forward-looking statements”). All statements other than statements of historical fact, including, without limitation, those regarding the future financial position and results of operations, strategy, plans, objectives, goals, targets and future developments of the Registrant in the markets where the Registrant participates or is seeking to participate, and any statements preceded by, followed by or that include the words “considers”, “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology, are forward-looking statements. These statements reflect management’s beliefs with respect to future events and are based on information available to management as of the respective dates of this Annual Report and the document incorporated by reference herein, including reasonable assumptions, estimates, internal and external analysis and opinions of management considering its experience, perception of trends, current conditions and expected developments as well as other factors that management

1 Check boxes are blank, pending adoption of the underlying rules.

2 Check boxes are blank, pending adoption of the underlying rules.

believed to be relevant as at the date such statements were made. These statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated or implied in such forward-looking statements, including, without limitation, those described in the Registrant’s Annual Information Form for the year ended March 31, 2023, attached hereto as Exhibit 99.1.

The Registrant and management caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Although the Registrant believes that the expectations reflected in the forward-looking statements were reasonable as of the time such forward-looking statements were made, it can give no assurance that such expectations will prove to have been correct. The Registrant and management assume no obligation to update or revise them to reflect new events or circumstances except as required by applicable securities laws.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States Securities and Exchange Commission (the “SEC”), to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant prepares its consolidated financial statements, which are filed as Exhibit 99.2 to this Annual Report, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and the audit is subject to Canadian auditing and auditor independence standards.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report are in Canadian dollars. The exchange rate of United States dollars into Canadian dollars, on March 31, 2023, based upon the daily exchange rate as quoted by the Bank of Canada was USD$1.00 = CAD$1.3533.

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report:

A. Annual Information Form

The Registrant’s Annual Information Form for the fiscal year ended March 31, 2023 (the “AIF”) is attached as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

B. Audited Annual Financial Statements

The Registrant’s consolidated audited annual financial statements for the fiscal year ended March 31, 2023, including the reports of the independent registered public accounting firm with respect thereto are attached as Exhibit 99.2 to this Annual Report and are incorporated by reference herein.

C. Management’s Discussion and Analysis

The Registrant’s management’s discussion and analysis of financial condition and operating performance for the fiscal year ended March 31, 2023 (the “MD&A”) is attached as Exhibit 99.3 to this Annual Report and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding, or disposing of the Company’s securities may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

DISCLOSURE CONTROLS AND PROCEDURES

As of the end of the period covered by this Annual Report, the Company carried out an evaluation, under the supervision of the Company's Chief Executive Officer (the “CEO”) and Chief Financial Officer (the “CFO”), of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act). Based upon that evaluation, the Company’s CEO and CFO have concluded that, as of the end of the period covered by this Annual Report, the Company’s disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) accumulated and communicated to the Company’s management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure.

While the Company’s principal executive officer and principal financial officer believe that the Company’s disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that the Company’s disclosure controls and procedures or internal control over financial reporting will prevent all errors or fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

MANAGEMENT’S ANNUAL REPORT ON

INTERNAL CONTROL OVER FINANCIAL REPORTING

Management, including the CEO and CFO, is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. The Company’s management has employed a framework consistent with Exchange Act Rule 13a-15(c), to evaluate the Company’s internal control over financial reporting described below. A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, that accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with applicable IFRS, and that receipts and expenditures of the company are only being made in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements. It should be noted that a control system, no matter how well designed or operated, can provide only reasonable assurance, not absolute assurance of achieving the desired control objectives. These inherent limitations include, among other items: (i) that management’s assumptions and judgments could ultimately prove to be incorrect under varying conditions and circumstances; (ii) the impact of any undetected errors; and (iii) that controls may be circumvented by the unauthorized acts of individuals, by collusion of two or more people, or by management override. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that any design will not succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost effective control system, misstatements due to error or fraud may occur and not be detected.

The Company’s management, including the CEO and CFO, is responsible for establishing and maintaining adequate internal control over financial reporting, and used the framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013) (COSO) to evaluate the effectiveness of our controls. Based on this evaluation, management concluded that the Company’s internal controls over financial reporting were effective as of March 31, 2023.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

As an "emerging growth company" under the Jumpstart our Business Startups Act, the Company is exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which requires that a public company's registered public accounting firm provide an attestation report relating to management' assessment of internal control over financial reporting.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There has been no change in the Registrant’s internal control over financial reporting during the fiscal year ended March 31, 2023, that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended March 31, 2023 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

CORPORATE GOVERNANCE

The Company's Board of Directors (the “Board”) is responsible for the Company’s corporate governance and has the following independent designated standing committees: the Compensation Committee, the Governance and Nomination Committee and Audit Committee. The charters of each committee can be viewed on the Company's

corporate website at https://ir.cybin.com/investors/governance/governance-documents/. In addition, the Company's Audit Committee Charter is attached as Exhibit "A" to the AIF, which is filed as Exhibit 99.1 to this Annual Report.

AUDIT COMMITTEE

The Board has established an independent Audit Committee for the purpose of overseeing our accounting and financial reporting processes and the audit of our annual financial statements. The Audit Committee is composed entirely of independent directors who meet the independence and experience requirements of the NYSE American LLC (the “NYSE American”), the Toronto Stock Exchange, SEC rules and National Instrument 52-110 adopted by Canadian securities regulators, as amended.

The Audit Committee is composed of Mark Lawson (Chair), Eric Hoskins, Theresa Firestone and Grant Froese.

Audit Committee Financial Experts

The Board has determined that all members of the audit committee qualify as a financial expert (as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act) and that all members are independent (as determined under Exchange Act Rule 10A-3 and Section 803.A(2) of the NYSE American Company Guide).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

The Company has adopted a code of ethics (the “Code of Business Conduct”) that applies to all employees and officers, and directors. The Code of Business Conduct is available on the Company's corporate website at https://ir.cybin.com/investors/governance/governance-documents. Any amendments to the Code of Business Conduct will be posted at the Company’s Internet website at the address listed above.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Tabular disclosure of the amounts billed to us by our independent auditors for each of our last two fiscal years ended March 31st, as Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees, is made on page 90 of the AIF, filed as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Registrant’s external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Registrant’s external auditors, in accordance with applicable law. the Company’s Audit Committee Charter is attached as Exhibit "A" to the AIF, which is filed as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The Company's description of off-balance sheet arrangements is provided in the section entitled “Off-balance sheet arrangements" contained in the MD&A filed as Exhibit 99.3 to this Annual Report is incorporated by reference herein.

CONTRACTUAL OBLIGATIONS

The Company's description of contractual and other obligations is provided in the section entitled “Contractual obligations and commitments" contained in the MD&A filed as Exhibit 99.3 to this Annual Report is incorporated by reference herein.

NYSE AMERICAN CORPORATE GOVERNANCE

The Company’s common shares are listed on the NYSE American. Section 110 of the NYSE American Company Guide (the “Company Guide”) permits the NYSE American to consider the laws, customs and practices of foreign issuers in permitting deviations from certain NYSE American listing criteria, and to grant exemptions from certain NYSE American listing criteria based on these considerations. A company seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company’s governance practices differ from those followed by United States domestic companies pursuant to the Company Guide is set forth below.

Quorum for Shareholders’ Meetings. The Company Guide requires that a listed company’s bylaws provide for a quorum of not less than 33 1/3 percent of such company’s shares issued and outstanding and entitled to vote at a meeting of shareholders. The Company’s quorum requirements, as set forth in its by-laws, provide that the quorum for a shareholders’ meeting shall be two (2) individuals present in person, each of whom is either a shareholder entitled to attend and vote at such meeting or the proxyholder of such a shareholder appointed by means of a valid proxy, holding or representing by proxy not less than five percent (5%) of the total number of the issued shares of the Company for the time being enjoying voting rights at such meeting unless a greater number of shareholders and/or a greater number of shares are required by the Business Corporations Act (Ontario) or by the articles or the by-laws).

Board Composition. The Company Guide requires that a listed company have a board of directors consisting of at least a majority of members who satisfy applicable independence standards under the Company Guide. The Company’s Board is currently composed of 6 members, 4 of whom qualify as independent under applicable independence standards under the Company Guide.

Governance and Nominating Committee. The Company Guide requires board of director nominees to be selected or recommended by either a Nominating Committee comprised solely of independent directors or by a majority of such company’s independent directors. The Company’s Governance and Nominating Committee is currently composed of 4 members, 3 of whom qualify as independent under applicable independence standards under the Company Guide.

Compensation Committee. The Company Guide requires the compensation of a listed company’s chief executive officer to be determined or recommended to the board of directors for determination, either by a Compensation Committee comprised of independent directors or by a majority of such company’s independent directors. The Company’s Compensation Committee consists of 3 directors, of which 2 are independent under applicable independence standards under the Company Guide.

Shareholder Approval Requirements. The Company Guide requires a listed company to obtain the approval of its shareholders for certain types of securities issuances, including private placements that may result in the issuance of common shares (or securities convertible into common shares) equal to 20 percent or more of presently outstanding shares for less than the greater of book or market value of the shares. The Company may seek a waiver from NYSE American’s shareholder approval requirements in circumstances where the securities issuance would not trigger such a requirement under Ontario law or under the rules of the Neo Exchange Inc. (the “NEO”), on which the Company’s common shares are also listed.

Proxy Delivery. The Company Guide requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings of a listed company, and requires that these proxies be solicited pursuant to a proxy statement that conforms to SEC proxy rules. The Company is a “foreign private issuer” under Rule 3b-4 of the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

The foregoing is consistent with the laws, customs and practices in Canada and the rules of the NEO. In addition, the Company may from time-to-time seek relief from the NYSE American corporate governance requirements on specific transactions under Section 110 of the Company Guide by providing written certification from independent local counsel that the non-complying practice is not prohibited by its home country law, in which case, the Company shall make the disclosure of such transactions available on its website at www.cybin.com. Information contained on, or accessible through, our website is not part of this Annual Report.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Not applicable.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Registrant’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | | Cybin Inc. |

| | | |

| | | |

| | By: | /s/ Greg Cavers |

| | | Name: Greg Cavers |

Date: June 27, 2023 | | Title: Chief Financial Officer |

EXHIBIT INDEX

The following documents are being filed with the SEC as Exhibits to this Form 40-F:

| | | | | |

| Exhibit | Description |

99.1 | |

99.2 | |

99.3 | |

99.4 | |

99.5 | |

99.6 | |

99.7 | |

99.8 | |

| 101.INS | XBRL Instance – the instance document does not appear in the Interactive Data File as its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH | XBRL Taxonomy Extension Schema |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

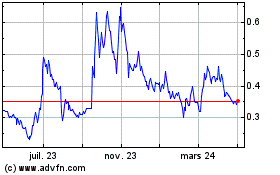

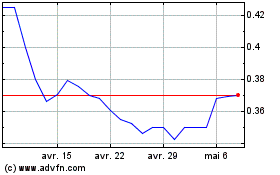

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024