Securities Registration (foreign Private Issuer) (f-3/a)

03 Août 2022 - 10:32PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on August 3, 2022

Registration No. 333-264179

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3/A

(Amendment No. 3)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

| DUNXIN FINANCIAL HOLDINGS LIMITED |

| (Exact name of registrant as specified in its charter) |

Not Applicable

(Translation of registrant’s name into English)

| Cayman Islands | | Not Applicable |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

27th Floor, Lianfa International Building

128 Xudong Road, Wuchang District

Wuhan City, Hubei Province 430063

Tel: +86-27-87303888

(Address and telephone number of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: (302) 738-6680

(Name, address, and telephone number of agent for service)

Copies to:

Joan Wu, Esq.

Hunter Taubman Fischer & Li LLC

48 Wall Street, Suite 1100

New York, NY 10005

Tel: (212) 530-2210

Fax: (212) 202-6380

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement as determined in light of market conditions.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

Dunxin Financial Holdings Limited is filing this Pre-Effective Amendment No. 3 (“Amendment No. 3 ”) to its Registration Statement on Form F -3 (333- 264179 ), originally filed on Ap ril 7, 2022 , and as amended by the Pre-Effective Amendment No. 1 filed on June 23 , 2022 and the Pre-Effective Amendment No. 2 filed on July 18, 2022 (the “Registration Statement”), as an exhibit-only filing solely to file an updated auditor consent as Exhibit 23. 2 . This Amendment No. 3 consists only of the facing page, this explanatory note , Part II of the Registration Statement, the signature page to the Registration Statement, the exhibit index and the exhibit being filed with this Amendment No. 3 . Part I of the Registration Statement is unchanged and has been omitted.

PART II INFORMATION NOT REQUIRED IN THE PROSPECTUS

| Item 8. | Indemnification of Directors and Officers. |

Cayman Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. Our articles of association provides that our officers and directors for the time being and from time to time of our company (but not including our company’s auditors) shall be indemnified and held harmless, our of our company’s assets, against all actions, costs, charges, losses, damages and expenses which they or any of them shall or may incur or sustain by or by reason of any act done, concurred in or omitted in the execution of their duties, or supposed duties, in their respective offices, other than by reason of such person’s own dishonesty, gross negligence, willful misconduct or fraud, including, among other things, costs, expenses, losses or liabilities incurred by such person in defending (whether successfully or otherwise) any civil proceedings concerning the company or its affairs in any court whether in the Cayman Islands or elsewhere.

The underwriting agreement, the form of which will be filed as Exhibit 1.1 to this registration statement, will also provide for indemnification of us and our officers and directors.

In so far as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

EXHIBIT INDEX

| * | To be filed as an amendment or as an exhibit to a document to be incorporated by reference into this registration statement. |

| ** | Filed herewith. |

| | |

| + | Previously filed. |

| | (a) | The undersigned registrant hereby undertakes: |

| | (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| | (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| | (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| | (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

| | | provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement. |

| | (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| | (4) | To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act need not be furnished, provided that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities Act or Item 8.A. of Form 20-F if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement. |

| | (5) | That, for the purpose of determining liability under the Securities Act to any purchaser: |

| | (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| | (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

| | (6) | That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| | (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| | (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| | (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| | (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| | (b) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | | |

| | (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Wuhan City, Hubei Province, China, on August 3, 2022.

| | Dunxin Financial Holdings Limited | |

| | | | |

| | By: | /s/ Ricky Qizhi Wei | |

| | | Name: Ricky Qizhi Wei | |

| | | Title: Chairman and Chief Executive Officer | |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Ricky Qizhi Wei as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this registration statement and any and all related registration statements pursuant to Rule 462(b) of the Securities Act, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC, hereby ratifying and confirming all that said attorney-in-fact and agent, or its substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities set forth below on August 3, 2022.

| Signature | | Title | | Date |

| | | | | |

| /s/ Ricky Qizhi Wei | | Chairman and Chief Executive Officer | | |

| Ricky Qizhi Wei | | (principal executive officer) | | August 3, 2022 |

| | | | | |

| /s/ Xiang (Johnny) Zhou | | | | |

| Xiang (Johnny) Zhou | | Chief Financial Officer | | August 3, 2022 |

| | | (principal financial and accounting officer) | | |

| | | | | |

| /s/ Weidong Xu | | | | |

| Weidong Xu | | Director | | August 3, 2022 |

| | | | | |

| /s/ Qi Chen | | | | |

| Qi Chen | | Director | | August 3, 2022 |

| | | | | |

| /s/ Weitao Liang | | | | |

| Weitao Liang | | Director | | August 3, 2022 |

AUTHORIZED U.S. REPRESENTATIVE

Pursuant to the Securities Act, as amended, the undersigned, the duly authorized representative in the United States of Dunxin Financial Holdings Limited, has signed this registration statement in Newark, Delaware, on August 3, 2022.

| | Authorized U.S. Representative | |

| | | | |

| | Puglisi & Associates | |

| | | | |

| | By: | /s/ Donald J. Puglisi | |

| | | Name: Donald J. Puglisi | |

| | | Title: Managing Director | |

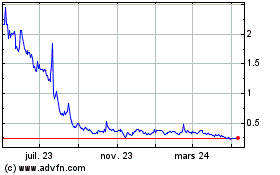

Dunxin Financial (AMEX:DXF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dunxin Financial (AMEX:DXF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025