Enservco Corporation (NYSE American: ENSV), a diversified national

provider of specialized well-site services to the domestic onshore

conventional and unconventional oil and gas industries, today

reported financial results for its third quarter and nine-month

period ended September 30, 2023.

“We are pleased to report an increase in revenue for the

nine-month period despite our earlier exit from North Dakota, which

negatively impacted third quarter and year-to-date revenue

comparisons. As a result, our year-to-date adjusted EBITDA improved

by 42% to a negative $1.5 million from a negative $2.6 million. Of

particular note, we are seeing substantially improved pricing and

longer-term customer commitments for the 2023-24 heating season in

all of our active basins,” said Rich Murphy, Executive

Chairman.

“The strategic decision to exit North Dakota will allow us to

reallocate resources to operating areas that offer more potential

for improved profitability and growth over the long term,” Murphy

added. “We are in advanced discussions to sell real estate and

excess equipment related to the North Dakota operations, which will

strengthen our cash position as we move into our heating season. We

also have made significant progress de-levering our business in

2023, closing the third quarter with just $4.2 million in term debt

associated with our equipment financing, down from $5.3 million at

2022 year-end and from a high of approximately $36 million in 2019

when we commenced our debt reduction program. We intend to continue

paying down debt as we increase revenue and operations become more

profitable.

Murphy continued, “Near the end of the third quarter we acquired

for stock substantially all of the assets of Rapid Hot, a major

provider of frac water heating services in Ohio, Pennsylvania and

West Virginia. In addition to strengthening our position in the

Marcellus shale, this transaction adds incremental revenue as well

as management depth, with Rapid Hot’s president and CFO Mike Lade

joining Enservco as Chief of Staff. We also added Rapid Hot

managing member Steve Weyel to our Board and look forward to

benefitting from his many years of experience in the energy space

and particularly from his ability to identify and close M&A

opportunities. In conjunction with this acquisition, we completed a

$1.6 million convertible debt financing that included participation

from lead investors of Rapid Hot, an Enservco board member and

Cross River Partners.

“We are steadily building momentum across our business and are

now entering our fourth and first quarter heating season when we

generate the majority of our revenue and profitability. Moving

forward, we are focused on growing revenue both organically and

through M&A, controlling costs to improve profitability and

reducing long-term debt. We are encouraged by improving margins and

continued drilling activity in our markets and based on customer

feedback, expect further demand growth for our services,” Murphy

concluded.

Nine Month Results

Revenue through nine months increased 3% year over year to $15.6

million from $15.1 million. The increase was attributable to 11%

growth in completion services revenue to $7.2 million from $6.5

million last year. That growth more than offset a 3% decline in

production services to $8.4 million versus $8.6 million year over

year.

Adjusted EBITDA through nine months improved by $1.1 million to

a negative $1.5 million from a negative $2.6 million in the same

period last year.

Net loss through nine months was $6.6 million, or $0.35 per

basic and diluted share, compared to a net loss of $3.9 million, or

$0.34 per basic and diluted share, in the same period last year

when the Company booked a non-recurring $4.3 million gain on debt

extinguishment.

Third Quarter Results

Revenue in the third quarter decreased 6% year over year to $2.9

million from $3.1 million. Production services revenue was $2.6

million compared to $2.8 million a year ago. Completion services

revenue was essentially flat at $0.3 million. The decrease in

revenue reflected the Company’s exit from the North Dakota region

to focus on basins that offer better opportunities for profitable

growth. The Company achieved revenue increases within its

Texas-based hot oiling operations, which partially offset the

decrease in revenue associated with its North Dakota exit.

Adjusted EBITDA in the third quarter was a negative $1.5 million

compared to a negative $1.3 million in the same quarter last

year.

Net loss in the third quarter was down slightly at $3.0 million,

or $0.13 per basic and diluted share, compared to a net loss of

$3.1 million, or $0.27 per basic and diluted share, in the same

quarter last year.

Conference Call InformationManagement will hold

a conference call to discuss these results on Thursday, November 16

at 9:30 a.m. ET. The call will be accessible by dialing

888-506-0062 (973-528-0011 for international callers). Access code

577898. A telephonic replay will be available through November 30,

2023, by calling 877-481-4010 (919-882-2331 for international

callers) and entering the Replay ID # 49479. To listen to the

webcast, participants should go to the Enservco website at

www.enservco.com and link to the “Investors” page at least 10

minutes early to register and download any necessary audio

software. A replay of the webcast will be available until September

15, 2023. The webcast also is available

here:https://www.webcaster4.com/Webcast/Page/2228/48952

About EnservcoThrough its various operating

subsidiaries, Enservco provides a range of oilfield services,

including hot oiling, acidizing, frac water heating, and related

services. The Company has a broad geographic footprint covering

seven major domestic oil and gas basins and serves customers in

Colorado, Montana, New Mexico, North Dakota, Oklahoma,

Pennsylvania, Ohio, Texas, Wyoming, West Virginia, Utah, Michigan,

Illinois, Florida, and Louisiana. Additional information is

available at www.enservco.com.

*Note on non-GAAP Financial Measures This press

release and the accompanying tables include a discussion of EBITDA

and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with

generally accepted accounting principles ("GAAP"). The term

"EBITDA" refers to a financial measure that we define as earnings

(net income or loss) plus or minus net interest taxes, depreciation

and amortization. Adjusted EBITDA excludes from EBITDA stock-based

compensation and, when appropriate, other items that management

does not utilize in assessing Enservco’s operating performance (as

further described in the attached financial schedules). None of

these non-GAAP financial measures are recognized terms under GAAP

and do not purport to be an alternative to net income as an

indicator of operating performance or any other GAAP measure. We

have reconciled Adjusted EBITDA to GAAP net loss in the

Consolidated Statements of Operations table at the end of this

release. We intend to continue to provide these non-GAAP financial

measures as part of our future earnings discussions and, therefore,

the inclusion of these non-GAAP financial measures will provide

consistency in our financial reporting.

Cautionary Note Regarding Forward-Looking

StatementsThis news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

contained in this release using the terms "may," "expects to,"

“should,” and other terms denoting future possibilities, are

forward-looking statements. The accuracy of these statements cannot

be guaranteed as they are subject to a variety of risks, which are

beyond Enservco's ability to predict, or control and which may

cause actual results to differ materially from the projections or

estimates contained herein. Among these risks are those set forth

in Enservco’s annual report on Form 10-K for the year ended

December 31, 2022, and subsequently filed documents with the SEC.

Forward looking statements in this news release that are subject to

risk include the ability sell real estate and equipment in the

North Dakota operations to increase the cash balance; ability to

pay down debt, add new revenue streams, grow revenue and

profitability, control costs, experience customer demand growth,

and identify and close M&A transactions. It is important that

each person reviewing this release understand the significant risks

attendant to the operations of Enservco. The Company disclaims any

obligation to update any forward-looking statement made herein.

Contact:

Mark PattersonChief Financial OfficerEnservco

Corporationmpatterson@enservco.com

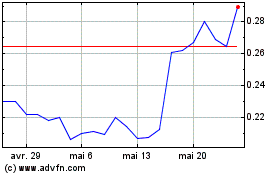

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024