UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)

Ivanhoe Electric Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

46578C108

(CUSIP Number)

Avner Bengera

Baker Botts L.L.P.

30 Rockefeller Plaza

New York, New York 10112

(212) 408-2500

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 23, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨

Note. Schedules filed in

paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties

to whom copies are to be sent.

*The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the

remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes)

| |

|

CUSIP

No. 46578C108 |

| |

1. |

Names of Reporting

Person

Saudi Arabian Mining Company (Ma’aden) |

| |

2. |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

3. |

SEC

Use Only |

| |

4. |

Source of Funds

(See Instructions)

WC |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| |

6. |

Citizenship

or Place of Organization

Kingdom of Saudi Arabia |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole

Voting Power

10,269,604* |

| 8. |

Shared Voting Power

N/A |

| 9. |

Sole Dispositive Power

10,269,604* |

| 10. |

Shared Dispositive Power

N/A |

| |

11. |

Aggregate Amount

Beneficially Owned by the Reporting Person

10,269,604* |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented

by Amount in Row (11)

8.7%* |

| |

14. |

Type of Reporting Person (See

Instructions)

CO |

* Percentage

is based on 117,524,115 outstanding Shares (as defined below), as set forth in the representations and warranties made by the Issuer for

the benefit of the Reporting Person in the Top-Up Subscription Agreement (as defined below) (the outstanding Shares based on the

foregoing, the “Outstanding Shares”). Following and conditional upon the Reporting

Person’s acquisition of 1,513,650 Shares as described in Item 4 below, the Reporting

Person will own 11,783,254 Shares, representing approximately 9.9% of the sum of the Outstanding Shares plus 1,513,650 Shares.

The following constitutes Amendment No. 2

(“Amendment No. 2”) to the Schedule 13D originally filed on July 17, 2023 (the “Schedule 13D”), as amended

by Amendment No. 1 filed on October 16, 2023 (the Schedule 13D as so amended, the “Amended Schedule 13D”) with the Securities

and Exchange Commission by Saudi Arabian Mining Company (Ma’aden) (the “Reporting Person”) with respect to shares of

common stock, par value $0.0001 per share (the “Shares”), of Ivanhoe

Electric Inc., a Delaware corporation (the “Issuer”). This Amendment No. 2 amends the Amended Schedule 13D as

specifically set forth herein. Other than as set forth below, the Amended Schedule 13D is unmodified. Capitalized terms not defined herein

have the meanings given to such terms in the Amended Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of the Amended Schedule 13D is hereby amended

to add the following:

On October 23, 2023, the Reporting Person and

the Issuer entered into a Top-Up Subscription Agreement (the “Top-up Subscription Agreement”), pursuant to which, subject

to the satisfaction of the conditions set forth therein, the Issuer shall issue and sell to the Reporting Person, and the Reporting Person

shall purchase from the Issuer, 1,513,650 Shares at a price of $13.50 per Share. Pursuant to the Top-Up Subscription Agreement, the closing

of the sale and purchase contemplated by the Top-Up Subscription Agreement shall occur on October 31, 2023, subject to the satisfaction

of the conditions set forth therein.

The foregoing description of the Subscription

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Subscription Agreement,

which is incorporated herein by reference to Exhibit 2 to this Amendment No. 2.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

The information contained

in Item 4 of this Amendment No. 2 is incorporated by reference.

Item 7. Material to Be Filed as Exhibits.

Item 7 of the Amended

Schedule 13D is hereby amended to add the following:

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 23, 2023

| |

SAUDI ARABIAN MINING COMPANY

(MA’ADEN) |

| |

|

| |

By: |

/s/ Louis Irvine |

| |

|

Name: |

Louis Irvine |

| |

|

Title: |

Executive Vice President, Finance and Chief Financial Officer |

Exhibit 2

TOP-UP SUBSCRIPTION

AGREEMENT

This

Top-Up Subscription Agreement, dated as of October 23, 2023 (this “Agreement”), is between IVANHOE ELECTRIC

INC., a Delaware corporation (the “Company”), and SAUDI ARABIAN MINING COMPANY (MA’ADEN), a joint stock company

existing under the laws of the Kingdom of Saudi Arabia (the “Purchaser”).

WHEREAS,

(i) the Company and the Purchaser are parties to the Common Stock Subscription Agreement, dated as of May 15, 2023 (the “Initial

Subscription Agreement”), and (ii) the Company and the Purchaser are parties to the Investor Rights Agreement, dated as of July

6, 2023, as amended from time to time (the “Investor Rights Agreement”).

WHEREAS,

pursuant to Article III (Top-Up Right) of the Investor Rights Agreement, the Company desires to issue and sell to the Purchaser,

and the Purchaser desires to purchase from the Company, Common Shares in accordance with the provisions of the Investor Rights Agreement

and this Agreement.

NOW

THEREFORE, in consideration of the respective representations, warranties, covenants and agreements set forth herein and for good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and the Purchaser hereby agree as follows:

1. Subject

to the terms of this Agreement, on October 31, 2023 (the “Closing Date”) the Company shall issue and sell to the Purchaser,

and the Purchaser shall purchase from the Company, 1,513,650 Common Shares (the “Purchased Shares”), and the Purchaser

shall pay to the Company the purchase price in the amount of $13.50 per Common Share and in the aggregate amount of $20,434,275 (the “Aggregate

Purchase Price”) (the consummation of such purchase and sale, the “Closing”).

2. Closing

and the obligation of the Purchaser to consummate the purchase of the Purchased Shares shall be subject to the satisfaction on or prior

to the Closing Date of each of the following conditions (any or all of which may be waived by the Purchaser in writing with respect to

the Purchased Shares, in whole or in part, to the extent permitted by applicable law):

(a) the

representations and warranties made in this Agreement by the Company that are qualified by materiality or Material Adverse Effect and

the representation and warranty made by the Company in paragraph 5(a) shall be true and correct when made and as of the Closing Date,

and all other representations and warranties of the Company shall be true and correct in all material respects when made and as of the

Closing Date (except that representations and warranties of the Company made as of a specific date shall be required to be true and correct

as of such date only);

(b) the

completion of the Company’s underwritten offering (the “Offering”) of 13,629,629 Common Shares pursuant to the

underwriting agreement by and among the Company and BMO Capital Markets Corp. and J.P. Morgan Securities LLC, as representatives of the

several underwriters, dated September 14, 2023, shall have occurred before or concurrently with the Closing;

(c) since

the date of this Agreement, there shall not have occurred a Material Adverse Effect (as defined in the Initial Subscription Agreement);

(d) the

Purchased Shares shall be approved for listing on the NYSE American and conditionally approved for listing on the TSX prior to the Closing,

subject to official notice of issuance in respect of the NYSE American and subject to compliance with all of the customary requirements

of the TSX, including receipt of all documentation required by the TSX; and

(e) the

Company shall have delivered, or caused to be delivered, to the Purchaser at the Closing, the Company’s closing deliveries described

in paragraph 4(b).

3. Closing

and the obligation of the Company to consummate the issuance and sale of the Purchased Shares to the Purchaser shall be subject to the

satisfaction on or prior to the Closing Date of each of the following conditions with respect to the Purchaser (any or all of which may

be waived by the Company in writing with respect to any Purchased Shares, in whole or in part, to the extent permitted by applicable law):

(a) the

representations and warranties of the Purchaser contained in this Agreement that are qualified by materiality shall be true and correct

when made and as of the Closing Date and all other representations and warranties of the Purchaser shall be true and correct in all material

respects as of the Closing Date (except that representations and warranties of the Purchaser made as of a specific date shall be required

to be true and correct as of such date only);

(b) the

completion of the Offering shall have occurred before or concurrently with the Closing; and

(c) the

Purchaser shall have delivered, or caused to be delivered, to the Company at the Closing the Purchaser’s closing deliveries described

in paragraph 4(a).

4. On

the Closing Date:

(a) the

Purchaser shall deliver to the Company evidence of payment of the Aggregate Purchase Price in immediately available funds to the following

bank account of the Company:

[redacted]

(b) the

Company shall deliver to the Purchaser evidence of issuance of the Purchased Shares credited to book-entry accounts maintained by the

Company’s transfer agent, bearing the legend or restrictive notation set forth below, free and clear of any liens, encumbrances

and defects, other than transfer restrictions under applicable federal and state securities laws or under the Investor Rights Agreement.

Subject to Section 5.6 of the Investor Rights Agreement, the book-entry account maintained by the transfer agent evidencing ownership

of the Purchased Shares will bear the following legend or restrictive notation:

“THE SECURITIES EVIDENCED HEREBY HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION,

AND MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES

ACT OR (2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE STATE

SECURITIES LAWS AND THE SECURITIES LAWS OF OTHER JURISDICTIONS, AND IN THE CASE OF A TRANSACTION EXEMPT FROM REGISTRATION, UNLESS THE

COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSACTION DOES NOT REQUIRE REGISTRATION UNDER THE

SECURITIES ACT AND SUCH OTHER APPLICABLE LAWS. HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE

WITH THE SECURITIES ACT.

THE SECURITIES EVIDENCED HEREBY ARE SUBJECT TO RESTRICTIONS

ON TRANSFER AND CERTAIN OTHER AGREEMENTS, SET FORTH IN THE INVESTOR RIGHTS AGREEMENT, DATED AS OF JULY 6, 2023, BY AND AMONG IVANHOE ELECTRIC

INC. AND SAUDI ARABIAN MINING COMPANY (MA’ADEN).”

5. The

Company represents and warrants to the Purchaser as follows:

(a) Capitalization.

The authorized capital stock of the Company consists of 750,000,000 shares, $0.0001 par value, of which 700,000,000 are Common Stock and

50,000,000 are preferred stock. As of the close of business on the date of this Agreement, there were 117,524,115 shares of Common Stock

and no shares of preferred stock outstanding. The Purchased Shares will be duly authorized, validly issued, fully paid and non-assessable,

and will be issued and sold in compliance with all federal and state securities laws.

(b) Initial

Subscription Agreement Representations and Warranties. Except for the representations and warranties set forth in Section 3.02 of

the Initial Subscription Agreement, which are superseded by Section 5(a) above, the representations and warranties of the Company in Article

III (Representations and Warranties of the Company) of the Initial Subscription Agreement are true and correct on and as of the

date hereof, except for those representations and warranties that speak solely as of a specific date and which were true and correct as

of such date, with the same force and effect as if expressly made on and as of the date hereof.

6. The

Purchaser represents and warrants to the Company as follows:

(a) Except

for the representations and warranties set forth in Section 4.13 of the Initial Subscription Agreement, which are superseded by Section

4(b) above, all representations and warranties set forth in Article IV (Representations and Warranties

of the Purchaser) of the Initial Subscription Agreement are true and correct on and as of the date hereof, except for those

representations and warranties that speak solely as of a specific date and which were true and correct as of such date, with the same

force and effect as if expressly made on and as of the date hereof.

(b) (i)

It is not purchasing the Purchased Shares for the account or benefit of a “U.S. person” (as defined in Regulation S promulgated

under the U.S. Securities Act (“Regulation S”)), and (ii) it will not engage in hedging transactions with respect to

the Purchased Shares except in compliance with the U.S. Securities Act.

7. The

Purchaser understands the Company will refuse to register any transfer of the Purchased Shares unless made in accordance with Regulation

S, registration under the U.S. Securities Act or an available exemption from such registration requirements.

8. The

provisions of Article V (Covenants), Article VI (Indemnification) and Article VII (Miscellaneous) of the Initial

Subscription Agreement are hereby incorporated by reference mutatis mutandis as if set out in full herein.

9. Capitalized

terms used herein (including in the Recitals) and not otherwise defined herein shall have the meaning ascribed to them in the Investor

Rights Agreement.

10. Whenever

a provision or a defined term of the Initial Subscription Agreement is incorporated by reference herein (including, without limitation,

the references herein to Articles III and IV of the Initial Subscription Agreement), references in the provisions and defined terms so

incorporated: (a) to the “Purchased Shares” shall be to the Purchased Shares hereunder; (b) to the “Common Stock”

shall be to the Common Stock, as defined hereunder; (c) to “this Agreement” shall be to this Agreement; (d) to the “Operative

Documents” shall include this Agreement; (e) to the “Closing” shall be to the Closing hereunder; (e) to the “Closing

Date” shall be to the Closing Date hereunder; (f) solely in Section 3.09 (Undisclosed Liabilities) of the Initial Subscription

Agreement, to “December 31, 2022” and “the Company’s annual report on Form 10-K for the year ended December 31,

2022” shall be to the date as of which the Company has filed its most recent annual report on Form 10-K or quarterly report on Form

10-Q, and to such annual report or quarterly report, respectively; (g) to the “Purchaser” shall be to the Purchaser hereunder;

and (h) to a “party” shall be to a party to this Agreement, and all terms defined with reference to the foregoing terms shall

be construed accordingly.

[Signature pages follow]

IN

WITNESS WHEREOF, the parties hereto execute this Agreement, effective as of the date first above written.

| |

IVANHOE ELECTRIC INC.: |

| |

|

| |

By: |

/s/ Taylor Melvin |

| |

Name: |

Taylor Melvin |

| |

Title: |

President and Chief Executive Officer |

IN

WITNESS WHEREOF, the parties hereto execute this Agreement, effective as of the date first above written.

| |

SAUDI ARABIAN MINING COMPANY (MA’ADEN): |

| |

|

| |

By: |

/s/ Robert Wilt |

| |

Name: |

Robert Wilt |

| |

Title: |

CEO |

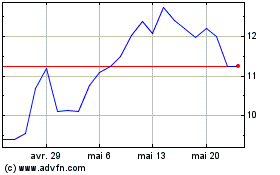

Ivanhoe Electric (AMEX:IE)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Ivanhoe Electric (AMEX:IE)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024