UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2023

| | IGC PHARMA, INC. (Exact name of registrant as specified in charter) | |

| | | |

| Maryland | 001-32830 | 20-2760393 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| | 10024 Falls Road, Potomac, Maryland 20859 (Address of principal executive offices) (Zip Code) | |

| | | |

| | (301) 983-0998 (Registrant’s telephone number, including area code) | |

India Globalization Capital, Inc.

4336 Montgomery Ave., Bethesda, MD 20814

(Former Name or Former Address, if Changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.0001 par value | IGC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement |

Master Loan and Security Agreement

On June 30, 2023, (the “Effective Date”), IGC Pharma, Inc. (“IGC” or “Borrower”) entered into a Master Loan and Security Agreement along with the General Banking Facility Letter (collectively called the “Loan Agreement”) with O-Bank, CO., LTD., a banking corporation incorporated under the laws of Taiwan, as administrative agent and lender (the “Lender’) pursuant to which the Borrower may borrow up to USD$12,000,000.00 only or the equivalent thereof in other major currencies (the “Credit Facility”). Funds available under the Loan Agreement are being used for working capital needs and general corporate purposes as IGC deems necessary and appropriate. At the closing, the Borrower paid Lender a facility fee of USD$120,000.00.

The Credit Facility under the Loan Agreement matures on the first anniversary of the Effective Date. Borrowings under the Loan Agreement will bear interest, calculated according to the interest rate mentioned in the Certificate of Deposit, as the case may be, plus an applicable margin of 1%, and the Borrower shall bear the tax. Interest is due and payable in full by the Borrower on the last business day of each interest period.

The Loan Agreement contains covenants that are usual for this type of facility and contains customary events of default. Upon the occurrence of an event of default, the Lender shall require the immediate payment of all amounts outstanding.

The foregoing summary of the Loan Agreement is qualified in its entirety by reference to the full text of the Loan Agreement, a copy of which is filed hereto as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

* Certain schedules or similar attachments to this exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K.

The registrant hereby agrees to furnish supplementally to the Securities and Exchange Commission upon request a copy of any omitted schedule or attachment to this exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IGC Pharma, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: July 7, 2023

|

By:

|

/s/ Ram Mukunda

|

|

|

|

|

Name: Ram Mukunda

|

|

|

|

|

Title: CEO

|

|

false

0001326205

0001326205

2023-06-30

2023-06-30

Exhibit 10.1

Exhibit 99.1

PRESS RELEASE ISSUED ON JULY 7, 2023

IGC Pharma Secures $12 Million Line of Credit from O-Bank

Strengthening Efforts in Alzheimer's Research

POTOMAC, MD July 7, 2023 – IGC Pharma, Inc. (NYSE American: IGC) (“IGC” or the “Company”), a clinical-stage pharmaceutical company, has secured a $12 million revolving line of credit from the Hong Kong Branch of O-Bank Co., Ltd. (“O-Bank” or the “Bank”). This funding will support IGC’s working capital needs primarily related to its Alzheimer’s research.

Under the terms for the line of credit, IGC can draw up to $1 million within a 30-day period. The interest rate for a draw is 1% plus the rate paid on certificates of deposits. The facility has an initial duration of 12 months, with the potential for a 12-month extension subject to Bank approval. The Bank received $120,000 as a fee from IGC for providing the 12-month facility. Bradbury Asset Management (Hong Kong) Limited (“Bradbury”), a Hong Kong headquartered financial institution with approximately $2 billion in assets under management, has collateralized cash assets in support of the line of credit. This follows the recently announced investment of $3 million in IGC led by four investment funds managed by Bradbury through a private placement, of unregistered shares with no warrants or other derivatives, highlighting their continued support for the Company.

IGC Pharma’s research and development efforts are focused on Alzheimer’s disease, with three molecules in various stages of development. Notably, IGC-AD1 is currently in Phase 2 of clinical trials as a potential treatment for agitation in dementia due to Alzheimer’s. According to Alzheimer’s Disease International, the number of people living with Alzheimer’s and other dementias is projected to nearly triple by 2050, with approximately 76% experiencing neuropsychiatric symptoms like agitation. Out of the targeted 146 patients for the Phase-2 trial, 16 individuals have already completed the trial. IGC Pharma has secured contracts with eight trial sites, with negotiations underway at seven additional sites. The Company expects that 13-15 trial sites can enroll between 15 to 20 patients per month, allowing the Company to target completion of its Phase-2 trial in the first quarter of calendar 2024.

Keith Loo See Yuen, Group CEO of Bradbury, expressed his firm's enthusiastic commitment to IGC's endeavors, stating, "We wholeheartedly endorse IGC's relentless pursuit of developing groundbreaking therapies for Alzheimer's disease. Our investment is a testament to our faith in IGC's mission and a strategic bet on a company that we believe holds the potential to redefine the Alzheimer’s landscape. We envision IGC as a trailblazer in this challenging field, creating significant value for its investors, and most importantly, bringing much-needed hope and relief to millions of patients and families worldwide."

Ram Mukunda, CEO of IGC Pharma, expressed gratitude for the line of credit provided by O-Bank and the continued support from Bradbury. He emphasized the Company's ongoing research and development initiatives, particularly with the promising drug candidate, IGC-AD1. Mukunda stated, “We are thankful to O-Bank for their support, and grateful for the continued support from Bradbury. Together, with our dedicated investors and partners, we are working towards our goal of developing innovative therapies for Alzheimer's disease. With their support, we are focused on advancing IGC-AD1 and bringing hope and relief to millions of patients and families worldwide."

About IGC Pharma, Inc.

IGC Pharma, Inc., (dba IGC) develops advanced cannabinoid-based formulations for treating diseases and conditions, including, but not limited to, Alzheimer’s disease, period cramps (“dysmenorrhea”), premenstrual syndrome (“PMS”), and chronic pain. IGC has two investigational drug assets targeting Alzheimer’s disease, IGC-AD1 and TGR-63, which have demonstrated in Alzheimer’s cell lines the potential to be effective in suppressing or ameliorating key hallmarks of Alzheimer’s disease, such as plaques or tangles. IGC-AD1 is a low-dose tetrahydrocannabinol (“THC”) based formulation that is currently in a 146-person Phase 2 clinical trial for agitation in dementia due to Alzheimer’s (clinicaltrials.gov, NCT05543681). IGC Pharma, Inc., also markets a wellness brand, Holief™, that targets women experiencing premenstrual syndrome and menstrual cramps.

About Bradbury Asset Management (Hong Kong) Limited

Bradbury Group, a group of companies which include Bradbury Asset Management (Hong Kong) Limited with headquarters in Hong Kong, is a comprehensive financial institution consisting of several licensed professional entities that specialize in offering international securities brokerage, asset management, investment funds & advisory, and wealth management services to sophisticated and institutional investors globally. Bradbury Asset Management (Hong Kong) Limited manages 21 Funds with a combined asset under management in excess of $2 billion. Its investment portfolio spans across green energy, real estate, biotechnology, AI technology, Fintech and e-commerce. Bradbury’s website is: https://www.bradburyfund.com.

Forward-looking Statements

This press release contains forward-looking statements. These forward-looking statements are based largely on IGC’s expectations and are subject to several risks and uncertainties, certain of which are beyond IGC’s control. Actual results could differ materially from these forward-looking statements as a result of, among other factors, the Company’s failure or inability to commercialize one or more of the Company’s products or technologies, including the products or formulations described in this release, or failure to obtain regulatory approval for the products or formulations, where required; general economic conditions that are less favorable than expected, including as a result of the ongoing COVID-19 pandemic; the FDA’s general position regarding cannabis- and hemp-based products; and other factors, many of which are discussed in IGC’s U.S. Securities and Exchange Commission (“SEC”) filings. IGC incorporates by reference the human trial disclosures and Risk Factors identified in its Annual Report on Form 10-K filed with the SEC on June 23, 2022, as if fully incorporated and restated herein. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained in this release will occur.

Contact:

Investors

IMS Investor Relations

Walter Frank

igc@imsinvestorrelations.com

(203) 972-9200

v3.23.2

Document And Entity Information

|

Jun. 30, 2023 |

| Document Information Line Items |

|

| Entity Registrant Name |

IGC PHARMA, INC.

|

| Trading Symbol |

IGC

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001326205

|

| Document Period End Date |

Jun. 30, 2023

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-32830

|

| Entity Tax Identification Number |

20-2760393

|

| Entity Address, Address Line One |

10024 Falls Road

|

| Entity Address, City or Town |

Potomac

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20859

|

| City Area Code |

(301)

|

| Local Phone Number |

983-0998

|

| Entity Information, Former Legal or Registered Name |

India Globalization Capital, Inc.

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.0001 par value

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

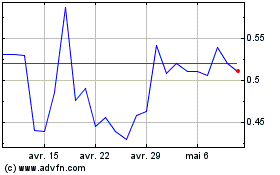

IGC Pharma (AMEX:IGC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

IGC Pharma (AMEX:IGC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024