Matinas BioPharma Reports First Quarter 2024 Financial Results and Provides a Business Update

09 Mai 2024 - 10:05PM

Matinas BioPharma Holdings, Inc. (NYSE American: MTNB), a

clinical-stage biopharmaceutical company focused on delivering

groundbreaking therapies using its lipid nanocrystal (LNC) platform

delivery technology, reports financial results for the three months

ending March 31, 2024 and provides a business update.

“We remain on track with active partnership

discussions to advance oral MAT2203 into the ORALTO trial in

invasive aspergillosis,” said Jerome D. Jabbour, Chief Executive

Officer of Matinas. “These discussions aim to secure one or more

development and commercial partners for this life-changing asset

with a shared sense of urgency that can maximize its value in

multiple geographies. Our confidence in oral MAT2203 continues to

build as we see further evidence of favorable outcomes in extremely

ill patients, some of whom have invasive fungal infections deemed

even more difficult to treat than aspergillosis. We believe MAT2203

has the potential to change the treatment paradigm for a variety of

invasive fungal infections by providing an effective, targeted,

safer, and more convenient option.

“Last month’s financing strengthened our balance

sheet and better positioned us to advance other studies providing a

strong foundation for our LNC platform programs,” he added. “We are

highly encouraged by results from in vivo studies demonstrating a

substantial reduction in the well-recognized toxicity of

IV-docetaxel. In inflammation, we have been successful in orally

delivering biologically active small oligonucleotides in several

inflammatory disease models. Strategically, we continue to pursue

studies with our LNC technology designed to establish its role as a

potentially preferred next-generation intracellular oral drug

delivery platform, potentially facilitating a robust internal and

external pipeline of drug candidates in multiple high-value

indications.”

Key Program Updates

MAT2203 (Oral Amphotericin B)

Program

- Active negotiations are progressing

to secure a partnership to commence the Phase 3 ORALTO

registrational trial with oral MAT2203. The Phase 3 randomized,

multicenter, open-label, adjudicator-blinded ORALTO trial will

evaluate the efficacy and safety of MAT2203 as an oral step-down

therapy following two days of treatment with AmBisome® (liposomal

IV-amphotericin B) compared with the standard of care in patients

with invasive aspergillosis who have limited treatment

options.

- An in vivo study of oral MAT2203

demonstrated prolonged and enhanced survival, reduced fungal burden

and improvement in lung infection compared with placebo in treating

the pulmonary mucormycosis fungal infections in immunosuppressed

mice. The results were reported in the manuscript “Efficacy of an

oral lipid nanocrystal (LNC) formulation of amphotericin B

(MAT2203) in the neutropenic mouse model of pulmonary mucormycosis”

(Gu, et al.) published in the peer-reviewed Journal of

Antimicrobial Agents and Chemotherapy.

- To date, Matinas has enrolled 22

patients with severe and sometimes life-threatening fungal

infections in its Compassionate/Expanded Use Access Program, with

additional patients under evaluation. The infections treated

involve a variety of micro-organisms including Aspergillus,

Mucorales species, Candidiasis, Fusarium, Histoplasmosis, and

suspected Coccidioides at multiple sites of infection including

brain, bladder/colon, bone, lung, sinus, and skin. The majority of

enrolled patients are post-transplant or are undergoing treatment

for underlying malignancies.

LNC Platform Update

- Two abstracts (one an oral

presentation) highlighting recent favorable data from ex vivo, in

vitro and in vivo studies evaluating the use of Matinas’ LNC

platform for the oral targeted delivery of small oligonucleotides

are being presented at the American Society of Gene & Cell

Therapy’s (ASGCT) 27th Annual Meeting in May.

- A new formulation of

LNC-miriplatin, an insoluble platinum chemotherapeutic approved in

Japan for hepatocellular carcinoma has been developed. In vitro

testing demonstrated strong cellular uptake and tumor cell-killing

capabilities. Next steps are to assess the formulation in vivo.

LNC-miriplatin would be the second cancer agent successfully

formulated with LNCs.

First Quarter Financial

Results

The Company reported no revenue for the first

quarter of 2024, compared with $1.1 million for the first quarter

of 2023, which was generated from research collaborations with

BioNTech SE and Genentech Inc.

Total costs and expenses for the first quarter

of 2024 were $5.9 million compared with $6.7 million for the first

quarter of 2023. The decrease was primarily due to lower clinical

development expenses, personnel costs, and administrative

expenses.

The net loss for the first quarter of 2024 was

$5.8 million, or $0.03 per share, compared with a net loss for the

first quarter of 2023 of $5.5 million, or $0.03 per share.

Cash, cash equivalents and marketable securities

as of March 31, 2024 were $8.1 million compared with $13.8 million

as of December 31, 2023. Subsequent to the close of the quarter, in

April the Company raised gross proceeds of $10.0 million through a

registered direct offering. Based on current projections, the

Company believes its cash position is sufficient to fund planned

operations into the second quarter of 2025.

Conference Call and Webcast

Matinas will host a conference call and webcast

today beginning at 4:30 p.m. Eastern time. To participate in the

call, please dial 877-484-6065 or 201-689-8846. The live webcast

will be accessible on the Investors section of the company’s

website and archived for 90 days.

About Matinas BioPharmaMatinas

BioPharma is a biopharmaceutical company focused on delivering

groundbreaking therapies using its lipid nanocrystal (LNC) platform

delivery technology.

Matinas’ lead LNC-based therapy is MAT2203, an

oral formulation of the broad-spectrum antifungal drug amphotericin

B, which although highly potent, can be associated with significant

toxicity. Matinas’ LNC platform provides oral delivery of

amphotericin B without the significant nephrotoxicity otherwise

associated with IV-delivered formulations. Combining comparable

fungicidal activity with targeted delivery results in a lower risk

of toxicity and potentially creates the ideal antifungal agent for

the treatment of invasive fungal infections. MAT2203 was

successfully evaluated in the completed Phase 2 EnACT study in HIV

patients suffering from cryptococcal meningitis, meeting its

primary endpoint and achieving robust survival. MAT2203 will be

further evaluated in a single Phase 3 registration trial (the

“ORALTO” trial) as an oral step-down monotherapy following

treatment with AmBisome® (liposomal amphotericin B) compared with

the standard of care in patients with invasive aspergillosis who

have limited treatment options.

In addition to MAT2203, preclinical and clinical

data have demonstrated that this novel technology can potentially

provide solutions to many challenges of achieving safe and

effective intracellular delivery of both small molecules and

larger, more complex molecular cargos including small

oligonucleotides such as ASOs and siRNA. The combination of its

unique mechanism of action and flexibility with routes of

administration (including oral) positions Matinas’ LNC technology

to potentially become a preferred next-generation orally available

intracellular drug delivery platform. For more information, please

visit www.matinasbiopharma.com.

Forward-looking StatementsThis

release contains "forward-looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995, including

those relating to our business activities, our strategy and plans,

the potential of our LNC platform technology, and the future

development of our product candidates, including MAT2203, the

Company’s ability to identify and pursue development, licensing and

partnership opportunities for its products, including MAT2203, or

platform delivery technologies on favorable terms, if at all, and

the ability to obtain required regulatory approval and other

statements that are predictive in nature, that depend upon or refer

to future events or conditions. All statements other than

statements of historical fact are statements that could be

forward-looking statements. Forward-looking statements include

words such as "expects," "anticipates," "intends," "plans,"

"could," "believes," "estimates" and similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking

statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, our ability

to continue as a going concern, our ability to obtain additional

capital to meet our liquidity needs on acceptable terms, or at all,

including the additional capital which will be necessary to

complete the clinical trials of our product candidates; our ability

to successfully complete research and further development and

commercialization of our product candidates; the uncertainties

inherent in clinical testing; the timing, cost and uncertainty of

obtaining regulatory approvals; our ability to protect the

Company’s intellectual property; the loss of any executive officers

or key personnel or consultants; competition; changes in the

regulatory landscape or the imposition of regulations that affect

the Company’s products; and the other factors listed under "Risk

Factors" in our filings with the SEC, including Forms 10-K, 10-Q

and 8-K. Investors are cautioned not to place undue reliance on

such forward-looking statements, which speak only as of the date of

this release. Except as may be required by law, the Company does

not undertake any obligation to release publicly any revisions to

such forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events. Matinas BioPharma’s product candidates are all in a

development stage and are not available for sale or use.

Investor Contact:

LHA Investor RelationsJody Cain

Jcain@lhai.com310-691-7100

[Financial Tables to Follow]

|

Matinas BioPharma Holdings, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands, except for share data) |

| |

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

ASSETS: |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,071 |

|

|

$ |

4,787 |

|

|

Marketable debt securities |

|

|

7,039 |

|

|

|

8,969 |

|

|

Restricted cash – security deposit |

|

|

50 |

|

|

|

50 |

|

|

Prepaid expenses and other current assets |

|

|

2,129 |

|

|

|

1,737 |

|

|

Total current assets |

|

|

10,289 |

|

|

|

15,543 |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

Leasehold improvements and equipment – net |

|

|

1,829 |

|

|

|

1,923 |

|

|

Operating lease right-of-use assets – net |

|

|

2,919 |

|

|

|

3,064 |

|

|

Finance lease right-of-use assets – net |

|

|

20 |

|

|

|

21 |

|

|

In-process research and development |

|

|

3,017 |

|

|

|

3,017 |

|

|

Goodwill |

|

|

1,336 |

|

|

|

1,336 |

|

|

Restricted cash – security deposit |

|

|

200 |

|

|

|

200 |

|

|

Total non-current assets |

|

|

9,321 |

|

|

|

9,561 |

|

|

Total assets |

|

$ |

19,610 |

|

|

$ |

25,104 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

473 |

|

|

$ |

514 |

|

|

Accrued expenses |

|

|

839 |

|

|

|

1,447 |

|

|

Operating lease liabilities – current |

|

|

681 |

|

|

|

656 |

|

|

Financing lease liabilities – current |

|

|

5 |

|

|

|

5 |

|

|

Total current liabilities |

|

|

1,998 |

|

|

|

2,622 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

|

341 |

|

|

|

341 |

|

|

Operating lease liabilities – net of current portion |

|

|

2,697 |

|

|

|

2,877 |

|

|

Financing lease liabilities – net of current portion |

|

|

16 |

|

|

|

18 |

|

|

Total non-current liabilities |

|

|

3,054 |

|

|

|

3,236 |

|

|

Total liabilities |

|

|

5,052 |

|

|

|

5,858 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock par value $0.0001 per share, 500,000,000 shares

authorized at March 31, 2024 and December 31, 2023; 217,482,830 and

217,264,526 issued and outstanding as of March 31, 2024 and

December 31, 2023, respectively |

|

|

22 |

|

|

|

22 |

|

|

Additional paid-in capital |

|

|

196,067 |

|

|

|

195,018 |

|

|

Accumulated deficit |

|

|

(181,397 |

) |

|

|

(175,573 |

) |

|

Accumulated other comprehensive loss |

|

|

(134 |

) |

|

|

(221 |

) |

|

Total stockholders’ equity |

|

|

14,558 |

|

|

|

19,246 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

19,610 |

|

|

$ |

25,104 |

|

|

|

|

Matinas BioPharma Holdings, Inc. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss |

|

(in thousands, except share and per share data) |

|

Unaudited |

| |

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Contract revenue |

|

$ |

— |

|

|

$ |

1,096 |

|

| Costs and Expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

3,446 |

|

|

|

3,970 |

|

|

General and administrative |

|

|

2,456 |

|

|

|

2,712 |

|

| |

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

|

5,902 |

|

|

|

6.682 |

|

| |

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(5,902 |

) |

|

|

(5,586 |

) |

| Other income, net |

|

|

78 |

|

|

|

73 |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(5,824 |

) |

|

$ |

(5,513 |

) |

| Net loss per share – basic and

diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

217,358,085 |

|

|

|

217,264,526 |

|

| Other comprehensive gain, net

of tax |

|

|

|

|

|

|

|

|

|

Unrealized gain on securities available-for-sale |

|

|

87 |

|

|

|

229 |

|

|

Other comprehensive gain, net of tax |

|

|

87 |

|

|

|

229 |

|

| Comprehensive loss |

|

$ |

(5,737 |

) |

|

$ |

(5,284 |

) |

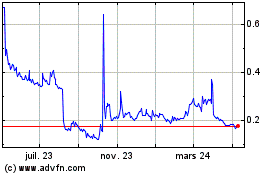

Matinas Biopharma (AMEX:MTNB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

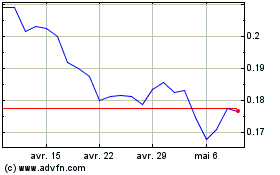

Matinas Biopharma (AMEX:MTNB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024