|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To the Prospectus effective January 8, 2024)

|

Registration No. 333-276330

|

Up to $5,309,602

IGC Pharma, Inc.

Common Stock

We have entered into an At-the-Market (ATM) Sales Agreement (the “Sales Agreement”) with A.G.P./Alliance Global Partners (“A.G.P.” or the “Sales Agent”) relating to shares of our common stock, par value $0.0001 per share. Under the Sales Agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $60,000,000 from time to time through the Sales Agent as our sales agent. Under the terms of the Sales Agreement, we may also sell shares to the Sales Agent as principal for its own account.

By means of this prospectus supplement, we are offering $5,309,602 of common stock pursuant to General Instruction I.B.6 of Form S-3. As of January 24, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was approximately $15,928,807, which was calculated based on approximately 49,777,522 shares of outstanding common stock held by non-affiliates and on a price per share of $0.32, the highest closing price of our common stock in the past 60 days or on January 24, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period (or $5,309,602) so long as our public float remains below $75,000,000. As of January 24, 2024, pursuant to General Instruction I.B.6 of Form S-3 and during the 12-calendar months prior to and including the date of this prospectus supplement, we have not sold any shares of our common stock in connection with this “At-the-Market” financing facility.

The Sales Agent is not required to sell any specific number or dollar amount of shares of our common stock but will use its commercially reasonable efforts, as our agent and subject to the terms of the Sales Agreement, to sell the shares offered by this prospectus supplement and the accompanying prospectus. Sales of the shares, if any, may be made by any means permitted by law and deemed to be an “at the market” offering as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the NYSE American, at market prices, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices, or any other method permitted by law. The price per share will be at prevailing market prices when we have an order to sell our shares in effect. An order to sell our shares may contain a minimum sales price and a maximum number of shares to be sold under the order.

The Sales Agent will be entitled to compensation at a fixed commission rate of 3% of the gross sales price per share sold. We have also agreed to reimburse certain expenses of the Sales Agent in connection with the Sales Agreement. The net proceeds to us that we receive from sales of our common stock will depend on the number of shares actually sold and the offering price for such shares. The actual proceeds to us will vary. In connection with the sale of shares of our common stock on our behalf, the Sales Agent may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of the Sales Agent may be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Sales Agent against certain liabilities, including liabilities under the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See “Plan of Distribution” beginning on page S-12 for more information regarding the Sales Agent’s compensation and expenses.

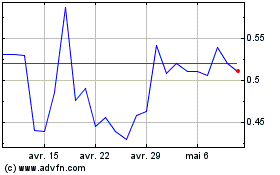

Our shares of common stock trade on the NYSE American under the symbol IGC. On January 24, 2024, the last reported sale price of our common stock, as reported on the NYSE American, was $0.28 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement, the documents incorporated by reference herein, and future filings.

Investing in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risk factors described in “Risk Factors” in this prospectus supplement beginning on page S-7, in the accompanying prospectus and in other documents incorporated by reference, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 filed with the U.S. Securities and Exchange Commission (“SEC”) on July 7, 2023, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 filed with the SEC on August 10, 2023, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC on November 9, 2023, and other documents that we subsequently file with the SEC that update, supplement or supersede such information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We urge you to carefully read this prospectus supplement and the accompanying prospectus which describe the terms of the offering before you make your investment decision.

Sales Agent

A.G.P.

The date of this prospectus supplement is January 31, 2024

IGC Pharma, Inc.

Table of Contents

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

Unless otherwise stated or the context otherwise requires, references in this prospectus supplement or the accompanying prospectus to “IGC,” “we,” “our,” “us” or similar references are to IGC Pharma, Inc. and its consolidated subsidiaries.

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and other matters relating to us. The second part is the accompanying prospectus, which gives more general information about the securities we may offer from time to time, some of which may not apply to this offering. This prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement that we filed with the SEC using the SEC’s shelf registration rules.

You should read both this prospectus supplement and the accompanying prospectus together with additional information described in this prospectus supplement in the section titled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. Any statement made in this prospectus supplement, in the accompanying prospectus, or in any document incorporated or deemed to be incorporated by reference in this prospectus supplement or the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference in this prospectus supplement or the accompanying prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

The industry and market data and other statistical information contained in this prospectus supplement, accompanying prospectus, and the documents we incorporate by reference in this prospectus supplement and the accompanying prospectus are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information.

The information in this prospectus supplement is accurate as of the date on the front cover. You should not assume that the information contained in this prospectus supplement or in the accompanying prospectus is accurate as of any date other than the date on the front of the applicable document or that information incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects, or other important facts or circumstances may have changed since those dates.

In making your investment decision, you should rely only on the information contained in or incorporated by reference in this prospectus supplement and in the accompanying prospectus. Neither we nor the Sales Agent has authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Sales Agent is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. This prospectus supplement and accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus supplement and accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of our securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

We further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties, or covenants were accurate only as of the date when made. Accordingly, such representations, warranties, and covenants should not be relied on as accurately representing the current state of our affairs.

You should assume that the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus or in any free writing prospectus that we may provide to you is accurate only as of the date of those documents regardless of the time of delivery of such documents or the sale of our securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary is provided solely for your convenience. It is not intended to be complete. You should carefully read this entire prospectus supplement, the accompanying prospectus and all the information included or incorporated by reference herein or therein carefully, especially the risks discussed in the section titled “Risk Factors” beginning on page S-7 of this prospectus supplement and the risk factors contained in the accompanying prospectus and the other documents incorporated by reference herein.

About IGC Pharma, Inc.

Business Overview

IGC Pharma is a clinical-stage pharmaceutical company developing novel therapies for Alzheimer’s disease and conditions related to the central nervous system. The company is pursuing five assets: IGC-AD1, TGR-63, LMP, IGC-1C, and IGC-M3, all of which target Alzheimer’s disease and are at various stages of development.

Our most clinically advanced investigational new drug for Alzheimer’s, IGC-AD1, has shown significant promise in preclinical studies. In Alzheimer’s cell lines, IGC-AD1 has demonstrated the potential to effectively suppress or ameliorate two key hallmarks of Alzheimer’s disease: plaques and tangles. In animal models, it has shown effectiveness in improving memory. Furthermore, in a Phase 1 multiple ascending dose (MAD) trial, it exhibited potential efficacy in reducing neuropsychiatric symptoms, including agitation, anxiety, and depression. IGC-AD1 is currently in a Phase 2B, multi-center, randomized, double-blind, placebo-controlled trial, specifically designed to address agitation in dementia from Alzheimer’s disease (clinicaltrials.gov, NCT05543681). This condition affects more than 10 million individuals in North America and Europe. The trial is being conducted at 10 sites in the US and Canada.

Our portfolio includes four other small molecule assets, each at distinct stages of development, all with a singular mission — to transform the landscape of Alzheimer's treatment. LMP targets neuroinflammation, Aβ plaques, and neurofibrillary tangles, TGR-63 targets Aβ plaque, where we seek to disrupt the progression of Alzheimer's disease. IGC-M3 targets the inhibition of Aβ plaque aggregation with the potential to create a profound impact on early-stage Alzheimer’s. IGC-1C targets tau and neurofibrillary tangles, IGC-1C represents a forward-thinking approach to Alzheimer’s therapy.

Furthermore, IGC controls a total of 21 patent filings. IGC maintains a state-of-the-art manufacturing facility in Washington State, which is poised for potential use in a Phase 3 trial and commercialization of IGC-AD1. In Bogota, Colombia, we also operate an R&D laboratory and an internal Contract Research Organization (CRO) that provides clinical trial services. We are actively expanding our technological capabilities with a primary focus on Generative Artificial Intelligence (AI) to enhance various aspects of clinical trial operations and data analysis. Our Company is investing in and driving AI development with an immediate focus on clinical trial processes, and analysis. Our AI initiatives are centered on informing clinical trials, developing a methodology for early detection of Alzheimer’s, and investigating the interaction of pharmaceuticals with cannabinoids.

Collectively, these core assets and initiatives underscore our commitment to advancing the field of pharmaceuticals, delivering groundbreaking treatments, and creating lasting value for our investors. We remain steadfast in our pursuit of excellence and our mission to improve the lives of those affected by Alzheimer’s and related conditions.

Our manufacturing facility is also utilized to produce women’s wellness products under the brand “Holief.” IGC Pharma is a Maryland corporation established in 2005 with a fiscal year ending on March 31, spanning a 52- or 53-week period. The company operates in two primary business segments: Life Sciences and Infrastructure.

Corporate Information

We were incorporated in the State of Maryland on April 29, 2005, under our former name, India Globalization Capital, Inc. Our principal executive offices are located at 10224 Falls Road, Potomac, Maryland 20854 and our telephone number is (301) 983-0998. We maintain several websites, including www.igcinc.us and www.igcpharma.com. Our public filings with the SEC are accessible on the SEC’s website, www.sec.gov.

The information contained on our websites is not incorporated by reference into this prospectus supplement, and you should not consider any information contained on, or that can be accessed through, our websites as part of this prospectus supplement or in deciding whether to purchase our securities.

The Offering

|

Common stock offered:

|

Shares of common stock having an aggregate offering price of up to $5,309,602.

|

|

Common stock to be outstanding immediately after this offering: (1)

|

Up to 82,697,305 shares, assuming the sale of up to 18,962,866 shares under this prospectus at a price of $0.28 per share, the last reported sale price of our common stock on the NYSE American on January 24, 2024, for aggregate gross proceeds of $5,309,602. Actual shares issued will vary depending on the sales prices in this offering.

|

|

Manner of offering:

|

“At-the-market” offering that may be made from time to time through A.G.P./Alliance Global Partners, our Sales Agent, on a commercially reasonable efforts basis. See “Plan of Distribution” on page S-12.

|

|

Use of proceeds:

|

We currently intend to use the net proceeds from this offering to fund our ongoing investments in clinical trials, AI capabilities, research and development, facilities, marketing and advertising, and potential acquisitions of complementary products and businesses as part of our growth strategy, as well as to support our overall working capital and general corporate requirements. For more detail, see “Use of Proceeds” on page S-10.

|

|

NYSE American trading symbol:

|

IGC

|

|

Risk factors:

|

An investment in our common stock involves significant risks. Before making an investment in our common stock, you should carefully review the “Risk Factors” section below and the risk factors stated in the accompanying prospectus, as well as the other documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

(1) The number of shares of common stock to be outstanding immediately after this offering is based on 63,734,439 shares issued and outstanding as of January 24, 2024, and excludes the following as of such date:

| |

●

|

3,934,165 shares of common stock reserved for future issuance pursuant to grants outstanding under the IGC Pharma, Inc. 2018 Omnibus Incentive Plan and special grants approved by our stockholders;

|

| |

●

|

9,147 shares of common stock pursuant to the conversion of 91,472 units that can be separated into common stock based on a ratio of one share of common stock for every ten units;

|

| |

●

|

150,000 shares of common stock reserved for future issuance upon the exercise of outstanding stock options; and

|

| |

●

|

4,730,002 shares of our common stock reserved for future issuance to our directors and executive officers pursuant to special grants approved by our stockholders.

|

RISK FACTORS

You should carefully consider the risk factors described in the accompanying prospectus and in our Annual Report on Form 10-K for the fiscal year ended March 31, 2023, as well as the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, and the risk factors set forth below before deciding to invest in shares of our common stock. Such risks and uncertainties are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. The occurrence of any of the events or actions described in these risk factors may have a material adverse effect on our business, financial condition, results of operations, and prospects.

Risks Related to Our Financial Condition, Our Common Stock, and This Offering

We have a history of annual net losses, which may continue, and which may negatively impact our ability to achieve our business objectives.

For the fiscal year ended March 31, 2023, we had revenue of $911,000 and a net loss attributable to common stockholders of $11,506,000. At March 31, 2023, we had total stockholders’ equity of $14,911,000, a decrease of $8,981,000 from March 31, 2022. Our total stockholders’ equity was $14,098,000 as of September 30, 2023. For the three months ended September 30, 2023, we had revenue of $291,000, compared to revenue of $202,000 for the comparable period in 2022. We had a net loss attributable to common stockholders of $2,451,000 for the three months ended September 30, 2023, compared to a net loss attributable to common stockholders of $2,442,000 for the comparable 2022 period. We are currently in a clinical trial stage and, thus, have not yet achieved profitability.

The challenges we face include unanticipated clinical trial delays, poor data, changes in the regulatory and competitive landscape, and additional costs and expenses that may exceed current budget estimates. In order to complete certain clinical trials and achieve our business objectives, we anticipate that we will incur increased operating expenses. In addition, we expect to incur significant losses and experience negative cash flow for the foreseeable future as we fund the operating losses and capital expenditures. We recognize that if we are unable to generate sufficient revenues or source funding, we will not be able to continue operations as currently contemplated, complete planned clinical trials, and/or achieve profitability. Our failure to achieve or maintain profitability will also negatively impact the value of our shares. If we are unsuccessful in addressing these risks, then we may need to limit our business activities.

We require additional funding for our business, but it is not possible to predict the aggregate proceeds resulting from sales made under the Sales Agreement.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Sales Agent at any time throughout the term of the Sales Agreement. The number of shares that are sold through the Sales Agent, if any, after delivering a placement notice will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with the Sales Agent in any applicable placement notice and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the aggregate proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and number of shares sold in this offering. In addition, subject to the final determination by our Board of Directors, there may be no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

Future sales of common stock by us could cause our stock price to decline and dilute your ownership percentage in our company.

In the future, we may issue shares of our common stock or preferred stock, including any securities that are convertible into or exchangeable for or that represent the right to receive common stock or preferred stock or any substantially similar securities. The market price of our common stock could decline as a result of sales of our common stock by us in the market or the perception that such sales could occur.

Our management team will have broad discretion over the use of the net proceeds from this offering.

Our management will use their discretion to direct the net proceeds from this offering. We intend to use the net proceeds from the sale of our shares in this offering as set forth in the “Use of Proceeds” section below. Our management’s judgments may not result in positive returns on your investment, and you will not have an opportunity to evaluate the economic, financial, or other information upon which our management bases its decisions. We may invest the net proceeds from this offering, pending their use, in a manner that does not produce income or that loses value. The failure by our management to apply these funds effectively could result in financial losses, and these financial losses could have a material adverse effect on our business and cause the price of our common stock to decline.

We do not intend to pay dividends on our common stock. Consequently, your ability to achieve a return on your investment will depend on the appreciation in the price of our common stock.

We have never declared or paid any cash dividend on our common stock. We currently anticipate that we will retain future earnings, if any, for the development, operation, and expansion of our business, and we do not anticipate declaring or paying any cash dividends on our common stock for the foreseeable future. Consequently, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investments. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

You may experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of 214,285,714 shares of our common stock are sold during the term of the Sales Agreement with the Sales Agent at a price of $0.28 per share, the closing price of our common stock on the NYSE American on January 24, 2024, for aggregate gross proceeds of $60,000,000, after deducting commissions and estimated aggregate offering expenses payable by us, you will experience immediate dilution $0.02 per share, representing the difference between our as adjusted pro forma net tangible book value per share as of September 30, 2023, after giving effect to this offering and the assumed offering price. The exercise of outstanding stock options and warrants may result in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated in this prospectus supplement by reference contain “forward-looking statements.” We or our representatives may, from time to time, make written or verbal forward-looking statements. In this prospectus supplement and the documents incorporated by reference, we discuss plans, expectations, and objectives regarding our business, financial condition, and results of operations. Without limiting the foregoing, statements that are in the future tense, and all statements accompanied by terms such as “believe,” “project,” “expect,” “trend,” “estimate,” “forecast,” “assume,” “intend,” “plan,” “target,” “anticipate,” “outlook,” “preliminary,” “will likely result,” “will continue” and variations of them and similar terms are intended to be “forward-looking statements” as defined by federal securities laws. We caution you not to place undue reliance on forward-looking statements, which are based upon assumptions, expectations, plans, and projections. In addition, our goals and objectives are aspirational and are not guarantees or promises that such goals and objectives will be met. Forward-looking statements are subject to risks and uncertainties, including those identified in the “Risk Factors” included in this prospectus supplement and in the documents incorporated by reference that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date when they are made. Except as required by federal securities law, we do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements.

Forward-looking statements are based upon, among other things, our assumptions with respect to:

|

●

|

the sufficiency of our existing cash and cash equivalents and marketable securities to fund our future operating and capital expenses;

|

|

●

|

our ability to successfully register trademarks and patents, create and market new products and services, including trading in Hong Kong and other parts of South Asia, contract for infrastructure projects and rental of equipment in India, and achieve customer acceptance in the industries we serve;

|

|

●

|

current and future economic and political conditions, including in Hong Kong, North America, Colombia, and India;

|

|

●

|

our ability to accurately predict the future demand for our products and services;

|

|

●

|

our ability to successfully market our hemp-based products in countries and states where hemp and hemp products are legal;

|

|

●

|

our ability to maintain a stock listing on a national securities exchange;

|

|

●

|

our ability to obtain and maintain regulatory approval of our existing product candidates and any other product candidates we may develop, and the labeling under any approval we may obtain;

|

|

●

|

our ability to timely complete regulatory filings;

|

|

●

|

our ability to obtain the U.S. Food and Drug Administration (FDA) approval for an Investigational New Drug Application (INDA) and to successfully run medical trials, including a Phase 2 trial for IGC-AD1;

|

|

●

|

our reliance on third parties to conduct clinical trials and for the manufacture of IGC-AD1 for non-clinical studies and clinical trials;

|

|

●

|

the impact of the COVID-19 pandemic on our results of operations, including the delay in our ability to launch certain projects;

|

|

●

|

our financial performance;

|

|

●

|

the outcome of medical trials that are conducted on our Investigational Drug Candidates and products;

|

|

●

|

our ability to fund the costs of clinical trials and other related expenses;

|

|

●

|

our ability to maintain our intellectual property position and our ability to maintain and protect our intellectual property rights;

|

|

●

|

competition and general acceptance of phytocannabinoids for alternative, pharmaceutical, and nutraceutical therapies;

|

|

●

|

our ability to effectively compete and our dependence on market acceptance of our brands and products within and outside the United States;

|

|

●

|

federal and state legislation and administrative policy regulating phytocannabinoids;

|

|

●

|

our ability (based in part on regulatory concerns) to license our products to processors that can produce pharmaceutical grade phytocannabinoids;

|

|

●

|

our ability to obtain and protect patents for the use of phytocannabinoids in our formulations;

|

|

●

|

our ability to obtain and install equipment for processing and manufacturing hemp and hemp products;

|

|

●

|

our ability to successfully navigate disruptions of information technology systems or data security breaches that could adversely affect our business.

|

You should consider the limitations on and risks associated with forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. As noted above, these forward-looking statements speak only as of the date when they are made. Moreover, in the future, we may make forward-looking statements through our senior management that involve the risk factors and other matters described in this prospectus supplement, as well as other risk factors subsequently identified, including, among others, those identified in our filings with the SEC in our quarterly reports on Form 10-Q and our current reports on Form 8-K.

This prospectus supplement and the documents incorporated by reference contain statements and claims that are not approved by the FDA, including statements on hemp and hemp extracts, including cannabidiol and other cannabinoids. These statements and claims are intended to be in compliance with state laws, specifically in states where medical cannabis has been legalized, and the diseases which we anticipate our products will target are approved conditions for treatment or usage with cannabis or cannabinoids.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $5,309,602 in this offering. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions, expenses, and proceeds to us, if any, are not determinable at this time but will be reported in our periodic reports.

We anticipate using the net proceeds, if any, from the sale of our shares of common stock offered by us to fund our ongoing investments in clinical trials, AI capabilities, research and development, facilities, marketing and advertising, and potential acquisitions of complementary products and businesses as part of our growth strategy. We currently have no definitive commitments or agreements with respect to any such acquisitions.

Although no assurances can be given, we believe these investments will fuel the development and delivery of innovative products that drive positive patient and customer experiences. We plan to leverage our R&D and intellectual property to develop science-based products that are proven effective through our clinical trials, subject to FDA approval. We believe this growth strategy can improve our existing products and lead to the creation of new products that can provide treatment options for multiple conditions, symptoms, and side effects.

We plan to use any remaining proceeds we receive for our overall working capital and other general corporate requirements. Other corporate requirements include amounts required to pay for continuing development expenses, salaries, professional fees, public reporting costs, office-related expenses, and other corporate expenses, including interest and overhead.

Pending use of the proceeds as described above, we intend to invest most of the net proceeds from this offering in short-term, investment-grade, interest-bearing securities.

The amounts and timing of our use of the net proceeds from this offering, if any, will depend on a number of factors, such as the timing and progress of our clinical trials, the timing and progress of any partnering and collaboration efforts, and technological advances. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to be received by us from this offering. Accordingly, our management will have broad discretion in the timing and application of these proceeds.

Any portion of the $5,309,602 included in this prospectus supplement not previously sold or included in an active placement notice pursuant to the Sales Agreement may be later made available for sale in other offerings pursuant to the accompanying base prospectus, and if no shares have been sold under the Sales Agreement, the full $60,000,000 of shares of common stock may be later made available for sale in other offerings pursuant to the accompanying base prospectus.

DIVIDEND POLICY

We have not declared or paid any dividends on our common stock. We currently anticipate that we will retain future earnings, if any, for the development, operation, and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determinations related to the dividend policy will be made at the discretion of our Board of Directors.

DILUTION

If you purchase our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share and the net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued and outstanding as of September 30, 2023.

Our net tangible book value as of September 30, 2023, was approximately $12,917,305, or approximately $0.20 per share, based on 63,706,939 shares of our common stock outstanding as of September 30, 2023. After giving effect to the sale of our common stock during the term of the Sales Agreement with the Sales Agent in the aggregate amount of $60,000,000 at an assumed offering price of $0.28 per share, the last reported sale price of our common stock on the NYSE American on January 24, 2024, and after deducting commissions and estimated aggregate offering expenses payable by us, our pro forma as adjusted net tangible book value as of September 30, 2023, would have been approximately $71,067,305, or $0.26 per share of common stock. This represents an immediate increase in the net tangible book value of $58,150,000 or $0.05 per share to our existing stockholders and an immediate dilution in net tangible book value of $0.02 per share to new investors.

The following table illustrates this per share dilution:

|

Assumed public offering price per share

|

|

$ |

|

|

|

$ |

0.28 |

|

|

Net tangible book value per share as of September 30, 2023

|

|

$ |

0.20 |

|

|

$ |

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$ |

0.05 |

|

|

$ |

|

|

|

Pro forma as adjusted net tangible book value per share as of September 30, 2023, after giving effect to this offering

|

|

$ |

|

|

|

$ |

0.26 |

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

$ |

|

|

|

$ |

0.02 |

|

The table above assumes for illustrative purposes that an aggregate of 214,285,714 shares of our common stock are sold during the term of the Sales Agreement at a price of $0.28 per share, the last reported sale price of our common stock on the NYSE American on January 24, 2024, for aggregate gross proceeds of $60,000,000.

The shares pursuant to the Sales Agreement are being sold from time to time at various prices. An increase of $0.10 per share in the price at which the shares are sold from the assumed offering price of $0.28 per share, the last reported sale price of our common stock on the NYSE American on January 24, 2024, assuming all of our common stock in the aggregate amount of $60,000,000 during the term of the Sales Agreement is sold at that price, would increase our pro forma as adjusted net tangible book value per share after the offering to $0.32 per share and would increase the dilution in net tangible book value per share to new investors in this offering to $0.06 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $0.10 per share in the price at which the shares are sold from the assumed offering price of $0.28 per share, the last reported sale price of our common stock on the NYSE American on January 24, 2024, assuming all of our common stock in the aggregate amount of $60,000,000 during the term of the Sales Agreement is sold at that price, would decrease our pro forma as adjusted net tangible book value per share after the offering to $0.18 per share and would not decrease the net tangible book value per share to new investors in this offering, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

The above discussion and tables are based on 63,706,939 shares of our common stock issued and outstanding as of September 30, 2023, and excludes as of that date the following:

| |

●

|

3,986,665 shares of common stock reserved for future issuance pursuant to grants outstanding under the IGC Pharma, Inc. 2018 Omnibus Incentive Plan;

|

| |

●

|

9,147 shares of common stock pursuant to the conversion of 91,472 units that can be separated into common stock based on a ratio of one share of common stock for every ten units;

|

| |

●

|

1,50,000 shares of common stock reserved for future issuance upon the exercise of outstanding stock options; and

|

| |

●

|

4,730,002 shares of our common stock reserved for future issuance to our directors and executive officers pursuant to special grants approved by our stockholders.

|

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with A.G.P./Alliance Global Partners (the “Sales Agent”), under which we may issue and sell from time to time shares of our common stock having an aggregate offering price of up to $60,000,000. The Sales Agent may sell the common stock by any method that is deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including sales made directly on or through the NYSE American or any other existing trading market for the common stock in the U.S. or to or through a market maker, subject to the limitations imposed by General Instruction I.B.6. to Form S-3, as applicable. By means of this prospectus supplement, we are offering $5,309,602 of common stock pursuant to General Instruction I.B.6 of Form S-3.

Each time we wish to issue and sell shares of common stock under the Sales Agreement, we will notify the Sales Agent of the number of shares to be issued, the dates on which such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may not be made. Once we have so instructed the Sales Agent, subject to the terms and conditions of the Sales Agreement, the Sales Agent has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of the Sales Agent under the Sales Agreement to sell our shares of common stock are subject to a number of conditions that we must meet.

The Sales Agent will provide written confirmation to us no later than the opening of the trading day immediately following the trading day on which shares of our common stock are sold under the Sales Agreement. Each confirmation will include the number of shares sold, the volume-weighted average price of the shares sold, the compensation payable by us to the Sales Agent with respect to such sales, and the net proceeds payable to us. The settlement of sales of shares between us and the Sales Agent is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales of our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Sales Agent may agree. There is no arrangement for funds to be received in an escrow, trust, or similar arrangement. We will report at least quarterly the number of shares of common stock sold through the Sales Agent under the Sales Agreement, the net proceeds to us, and the compensation paid by us to the Sales Agent in connection with the sales of common stock.

We will pay the Sales Agent a commission equal to 3% of the aggregate gross proceeds we receive from each sale of our shares of common stock. Because there is no minimum offering amount required as a condition of this offering, the actual total public offering amount, commissions, and proceeds to us, if any, are not determinable at this time. In addition, we have agreed to reimburse the Sales Agent for certain of their expenses incurred in connection with acting as Sales Agent, including the fees and expenses of its counsel of up to $40,000 and pay an annual maintenance fee of $10,000.

In connection with the sale of common stock on our behalf, the Sales Agent may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to the Sales Agent may be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to the Sales Agent against certain civil liabilities, including liabilities under the Securities Act.

In the ordinary course of their business, the Sales Agent and/or their affiliates may in the future perform investment banking, broker-dealer, financial advisory, or other services for us, for which they may receive separate fees.

The offering of shares of our common stock pursuant to the Sales Agreement will terminate upon the earliest of (i) the sale of the maximum dollar amount of shares of common stock subject to the Sales Agreement, (ii) the termination of the Sales Agreement by us or the Sales Agent and (iii) the expiration of the shelf registration statement on Form S-3 (File No. 333-276330) on the third anniversary of the initial effective date of such registration statement.

To the extent required by Regulation M, the Sales Agent will not engage in any market-making activities involving our shares while the offering is ongoing under this prospectus supplement.

This summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sales Agreement was filed as an exhibit to our Current Report on Form 8-K filed with the SEC on October 27, 2023, and is incorporated by reference into the registration statement of which this prospectus supplement is a part. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” below.

DESCRIPTION OF CAPITAL STOCK

The following is a description of the material terms and provisions of our common stock. It may not contain all the information that is important to you. You can access complete information by referring to our articles of incorporation and by-laws, each as amended to date, which we refer to as our “articles of incorporation” and “by-laws.”

General

We are a Maryland corporation. Under our articles of incorporation, we have authority to issue 150,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of preferred stock, par value $0.0001 per share.

As of January 24, 2024, there were issued and outstanding:

| |

●

|

63,734,439 shares of common stock;

|

| |

●

|

no shares of preferred stock;

|

| |

●

|

3,959,165 shares of common stock reserved for future issuance pursuant to grants outstanding under the IGC Pharma, Inc. 2018 Omnibus Incentive Plan and special grants approved by our stockholders;

|

| |

●

|

9,147 shares of common stock pursuant to the conversion of 91,472 units that can be separated into common stock based on a ratio of one share of common stock for every ten units;

|

| |

●

|

150,000 shares of common stock reserved for future issuance upon the exercise of outstanding stock options; and

|

| |

●

|

4,730,002 shares of our common stock reserved for future issuance to our directors and executive officers pursuant to special grants approved by our stockholders.

|

Voting, Dividends, and Other Rights

Holders of shares of our common stock are entitled to one vote for each share held of record on each matter submitted to a vote of stockholders. There is no cumulative voting for election of directors. Accordingly, the holders of a majority of our outstanding shares of common stock are entitled to vote in any election of directors and can elect all of the directors standing for election if they should so choose. Holders of shares of our common stock are entitled to receive dividends ratably when, as, and if declared by the board of directors out of funds legally available therefor and, upon our liquidation, dissolution, or winding up, are entitled to share ratably in all assets remaining after payment of liabilities. Holders of shares of our common stock have no preemptive rights and have no rights to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock. The outstanding shares of our common stock are, and the shares of common stock to be sold in this offering will be, when issued, validly authorized, and issued, fully paid and nonassessable.

Transfer Agent

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Co., and its address is 1 State Street, 30th Floor, New York, NY 10004-1561, telephone number +1 (212) 509-4000.

Listing

Our shares of common stock trade on the NYSE American under the symbol IGC. Our shares are also quoted on the Frankfurt, Berlin, and Stuttgart (XETRA2) stock exchanges in Germany under the symbol IGSI.

Anti-takeover Law, Limitations of Liability and Indemnification

Business Combinations

Under the Maryland General Corporation Law, some business combinations, including a merger, consolidation, share exchange or, in some circumstances, an asset transfer or issuance or reclassification of equity securities, are prohibited for a period of time and require an extraordinary vote. These transactions include those between a Maryland corporation and the following persons (a “Specified Person”):

| |

●

|

an interested stockholder is defined as any person (other than a subsidiary) who beneficially owns 10% or more of the corporation’s voting stock or who is an affiliate or an associate of the corporation who, at any time within a two-year period prior to the transaction, was the beneficial owner of 10% or more of the voting power of the corporation’s voting stock; or

|

| |

●

|

an affiliate of an interested stockholder.

|

A person is not an interested stockholder if the board of directors approved in advance the transaction by which the person otherwise would have become an interested stockholder. The board of directors of a Maryland corporation also may exempt a person from these business combination restrictions prior to the time the person becomes a Specified Person and may provide that its exemption be subject to compliance with any terms and conditions determined by the board of directors. Transactions between a corporation and a Specified Person are prohibited for five years after the most recent date on which such stockholder becomes a Specified Person. After five years, any business combination must be recommended by the board of directors of the corporation and approved by at least 80% of the votes entitled to be cast by holders of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than voting stock held by the Specified Person with whom the business combination is to be effected, unless the corporation’s stockholders receive a minimum price as defined by Maryland law and other conditions under Maryland law are satisfied.

A Maryland corporation may elect not to be governed by these provisions by having its board of directors exempt various Specified Persons, by including a provision in its charter expressly electing not to be governed by the applicable provision of Maryland law, or by amending its existing charter with the approval of at least 80% of the votes entitled to be cast by holders of outstanding shares of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than those held by any Specified Person. Our Charter does not include any provision opting out of these business combination provisions.

Control Share Acquisitions

The Maryland General Corporation Law also prevents, subject to exceptions, an acquirer who acquires sufficient shares to exercise specified percentages of the voting power of a corporation from having any voting rights except to the extent approved by two-thirds of the votes entitled to be cast on the matter not including shares of stock owned by the acquiring person, any directors who are employees of the corporation and any officers of the corporation. These provisions are referred to as the control share acquisition statute.

The control share acquisition statute does not apply to shares acquired in a merger, consolidation, or share exchange if the corporation is a party to the transaction or to acquisitions approved or exempted prior to the acquisition by a provision contained in the corporation’s charter or bylaws. Our bylaws include a provision exempting us from the restrictions of the control share acquisition statute, but this provision could be amended or rescinded either before or after a person acquired control shares. As a result, the control share acquisition statute could discourage offers to acquire our common stock and could increase the difficulty of completing an offer.

Board of Directors

The Maryland General Corporation Law provides that a Maryland corporation which is subject to the Exchange Act and has at least three outside directors (who are not affiliated with an acquirer of the company) under certain circumstances may elect by resolution of the board of directors or by amendment of its charter or bylaws to be subject to statutory corporate governance provisions that may be inconsistent with the corporation’s charter and bylaws. Under these provisions, a board of directors may divide itself into three separate classes without the vote of stockholders such that only one-third of the directors are elected each year. A board of directors classified in this manner cannot be altered by amendment to the charter of the corporation. Further, the board of directors may, by electing to be covered by the applicable statutory provisions and notwithstanding the corporation’s charter or bylaws:

| |

●

|

provide that a special meeting of stockholders will be called only at the request of stockholders entitled to cast at least a majority of the votes entitled to be cast at the meeting,

|

| |

●

|

reserve for itself the right to fix the number of directors,

|

| |

●

|

provide that a director may be removed only by the vote of at least two-thirds of the votes entitled to be cast generally in the election of directors and

|

| |

●

|

retain for itself sole authority to fill vacancies created by an increase in the size of the board or the death, removal, or resignation of a director.

|

In addition, a director elected to fill a vacancy under these provisions serves for the balance of the unexpired term instead of until the next annual meeting of stockholders. A board of directors may implement all or any of these provisions without amending the charter or bylaws and without stockholder approval. Although a corporation may be prohibited by its charter or by resolution of its board of directors from electing any of the provisions of the statute, we have not adopted such a prohibition. We have adopted a staggered board of directors with three separate classes in our charter and given the board the right to fix the number of directors, but we have not prohibited the amendment of these provisions. The adoption of the staggered board may discourage offers to acquire our common stock and may increase the difficulty of completing an offer to acquire our stock. If our Board chose to implement the statutory provisions, it could further discourage offers to acquire our common stock and could further increase the difficulty of completing an offer to acquire our common stock.

Effect of Certain Provisions of our Charter and Bylaws

In addition to the charter and bylaws provisions discussed above, certain other provisions of our bylaws may have the effect of impeding the acquisition of control of our company by means of a tender offer, proxy fight, open market purchases, or otherwise in a transaction not approved by our Board of Directors. These provisions of bylaws are intended to reduce our vulnerability to an unsolicited proposal for the restructuring or sale of all or substantially all of our assets or an unsolicited takeover attempt, which our Board believes is otherwise unfair to our stockholders. These provisions, however, also could have the effect of delaying, deterring, or preventing a change in control of our company.

Our bylaws provide that with respect to annual meetings of stockholders, (i) nominations of individuals for election to our Board of Directors and (ii) the proposal of business to be considered by stockholders may be made only pursuant to our notice of the meeting, by or at the direction of our Board of Directors, or by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our bylaws.

Special meetings of stockholders may be called only by the chief executive officer, the board of directors, or the secretary of our company (upon the written request of the holders of a majority of the shares entitled to vote). At a special meeting of stockholders, the only business that may be conducted is the business specified in our notice of meeting. With respect to nominations of persons for election to our Board of Directors, nominations may be made at a special meeting of stockholders only pursuant to our notice of meeting, by or at the direction of our Board of Directors, or if our Board of Directors has determined that directors will be elected at the special meeting, by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our bylaws.

These procedures may limit the ability of stockholders to bring business before a stockholders meeting, including the nomination of directors and the consideration of any transaction that could result in a change in control and that may result in a premium to our stockholders.

Disclosure of the SEC’s Position on Indemnification for Securities Act Liabilities

Insofar as indemnification for liabilities under the Securities Act may be permitted to directors, officers, or persons controlling us pursuant to the above provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer, or controlling person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer or controlling person in connection with the shares of common stock being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

LEGAL MATTERS

Olshan Frome Wolosky LLP, New York, New York, will pass upon the validity of the issuance of the shares of common stock offered by this prospectus supplement as our counsel. Crone Law Group is acting as counsel for A.G.P. in connection with this offering.

EXPERTS

The consolidated financial statements of IGC Pharma, Inc. included in our annual report on Form 10-K for the fiscal year ended March 31, 2023, and March 31, 2022, have been audited by Manohar Chowdhry & Associates, independent registered public accountants, as set forth in their reports thereon, included therein, and incorporated herein by reference in this prospectus supplement and elsewhere in the registration statement. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements, and other documents with the SEC. You may read and copy any document we file at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You should call 1-800-SEC-0330 for more information on the operation of the public reference room. Our SEC filings are also available to you on the SEC’s Internet site at http://www.sec.gov. The SEC’s Internet site contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

This prospectus supplement constitutes a part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act. This prospectus supplement does not contain all of the information set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. For further information about us and our securities, we refer you to the registration statement and the accompanying exhibits and schedules. The registration statement may be inspected at the Public Reference Room maintained by the SEC at the address set forth above. Statements contained in this prospectus supplement regarding the contents of any contract, or any other document filed as an exhibit are not necessarily complete. In each instance, reference is made to the copy of such contract or document filed as an exhibit to the registration statement, and each statement is qualified in all respects by that reference.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating by reference” information into this prospectus supplement. This means that we are disclosing important information to you by referring you to another document that has been filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede the information contained in documents filed earlier with the SEC or contained in this prospectus supplement. We incorporate by reference in this prospectus supplement the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act after the initial filing of this prospectus supplement and prior to the termination or completion of the offering of securities under this prospectus supplement (except in each case the information contained in such documents to the extent “furnished” and not “filed”):

| |

●

|

Our Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on July 7, 2023;

|

| |

●

|

Our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2023, filed with the SEC on August 10, 2023 and September 30, 2023 filed with the SEC on November 9, 2023;

|

| |

●

|

Our Current Reports on Form 8-K (excluding any reports or portions thereof that are deemed to be furnished and not filed), filed with the SEC on May 8, 2023, July 7, 2023, July 7, 2023, August 21, 2023, and October 27, 2023;

|

| |

●

|

Our definitive proxy statement on Schedule 14A for our 2023 Annual Meeting of Stockholders filed with the SEC on July 26, 2023; and

|

| |

●

|

The description of our common stock contained in our Registration Statement on Form 8-A filed pursuant to Section 12 of the Exchange Act on March 7, 2006, and any amendments or reports filed for the purpose of updating the description.

|

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We will provide to each person, including any beneficial owner, to whom this prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus supplement but not delivered with this prospectus supplement. Copies of the above documents (other than exhibits to such documents unless those exhibits have been specifically incorporated by reference in this prospectus supplement) may be obtained upon written or oral request, without charge to you, by contacting:

IGC Pharma, Inc.

Attn: Corporate Secretary

10224 Falls Road

Potomac, Maryland 20854

Telephone: (301) 983-0998

|

PROSPECTUS

|

Subject to completion, dated December 29, 2023 |

IGC PHARMA, INC.

$100,000,000

Common Stock Warrants Units

Rights

This prospectus relates to common stock, warrants, units, and rights that we may sell from time to time in one or more offerings up to a total dollar amount of $100,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters, or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Our common stock is listed for trading on the NYSE American under the symbol IGC. The closing price of our common stock on December 28, 2023, as reported by the NYSE American, was $0.30 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus, the documents incorporated by reference herein, and future filings.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 2.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 31, 2024

TABLE OF CONTENTS

Important Notice about the Information Presented in this Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. For further information, see the section of this prospectus entitled “Where You Can Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date on the front cover of this prospectus or the applicable prospectus supplement, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of common stock. Our business, financial condition, results of operations and prospects may have changed since such dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $100,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update, or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” carefully before making an investment decision.

Unless the context requires otherwise, all references in this report to “IGC,” “the Company,” “we,” “our,” and/or “us” refer to IGC Pharma, Inc. (formerly known as India Globalization Capital, Inc.), together with our subsidiaries and beneficially owned subsidiary.

ABOUT IGC PHARMA, INC.

Overview

IGC Pharma, Inc., is a clinical-stage pharmaceutical company with a diversified revenue model that develops prescription drugs and over-the-counter (OTC) products. We were formerly known as India Globalization Capital, Inc. and incorporated in Maryland on April 29, 2005. Our fiscal year is the 52- or 53-week period ending March 31.

Our focus is on developing innovative therapies for neurological disorders such as Alzheimer’s disease, epilepsy, Tourette syndrome, and sleep disorders. We also focus on formulations for eating disorders, chronic pain, premenstrual syndrome (PMS), and dysmenorrhea, in addition to health and wellness OTC formulations. The Company is developing its proprietary lead candidate, IGC-AD1, an investigational oral therapy for the treatment of agitation associated with Alzheimer’s disease. IGC-AD1 is currently in Phase 2 (Phase 2B) clinical trials after completing nearly a decade of research and realizing positive results from pre-clinical and a Phase 1 trial. This previous research into IGC-AD1 has demonstrated efficacy in reducing plaques and tangles, which are two important hallmarks of Alzheimer’s, as well as reducing neuropsychiatric symptoms associated with dementia in Alzheimer’s disease, such as agitation.

The progress we are making in clinical trials gives us confidence in the potential of IGC-AD1 to be a groundbreaking therapy, with the potential to treat Alzheimer’s and also to manage devastating symptoms that separate families, increase admissions to nursing homes, and drive the cost of Alzheimer’s care. We have filed forty-one (41) patent applications in different countries and secured ten patents, including control of four in the Alzheimer’s space. We have built a facility for a potential Phase 3 trial and have strategic relations for the procurement of Active Pharmaceutical Ingredients (APIs). In addition, we have acquired and initiated work on TGR-63, a pre-clinical molecule that exhibits an impressive affinity for reducing neurotoxicity in Alzheimer’s cell lines. The advancement of IGC-AD1 into Phase 2 trials represents a significant milestone for the Company and positions us for multiple pathways to future success. We anticipate that the positive outcomes from these and other trials will drive further growth, valuation, and market potential for IGC-AD1, although there can be no assurance thereof.

We recognize the significance of operational excellence and cost management in clinical trials. We have established an internal capability to manage trials, including proprietary software, rather than working with an external Contract Research Organization (CRO). We believe this empowers us to substantially reduce the costs associated with clinical trials compared to relying on external CROs. Our proprietary software allows us to streamline the trial processes, enabling seamless coordination and data management. Additionally, we are integrating machine learning technologies into our software framework. We believe this overlay of Artificial Intelligence (AI) will help us simulate trial scenarios, generate new insights to facilitate improved decision-making, efficiently design our Phase 3 trial, provide advanced data analysis, and ultimately enhancing the effectiveness and efficiency of our clinical trials, although there can be no assurance thereof.

Corporate Information

We were incorporated in the State of Maryland on April 29, 2005, under our former name, India Globalization Capital, Inc. Our principal executive offices are located at 10224 Falls Road, Potomac, Maryland 20854, and our telephone number is (301) 983-0998. We maintain several websites, including www.igcinc.us and www.igcpharma.com. Our public filings with the SEC are accessible on the SEC’s website, www.sec.gov.

The information contained on our websites is not incorporated by reference into this prospectus and you should not consider any information contained on, or that can be accessed through, our websites as part of this prospectus or in deciding whether to purchase our securities.

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the following risk factors, you should carefully consider the risks, uncertainties, and assumptions discussed in Item 1A., “Risk Factors” of our annual report on Form 10-K for the fiscal year ended March 31, 2023, and in other documents that we subsequently file with the SEC that update, supplement or supersede such information, which documents are incorporated by reference into this prospectus. See “Where You Can Find More Information.” Additional risks not presently known to us or which we consider immaterial based on information currently available to us may also materially adversely affect us. If any of the events anticipated by the risks described occur, our results of operations and financial condition could be adversely affected, which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

We may not be successful in our artificial intelligence initiatives, which could adversely affect our business, reputation, or financial results.

We are making investments in AI initiatives, including generative AI, to, among other things, recommend relevant unconnected content across our products, enhance our advertising tools, develop new products, and develop new features for existing products. In particular, we expect our AI initiatives will require increased investment in infrastructure and headcount.

There are significant risks involved in developing and deploying AI and there can be no assurance that the usage of AI will enhance our products or services or be beneficial to our business, including our efficiency or profitability. For example, our AI-related efforts, particularly those related to generative AI, subject us to risks related to harmful content, accuracy, bias, discrimination, toxicity, intellectual property infringement or misappropriation, defamation, data privacy, cybersecurity, and sanctions and export controls, among others. It is also uncertain how various laws related to online services, intermediary liability, and other issues will apply to content generated by AI. In addition, we are subject to the risks of new or enhanced governmental or regulatory scrutiny, litigation, or other legal liability, ethical concerns, negative consumer perceptions as to automation and AI, or other complications that could adversely affect our business, reputation, or financial results.

As a result of the complexity and rapid development of AI, it is also the subject of evolving review by various U.S. governmental and regulatory agencies, and other foreign jurisdictions are applying, or are considering applying, their platform moderation, intellectual property, cybersecurity, and data protection laws to AI and/or are considering general legal frameworks on AI. We may not always be able to anticipate how to respond to these frameworks, given they are still rapidly evolving. We may also have to expend resources to adjust our offerings in certain jurisdictions if the legal frameworks on AI are not consistent across jurisdictions.

As such, it is not possible to predict all of the risks related to the use of AI, and changes in laws, rules, directives, and regulations governing the use of AI may adversely affect our ability to develop and use AI or subject us to legal liability.

Potential Risks Associated with Disposal of Non-Core Assets

Investing in our company may be subject to risks related to the disposal of our non-core assets. The Company owns land in Nagpur with a book value of approximately $4.1 million and other assets in Kochi, India and Vancouver, Washington totaling about $ 2 million that are not core to our pharmaceutical business focus. While our decision to dispose of these non-core assets is aimed at monetizing non-core assets, streamlining operations, and optimizing resource allocation, the process carries certain risks that may negatively impact our financial performance. The sale of these assets could result in a potential financial loss that is approximately the difference between the book value reflected on the balance sheet and the sale price.