Big Board Lists Market Vectors-Russia ETF

30 Avril 2007 - 4:45PM

PR Newswire (US)

RSX Provides U.S. Investors With Access to a Portfolio of 30

Russian Companies Traded on Global Exchanges NEW YORK, April 30

/PRNewswire-FirstCall/ -- New York-based asset manager Van Eck

Global today launched Market Vectors-Russia ETF (NYSE:RSX), a new

exchange-traded fund (ETF) that is listed on the New York Stock

Exchange (NYSE). The fund is the first ETF listed in the U.S. that

enables U.S. investors to gain exposure to a broad spectrum of

Russian companies. RSX has been approved for extended trading

privileges on the NYSE Arca electronic marketplace. In addition to

being available for trading during the normal trading hours of 9:30

am to 4:00 pm, RSX will be available to trade on NYSE Arca from

4:00 am to 9:30 am and from 4:00 pm to 8:00 pm. NYSE Arca will

calculate and disseminate the IOPV (indicated optimized portfolio

value) over the CTA (Consolidated Tape Association) from 4:00 am to

8:00 pm ET. Options are expected to be available on RSX. The new

Market Vectors-Russia ETF seeks to replicate as closely as

possible, before fees and expenses, the price and yield performance

of the DAXglobal(R) Russia+ Index (DXRPUS), a basket of the

securities of 30 of the most heavily traded Russian companies that

have listings on global exchanges, either through an American

Depository Receipt (ADR), a Global Depository Receipt (GDR), or

local Russian shares. The index, which was launched in March 2007,

includes many companies of global prominence, including energy

giants as Lukoil, OAO Gazprom, and Surgutneftgaz, as well as

utility giant Unified Energy Systems, steel manufacturing firms

Mechel OAO and Evraz Group SA, mining firm JSC MMC Norilsk Nickel,

and communications firms Mobile TeleSystems OJSC and

Vimpel-Communications, and banking leader Sberbank. RSX provides

investors with a convenient, low cost means to gain diversified

exposure to the world's 14th ranked economy, whose growth in recent

years has been well in excess of many developed economies. Spanning

11 time zones, Russia is the largest country in the world

geographically and has enormous reserves of petroleum, natural gas,

coal, precious and base metals, diamonds and timber. The total net

expense ratio of RSX is 0.69%, well below those of mutual funds

focused on Russia. "As Russia continues to grow and mature, it will

likely assume an increasingly important role in the global economy,

and exposure to the country's markets will be of growing interest

to U.S. investors," said Jan van Eck, Principal at Van Eck Global.

"As the first ETF listed in the U.S. to target Russia, we believe

that RSX will appeal to anyone looking for a convenient means to

access the market." For nearly a decade after the collapse of the

Soviet Union in 1991, investment in Russia was hampered by

political instability and economic uncertainty. Since 2001,

however, significantly greater political stability and the global

commodities boom have combined to help Russian companies produce

strong returns. As a result, the DAXglobal(R) Russia+ Index

returned approximately 152.52 percent and 580.90 percent over

three- and five-years, respectively* and have a combined market

capitalization of approximately $762.45 billion.* "The DAXglobal(R)

Russia+ Index was created to capture the strengths of the Russian

economy," said Angelika Weinfurtner of the Deutsche Borse AG. "We

look forward to working with Van Eck to bring the index before a

wider audience through the introduction of the Market

Vectors-Russia ETF." Founded in 1955, Van Eck Global was among the

first U.S. money managers helping investors achieve greater

diversification through global investing. As of February 28, 2007,

the company managed over $4.8 billion in assets for individuals,

insurers and institutional investors. RSX is the fourth ETF

introduced under Van Eck's Market Vectors brand and its first to

track international equities. It follows 2006 introductions of

three Market Vectors ETFs: Environmental Services (AMEX:EVX), Gold

Miners (AMEX:GDX) and Steel (AMEX:SLX). Past performance does not

guarantee future results. The returns of DXRPUS or any particular

company do not represent the performance of any ETF. DXRPUS does

not charge any fees, including management fees or brokerage

expenses, and no such fees or expenses were deducted from the

performance described. You cannot invest directly in an index. *All

performance information for DXRPUS covering the period prior to

March 22, 2007 is based on hypothetical, back-tested data. Prior to

March 22, 2007, the Index was not calculated in real time by an

independent calculation agent. Hypothetical back-tested performance

has inherent limitations and is not indicative of future results.

No representation is being made that any investment will achieve

performance similar to that shown. About Deutsche Borse AG Deutsche

Borse Group offers more than a marketplace for trading shares and

other securities. It is a transaction services provider with

advanced technology to afford companies and investors access to

global capital markets. Deutsche Borse has a broader basis than any

of its competitors. Its product and services mix cover the entire

process chain: securities and derivatives trading, transaction

settlement, provision of market information as well as the

development and operation of electronic trading systems. With its

process-oriented business model, Deutsche Borse increases capital

markets efficiency. Issuers benefit from low capital costs and

investors enjoy the advantages of high liquidity and low

transaction costs. The DAXglobal(R) Russia+ Index (DXRPUS) is a

trademark of the Deutsche Borse AG which is licensed for use by Van

Eck Associates Corporation in connection with the Fund. Market

Vectors-Russia ETF is not sponsored or endorsed by the Deutsche

Borse and the Deutsche Borse makes no warranty or representation as

to the accuracy and/or completeness of the Index or the results to

be obtained by any person from the use of the Index in connection

with the trading of the Fund. About Van Eck Global Founded in 1955,

Van Eck Associates Corporation was among the first U.S. money

managers helping investors achieve greater diversification through

global investing. Today, the firm continues its 50+ year tradition

by offering global investment choices in hard assets, emerging

markets, precious metals including gold, and other specialized

asset classes. Van Eck Global's investment products are designed

for investors seeking innovative choices for portfolio

diversification. They are often categorized in asset classes having

returns with low correlations to those of more traditional U.S.

equity and fixed income investments. Investors may call

1.888.MKT.VCTR or visit http://www.vaneck.com/etf for a free

prospectus or for the performance information current to the most

recent month end for each Market Vectors ETF. Investors should

consider the investment objective, risks and charges and expenses

carefully before investing. Each Market Vectors ETF prospectus

contains this and other information. Please read the relevant

prospectus carefully before investing. There are risks associated

with investing including the possible loss of principal.

DATASOURCE: Van Eck Global CONTACT: Mike MacMillan or Andrew Schiff

of MacMillan Communications, +1-212-473-4442, , both for Van Eck

Global Web site: http://www.vaneck.com/etf

Copyright

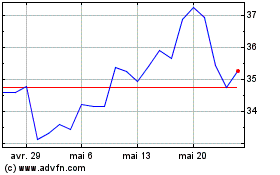

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

VanEck Gold Miners ETF (AMEX:GDX)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025