As filed with the Securities and Exchange Commission

on February 14, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

1847 HOLDINGS LLC

(Exact name of registrant as specified in its

charter)

| Delaware |

|

5700 |

|

38-3922937 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

260 Madison Avenue, 8th Floor

New York, NY 10016

(212) 417-9800

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Ellery

W. Roberts

Chief

Executive Officer

260 Madison Avenue, 8th Floor

New York, NY 10016

(212) 417-9800

Copies to:

Louis A. Bevilacqua, Esq.

BEVILACQUA PLLC

1050 Connecticut Ave., NW, Suite 500

Washington, DC 20036

(202) 869-0888

(Names, address, including zip code, and telephone

number, including area code, of agent for service)

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a),

may determine.

The

information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED FEBRUARY 14, 2025 |

1847

HOLDINGS LLC

480,231,190 Common Shares

This prospectus relates to 480,231,190 common

shares that may be sold from time to time by the selling shareholders named in this prospectus, which includes:

| ● | 3,437,210 common shares issued to the selling shareholders; |

| ● | 38,873,908 common shares issuable to the selling shareholders upon the exercise of pre-funded warrants; |

| ● | 285,600,046 common shares issuable to the selling shareholders upon the exercise of series A warrants;

and |

| ● | 152,320,026 common shares issuable to the selling shareholders upon the exercise of series B warrants. |

We will not receive any proceeds from sales of

the common shares held by the selling shareholders or from the exercise of the pre-funded warrants or series A warrants held by the selling

shareholders, but we will receive funds from the exercise of the series B warrants held by the selling shareholders.

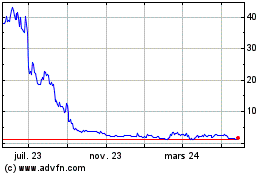

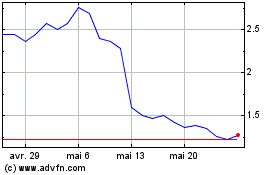

Our common shares are listed on NYSE American

under the symbol “EFSH.” On February 12, 2025, the last reported sale price of our common shares on NYSE American was $0.187

per share. There is no public market for the warrants.

The selling shareholders may offer and sell the

common shares being offered by this prospectus from time to time in public or private transactions, or both. These sales may occur at

fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices.

The selling shareholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form

of discounts, concessions or commissions from the selling shareholders, the purchasers of the shares, or both. Any participating broker-dealers

and any selling shareholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of

the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such broker-dealer or affiliates

of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling shareholders have informed

us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common shares. See

“Plan of Distribution” for a more complete description of the ways in which the shares may be sold.

Investing in our common shares involves a high

degree of risk. See “Risk Factors” beginning on page 7 to read about factors you should consider before you make an

investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025

TABLE OF CONTENTS

You should rely only on the information that

we have provided or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing prospectus

that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information

or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related

free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by

reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus,

any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

PROSPECTUS SUMMARY

This summary highlights selected information

that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information

that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus,

including the matters set forth in the section of this prospectus titled “Risk Factors” and the financial statements and related

notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports

on Form 10-Q. Unless the context indicates otherwise, references in this prospectus to “we,” “us,” “our”

and “our company” refer, collectively, to 1847 Holdings LLC and its subsidiaries taken as a whole.

Our Company

Overview

We are an acquisition holding company focused

on acquiring and managing a group of small businesses, which we characterize as those that have an enterprise value of less than $50 million,

in a variety of different industries headquartered in North America.

Through our structure, we offer investors an opportunity

to participate in the ownership and growth of a portfolio of businesses that traditionally have been owned and managed by private equity

firms, private individuals or families, financial institutions or large conglomerates. We believe that our management and acquisition

strategies will allow us to achieve our goals to make and grow regular distributions to our common shareholders and increase common

shareholder value over time.

We seek to acquire controlling interests in small

businesses that we believe operate in industries with long-term macroeconomic growth opportunities, and that have positive and stable

earnings and cash flows, face minimal threats of technological or competitive obsolescence and have strong management teams largely in

place. We believe that private company operators and corporate parents looking to sell their businesses will consider us to be an attractive

purchaser of their businesses. We make these businesses our majority-owned subsidiaries and actively manage and grow such businesses.

We expect to improve our businesses over the long term through organic growth opportunities, add-on acquisitions and operational improvements.

Our Businesses

Construction

Our construction business is operated through

our subsidiaries Kyle’s Custom Wood Shop, Inc., an Idaho corporation, or Kyle’s, Sierra Homes, LLC d/b/a Innovative Cabinets

& Design, a Nevada limited liability company, or Innovative Cabinets, CMD Inc., a Nevada corporation, and CMD Finish Carpentry LLC,

a Nevada limited liability company, which we collectively refer to as CMD, and prior to September 30, 2024, High Mountain Door & Trim

Inc., a Nevada corporation, or High Mountain. Kyle’s was acquired in the third quarter of 2020, Innovative Cabinets and High Mountain

were acquired in the fourth quarter of 2021 and CMD was acquired in the fourth quarter of 2024. This business segment accounted for approximately

57.8% and 64.9% of our total revenues for the years ended December 31, 2023 and 2022, respectively, and for approximately 69.1% and 69.9%

of our total revenues for the nine months ended September 30, 2024 and 2023, respectively.

Our construction business specializes in designing,

building, and installing custom cabinetry and countertops. We primarily service large homebuilders and homeowners of single-family homes

and commercial and multi-family developers in Nevada, Utah, Arizona, California, North Dakota, Washington State and in the Boise, Idaho

area.

Automotive Supplies

Our automotive supplies business is operated by

Wolo Mfg. Corp., a New York corporation, and Wolo Industrial Horn & Signal, Inc., a New York corporation, which we collectively refer

to as Wolo. This business segment accounted for approximately 6.6% and 13.3% of our total revenues for the years ended December 31, 2023

and 2022, respectively, and for approximately 30.9% and 30.1% of our total revenues for the nine months ended September 30, 2024 and 2023,

respectively.

Our automotive supplies business is headquartered

in Deer Park, New York and was founded in 1965. We design and sell horn and safety products (electric, air, truck, marine, motorcycle

and industrial equipment), and offer vehicle emergency and safety warning lights for cars, trucks, industrial equipment and emergency

vehicles. Focused on the automotive and industrial after-market, we sell our products to big-box national retail chains, through specialty

and industrial distributors, as well as on- line/mail order retailers and original equipment manufacturers.

Our Manager

We have engaged 1847 Partners LLC, which we refer

to as our manager, to manage our day-to-day operations and affairs, oversee the management and operations of our businesses and perform

certain other services on our behalf, subject to the oversight of our board of directors. Ellery W. Roberts, our Chief Executive Officer,

is the sole manager of our manager and, as a result, our manager is an affiliate of Mr. Roberts.

We have entered into a management services agreement

with our manager, pursuant to which we are required to pay our manager a quarterly management fee equal to 0.5% (2.0% annualized) of our

company’s adjusted net assets (as defined in the management services agreement) for services performed. Pursuant to the management

services agreement, we have agreed that our manager may, at any time, enter into offsetting management services agreements with our businesses

pursuant to which our manager may perform services that may or may not be similar to management services. Any fees to be paid by one of

our businesses pursuant to such agreements are referred to as offsetting management fees and will offset, on a dollar-for-dollar basis,

the management fee otherwise due and payable by us under the management services agreement with respect to a fiscal quarter. Our manager

has entered into offsetting management services agreements with our subsidiary 1847 Cabinet Inc., which provides for the payment of quarterly

management fees equal to the greater of $75,000 or 2% of adjusted net assets, and with 1847 Wolo Inc., which provides for the payment

of quarterly management fees equal to the greater of $125,000 or 2% of adjusted net assets. The management services agreement provides

that the aggregate amount of offsetting management fees to be paid to our manager with respect to any fiscal quarter shall not exceed

the management fee to be paid to our manager with respect to such fiscal quarter.

Our manager also owns all of our allocation shares,

which are a separate class of limited liability company interests. The allocation shares generally will entitle our manager to receive

a 20% profit allocation upon the sale of a particular subsidiary, calculated based on whether the gains generated by such sale (in excess

of a high-water mark) plus certain historical profits of the subsidiary exceed an annual hurdle rate of 8% (which rate is multiplied by

the subsidiary’s average share of our consolidated net assets). Once such hurdle rate has been exceeded, then the profit allocation

becomes payable to our manager.

Private Placement Transaction

On December 13, 2024, we entered into a securities

purchase agreement, or the Purchase Agreement, with certain purchasers, or the Purchasers, and a placement agreement with Spartan Capital

Securities, LLC, as placement agent, pursuant to which on December 16, 2024 we issued and sold to the Purchasers an aggregate of 42,311,118

units, at a purchase price of $0.27 per unit, for total gross proceeds of approximately $11.42 million.

The units are comprised of (i) 3,437,210 common

shares and pre-funded warrants for the purchase of 38,873,908 common shares, (ii) series A warrants to purchase 42,311,118 common shares

at an exercise price of $0.81 per share and (iii) series B warrants to purchase 42,311,118 common shares at an exercise price of $0.54

per share.

The pre-funded warrants are exercisable at any

time following Shareholder Approval (as defined below) until they are exercised in full at an exercise price of $0.01 per share, which

has been pre-paid by the Purchasers in full. The exercise price and number of common shares issuable upon exercise will adjust in the

event of certain share dividends and distributions, share splits, share combinations, reclassifications or similar events affecting the

common shares. Notwithstanding the foregoing, a holder will not have the right to exercise any portion of a pre-funded warrant if the

holder (together with its affiliates) would beneficially own in excess of 4.99% or 9.99% (at the Purchaser’s option) of the number

of common shares outstanding immediately after giving effect to the exercise, which such percentage may be increased or decreased by the

holder, but not in excess of 9.99%, upon at least 61 days’ prior notice to us.

The series A warrants are exercisable at any time

following Shareholder Approval at an exercise price of $0.81 per share (subject to adjustment) and will expire five years from the later

of (a) the date that we obtain Shareholder Approval and (b) the earlier of the date that (i) the initial Registration Statement (as defined

below) registering for resale the Registerable Securities (as defined below) has been declared effective by the Securities and Exchange

Commission, or the SEC, or (ii) the date that the Registerable Securities can be sold,

assigned or transferred without restriction or limitation pursuant to Rule 144 or Rule 144A promulgated under the Securities Act.

The series B warrants are exercisable at any time

following Shareholder Approval at an exercise price of $0.54 per share (subject to adjustment) and will expire five years from the later

of (a) the date that we obtain Shareholder Approval and (b) the earlier of the date that (i) the initial Registration Statement registering

for resale the Registerable Securities has been declared effective by the SEC or (ii) the date that the Registerable Securities can be

sold, assigned or transferred without restriction or limitation pursuant to Rule 144 or Rule 144A promulgated under the Securities Act.

The series A warrants and the series B warrants

may be exercised on a cashless basis if there is no effective registration statement with respect to the underlying common shares. In

addition, under an alternate cashless exercise option contained in the series A warrants, the holders of the series A warrants will have

the right to receive an aggregate number of shares equal to the product of (i) the aggregate number of common shares that would be issuable

upon a cash exercise of the series A warrants and (ii) 1.25.

The exercise prices of the series A warrants and

the series B warrants contain standard adjustments for forward and reverse share splits, share dividends, reclassifications and similar

transactions. In addition, the series A warrants and the series B warrants also contain the following resets of the exercise prices and

number of shares underlying the series A warrants and the series B warrants:

| ● | Share Combination Event: Subject to Shareholder Approval, if at any time and from time to

time on or after the issue date there occurs any share split, share dividend, share combination or reverse share split, recapitalization,

or other similar transaction involving the common shares (each referred to herein as a Share Combination Event, and such date thereof,

the Share Combination Event Date) and the lowest volume weighted average price of our common shares on its principal trading market (which

we refer to as the VWAP) during the period commencing five (5) consecutive trading days immediately preceding and the five (5) consecutive

trading days commencing on the Share Combination Event Date (which we refer to as the Event Market Price) (provided if the Share Combination

Event is effective after the close of trading, then commencing on the next trading day, which period is referred to as the Share Combination

Adjustment Period) is less than the exercise price then in effect, then at the close of trading on the last day of the Share Combination

Adjustment Period, the exercise price then in effect on such fifth (5th) trading day shall be reduced (but in no event increased) to the

Event Market Price, subject to the Floor Price (as defined below), and the number of common shares issuable upon exercise shall be increased

such that the aggregate exercise price shall remain unchanged. |

| ● | Registration Reset: On the Reset Date (as defined below), the exercise price shall be adjusted

to equal the lower of (i) the exercise price then in effect and (ii) a price equal to the greater of (a) the lowest single day VWAP during

the period commencing on the twentieth (20th) trading day immediately preceding the Reset Date and ending on the Reset Date and (b) the

Floor Price. Upon such reset of the exercise price, the number of common shares issuable upon exercise shall be increased such that the

aggregate exercise price shall remain unchanged. As used herein, Reset Date means the date following Shareholder Approval that is the

earliest of the following dates, (i) the date on which for twenty (20) consecutive trading days all Registrable Securities have become

and remained registered pursuant to an effective Registration Statement that is available for the resale of all Registrable Securities,

provided, however, that if less than all Registrable Securities have become registered for resale on the date that a Registration Statement

is declared effective, the holder with respect to itself only, shall have the right in its sole and absolute discretion to deem such condition

satisfied, including with regard only to the Registrable Securities that have been so registered, (ii) the date on which the holder, for

twenty (20) consecutive trading days, can sell all Registrable Securities pursuant to Rule 144 without restriction or limitation and the

Company has not had a Public Information Failure (as defined in the Purchase Agreement) or (iii) twelve (12) months and twenty (20) trading

days immediately following the issuance date of the series A warrants and the series B warrants. |

| ● | Subsequent Equity Sales: Subject to Shareholder Approval, if at any time we issue, sell,

enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement to sell, or grant any right to reprice,

or otherwise dispose of or issue (or announce any offer, sale, grant, or any option to purchase or other disposition), or are deemed to

have issued or sold, any common shares or any securities which would entitle the holder thereof to acquire at any time common shares,

including, without limitation, any debt, preferred shares, right, option, warrant or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, common shares, for a consideration per share

(which we refer to as the New Issuance Price) less than a price equal to the exercise price in effect immediately prior to such issuance

or sale or deemed issuance or sale, then simultaneously with the consummation

(or, if earlier, the announcement) of such issuance, the exercise price then in effect shall be reduced to an amount equal to the lower

of (i) the New Issuance Price and (ii) the lowest VWAP during the five (5) consecutive trading days immediately following the issuance,

subject to the Floor Price, and the number of common shares issuable upon exercise shall be increased such that the aggregate exercise

price shall remain unchanged. |

Notwithstanding the foregoing exercise price resets,

in no event shall the exercises prices of the series A warrants and the series B warrants be reduced to a price that is less than the

Floor Price, which is defined as (i) prior to Shareholder Approval, a price equal to thirty-five percent (35%) of $0.27 (which price shall

be appropriately adjusted for any share dividend, share split, share combination, reclassification or similar transactions) (which price,

as may be so adjusted, is referred to herein as the Minimum Price), or (ii) following Shareholder Approval, a price equal to twenty percent

(20%) of the Minimum Price; provided, however, that upon every Share Combination Event, the Floor Price shall be equal to 50% of the prior

Floor Price, and shall subsequently continue to be so adjusted for every additional Share Combination Event.

Pursuant to the Purchase Agreement, we agreed

to hold a special meeting of shareholders at the earliest practicable date, but in no event later than ninety (90) days after the closing

date for the purpose of obtaining the requisite approval from its shareholders for (i) the issuance of all common shares issuable upon

exercise of the pre-funded warrants, series A warrant and series B warrants, including without limitation, with respect to any and all

additional shares that may be issued as a result of the adjustments set forth in such warrants, (ii) a reset of the exercise price and

approval of a corresponding increase in the total number of common shares issuable upon exercise of the series A warrants issued by us

to investors on October 30, 2024 that remain outstanding to an exercise price equal to the initial exercise price of the series A warrants,

and any additional share issuance(s) as may be warranted due to such adjustment(s), and (iii) a reset of the exercise price and approval

of a corresponding increase in the total number of common shares issuable upon exercise of the series B warrants issued by us to investors

on October 30, 2024 to an exercise price equal to the initial exercise price of the series B warrants, and any additional share issuance(s)

as may be warranted due to such adjustment(s), in accordance with NYSE American’s rules (which we refer to herein as the Shareholder

Approval), with the recommendation of our board of directors that such proposal be approved, and we agreed to solicit proxies from our

shareholders in connection therewith in the same manner as all other management proposals in such proxy statement and all management-appointed

proxyholders agreed to vote their proxies in favor of such proposal. We agreed to file a preliminary proxy statement with the SEC within

ten (10) business days following the closing date for the purpose of obtaining the Shareholder Approval and to use our best efforts to

obtain such Shareholder Approval. In the event that Shareholder Approval does not occur at the first shareholder meeting, we will be required

to hold additional meetings at least one time every seventy-five (75) days until the earlier of the date Shareholder Approval is obtained

or the warrants are no longer outstanding. We timely filed the proxy statement with the SEC and have scheduled the special shareholder

meeting for March 11, 2025.

In connection with the Purchase Agreement,

we also entered into a registration rights agreement with the Purchasers, or the Registration Rights Agreement, pursuant to which we

agreed to file a registration statement on Form S-1, or the Registration Statement, with the SEC within 45 trading days of closing

(which we refer to as the Filing Date) in order to register (i) the common shares issued in the private placement, (ii) all common

shares that may be issued upon exercise of the pre-funded warrants, series A warrant and series B warrants (without regard to any

exercise limitations therein), and (iii) any securities issued or then issuable upon any share split, dividend or other

distribution, recapitalization or similar event with respect to the foregoing (which we refer to as the Registrable Securities) and

use our best efforts to cause the Registration Statement to be declared effective under the Securities Act as promptly as possible

after the filing thereof, but in any event no later than forty-five (45) calendar days following the Filing Date or, in the event of

a full review by SEC, ninety (90) calendar days following the Filing Date (which we refer to as the Effectiveness Date). If (i) the

Registration Statement is not filed on or prior to the Filing Date, (ii) we fail to file with the SEC a request for acceleration of

the Registration Statement in accordance with Rule 461 promulgated by the SEC pursuant to the Securities Act within five (5) trading

days of the date that we are notified by the SEC that the Registration Statement will not be “reviewed” or will not be

subject to further review, (iii) prior to the effective date of the Registration Statement, we fail to file a pre-effective

amendment and otherwise respond in writing to comments made by the SEC in respect of the Registration Statement within ten (10)

calendar days after the receipt of comments by or notice from the SEC that such amendment is required in order for the Registration

Statement to be declared effective, (iv) the Registration Statement registering for resale all of the Registrable Securities is not

declared effective by the SEC by the Effectiveness Date, or (v) after the effective date of the Registration Statement, it ceases

for any reason to remain continuously effective as to all Registrable Securities included in the Registration Statement, or the

Purchasers are otherwise not permitted to utilize the prospectus therein to resell such Registrable Securities for more than ten

(10) consecutive calendar days or more than an aggregate of fifteen (15) calendar days (which need not be consecutive calendar days)

during any 12-month period (any such failure or breach being referred to as an Event, and for purposes of clauses (i) and (iv), the

date on which such Event occurs, and for purpose of clause (ii) the date on which such five (5) trading day period is exceeded, and

for purpose of clause (iii) the date which such twenty (20) calendar day period is exceeded, and for purpose of clause (v) the date

on which such ten (10) or fifteen (15) calendar day period, as applicable, is exceeded being referred to as the Event Date), then,

in addition to any other rights the Purchasers may have under the Registration Rights Agreement or under applicable law, on each

such Event Date and on each day thereafter until the applicable Event is cured, we shall pay and distribute to each Purchaser an

amount in cash or common shares (as preferred by the Purchasers, and determined thereupon), on a pro rata basis as partial

liquidated damages and not as a penalty, on a daily basis, a sum equal to 0.5% of the aggregate subscription amount paid by the

Purchasers pursuant to the Purchase Agreement until fifteen (15) calendar days of each such Event, which amount shall increase to

1.00% of the aggregate subscription amount between sixteenth (16) calendar days and until cure of the Event, as calculated on a

daily basis. If we fail to pay any such partial liquidated damages in full within seven (7) days after the date payable, we will pay

interest thereon at a rate of 12% per annum (or such lesser maximum amount that is permitted to be paid by applicable law) to the

Purchasers, accruing daily from the date such partial liquidated damages are due until such amounts, plus all such interest thereon,

are paid in full.

We have filed the registration statement of which

this prospectus forms a part to register the 3,437,210 common shares issued to the Purchasers, 38,873,908 common shares issuable to the

Purchasers upon the exercise of pre-funded warrants, 285,600,046 common shares that may be issued to the Purchasers upon exercise of the

series A warrants and 152,320,026 common shares that may be issued to the Purchasers upon exercise of the series B warrants.

Corporate Information

Our principal executive offices are located at

260 Madison Avenue, 8th Floor, New York, NY 10016 and our telephone number is 212-417-9800. We maintain a website at www.1847holdings.com.

Kyle’s maintains a website at www.kylescabinets.com, Innovative Cabinets maintains a website at www.innovativecabinetsanddesign.com,

CMD maintains a website at www.cmdnv.com and Wolo maintains a website at www.wolo-mfg.com. Information available on our websites is not

incorporated by reference in and is not deemed a part of this prospectus.

The Offering

| Common shares offered by selling shareholders: |

|

This prospectus relates to 480,231,190 common shares that may be sold from time to time by the selling shareholders named in this prospectus, which includes: |

| |

|

|

| |

|

|

● |

3,437,210 common shares issued to the selling shareholders; |

| |

|

|

| |

|

|

● |

38,873,908 common shares issuable to the selling

shareholders upon the exercise of pre-funded warrants; |

| |

|

|

| |

|

|

● |

285,600,046 common shares issuable to the selling shareholders

upon the exercise of series A warrants; and |

| |

|

|

| |

|

|

● |

152,320,026 common shares issuable to the selling shareholders

upon the exercise of series B warrants. |

| |

|

|

|

|

| Common shares outstanding(1): |

|

26,539,774 common shares. |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from sales of the common shares held by the selling shareholders or from the exercise of the pre-funded warrants or series A warrants held by the selling shareholders, but we will receive funds from the exercise of the series B warrants held by the selling shareholders. See “Use of Proceeds.” |

| |

|

|

| Risk factors: |

|

Investing in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 7. |

| |

|

|

| Trading market and symbol: |

|

Our common shares are listing on NYSE American under the symbol “EFSH.” |

| (1) | The number of common shares outstanding excludes: |

| ● | 1,854 common shares issuable upon the conversion of our outstanding

series A senior convertible preferred shares; |

| ● | 5,574 common shares issuable upon the conversion of our outstanding

series C senior convertible preferred shares; |

| ● | 32,274 common shares issuable upon the conversion of our

outstanding series D senior convertible preferred shares; |

| ● | 148,558,762 common shares issuable upon the exercise of outstanding

warrants at a weighted average exercise price of $0.63 per share (excluding any decrease to the exercise price and increase in the number

of shares as a result of antidilution adjustments contained in certain outstanding warrants, including the series A warrants and series

B warrants described above); |

| ● | common shares issuable upon the conversion of secured convertible

promissory notes in the aggregate principal amount of $23,074,286, which are convertible into our common shares at a conversion price

of equal to the lowest daily volume weighted price of our common shares during the five trading days prior to conversion (subject to

adjustment); and |

| ● | 1,272,584 common shares that are reserved for issuance under

our 2023 Equity Incentive Plan. |

RISK FACTORS

An investment in our securities involves a high

degree of risk. You should consider the risks, uncertainties and assumptions discussed under “Part I-Item 1A-Risk Factors”

of our most recent Annual Report on Form 10-K and in “Part II-Item 1A-Risk Factors” in our most recent Quarterly Report on

Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may be amended, supplemented or superseded

from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only

ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and

the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “could,” “would,”

“project,” “plan,” “potentially,” “likely,” and similar expressions and variations thereof

are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements

appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly

in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and include statements regarding the intent, belief or current expectations of our management that are subject to

known and unknown risks, uncertainties and assumptions. You are cautioned that any such forward-looking statements are not guarantees

of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking

statements as a result of various factors.

Because forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements

as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur

and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law,

including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise

any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future

events or otherwise. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on

the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and although we believe

such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should

not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information.

These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This prospectus and the documents incorporated

by reference in this prospectus may contain market data that we obtain from industry sources. These sources do not guarantee the accuracy

or completeness of the information. Although we believe that our industry sources are reliable, we do not independently verify the information.

The market data may include projections that are based on a number of other projections. While we believe these assumptions to be reasonable

and sound as of the date of this prospectus, actual results may differ from the projections.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of common shares by the selling shareholders or from the exercise of pre-funded warrants or series A warrants held by the selling shareholders.

We may, however, receive up to approximately $22.8 million from the exercise of series B warrants held by selling shareholders. We will

retain broad discretion over the use of the net proceeds to us. We currently expect to use the net proceeds that we receive from the exercise

of the series B warrants for working capital and other general corporate purposes. We may also use a portion of the net proceeds to acquire,

license or invest in complementary products, technologies or businesses. The expected use of net proceeds represents our current intentions

based on our present plans and business conditions. We cannot specify with certainty all of the particular uses for the net proceeds to

be received upon exercise of the series B warrants. Pending these uses, we may invest the net proceeds of this offering in short- and

intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations

of the U.S. government.

The selling shareholders will pay any underwriting

discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred

by them in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting

the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees and fees and

expenses of our counsel and our accountants.

SELLING SHAREHOLDERS

The common shares being offered by the selling

shareholders are common shares issued to the selling shareholders and common shares issuable to the selling shareholders upon the exercise

of the pre-funded warrants, series A warrants and series B warrants issued to the selling shareholders. For purposes of calculating the

number of common shares that may be issued upon exercise of the series A warrants and the series B warrants following the adjustments

described above, we have used an assumed exercise price of $0.15. We are registering the shares in order to permit the selling shareholders

to offer the shares for resale from time to time.

We have determined beneficial ownership in accordance

with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the

persons and entities named in the table below have sole voting and investment power with respect to all shares that they beneficially

own, subject to applicable community property laws. Unless otherwise indicated in the footnotes below, based on the information provided

to us by or on behalf of the selling shareholders, no selling shareholder is a broker-dealer or an affiliate of a broker-dealer.

The table below lists the selling shareholders

and other information regarding the beneficial ownership of the common shares by each of the selling shareholders. The second column lists

the number of common shares beneficially owned by each selling shareholder. The third column lists the common shares being offered by

this prospectus by the selling shareholders. The fourth column assumes the sale of all of the ordinary shares offered by the selling shareholders

pursuant to this prospectus.

Applicable percentage ownership is based on 26,539,774

common shares outstanding as of February 12, 2025. For purposes of computing percentage ownership after this offering, we have assumed

that all warrants held by the selling shareholders will be converted to common shares and sold in this offering. In computing the number

of common shares beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all common shares

subject to options, warrants or other convertible securities held by that person or entity that are currently exercisable or releasable

or that will become exercisable or releasable within 60 days of February 12, 2025. We did not deem these shares outstanding, however,

for the purpose of computing the percentage ownership of any other person. Notwithstanding the foregoing, all of the warrants held by

the selling shareholders contain ownership limitations, such that the we shall not effect any exercise of such warrants to the extent

that after giving effect to the issuance of common shares upon exercise thereof, such holder, together with its affiliates, would beneficially

own in excess of 4.99% (or 9.99% for certain selling shareholders) of the number of common shares outstanding immediately after giving

effect to the issuance of such common shares, which such limitation may be waived by us upon no fewer than 61 days’ prior notice.

Therefore, if a selling shareholder subject to these limitations would beneficially own in excess of 4.99% or 9.99%, we have reduced the

applicable percentage to 4.99% or 9.99%, as applicable.

The selling shareholders may sell all, some or

none of their shares in this offering. See “Plan of Distribution.”

| | |

Common Shares Beneficially Owned Prior to this Offering | | |

Number of Common Shares | | |

Common Shares Beneficially Owned After this Offering | |

| Name of Beneficial Owner | |

Shares | | |

% | | |

Being Offered | | |

Shares | | |

% | |

| 3i, LP(1) | |

| 34,947,270 | | |

| 4.99 | % | |

| 34,680,561 | | |

| 266,709 | | |

| 1.00 | % |

| Alpha Capital Anstalt(2) | |

| 36,152,984 | | |

| 4.99 | % | |

| 34,680,561 | | |

| 1,472,423 | | |

| 4.99 | % |

| Alta Partners, LLC(3) | |

| 42,703,707 | | |

| 4.99 | % | |

| 42,037,041 | | |

| 666,666 | | |

| 2.51 | % |

| Altium Growth Fund, LP(4) | |

| 47,574,560 | | |

| 9.99 | % | |

| 46,240,751 | | |

| 1,333,809 | | |

| 5.03 | % |

| Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B(5) | |

| 33,349,816 | | |

| 4.99 | % | |

| 33,083,150 | | |

| 266,666 | | |

| 1.00 | % |

| Bigger Capital Fund, LP(6) | |

| 47,840,749 | | |

| 4.99 | % | |

| 46,240,751 | | |

| 1,599,998 | | |

| 4.99 | % |

| BJI Financial Group(7) | |

| 32,127,779 | | |

| 4.99 | % | |

| 31,527,780 | | |

| 599,999 | | |

| 2.26 | % |

| Brio Capital Master Fund Ltd.(8) | |

| 6,847,709 | | |

| 4.99 | % | |

| 6,305,561 | | |

| 542,148 | | |

| 2.04 | % |

| CVI Investments, Inc.(9) | |

| 33,349,816 | | |

| 4.99 | % | |

| 33,083,150 | | |

| 266,666 | | |

| 1.00 | % |

| FirstFire Global Opportunities Fund, LLC(10) | |

| 10,842,605 | | |

| 4.99 | % | |

| 10,509,260 | | |

| 333,345 | | |

| 1.26 | % |

| Great Point Capital, LLC(11) | |

| 46,907,417 | | |

| 4.99 | % | |

| 46,240,751 | | |

| 666,666 | | |

| 2.51 | % |

| L1 Capital Global Opportunities Master Fund(12) | |

| 43,703,707 | | |

| 4.99 | % | |

| 42,037,041 | | |

| 1,666,666 | | |

| 4.99 | % |

| Rainforest Partners LLC(13) | |

| 13,113,510 | | |

| 4.99 | % | |

| 12,611,121 | | |

| 502,389 | | |

| 1.89 | % |

| Robert Forster(14) | |

| 32,127,779 | | |

| 4.99 | % | |

| 31,527,780 | | |

| 599,999 | | |

| 2.26 | % |

| S.H.N. Financial Investments Ltd.(15) | |

| 30,359,263 | | |

| 9.99 | % | |

| 29,425,931 | | |

| 933,332 | | |

| 3.52 | % |

| (1) | The number of common shares being offered includes (i) 248,223 common shares, (ii) 2,807,333 common shares

issuable upon the exercise of pre-funded warrants, (iii) 20,625,003 common shares issuable upon the exercise of series A warrants and

(iv) 11,000,002 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 266,709 common shares issuable upon the exercise of other warrants. 3i Management LLC is the general partner of 3i,

LP, and Maier Joshua Tarlow is the manager of 3i Management LLC. As such, Mr. Tarlow exercises sole voting and investment discretion over

securities beneficially owned directly or indirectly by 3i, LP and 3i Management LLC. Mr. Tarlow disclaims beneficial ownership of the

securities beneficially owned directly by 3i, LP and indirectly by 3i Management LLC. The business address of each of the aforementioned

parties is 2 Wooster Street, 2nd Floor, New York, NY 10013. |

| (2) | The number of common shares being offered includes (i) 248,223 common shares, (ii) 2,807,333 common shares

issuable upon the exercise of pre-funded warrants, (iii) 20,625,003 common shares issuable upon the exercise of series A warrants and

(iv) 11,000,002 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 1,472,423 common shares issuable upon the exercise of other warrants. Nicola Feuerstein is the Director of Alpha Capital

Anstalt and may be deemed to beneficially own the securities held by it. The principal address of Alpha Capital Anstalt is Altenbach 8,

9490 Vaduz, Liechtenstein. |

| (3) | The number of common shares being offered includes (i) 300,876 common shares,

(ii) 3,402,828 common shares issuable upon the exercise of pre-funded warrants, (iii) 25,000,003 common shares issuable upon the exercise

of series A warrants and (iv) 13,333,334 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially

owned after this offering includes 666,666 common shares issuable upon the exercise of other warrants. The principal address of Alta Partners,

LLC is 1205 Franklin Ave, Ste 320, Garden City, NY 11530. |

| (4) | The number of common shares being offered includes (i) 330,964 common shares, (ii) 3,743,111 common shares

issuable upon the exercise of pre-funded warrants, (iii) 27,500,006 common shares issuable upon the exercise of series A warrants and

(iv) 14,666,670 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 1,333,809 common shares issuable upon the exercise of other warrants. Altium Capital

Management, LP, the investment manager of Altium Growth Fund, LP, has voting and investment power over these securities. Jacob Gottlieb

is the managing member of Altium Capital Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth

Fund, LP and Jacob Gottlieb disclaims beneficial ownership over these securities. The principal address of Altium Capital Management,

LP is 152 West 57th Street, 20th Floor, New York, NY 10019. |

| (5) | The number of common shares being offered includes (i) 236,790 common shares, (ii) 2,678,025 common shares

issuable upon the exercise of pre-funded warrants, (iii) 19,675,001 common shares issuable upon the exercise of series A warrants and

(iv) 10,493,334 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 266,666 common shares issuable upon the exercise of other warrants. Ayrton Capital

LLC, the investment manager to Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B, has discretionary authority to vote

and dispose of the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B and may be deemed to be the beneficial owner

of these shares. Waqas Khatri, in his capacity as Managing Member of Ayrton Capital LLC, may also be deemed to have investment discretion

and voting power over the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B. Ayrton Capital LLC and

Mr. Khatri each disclaim any beneficial ownership of these shares. The principal address of Alto Opportunity Master Fund,

SPC - Segregated Master Portfolio B is c/o Ayrton Capital LLC, 55 Post Rd. W., 2nd Floor, Westport, CT 06880. |

| (6) | The number of common shares being offered includes (i) 330,964 common shares, (ii) 3,743,111 common shares

issuable upon the exercise of pre-funded warrants, (iii) 27,500,006 common shares issuable upon the exercise of series A warrants and

(iv) 14,666,670 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 1,599,998 common shares issuable upon the exercise of other warrants. Bigger Capital Fund GP, LLC, as the general partner

of Bigger Capital Fund, LP, may be deemed to beneficially own the securities held by Bigger Capital Fund, LP. Michael Bigger, as the managing

member of Bigger Capital Fund GP, LLC, may be deemed to beneficially own the securities beneficially owned by Bigger Capital Fund GP,

LLC. Each of Bigger Capital Fund GP, LLC and Mr. Bigger disclaims beneficial ownership of the securities held by Bigger Capital Fund GP,

LLC. The principal address of Bigger Capital Fund, LP is 11700 West Charleston Blvd. #170-659, Las Vegas, NV 89135. |

| (7) | The number of common shares being offered includes (i) 225,657 common shares, (ii) 2,552,121 common shares

issuable upon the exercise of pre-funded warrants, (iii) 18,750,001 common shares issuable upon the exercise of series A warrants and

(iv) 10,000,001 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 599,999 common shares issuable upon the exercise of other warrants. Brian Walsh is the President of BJI Financial Group

and may be deemed to beneficially own the securities held by it. The principal address of BJI Financial Group is 111 Sandelwood Drive,

Marlboro, NJ 07746. |

| (8) | The number of common shares being offered includes (i) 45,131 common shares, (ii) 510,425 common shares

issuable upon the exercise of pre-funded warrants, (iii) 3,750,003 common shares issuable upon the exercise of series A warrants and (iv)

2,000,002 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this offering

includes 542,148 common shares issuable upon the exercise of other warrants. Shaye Hirsch is the Director of Brio Capital Master Fund

Ltd. and may be deemed to beneficially own the securities held by it. The principal address of Brio Capital Master Fund Ltd. is 100 Merrick

Road, Suite 401 W., Rockville Center, NY 11570. |

| (9) | The number of common shares being offered includes (i) 236,790 common shares, (ii) 2,678,025 common shares

issuable upon the exercise of pre-funded warrants, (iii) 19,675,001 common shares issuable upon the exercise of series A warrants and

(iv) 10,493,334 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 266,666 common shares issuable upon the exercise of other warrants. Heights Capital Management, Inc., the authorized

agent of CVI Investments, Inc. has discretionary authority to vote and dispose of the shares held by CVI Investments, Inc. and may be

deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as President of Heights Capital Management, Inc.,

may also be deemed to have investment discretion and voting power over the shares held by CVI Investments, Inc. Mr. Kobinger disclaims

any such beneficial ownership of the shares. CVI Investments, Inc. is affiliated with one or more FINRA members, none of whom are currently

expected to participate in the sale pursuant to this prospectus. The principal address of CVI Investments, Inc. is c/o Heights Capital

Management, Inc., 101 California Street, Suite 325, San Francisco, CA 94111. |

| (10) | The number of common shares being offered includes (i) 75,219 common shares, (ii) 850,707 common shares

issuable upon the exercise of pre-funded warrants, (iii) 6,250,000 common shares issuable upon the exercise of series A warrants and (iv)

3,333,334 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this offering

includes 333,345 common shares issuable upon the exercise of other warrants. Eli Fireman is the Managing Member of FirstFire Global Opportunities

Fund, LLC and may be deemed to beneficially own the securities held by it. The principal address of FirstFire Global Opportunities Fund,

LLC is 1040 1st Ave, New York, NY 10022. |

| (11) | The number of common shares being offered includes (i) 330,964 common shares, (ii) 3,743,111 common shares

issuable upon the exercise of pre-funded warrants, (iii) 27,500,006 common shares issuable upon the exercise of series A warrants and

(iv) 14,666,670 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 666,666 common shares issuable upon the exercise of other warrants. Dan Dimiero is the Manager of Great

Point Capital, LLC and may be deemed to beneficially own the securities held by it. The principal

address of Great Point Capital, LLC is 200 West Jackson, Ste 1000, Chicago, IL 60606. |

| (12) | The number of common shares being offered includes (i) 300,876 common shares, (ii) 3,402,828 common shares

issuable upon the exercise of pre-funded warrants, (iii) 25,000,003 common shares issuable upon the exercise of series A warrants and

(iv) 13,333,334 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 1,666,666 common shares issuable upon the exercise of other warrants. David Feldman and Joel Arber are the Directors

of L1 Capital Global Opportunities Master Fund, Ltd. As such, L1 Capital Global Opportunities Master Fund, Ltd., Mr. Feldman, and Mr.

Arber may be deemed to beneficially own (as that term is defined in Rule 13d-3 under the Exchange Act) the securities held by L1 Capital

Global Opportunities Master Fund, Ltd. To the extent Mr. Feldman and Mr. Arber are deemed to beneficially own such securities, Mr. Feldman

and Mr. Arber disclaim beneficial ownership of these securities for all other purposes. The principal address of L1 Capital Global Opportunities

Master Fund is 161A Shedden Road, 1 Artillery Court PO Box 10085 Grand Cayman, Cayman Islands KY1-1001. |

| (13) | The number of common shares being offered includes (i) 90,263 common shares, (ii) 1,020,849 common shares

issuable upon the exercise of pre-funded warrants, (iii) 7,500,006 common shares issuable upon the exercise of series A warrants and (iv)

4,000,003 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this offering

includes 502,389 common shares issuable upon the exercise of other warrants. Mark Weinberger is the Authorized Signatory of Rainforest

Partners LLC and may be deemed to beneficially own the securities held by it. The principal

address of Rainforest Partners LLC is 850 East 26th Street, Brooklyn, NY 11210. |

| (14) | The number of common shares being offered includes (i) 225,657 common shares, (ii) 2,552,121 common shares

issuable upon the exercise of pre-funded warrants, (iii) 18,750,001 common shares issuable upon the exercise of series A warrants and

(iv) 10,000,001 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 599,999 common shares issuable upon the exercise of other warrants. The principal address of Robert Forster is 54 Deepdale

Dr., Great Neck, NY 11021. |

| (15) | The number of common shares being offered includes (i) 210,613 common shares, (ii) 2,381,980 common shares

issuable upon the exercise of pre-funded warrants, (iii) 17,500,003 common shares issuable upon the exercise of series A warrants and

(iv) 9,333,335 common shares issuable upon the exercise of series B warrants. The number of common shares beneficially owned after this

offering includes 933,332 common shares issuable upon the exercise of other warrants. Nir Shamir is the Chief Executive Officer of S.H.N.

Financial Investments Ltd. As such, S.H.N. Financial Investments Ltd. and Mr. Shamir

may be deemed to beneficially own (as that term is defined in Rule 13d-3 under the Exchange Act) the securities described herein. To the

extent Mr. Shamir is deemed to beneficially own such securities, Mr. Shamir disclaims beneficial ownership of these securities for all

other purposes. The principal address of S.H.N. Financial Investments Ltd. is Herzliya Hills,

Arik Einstein 3, Israel, 4610301. |

PLAN OF DISTRIBUTION

The selling shareholders and any of their pledgees,

donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their common shares on any stock

exchange, market or trading facility on which the shares are traded or quoted or in private transactions. These sales will occur at fixed

prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices.

The selling shareholders may use any one or more

of the following methods when selling shares:

| ● | ordinary brokerage transactions and transactions in which

the broker-dealer solicits investors; |

| ● | block trades in which the broker-dealer will attempt

to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale

by the broker-dealer for its account; |

| ● | an exchange distribution in accordance with the rules of

the applicable exchange; |

| ● | privately negotiated transactions; |

| ● | through the writing of options on the shares; |

| ● | to cover short sales made after the date that the registration

statement of which this prospectus is a part is declared effective by the SEC; |

| ● | broker-dealers may agree with the selling shareholders

to sell a specified number of such shares at a stipulated price per share; and |

| ● | a combination of any such methods of sale. |

The selling shareholders may also sell shares

under Rule 144 of the Securities Act, if available, rather than under this prospectus. The selling shareholders shall have the sole and

absolute discretion not to accept any purchase offer or make any sale of shares if it deems the purchase price to be unsatisfactory at

any particular time.

The selling shareholders or their respective pledgees,

donees, transferees or other successors in interest, may also sell the shares directly to market makers acting as principals and/or broker-dealers

acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions

or commissions from the selling shareholders and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom

they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Market

makers and block purchasers purchasing the shares will do so for their own account and at their own risk. It is possible that a selling

shareholder will attempt to sell shares in block transactions to market makers or other purchasers at a price per share which may be below

the then existing market price. We cannot assure that all or any of the shares offered in this prospectus will be issued to, or sold by,

the selling shareholders. The selling shareholders and any brokers, dealers or agents, upon effecting the sale of any of the shares offered

in this prospectus, may be deemed to be “underwriters” as that term is defined under the Securities Act, the Exchange Act

and the rules and regulations of such acts. In such event, any commissions received by such broker-dealers or agents and any profit on

the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident

to the registration of the shares, including fees and disbursements of counsel to the selling shareholders, but excluding brokerage commissions

or underwriter discounts.

The selling shareholders, alternatively, may sell

all or any part of the shares offered in this prospectus through an underwriter. The selling shareholders have not entered into any agreement

with a prospective underwriter and there is no assurance that any such agreement will be entered into.

The selling shareholders may pledge their shares

to their brokers under the margin provisions of customer agreements. If a selling shareholder defaults on a margin loan, the broker may,

from time to time, offer and sell the pledged shares. The selling shareholders and any other persons participating

in the sale or distribution of the shares will be subject to applicable provisions of the Exchange Act, and the rules and regulations

under such act, including, without limitation, Regulation M. These provisions may restrict certain activities of, and limit the timing

of purchases and sales of any of the shares by, the selling shareholders or any other such person. In the event that any of the selling

shareholders are deemed an affiliated purchaser or distribution participant within the meaning of Regulation M, then the selling shareholders

will not be permitted to engage in short sales of common shares. Furthermore, under Regulation M, persons engaged in a distribution of

securities are prohibited from simultaneously engaging in market making and certain other activities with respect to such securities for

a specified period of time prior to the commencement of such distributions, subject to specified exceptions or exemptions. In addition,

if a short sale is deemed to be a stabilizing activity, then the selling shareholders will not be permitted to engage in a short sale

of our shares. All of these limitations may affect the marketability of the shares.

If a selling shareholder notifies us that it has

a material arrangement with a broker-dealer for the resale of the shares, then we would be required to amend the registration statement

of which this prospectus is a part, and file a prospectus supplement to describe the agreements between the selling shareholder and the

broker-dealer.

LEGAL MATTERS

The validity of the securities offered hereby

will be passed upon for us by Bevilacqua PLLC, Washington, DC.

As of the date of this prospectus, Bevilacqua

PLLC owns 15 common shares and Louis A. Bevilacqua, the managing member of Bevilacqua PLLC, owns 5 common shares. Mr. Bevilacqua also

owns approximately 9% of 1847 Partners Class A Member LLC and 10% of 1847 Partners Class B Member LLC. Bevilacqua PLLC and Mr. Bevilacqua

received these securities as partial consideration for legal services previously provided to us.

EXPERTS

Our financial statements for the years ended

December 31, 2023 and 2022 have been incorporated by reference in this prospectus in reliance upon the report of Sadler, Gibb & Associates,

LLC, an independent registered public accounting firm, upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.1847holdings.com.

Information accessible on or through our website is not a part of this prospectus.

This prospectus is part of a registration statement

that we filed with the SEC and does not contain all of the information in the registration statement. You should review the information

and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities that we

are offering. Statements in this prospectus about these documents are summaries and each statement is qualified in all respects by reference

to the document to which it refers. You should read the actual documents for a more complete description of the relevant matters.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference

much of the information that we file with the SEC, which means that we can disclose important information to you by referring you to

those publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this

prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future

filings may modify or supersede some of the information included or incorporated by reference in this prospectus. This means that you

must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any

document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents

listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case,

other than those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form

8-K and, except as may be noted in any such Form 8-K, exhibits filed on such form that are related to such information), until the offering

of the securities under the registration statement of which this prospectus forms a part is terminated or completed:

| ● | our Annual Report on Form

10-K for the year ended December 31, 2023 filed with the SEC on April 25, 2024; |

| ● | our Current Reports on Form 8-K filed with the

SEC on February 9, 2024, February

9, 2024, February 15, 2024,

April 11, 2024, May

14, 2024, July 1, 2024,

July 31, 2024, August 9, 2024, August 22, 2024,

August 23, 2024, October

4, 2024, October 31, 2024,

November 8, 2024, December

18, 2024, December 20, 2024,

December 31, 2024, February

11, 2025 and February 14, 2025; |

| ● | our Definitive Proxy Statement on Schedule

14A filed on April 29, 2024; and |

| ● | our Definitive Proxy Statement on Schedule

14A filed on January 23, 2025. |

We undertake to provide without charge to each

person (including any beneficial owner) who receives a copy of this prospectus, upon written or oral request, a copy of all of the preceding

documents that are incorporated by reference (other than exhibits, unless the exhibits are specifically incorporated by reference into

these documents). We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or

all of the reports or documents that we incorporate by reference in this prospectus contained in the registration

statement (except exhibits to the documents that are not specifically incorporated by reference) at no cost to you, by writing or calling

us at:

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Secretary

(212) 417-9800

480,231,190

Common Shares

1847

HOLDINGS LLC

PROSPECTUS

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth estimated fees

and expenses (except in the case of the SEC registration fee) in connection with the issuance and distribution of the securities being

registered.

| | |

Amount | |

| SEC registration fee | |

$ | 13,748.87 | |

| Accounting fees and expenses | |

| 10,000.00 | |

| Legal fees and expenses | |

| 15,000.00 | |

| Transfer agent fees and expenses | |

| 3,000.00 | |

| Printing and related fees and expenses | |

| 5,000.00 | |

| Miscellaneous fees and expenses | |

| 5,251.13 | |

| Total | |

$ | 52,000.00 | |

Item 14. Indemnification of Directors and Officers

Certain provisions of our operating agreement

are intended to be consistent with Section 145 of the General Corporation Law of the State of Delaware, which provides that a corporation

has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request

of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceedings to which

he is, or is threatened to be made, a party by reason of such position, if such person shall have acted in good faith and in a manner

he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal proceedings, if such person

had no reasonable cause to believe his conduct was unlawful; provided that, in the case of actions brought by or in the right of the corporation,

no indemnification shall be made with respect to any matter as to which such person shall have been adjudged to be liable to the corporation

unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances.

Our operating agreement includes a provision that

eliminates the personal liability of its directors for monetary damages for breach of fiduciary duty as a director, except for liability:

| ● | for any breach of the director’s duty of loyalty to the company or its shareholders; |

| ● | for acts or omissions not in good faith or a knowing violation of law; |

| ● | regarding unlawful distributions and interest purchases analogous to Section 174 of the General Corporation

Law of the State of Delaware; or |

| ● | for any transaction from which the director derived an improper benefit. |

Our operating agreement provides that:

| ● | we must indemnify our directors and officers to the equivalent extent permitted by General Corporation

Law of the State of Delaware; |

| ● | we may indemnify our other employees and agents to the same extent that we indemnify our officers and

directors, unless otherwise determined by our board of directors; and |

| ● | we must advance expenses, as incurred, to our directors and executive officers in connection with a legal

proceeding to the extent permitted by Delaware law and may advance expenses as incurred to our other employees and agents, unless otherwise

determined by our board of directors. |

The indemnification provisions contained in our

operating agreement are not exclusive of any other rights to which a person may be entitled by law, agreement, vote of shareholders or

disinterested directors or otherwise.

In addition, we have entered into indemnification

agreements with each of our executive officers and directors, pursuant to which we have agreed to indemnify them to the fullest extent

permitted by law. Under the indemnification agreements, we have agreed to advance all expenses incurred by or on behalf of the independent

directors in connection with any proceeding within thirty (30) days after the receipt by us of a statement requesting such advance, whether

prior to or after final disposition of such proceeding.

We also have insurance on behalf of our directors

and executive officers and certain other persons insuring them against any liability asserted against them in their respective capacities

or arising out of such status.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling us under the foregoing provisions, we have been

informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore

unenforceable.

Item 15. Recent Sales of Unregistered Securities

During the past three years, we issued the following

securities, which were not registered under the Securities Act.

On February 24, 2022, we sold an aggregate of