Form 8-K/A date of report 03-25-24

true

0001389545

0001389545

2024-03-25

2024-03-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 31, 2024 (March 25, 2024)

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33678

|

68-0454536

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange On Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

NBY

|

|

NYSE American

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

On March 25, 2024, NovaBay Pharmaceuticals, Inc. (the “Company”) completed the sale of its wholly-owned subsidiary, DERMAdoctor, LLC, a Missouri limited liability company (“DERMAdoctor”).

On March 26, 2024, the Company filed a Current Report on Form 8-K (the “Initial Report”) with regard to the sale of DERMAdoctor. This amendment is being filed for the sole purpose of filing pro forma financial information pursuant to Item 9.01(b) of Form 8-K and should be read in conjunction with the Initial Report. This amendment does not amend any other item of the Initial Report or purport to provide any update, modification or discussion of any developments or events with respect to the Company subsequent to the filing date of the Initial Report except as otherwise expressly indicated. The information previously reported in, or filed with, the Initial Report is hereby incorporated by reference into this Amendment No. 1.

Item 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information

The following unaudited pro forma financial information of the Company is filed as Exhibit 99.1 to this Current Report on Form 8-K:

| |

●

|

Unaudited Pro Forma Condensed Consolidated Balance Sheet as of March 31, 2024;

|

| |

●

|

Unaudited Pro Forma Condensed Consolidated Statement of Operations for the three months ended March 31, 2024;

|

| |

●

|

Unaudited Pro Forma Condensed Consolidated Balance Sheet as of December 31, 2023;

|

| |

●

|

Unaudited Pro Forma Condensed Consolidated Statement of Operations for the year ended December 31, 2023; and

|

| |

●

|

Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements.

|

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Cautionary Language Concerning Forward-Looking Statements

The pro forma financial information in Exhibit 99.1 contains forward looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements about the commercial progress and future financial performance of the Company. Accordingly, this Amendment No. 1 contains forward-looking statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. These statements include, but are not limited to, statements regarding our current product offerings and marketing efforts, the financial impact of the Company’s recently completed divestiture of DERMAdoctor, our partnerships, and any future revenue that may result from selling our products, as well as generally the Company’s expected future financial results. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by these forward-looking statements. Other risks relating to the Company’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this Amendment No. 1, are detailed in the Company’s latest Form 10-K, as amended, and the subsequent Definitive Proxy Statements, Forms 10-Q and/or Form 8-K filings with the Securities and Exchange Commission, especially under the heading “Risk Factors.” The forward-looking statements in this Amendment No. 1 speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NovaBay Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Justin M. Hall

|

|

|

|

|

Justin M. Hall

|

|

|

|

|

Chief Executive Officer and General Counsel

|

|

Dated: May 31, 2024

Exhibit 99.1

Unaudited Pro Forma Condensed Consolidated Financial Information

On March 25, 2024, NovaBay Pharmaceuticals, Inc. (the “Company” or “NovaBay”) completed the sale of its wholly-owned subsidiary, DERMAdoctor, LLC, a Missouri limited liability company (“DERMAdoctor”) (the “DERMAdoctor Divestiture”).

The following unaudited pro forma condensed consolidated financial information has been derived from the Company’s historical consolidated financial statements and gives effect to the DERMAdoctor Divestiture. The unaudited pro forma condensed consolidated balance sheet as of March 31, 2024 reflects the Company’s actual financial position as of March 31, 2024, as the DERMAdoctor Divestiture was effective prior to that date, on March 25, 2024. The unaudited pro forma condensed consolidated balance sheet as of December 31, 2023 reflects the Company’s financial position as if the DERMAdoctor Divestiture had occurred on December 31, 2023. The unaudited pro forma condensed consolidated statement of operations for the three months ended March 31, 2024 and the year ended December 31, 2023 reflect the Company’s operating results as if the DERMAdoctor Divestiture had occurred immediately prior to January 1, 2023. In public filings, beginning with the Company’s Quarterly Report on Form 10-Q for the three-months ended March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 9, 2024 (the “March 2024 Form 10-Q”), the Company began reporting the historical financial results of DERMAdoctor in the Company’s consolidated financial statements as discontinued operations under U.S. generally accepted accounting principles (“GAAP”) for all periods presented.

The “Historical NovaBay” column of the unaudited pro forma condensed consolidated balance sheet as of December 31, 2023 and the unaudited pro forma condensed consolidated statement of operations for the three months ended March 31, 2024 reflect DERMAdoctor as discontinued operations as reported in the March 2024 Form 10-Q. The “Historical NovaBay” column in the remaining unaudited pro forma condensed consolidated financial information reflects our historical condensed consolidated financial statements as of and for each of the periods presented and does not reflect any adjustments related to the DERMAdoctor Divestiture.

The unaudited pro forma condensed consolidated financial statements and the accompanying notes should be read in conjunction with the unaudited condensed consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the March 2024 Form 10-Q and the audited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 26, 2024, as amended on March 29, 2024.

The unaudited pro forma condensed consolidated financial information is provided for illustrative purposes only and has been prepared based upon currently available information and management estimates and is subject to the assumptions and adjustments outlined herein. The unaudited pro forma financial information is not intended to be a complete presentation of the Company’s financial position or results of operations had the DERMAdoctor Divestiture occurred as of and for the periods presented. In addition, the unaudited pro forma condensed consolidated financial information is not necessarily indicative of the Company’s future results of operations or financial condition. The Company’s actual financial position and results of operations may differ materially from the pro forma amounts reflected herein due to a variety of factors. Management believes these assumptions and adjustments used are reasonable, given the information available at the filing date.

Effective May 30, 2024, the Company effected a 1-for-35 reverse split of its outstanding common stock ("Reverse Stock Split”). The unaudited pro forma condensed consolidated financial information has been adjusted, on a retroactive basis, to reflect the Reverse Stock Split.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF MARCH 31, 2024

(in thousands)

| |

|

Historical

NovaBay

|

|

|

DERMAdoctor

Discontinued

Operations

(Note 2 (a))

|

|

|

Other Pro Forma

Adjustments

|

|

Note 2

|

|

Pro Forma

NovaBay

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,823 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

1,823 |

|

|

Accounts receivable, net of allowance

|

|

|

734 |

|

|

|

- |

|

|

|

- |

|

|

|

|

734 |

|

|

Inventory, net of allowance

|

|

|

663 |

|

|

|

- |

|

|

|

- |

|

|

|

|

663 |

|

|

Prepaid expenses and other current assets

|

|

|

371 |

|

|

|

- |

|

|

|

- |

|

|

|

|

371 |

|

|

Total current assets

|

|

|

3,591 |

|

|

|

- |

|

|

|

- |

|

|

|

|

3,591 |

|

|

Operating lease right-of-use assets

|

|

|

1,212 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,212 |

|

|

Property and equipment, net

|

|

|

77 |

|

|

|

- |

|

|

|

- |

|

|

|

|

77 |

|

|

Other assets

|

|

|

477 |

|

|

|

- |

|

|

|

- |

|

|

|

|

477 |

|

|

TOTAL ASSETS

|

|

$ |

5,357 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

5,357 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,117 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

1,117 |

|

|

Accrued liabilities

|

|

|

1,266 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,266 |

|

|

Secured Convertible Notes, net of discounts

|

|

|

973 |

|

|

|

- |

|

|

|

- |

|

|

|

|

973 |

|

|

Unsecured Convertible Notes, net of discounts

|

|

|

34 |

|

|

|

- |

|

|

|

- |

|

|

|

|

34 |

|

|

Embedded derivative liability

|

|

|

159 |

|

|

|

- |

|

|

|

- |

|

|

|

|

159 |

|

|

Operating lease liabilities

|

|

|

375 |

|

|

|

- |

|

|

|

- |

|

|

|

|

375 |

|

|

Total current liabilities

|

|

|

3,924 |

|

|

|

- |

|

|

|

- |

|

|

|

|

3,924 |

|

|

Warrant liabilities

|

|

|

232 |

|

|

|

- |

|

|

|

- |

|

|

|

|

232 |

|

|

Operating lease liabilities- non-current

|

|

|

1,041 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,041 |

|

|

Total liabilities

|

|

|

5,197 |

|

|

|

- |

|

|

|

- |

|

|

|

|

5,197 |

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series B Preferred Stock

|

|

|

44 |

|

|

|

- |

|

|

|

- |

|

|

|

|

44 |

|

|

Series C Preferred Stock

|

|

|

1,441 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,441 |

|

|

Common stock

|

|

|

320 |

|

|

|

- |

|

|

|

(311 |

) |

(b)

|

|

|

9 |

|

|

Additional paid-in capital

|

|

|

176,798 |

|

|

|

- |

|

|

|

311 |

|

(b)

|

|

|

177,109 |

|

|

Accumulated deficit

|

|

|

(178,443 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

(178,443 |

) |

|

Total stockholders' equity

|

|

|

160 |

|

|

|

- |

|

|

|

- |

|

|

|

|

160 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

5,357 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

5,357 |

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(in thousands, except per share amounts)

| |

|

Historical

NovaBay

|

|

|

DERMAdoctor

Discontinued

Operations

(Note 2 (a))

|

|

|

Other Pro Forma

Adjustments

|

|

Note 2

|

|

Pro Forma

NovaBay

|

|

|

Sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net

|

|

$ |

2,624 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

2,624 |

|

|

Other revenue, net

|

|

|

7 |

|

|

|

- |

|

|

|

- |

|

|

|

|

7 |

|

|

Total sales, net

|

|

|

2,631 |

|

|

|

- |

|

|

|

- |

|

|

|

|

2,631 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

837 |

|

|

|

- |

|

|

|

- |

|

|

|

|

837 |

|

|

Gross Profit

|

|

|

1,794 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,794 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

19 |

|

|

|

- |

|

|

|

- |

|

|

|

|

19 |

|

|

Sales and marketing

|

|

|

1,055 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,055 |

|

|

General and administrative

|

|

|

2,291 |

|

|

|

- |

|

|

|

- |

|

|

|

|

2,291 |

|

|

Loss on divestiture of subsidiary

|

|

|

865 |

|

|

|

- |

|

|

|

(865 |

) |

(c)

|

|

|

- |

|

|

Total operating expenses

|

|

|

4,230 |

|

|

|

- |

|

|

|

(865 |

) |

|

|

|

3,365 |

|

|

Operating loss

|

|

|

(2,436 |

) |

|

|

- |

|

|

|

865 |

|

|

|

|

(1,571 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash gain on changes in fair value of warrant liability

|

|

|

194 |

|

|

|

- |

|

|

|

- |

|

|

|

|

194 |

|

|

Non-cash gain on change in fair value of embedded derivative liability

|

|

|

65 |

|

|

|

- |

|

|

|

- |

|

|

|

|

65 |

|

|

Accretion of interest and amortization of discounts on convertible notes

|

|

|

(433 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

(433 |

) |

|

Other expense, net

|

|

|

(480 |

) |

|

|

- |

|

|

|

(54 |

) |

(d)

|

|

|

(534 |

) |

|

Net loss from continuing operations

|

|

|

(3,090 |

) |

|

|

- |

|

|

|

811 |

|

|

|

|

(2,279 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations

|

|

|

(124 |

) |

|

|

124 |

|

|

|

- |

|

|

|

|

- |

|

|

Net loss

|

|

|

(3,214 |

) |

|

|

124 |

|

|

|

811 |

|

|

|

|

(2,279 |

) |

|

Less: Increase to accumulated deficit due to adjustment to Preferred Stock conversion price

|

|

|

380 |

|

|

|

- |

|

|

|

- |

|

|

|

|

380 |

|

|

Net loss attributable to common stockholders

|

|

$ |

(3,594 |

) |

|

$ |

124 |

|

|

$ |

811 |

|

|

|

$ |

(2,659 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share per share from continuing operations

|

|

$ |

(0.14 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share per share from discontinued operations

|

|

|

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders (basic and diluted)

|

|

$ |

(0.15 |

) |

|

|

|

|

|

|

|

|

|

|

$ |

(3.77 |

) |

|

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock (basic and diluted)

|

|

|

24,672 |

|

|

|

|

|

|

|

(23,967 |

) |

(b)

|

|

|

705 |

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF DECEMBER 31, 2023

(in thousands)

| |

|

Historical NovaBay

|

|

|

DERMAdoctor Discontinued Operations

(Note 2 (a))

|

|

|

Other Pro Forma Adjustments

|

|

Note 2

|

|

Pro Forma NovaBay

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

2,924 |

|

|

$ |

- |

|

|

$ |

1,070 |

|

(e)

|

|

$ |

3,994 |

|

|

Accounts receivable, net of allowance

|

|

|

680 |

|

|

|

- |

|

|

|

- |

|

|

|

|

680 |

|

|

Inventory, net of allowance

|

|

|

564 |

|

|

|

- |

|

|

|

- |

|

|

|

|

564 |

|

|

Prepaid expenses and other current assets

|

|

|

256 |

|

|

|

- |

|

|

|

- |

|

|

|

|

256 |

|

|

Current assets, discontinued operations

|

|

|

2,730 |

|

|

|

(2,730 |

) |

|

|

- |

|

|

|

|

- |

|

|

Total current assets

|

|

|

7,154 |

|

|

|

(2,730 |

) |

|

|

1,070 |

|

|

|

|

5,494 |

|

|

Operating lease right-of-use assets

|

|

|

1,296 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,296 |

|

|

Property and equipment, net

|

|

|

87 |

|

|

|

- |

|

|

|

- |

|

|

|

|

87 |

|

|

Other assets

|

|

|

478 |

|

|

|

- |

|

|

|

- |

|

|

|

|

478 |

|

|

Other assets, discontinued operations

|

|

|

19 |

|

|

|

(19 |

) |

|

|

- |

|

|

|

|

- |

|

|

TOTAL ASSETS

|

|

$ |

9,034 |

|

|

$ |

(2,749 |

) |

|

$ |

1,070 |

|

|

|

$ |

7,355 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

906 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

906 |

|

|

Accrued liabilities

|

|

|

1,169 |

|

|

|

- |

|

|

|

525 |

|

(e)

|

|

|

1,694 |

|

|

Secured Convertible Notes, net of discounts

|

|

|

1,137 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,137 |

|

|

Unsecured Convertible Notes, net of discounts

|

|

|

- |

|

|

|

- |

|

|

|

34 |

|

(e)

|

|

|

34 |

|

|

Embedded derivative liabilities

|

|

|

- |

|

|

|

- |

|

|

|

224 |

|

(e)

|

|

|

224 |

|

|

Operating lease liabilities

|

|

|

368 |

|

|

|

- |

|

|

|

- |

|

|

|

|

368 |

|

|

Current liabilities, discontinued operations

|

|

|

698 |

|

|

|

(698 |

) |

|

|

- |

|

|

|

|

- |

|

|

Total current liabilities

|

|

|

4,278 |

|

|

|

(698 |

) |

|

|

783 |

|

|

|

|

4,363 |

|

|

Warrant liabilities

|

|

|

334 |

|

|

|

- |

|

|

|

92 |

|

(e)

|

|

|

426 |

|

|

Operating lease liabilities- non-current

|

|

|

1,108 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,108 |

|

|

Total liabilities

|

|

|

5,720 |

|

|

|

(698 |

) |

|

|

875 |

|

|

|

|

5,897 |

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net book value of DERMAdoctor as of December 31, 2023

|

|

|

- |

|

|

|

(2,051 |

) |

|

|

2,051 |

|

(e)

|

|

|

- |

|

|

Preferred stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series B Preferred Stock

|

|

|

275 |

|

|

|

- |

|

|

|

- |

|

|

|

|

275 |

|

|

Series C Preferred Stock

|

|

|

1,675 |

|

|

|

- |

|

|

|

- |

|

|

|

|

1,675 |

|

|

Common stock

|

|

|

112 |

|

|

|

- |

|

|

|

(109 |

) |

(b)

|

|

|

3 |

|

|

Additional paid-in capital

|

|

|

176,101 |

|

|

|

- |

|

|

|

109 |

|

(b)

|

|

|

176,210 |

|

|

Accumulated deficit

|

|

|

(174,849 |

) |

|

|

- |

|

|

|

(1,856 |

) |

(e)

|

|

|

(176,705 |

) |

|

Total stockholders' equity

|

|

|

3,314 |

|

|

|

(2,051 |

) |

|

|

195 |

|

|

|

|

1,458 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

9,034 |

|

|

$ |

(2,749 |

) |

|

$ |

1,070 |

|

|

|

$ |

7,355 |

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2023

(in thousands, except per share amounts)

| |

|

Historical

NovaBay

|

|

|

DERMAdoctor

Discontinued

Operations

(Note 2 (a))

|

|

|

Other Pro Forma

Adjustments

|

|

Note 2

|

|

Pro Forma

NovaBay

|

|

|

Sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net

|

|

$ |

14,687 |

|

|

$ |

(3,552 |

) |

|

$ |

- |

|

|

|

$ |

11,135 |

|

|

Other revenue, net

|

|

|

39 |

|

|

|

- |

|

|

|

- |

|

|

|

|

39 |

|

|

Total sales, net

|

|

|

14,726 |

|

|

|

(3,552 |

) |

|

|

- |

|

|

|

|

11,174 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

6,831 |

|

|

|

(2,335 |

) |

|

|

- |

|

|

|

|

4,496 |

|

|

Gross Profit

|

|

|

7,895 |

|

|

|

(1,217 |

) |

|

|

- |

|

|

|

|

6,678 |

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

68 |

|

|

|

(34 |

) |

|

|

- |

|

|

|

|

34 |

|

|

Sales and marketing

|

|

|

6,500 |

|

|

|

(1,795 |

) |

|

|

- |

|

|

|

|

4,705 |

|

|

General and administrative

|

|

|

6,330 |

|

|

|

(742 |

) |

|

|

- |

|

|

|

|

5,588 |

|

|

Goodwill, intangible and other asset impairment

|

|

|

2,593 |

|

|

|

(2,593 |

) |

|

|

- |

|

|

|

|

- |

|

|

Total operating expenses

|

|

|

15,491 |

|

|

|

(5,164 |

) |

|

|

- |

|

|

|

|

10,327 |

|

|

Operating loss

|

|

|

(7,596 |

) |

|

|

3,947 |

|

|

|

- |

|

|

|

|

(3,649 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash gain on changes in fair value of warrant liability

|

|

|

272 |

|

|

|

- |

|

|

|

- |

|

|

|

|

272 |

|

|

Non-cash gain on changes in fair value of embedded derivative liability

|

|

|

40 |

|

|

|

- |

|

|

|

- |

|

|

|

|

40 |

|

|

Non-cash loss on modification of common stock warrants

|

|

|

(292 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

(292 |

) |

|

Other expense, net

|

|

|

(2,064 |

) |

|

|

1 |

|

|

|

(100 |

) |

(d)

|

|

|

(2,163 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(9,640 |

) |

|

|

3,948 |

|

|

|

(100 |

) |

|

|

|

(5,792 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Increase to accumulated deficit due to adjustment to Preferred Stock conversion prices

|

|

|

7,057 |

|

|

|

- |

|

|

|

- |

|

|

|

|

7,057 |

|

|

Net loss attributable to common stockholders

|

|

$ |

(16,697 |

) |

|

$ |

3,948 |

|

|

$ |

(100 |

) |

|

|

$ |

(12,849 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders (basic and diluted)

|

|

$ |

(3.96 |

) |

|

|

|

|

|

|

|

|

|

|

$ |

(107.08 |

) |

|

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock (basic and diluted)

|

|

|

4,215 |

|

|

|

|

|

|

|

(4,095 |

) |

(b)

|

|

|

120 |

|

Note 1. Basis of Presentation

The unaudited pro forma condensed consolidated financial information has been prepared based on NovaBay’s historical consolidated financial statements and in accordance with Article 11 of SEC Regulation S-X, Pro Forma Financial Information.

Note 2. Pro Forma Adjustments and Assumptions

|

(a)

|

Column gives effect to the DERMAdoctor Divestiture and has been prepared in accordance with the guidance for discontinued operations, ASC 205-20 Presentation of Financial Statements – Discontinued Operations, under U.S. Generally Accepted Accounting Principles.

|

|

(b)

|

Reflects the estimated retroactive effect of the Reverse Stock Split.

|

|

(c)

|

Offsets the actual loss recognized on the DERMAdoctor Divestiture.

|

|

(d)

|

Reflects the net impact on interest expense as if the Unsecured Convertible Notes and March 2024 Warrant (both as defined in the March 2024 Form 10-Q) were issued immediately prior to January 1, 2023, rather than March 25, 2024. The Unsecured Convertible Notes and March 2024 Warrant were issued to obtain the consent of Secured Convertible Note (as defined in the March 2024 Form 10-Q) holders and was required in order to close the DERMAdoctor Divestiture.

|

|

(e)

|

Reflects the impacts of the DERMAdoctor Divestiture as if it occurred on December 31, 2023 as shown in the table below (in thousands):

|

|

Cash purchase price

|

|

$ |

1,070 |

|

|

Less: DERMAdoctor net book value as of December 31, 2023

|

|

|

(2,051 |

) |

|

Pro forma loss on divestiture of subsidiary as of December 31, 2023

|

|

|

(981 |

) |

| |

|

|

|

|

|

Less: Cash transaction expenses incurred subsequent to December 31, 2023

|

|

|

395 |

|

| |

|

|

|

|

|

Less: Cost incurred to obtain note holder consent subsequent to December 31, 2023:

|

|

|

|

|

|

Unsecured convertible notes, net, issued

|

|

|

34 |

|

|

Embedded derivative liabilities issued

|

|

|

224 |

|

|

Warrants issued

|

|

|

92 |

|

|

Issuance costs incurred

|

|

|

130 |

|

|

Total

|

|

|

480 |

|

| |

|

|

|

|

|

Net impact to Accumulated deficit

|

|

$ |

(1,856 |

) |

v3.24.1.1.u2

Document And Entity Information

|

Mar. 25, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Mar. 25, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A date of report 03-25-24

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

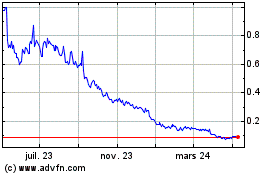

NovaBay Pharmaceuticals (AMEX:NBY)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024