Evolution Petroleum Announces Acquisition of Non-Operated Oil and Natural Gas Assets in New Mexico, Texas, and Louisiana

04 Mars 2025 - 1:45PM

Evolution Petroleum Corporation (NYSE American: EPM) ("Evolution"

or the "Company") today announced that it has entered into a

definitive agreement to acquire non-operated oil and natural gas

assets in New Mexico, Texas, and Louisiana (the "Acquisition"). The

total purchase price for the Acquisition is $9.0 million, subject

to customary closing adjustments. The Acquisition is expected to

close by the end of Evolution's third quarter of fiscal 2025 with

an effective date of February 1, 2025. The Company intends to

finance the Acquisition through a combination of cash on hand and

borrowings under its existing credit facility.

Kelly Loyd, President and Chief Executive

Officer, commented: "This Acquisition marks our 7th such

transaction in the last 6 years and is another step forward in

strengthening our production base – aligns with our disciplined

growth strategy by adding high-quality, low-decline production at

an attractive valuation, estimated at ~2.8x NTM2 Adjusted EBITDA1

which doesn’t include any incremental cash flows for upside

opportunities. These assets complement our existing portfolio and

enhance our ability to generate stable free cash flow, which

supports our long-standing commitment to returning capital to

shareholders. We see additional upside through reactivations of

existing waterfloods and through operational efficiencies, which

will further enhance long-term value."

The Acquisition expands Evolution's diverse

asset portfolio with approximately 440 barrels of oil equivalent

per day (BOEPD) of net production, consisting of a balanced

commodity mix of 60% oil and 40% natural gas. The acquired assets

are primarily low-decline, Proved Developed Producing (PDP)

properties, characterized by a sub-7% annual base decline, ensuring

stable cash flows and long-term value creation. The transaction is

immediately accretive to all key metrics, reinforcing Evolution's

ability to sustain and grow its shareholder returns. The portfolio

consists of approximately 254 gross producing wells across all

regions. The assets will be managed by a top-tier private operator,

ensuring operational efficiency and the ability to maximize

value.

"We remain committed to executing our strategy

of acquiring high-quality, long-life assets that enhance our

production base while maintaining financial discipline," added Mr.

Loyd. "This transaction further reinforces our strong balance sheet

and ability to deliver consistent shareholder value through

sustainable production and cash flow generation."

Non-GAAP Disclosure

Certain financial information utilized by the

Company are not measures of financial performance recognized by

accounting principles generally accepted in the United States

(“GAAP”).

Adjusted EBITDA is a non-GAAP financial measure

used as a supplemental financial measure by management and external

users of the Company's financial statements, such as investors,

commercial banks, and others, to assess our operating performance

as compared to that of other companies in our industry. We use

these measures to assess our ability to incur and service debt and

fund capital expenditures. Adjusted EBITDA should not be considered

in isolation from or as a substitute for net income, as an

indication of operating performance or cash flows from operating

activities or as a measure of liquidity. Adjusted EBITDA may not be

comparable to similarly titled measures reported by other

companies. The Company defines “Adjusted EBITDA” as net income

(loss) plus interest expense, income tax expense (benefit),

depreciation, depletion, and accretion (DD&A), stock-based

compensation, ceiling test impairment, and other impairments,

unrealized loss (gain) on change in fair value of derivatives, and

other non-recurring or non-cash expense (income) items. The Company

cannot provide a reconciliation of NTM Adjusted EBITDA without

unreasonable efforts because it is unable to predict with

reasonable certainty the ultimate outcome of certain significant

items required for reconciliation. These items are uncertain,

depend on various factors and could have a material impact on GAAP

reported results.

PV-10 is a non-GAAP financial measure that

differs from a financial measure under GAAP known as “standardized

measure of discounted future net cash flows” in that PV-10 is

calculated without including future income taxes. The Company

believes the presentation of PV-10 provides useful information

because it is widely used by investors in evaluating oil and

natural gas companies without regard to specific income tax

characteristics of such entities. The Company also uses PV-10 when

assessing the potential return on investment related to oil and

natural gas properties and in evaluating acquisition opportunities.

PV-10 is not intended to represent the current market value of the

Company’s estimated proved reserves. PV-10 should not be considered

in isolation or as a substitute for the standardized measure as

defined under GAAP. The Company also presents PV-10 at strip

pricing, which is PV-10 adjusted for price sensitivities. Since

GAAP does not prescribe a comparable GAAP measure for PV-10 of

reserves adjusted for pricing sensitivities, it is not practicable

for the Company to reconcile PV-10 at strip pricing to a

standardized measure or any other GAAP measure.

About Evolution Petroleum

Evolution Petroleum Corporation is an

independent energy company focused on maximizing total shareholder

returns through the ownership of and investment in onshore oil and

natural gas properties in the U.S. The Company aims to build and

maintain a diversified portfolio of long-life oil and natural gas

properties through acquisitions, selective development

opportunities, production enhancements, and other exploitation

efforts. Properties include non-operated interests in the following

areas: the SCOOP/STACK plays of the Anadarko Basin in Oklahoma; the

Chaveroo Oilfield located in Chaves and Roosevelt Counties, New

Mexico; the Jonah Field in Sublette County, Wyoming; the Williston

Basin in North Dakota; the Barnett Shale located in North Texas;

the Hamilton Dome Field located in Hot Springs County, Wyoming; the

Delhi Holt-Bryant Unit in the Delhi Field in Northeast Louisiana;

as well as small overriding royalty interests in four onshore Texas

wells. Visit www.evolutionpetroleum.com for more information.

Cautionary Statement

All forward-looking statements contained in this

press release regarding the Company's current and future

expectations, potential results, and plans and objectives involve a

wide range of risks and uncertainties. Statements herein using

words such as "believe," "expect," "may," "plans," "outlook,"

"should," "will," and words of similar meaning are forward-looking

statements. Although the Company's expectations are based on

business, engineering, geological, financial, and operating

assumptions that it believes to be reasonable, many factors could

cause actual results to differ materially from its expectations.

The Company gives no assurance that its goals will be achieved.

These factors and others are detailed under the heading "Risk

Factors" and elsewhere in our periodic reports filed with the

Securities and Exchange Commission ("SEC"). The Company undertakes

no obligation to update any forward-looking statement.

ContactInvestor Relations(713)

935-0122ir@evolutionpetroleum.com

| 1) |

|

|

Adjusted EBITDA is

Adjusted Earnings Before Interest, Taxes, Depreciation, and

Amortization and is a non-GAAP financial measure; see disclosures

at the end of this release for more information. |

| 2) |

|

|

Based on current NYMEX strip

prices as of 3/3/25; NTM represents 12-month period of

4/1/25-4/1/26. |

| 3) |

|

|

PV-10 is based on proved reserves

determined by internal management estimates using current NYMEX

strip prices as of 3/3/25 and is a non-GAAP financial measure; see

disclosures at the end of this release for more information. |

This press release was published by a CLEAR® Verified

individual.

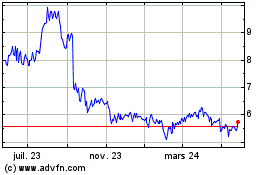

Evolution Petroleum (AMEX:EPM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

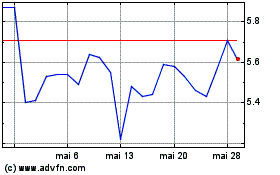

Evolution Petroleum (AMEX:EPM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025