false

2024-12-30

--12-31

0001847806

0001847806

2024-12-30

2024-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of December, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Genius

Group Limited (the “Company”) is providing the following update with regards to its Bitcoin Treasury strategy and financing

activities and other corporate events.

The

Company has entered into a loan with a commercial lender for $10 million principal amount loan to purchase Bitcoin. The loan has an 18

month term and bears interest at 13.9% per annum, with interest repaid monthly over the 18 month term and the principal payable in full

at the end of the term. The loan is issued with a 50% LTV with top up request at 70% and liquidation at 80%. The loan is secured against

the Company’s current Bitcoin Treasury. 100% of the loan has been utilized to increase the Company’s Bitcoin holdings, from

$20 million to $30 million. The Company may repay the loan early with no penalty.

The

Company has reached a provisional resolution, subject to execution of definitive documentation, with its institutional investor

with relation to the previously disclosed breach of agreement caused by LZGI officers, with whom the Company is currently in arbitration.

The proposed settlement with the investor is to include payment of $500,000 and a full exchange of 1.95 million outstanding

warrants, with 0.5 freely tradable shares exchanged for each 1.0 outstanding warrant in a transaction exempt from registration

under Section 3(a)(9) of the Securities Act of 1933, as amended. The Company intends to pursue the recovery of this settlement cost from

the LZGI officers responsible for the breach.

The

Company does not have any other loan indebtedness on its balance sheet at this time except as disclosed above.

CYBERSECURITY

Information

Security Program

The

mission of our information security organization is to design, implement, and maintain an information security program that protects

our systems, services, and data against unauthorized access, disclosure, modification, damage, and loss. The information security organization

is comprised of internal and external security and technology professionals. We continue to make investments in information security

resources to mature, expand, and adapt our capabilities to address emerging cybersecurity risks and threats. The information security

organization is overseen by the Information Security Advisory Team, further detailed under the caption “Cybersecurity Governance”

below.

Cybersecurity

Risk Management and Strategy

Cybersecurity

risk management is one component of our information security program that guides continuous improvement to, and evaluates the confidentiality,

integrity, and availability of our critical systems, data, and operations.

Our

approach to controls and risk management is based on guidance from the National Institute of Standards and Technology (“NIST”)

and the CryptoCurrency Security Standard (“CCSS”). This does not mean that we meet any particular technical standards, specifications,

or requirements, but rather that we use the NIST and CCSS as a guide to help us identify, assess, and manage cybersecurity controls and

risks relevant to our business.

Our

cybersecurity risk management program includes:

●Identifying

cybersecurity risks that could impact our facilities, third-party vendors/partners, operations, critical systems, information, and broader

enterprise IT environment. Risks are informed by threat intelligence, current and historical adversarial activity, and industry specify

threats;

●Performing

a cybersecurity risk assessment to evaluate our readiness if the risks were to materialize; and

●Ensuring

risk is addressed and tracking any necessary remediation through an action plan.

While

we face a number of ongoing cybersecurity risks in connection with our business, such risks have not materially affected us to date,

including our business strategy, results of operations, or financial condition.

Cybersecurity

Governance

Our

Board considers cybersecurity risk as part of its risk oversight function and has delegated the oversight of cybersecurity and other

information technology risks to the Board’s Audit Committee. As part of this oversight, we creating the Information Security Advisory

Team (the “Task Force”). The Task Force will be comprised of senior managers and executives from multiple departments within

the Company, including the IT, finance, legal and operations departments. The Task Force will oversee our information security program

and our strategy, including management’s implementation of cybersecurity risk management.

The

Task Force will meet at least quarterly to discuss matters involving cybersecurity risks.

The

Task Force ultimately will provide information to our Audit Committee regarding its activities, including those related to cybersecurity

risks. The Audit Committee will also receive a briefing and continuing education from a member of the Task Force relating to our cyber

risk management program at least annually. The Task Force will be responsible for notifying the Audit Committee of material cybersecurity

incidents.

Risks

related to our Bitcoin Acquisition Strategy

WE

ARE NOT REGISTERED AS AN INVESTMENT COMPANY UNDER THE INVESTMENT COMPANY ACT OF 1940 AND STOCKHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED

WITH OWNERSHIP OF SHARES IN A REGISTERED INVESTMENT COMPANY NOR THE PROTECTIONS AFFORDED BY COMMODITIES EXCHANGE REGULATIONS.

Our

bitcoin acquisition strategy may expose us to various risks associated with bitcoin

Our

bitcoin acquisition strategy may expose us to various risks associated with bitcoin, including the following:

Bitcoin

is a highly volatile asset. Bitcoin is a highly volatile asset that has traded below $39,000 per bitcoin and above $108,000 per

bitcoin on Coinbase in the 12 months preceding the date of this disclosure. The trading price of bitcoin was significantly lower during

prior periods, and such decline may occur again in the future. Further risk includes requirements to redeem the above mentioned loan

if LTV approaches 50% or less, which could happen if the price of Bitcoin is significantly lower than current levels.

Our

bitcoin acquisition strategy has not been tested. This bitcoin acquisition strategy has not been tested. Although we believe

bitcoin, due to its limited supply, has the potential to serve as a hedge against inflation in the long term, the short-term price of

bitcoin declined in recent periods during which the inflation rate increased. Some investors and other market participants may disagree

with our bitcoin acquisition strategy or actions we undertake to implement it. If bitcoin prices were to decrease or our bitcoin acquisition

strategy otherwise proves unsuccessful, our financial condition, results of operations, and the market price of our common stock would

be materially adversely impacted.

The

broader digital assets industry is subject to counterparty risks, which could adversely impact the adoption rate, price, and use of bitcoin.

A series of recent high-profile bankruptcies, closures, liquidations, regulatory enforcement actions and other events relating

to companies operating in the digital asset industry, the closure or liquidation of certain financial institutions that provided lending

and other services to the digital assets industry, and the filing and subsequent settlement of a civil fraud lawsuit by the New York

Attorney General have highlighted the counterparty risks applicable to owning and transacting in digital assets. Any such bankruptcies,

closures, liquidations, regulatory enforcement actions or other events involving participants in the digital assets industry may negatively

impact the adoption rate, price, and use of bitcoin, limit the availability to us of financing collateralized by bitcoin, or create or

expose additional counterparty risks.

Changes

in the legal and/or accounting treatment of our bitcoin holdings could have significant accounting impacts, including increasing the

volatility of our results.

The

broader digital assets industry, including the technology associated with digital assets, the rate of adoption and development of, and

use cases for, digital assets, market perception of digital assets, and the legal, regulatory, and accounting treatment of digital assets

are constantly developing and changing, and there may be additional risks in the future that are not possible to predict.

We

may use the net proceeds from this offering to purchase bitcoin, the price of which has been, and will likely continue to be, highly

volatile.

We

may use the net proceeds from this offering to purchase bitcoin. Bitcoin is a highly volatile asset In addition, bitcoin does not pay

interest or other returns and so ability to generate a return on investment from the net proceeds from this offering will depend on whether

there is appreciation in the value of bitcoin following our purchases of bitcoin with the net proceeds from this offering. Future fluctuations

in bitcoin trading prices may result in our converting bitcoin purchased with the net proceeds from this offering into cash with a value

substantially below the net proceeds from this offering.

Bitcoin

and other digital assets are novel assets, and are subject to significant legal, commercial, regulatory and technical uncertainty.

Bitcoin

and other digital assets are relatively novel and are subject to significant uncertainty, which could adversely impact their price. The

application of state and federal securities laws and other laws and regulations to digital assets is unclear in certain respects, and

it is possible that regulators in the United States or foreign countries may interpret or apply existing laws and regulations in a manner

that adversely affects the price of bitcoin.

The

U.S. federal government, states, regulatory agencies, and foreign countries may also enact new laws and regulations, or pursue regulatory,

legislative, enforcement or judicial actions, that could materially impact the price of bitcoin or the ability of individuals or institutions

such as us to own or transfer bitcoin. It is not possible to predict whether, or when, any of these developments will lead to Congress

granting additional authorities to the SEC or other regulators, or whether, or when, any other federal, state or foreign legislative

bodies will take any similar actions. It is also not possible to predict the nature of any such additional authorities, how additional

legislation or regulatory oversight might impact the ability of digital asset markets to function or the willingness of financial and

other institutions to continue to provide services to the digital assets industry, nor how any new regulations or changes to existing

regulations might impact the value of digital assets generally and bitcoin specifically. The consequences of increased regulation of

digital assets and digital asset activities could adversely affect the market price of bitcoin and in turn adversely affect the market

price of our common stock.

Moreover,

the risks of engaging in a bitcoin treasury strategy are relatively novel and have created, and could continue to create, complications

due to the lack of experience that third parties have with companies engaging in such a strategy, such as increased costs of director

and officer liability insurance or the potential inability to obtain such coverage on acceptable terms in the future.

The

growth of the digital assets industry in general, and the use and acceptance of bitcoin in particular, may also impact the price of bitcoin

and is subject to a high degree of uncertainty. The pace of worldwide growth in the adoption and use of bitcoin may depend, for instance,

on public familiarity with digital assets, ease of buying, accessing or gaining exposure to bitcoin, institutional demand for bitcoin

as an investment asset, the participation of traditional financial institutions in the digital assets industry, consumer demand for bitcoin

as a means of payment, and the availability and popularity of alternatives to bitcoin. Even if growth in bitcoin adoption occurs in the

near or medium-term, there is no assurance that bitcoin usage will continue to grow over the long-term.

Because

bitcoin has no physical existence beyond the record of transactions on the bitcoin blockchain, a variety of technical factors related

to the bitcoin blockchain could also impact the price of bitcoin. For example, malicious attacks by miners, inadequate mining fees to

incentivize validating of bitcoin transactions, hard “forks” of the bitcoin blockchain into multiple blockchains, and advances

in digital computing, algebraic geometry, and quantum computing could undercut the integrity of the bitcoin blockchain and negatively

affect the price of bitcoin. The liquidity of bitcoin may also be reduced and damage to the public perception of bitcoin may occur, if

financial institutions were to deny or limit banking services to businesses that hold bitcoin, provide bitcoin-related services or accept

bitcoin as payment, which could also decrease the price of bitcoin. Similarly, the open-source nature of the bitcoin blockchain means

the contributors and developers of the bitcoin blockchain are generally not directly compensated for their contributions in maintaining

and developing the blockchain, and any failure to properly monitor and upgrade the bitcoin blockchain could adversely affect the bitcoin

blockchain and negatively affect the price of bitcoin.

Recent

actions by U.S. banking regulators have reduced the ability of bitcoin-related services providers to gain access to banking services

and liquidity of bitcoin may also be impacted to the extent that changes in applicable laws and regulatory requirements negatively impact

the ability of exchanges and trading venues to provide services for bitcoin and other digital assets.

Our

intended bitcoin holdings may be less liquid than our existing cash and cash equivalents and may not be able to serve as a source of

liquidity for us to the same extent as cash and cash equivalents.

Historically,

the bitcoin markets have been characterized by significant volatility in price, limited liquidity and trading volumes compared to sovereign

currencies markets, relative anonymity, a developing regulatory landscape, potential susceptibility to market abuse and manipulation,

compliance and internal control failures at exchanges, and various other risks inherent in its entirely electronic, virtual form and

decentralized network. During times of market instability, we may not be able to sell our bitcoin at favorable prices or at all. For

example, a number of bitcoin trading venues temporarily halted deposits and withdrawals in 2022. As a result, our bitcoin holdings may

not be able to serve as a source of liquidity for us to the same extent as cash and cash equivalents. Further, bitcoin we may hold with

our custodians and transact with our trade execution partners may not enjoy the same protections as are available to cash or securities

deposited with or transacted by institutions subject to regulation by the Federal Deposit Insurance Corporation or the Securities Investor

Protection Corporation. Additionally, we may be unable to enter into term loans or other capital raising transactions collateralized

by our unencumbered bitcoin or otherwise generate funds using our bitcoin holdings, including in particular during times of market instability

or when the price of bitcoin has declined significantly. If we are unable to sell our bitcoin, enter into additional capital raising

transactions using bitcoin as collateral, or otherwise generate funds using our bitcoin holdings, or if we are forced to sell our bitcoin

at a significant loss, in order to meet our working capital requirements, our business and financial condition could be negatively impacted.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

December 30, 2024 |

|

|

| |

By: |

/s/

Roger Hamilton |

| |

Name: |

Roger

Hamilton |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

Exhibit

99.1

Genius

Group increases Bitcoin Treasury by 50%

to

$30 million, reports 1,649% BTC Yield in Q4 2024

SINGAPORE,

December 30, 2024 - Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a

leading AI-powered, Bitcoin-first education group, today announced that it had increased its Bitcoin purchases for its Bitcoin Treasury

by an additional $10 million to 319.4 Bitcoin for $30 million, at an average price of $93,919 per Bitcoin.

The

total purchase of $30 million of Bitcoin has been made within six weeks of the Company’s announcement on November 12 of its “Bitcoin-first”

strategy that it is committing 90% or more of its current and future reserves to be held in Bitcoin, with an initial target of $120 million

in Bitcoin. The milestone to reach 25% of the initial target is ahead of the Company’s target schedule.

Company

adopts BTC Yield as a Bitcoin Treasury KPI

Genius

Group has adopted BTC Yield as a Bitcoin Treasury Key Performance Indicator (KPI) to help assess the performance of its Bitcoin Treasury

strategy in a manner the Company believes is accretive to its shareholders, and to compare its performance to other Bitcoin Standard

companies.

BTC

Yield is a Bitcoin Treasury KPI that represents the percentage change period-to-period of the ratio between the change in the Company’s

bitcoin holdings and the change in its Assumed Diluted Shares Outstanding. The Company believes this KPI can be used to supplement an

investor’s understanding of the extent to which the issuing of additional shares of its common stock to purchase bitcoin is accretive.

The higher the yield, the greater the increase in Bitcoin per share during the period.

Genius

Group achieved a BTC Yield of 1,649% in Q4 2024, from the first day it purchased Bitcoin in November 2024 to the date of this

release on December 30, 2024.

Genius

Group CEO, Roger Hamilton said “It has been less than two months since we launched our Bitcoin Treasury Strategy. We have been

buying Bitcoin consistently and are pleased to be ahead of our internal schedule to reach our initial target of 1,000 Bitcoin in our

treasury. Now, with a focus on BTC Yield KPI, we are considering various investment and finance options that maximize shareholder

value whilst accelerating our progress in building our Bitcoin Treasury.”

The

Company has maximized its BTC Yield in Q4 2024 by funding its purchase of Bitcoin to date through a combination of its reserves,

its ATM and a $10 million Bitcoin loan it has entered into with crypto-backed loan platform, Arch Lending.

As

at December 29, 2024, the Company’s Bitcoin Treasury of 319.4 Bitcoin had a market value of $30.4 million based on the Bitcoin

price of US$95,060 per Bitcoin. The Company’s market cap was $40.6 million based on 63.0 million issued shares and the share price

of $0.64 at market close on December 27, 2024. This gives the company a BTC / Price ratio of 75%, with the ratio calculated by dividing

the market value of the Company’s Bitcoin Treasury by its market cap. This ratio is an additional Bitcoin Treasury KPI that can

give management and Investors an indication of the degree to which the Company’s market cap is below or above the value of its

Bitcoin Treasury.

Genius

Group CFO, Gaurav Dama said “Whilst we are pleased to be achieving a high BTC Yield, we believe our Bitcoin performance is not

yet reflected in our share price. This is indicated by Genius Group having a high BTC / Price ratio of 75%, which we believe is significantly

higher than our industry peers.”

“In

addition, we reported a 177% growth in our net asset value to $54.6 million in our recently released unaudited financials for the first

half of 2024, which is higher than our current market cap of $40.6 million. We are committed to an ongoing strengthening of our balance

sheet and, in order to keep our investors informed of our progress, we plan to report our Bitcoin Treasury performance together with

our operating financials more frequently in 2025.”

Important

Information about BTC Yield

BTC

Yield represents the percentage change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Fully

Diluted Shares Outstanding. Assumed Fully Diluted Shares Outstanding refers to the aggregate of the Company’s actual shares

of common stock outstanding as of the end of each period plus all additional shares that would result from the assumed conversion of

all outstanding convertible notes, exercise of all outstanding warrants, and settlement of all outstanding restricted stock units and

performance stock units. Assumed Fully Diluted Shares Outstanding is not calculated using the treasury method and does not take into

account any vesting conditions (in the case of equity awards), the exercise price of any warrants or any contractual conditions limiting

convertibility of convertible debt instruments.

Genius

Group uses BTC Yield as a KPI to help assess the performance of its bitcoin acquisition strategy and whether the Company is using equity

capital in a manner the Company believes is accretive to shareholders as it pertains to its bitcoin holdings. The Company believes this

KPI can be used to supplement an investor’s understanding of its decision to fund the purchase of bitcoin by issuing additional

shares of its common stock or instruments convertible to common stock. When the Company uses this KPI, management also takes into account

the various limitations of this metric, including that it does not take into account debt and other liabilities and claims on company

assets that would be senior to common equity and that it assumes that all indebtedness will be refinanced or, in the case of the Company’s

senior convertible debt instruments, converted into shares of common stock in accordance with their respective terms.

Additionally,

this KPI is not, and should not be understood as, an operating performance measure or a financial or liquidity measure. In particular,

BTC Yield is not equivalent to “yield” in the traditional financial context. It is not a measure of the return on investment

the Company’s shareholders may have achieved historically or can achieve in the future by purchasing stock of the Company, or a

measure of income generated by the Company’s operations or its bitcoin holdings, return on investment on its bitcoin holdings,

or any other similar financial measure of the performance of its business or assets.

The

trading price of the Company’s common stock is informed by numerous factors in addition to the amount of bitcoins the Company holds

and number of actual or potential shares of its stock outstanding, and as a result, the market value of the Company’s shares may

trade at a discount or a premium relative to the market value of the bitcoin the Company holds, and BTC Yield is not indicative nor predictive

of the trading price of the Company’s shares of common stock. In calculating this KPI, the Company does not take into account the

source of capital used for the acquisition of its bitcoin. Accordingly, this metric might overstate or understate the accretive nature

of the Company’s use of equity or equity-linked capital to buy bitcoin.

The

Company determines its KPI targets based on its historical and future goals. The Company’s ability to achieve positive BTC Yield

may depend on a variety of factors, including its ability to generate cash from operations in excess of its fixed charges and other expenses,

as well as factors outside of its control, such as the availability of debt and equity financing on favorable terms. Past performance

is not indicative of future results. Investors should rely on the financial statements and other disclosures contained in the Company’s

SEC filings. This KPI is merely a supplement to, not a substitute for, such information. Investors should exercise caution when assessing

our BTC Yield given its limited purpose and many limitations.

About

Genius Group

Genius

Group (NYSE: GNS) is a Bitcoin-first business delivering AI powered, education and acceleration solutions for the future of work. Genius

Group serves 5.4 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI

tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at

the individual, enterprise and government level. To learn more, please visit www.geniusgroup.net.

For

more information, please visit https://www.geniusgroup.net/

Forward-Looking

Statements

Statements

made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,”

“will”, “plan,” “should,” “expect,” “anticipate,” “estimate,”

“continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and

uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve

factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue

reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors

under the heading “Risk Factors” in the Company’s Annual Reports on Form 20-F, as may be supplemented or amended by

the Company’s Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking

statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should

be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

Contacts

MZ

Group - MZ North America

(949)

259-4987

GNS@mzgroup.us

www.mzgroup.us

Exhibit

99.2

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.4

Material Cybersecurity Incident Disclosure

|

Dec. 30, 2024 |

| Material Cybersecurity Incident [Abstract] |

|

| Material Cybersecurity Incident Nature [Text Block] |

Cybersecurity

risk management is one component of our information security program that guides continuous improvement to, and evaluates the confidentiality,

integrity, and availability of our critical systems, data, and operations. Our

approach to controls and risk management is based on guidance from the National Institute of Standards and Technology (“NIST”)

and the CryptoCurrency Security Standard (“CCSS”). This does not mean that we meet any particular technical standards, specifications,

or requirements, but rather that we use the NIST and CCSS as a guide to help us identify, assess, and manage cybersecurity controls and

risks relevant to our business.

|

| Material Cybersecurity Incident Scope [Text Block] |

Identifying

cybersecurity risks that could impact our facilities, third-party vendors/partners, operations, critical systems, information, and broader

enterprise IT environment. Risks are informed by threat intelligence, current and historical adversarial activity, and industry specify

threats;Performing

a cybersecurity risk assessment to evaluate our readiness if the risks were to materialize; andEnsuring

risk is addressed and tracking any necessary remediation through an action plan.

|

| Material Cybersecurity Incident Information Not Available or Undetermined [Text Block] |

While

we face a number of ongoing cybersecurity risks in connection with our business, such risks have not materially affected us to date,

including our business strategy, results of operations, or financial condition.

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 8-K

-Section 1.05

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 6-K

-Section General Instruction

-Subsection B

| Name: |

cyd_MaterialCybersecurityIncidentAbstract |

| Namespace Prefix: |

cyd_ |

| Data Type: |

i:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 8-K

-Section 1.05

-Subsection Instruction

-Paragraph 2

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 6-K

-Section General Instruction

-Subsection B

| Name: |

cyd_MaterialCybersecurityIncidentInformationNotAvailableOrUndeterminedTextBlock |

| Namespace Prefix: |

cyd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 8-K

-Section 1.05

-Subsection a

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 6-K

-Section General Instruction

-Subsection B

| Name: |

cyd_MaterialCybersecurityIncidentNatureTextBlock |

| Namespace Prefix: |

cyd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 8-K

-Section 1.05

-Subsection a

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 6-K

-Section General Instruction

-Subsection B

| Name: |

cyd_MaterialCybersecurityIncidentScopeTextBlock |

| Namespace Prefix: |

cyd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

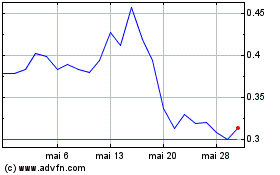

Genius (AMEX:GNS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Genius (AMEX:GNS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025