false

0001476963

0001476963

2024-01-26

2024-01-26

0001476963

us-gaap:CommonStockMember

2024-01-26

2024-01-26

0001476963

NHWK:CommonStockPurchaseRightsMember

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

January 26, 2024

NightHawk Biosciences, Inc.

(Exact name of registrant as specified in

charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-35994 |

26-2844103 |

| (Commission File Number) |

(IRS Employer Identification No.) |

627

Davis Drive, Suite

300

Morrisville, North Carolina 27560

(Address of principal executive offices and

zip code)

(919) 240-7133

(Registrant’s telephone number including

area code)

N/A

(Former Name and Former Address)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0002 par value per share |

NHWK |

NYSE American LLC |

| Common Stock Purchase Rights |

None |

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ¨ |

|

If an emerging growth company, indicate by

checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On January 29, 2024, NightHawk Biosciences,

Inc., a Delaware corporation (the “Company”), entered into a Patent Rights Sale and Assignment Agreement with Kopfkino IP,

LLC (“Patent Agreement”). Pursuant to the Patent Agreement, in exchange for $1,000,000, the Company has assigned its right,

title and interest in and under the exclusive license agreement it entered into with Shattuck Labs, Inc. (“Shattuck”)

in 2016, including its rights to certain provisional patent applications and know-how related to fusion proteins to treat cancer and other

diseases that were not being developed by the Company.

On

January 26, 2024 in accordance with the terms of that certain Asset and Equity Interests Purchase Agreement, dated December 11, 2023

(the “Agreement”), with Elusys Holdings Inc. (“Elusys”), Elusys purchased from the Company a convertible promissory

note in the aggregate amount of $2,250,000 (the “Note”), the conversion of which is subject to both Elusys’ election

and obtaining stockholder approval of the issuance of shares of the Company’s common stock upon such conversion. The Note bears

interest at a rate of 1% per annum, matures on the one-year anniversary of its issuance and converts into shares of the Company’s

common stock at the option of Elusys only if stockholder approval of the issuance of such shares of common stock issuable upon conversion

of the Note is obtained prior to the maturity date. The conversion price is $0.39281, which is equal to 110% of the volume weighted average

price (VWAP) of the Company’s common stock for the seven trading days prior to December 11, 2023. Based upon such conversion price

Elusys would be issued 5,727,960 shares of the Company’s common stock upon conversion of the Note. Notwithstanding the foregoing,

if the Company consummates a public financing, subject to certain exceptions, within sixty days of December 11, 2023, the conversion

price will be adjusted to be 110% of the per share purchase price of the common stock in such public financing. Such adjustment will

only be made upon the first financing in the event of multiple financings during the foregoing period.

The foregoing description of the terms of the

Patent Agreement, the Agreement and Note do not purport to be complete and are qualified in its entirety by reference to the full text

of such agreements, copies of which are attached hereto as Exhibit 2.1, 4.1 and 10.1 respectively, and each of which is incorporated herein

in its entirety by reference.

Item 2.03 Creation of a Direct Financial Obligation Or an Obligation

under an Off Balance Sheet Arrangement of a Registrant

The information

set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference into this Item 2.03 in its entirety.

Item 3.02 Unregistered Sales of Equity Securities.

The information set

forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference into this Item 3.02 in its entirety. The Note

and the shares of common stock that may be issued under the Note are being offered and sold in a transaction exempt from registration

under the Securities Act in reliance on Section 4(a)(2) thereof and/or Rule 506(b) of Regulation D thereunder.

Item 7.01 Regulation FD Disclosure.

On January 30, 2024, the

Company issued a press release announcing its entry into the Patent Agreement and the issuance of the Note. A copy of the press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information in this Item 7.01 and in the press release furnished

as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities

Act of 1933, as amended and shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made

by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The

press release furnished as Exhibit 99.1 to this Current Report on Form 8-K includes “safe harbor” language pursuant to the

Private Securities Litigation Reform Act of 1995, as amended, indicating that certain statements contained therein are “forward-looking”

rather than historical.

Item 9.01 Financial Statements and Exhibits.

| |

|

|

Exhibit

Number |

|

Description |

| |

|

|

2.1

|

|

Asset and Equity Interests Purchase Agreement by and

between NightHawk Biosciences, Inc. and Elusys Holdings Inc., dated as December 11, 2023 (incorporated by reference to the Current

Report on Form 8-K filed with the Securities and Exchange Commission on December 12, 2023 (File No. 001-35994) |

| 4.1 |

|

Note in the principal amount of $2,250,000 issued to Elusys Holdings Inc. |

| 10.1 |

|

Patent Rights Sale and Assignment Agreement between NightHawk Biosciences, Inc. and Kopfkino IP, LLC |

| 99.1 |

|

Press Release issued by NightHawk Biosciences, Inc. January 3 , 2024. |

| 104 |

|

Cover Page Interactive Data

File (formatted in Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 30, 2024 |

NightHawk Biosciences, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Jeff Wolf |

| |

Name: |

Jeff Wolf |

| |

Title: |

Chief Executive Officer |

Exhibit 4.1

NEITHER THIS

SECURITY NOR THE SECURITIES INTO WHICH THIS SECURITY IS CONVERTIBLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION

OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS

OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

| Original Issue Date: January 26, 2024 |

$2,250,000 |

CONVERTIBLE

PROMISSORY NOTE

THIS

CONVERTIBLE PROMISSORY NOTE (the “Note”) is issued by NightHawk Biosciences, Inc., a Delaware corporation (the “Company”).

FOR

VALUE RECEIVED, the Company promises to pay to Elusys Holdings Inc. or its registered assigns (the “Holder”),

the principal amount of Two Million Two Hundred Fifty Thousand Dollars ($2,250,000) (“Principal Amount”) together

with simple interest on the outstanding Principal Amount at a rate of 1% per annum until paid in full or converted. Interest shall be computed on the basis

of a year of 365 days for the actual number of days elapsed. Unless

earlier converted into Common Stock as provided in this Note, all payments of interest and principal under the Note shall be in lawful

money of the United States of America. This Note is subject to the following additional provisions:

Section 1. Definitions.

For the purposes hereof, (a) capitalized terms not otherwise defined herein shall have the meanings set forth in the Purchase Agreement

and (b) the following terms shall have the following meanings:

“Bankruptcy

Event” means any of the following events: (a) the Company or any Significant Subsidiary (as such term is defined in Rule 1-02(w)

of Regulation S-X) thereof commences a case or other proceeding under any bankruptcy, reorganization, arrangement, adjustment of debt,

relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction relating to the Company or any Significant

Subsidiary thereof, (b) there is commenced against the Company or any Significant Subsidiary thereof any such case or proceeding that

is not dismissed within 60 days after commencement, (c) the Company or any Significant Subsidiary thereof is adjudicated insolvent or

bankrupt or any order of relief or other order approving any such case or proceeding is entered, (d) the Company or any Significant Subsidiary

thereof suffers any appointment of any custodian or the like for it or any substantial part of its property that is not discharged or

stayed within 60 days after such appointment, (e) the Company or any Significant Subsidiary thereof makes a general assignment for the

benefit of creditors, or (f) the Company or any Significant Subsidiary thereof, by any act or failure to act, expressly indicates

its consent to, approval of or acquiescence in any of the foregoing or takes any corporate or other action for the purpose of effecting

any of the foregoing.

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day

on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Common

Stock” shall mean the common stock, par value $0.0002 per share, of the Company.

“Company

Stockholder Meeting” shall mean the meeting at which holders of the Company’s Common Stock vote on whether to approve

the Conversion.

“Conversion”

shall have the meaning ascribed to such term in Section 2.

“Conversion

Date” means the date specified in the Conversion Notice as the effective date of the Conversion and if no date is specified

then the Conversion Date shall be the date the Conversion Notice is deemed delivered pursuant to Section 6(b); provided, however that

the Conversion Date shall not be prior to the date on which Stockholder Approval is received and deemed effective under Delaware General

Corporation Law.

“Conversion

Notice” shall have the meaning set forth in Section 2(c).

“Conversion

Price” shall have the meaning set forth in Section 2(b).

“Conversion

Price Adjustment” shall have the meaning set forth in Section 2(b).

“Conversion

Shares” means, collectively, the shares of Common Stock issuable upon conversion of Principal Amount of this Note and all accrued

and unpaid interest thereon in accordance with the terms hereof.

“Event

of Default” shall have the meaning set forth in Section 5(a).

“Financing

Period” shall have the meaning set forth in Section 2(b).

“Maturity

Date” shall have the meaning set forth in Section 3.

“Original

Issue Date” means the date of the first issuance of the Note, regardless of any transfers of the Note and regardless of the

number of instruments which may be issued to evidence such Note.

“Outstanding

Balance” shall mean the Principal Amount of this Note and any accrued and unpaid interest as of the applicable date.

“Principal

Amount” means Two Million, Two Hundred Fifty Thousand Dollars ($2,250,000).

“Purchase

Agreement” means the Asset and Equity Purchase Agreement, dated as of December 11, 2023 between the Company and the Holder,

as amended, modified or supplemented from time to time in accordance with its terms.

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Shareholder

Approval” means such approval as may be required by the applicable rules and regulations of the NYSE American, LLC (or any

successor entity) from the stockholders of the Company with respect to conversion of all outstanding amounts owed under this Note and

the issuance of all of the Conversion Shares upon conversion thereof.

“Trading

Day” means a day on which the principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: the NYSE American, LLC, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New

York Stock Exchange (or any successors to any of the foregoing).

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30

a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the OTCQB Venture Market (“OTCQB”) or the OTCQX

Best Market (“OTCQX”) is not a Trading Market, the volume weighted average price of the Common Stock for such date

(or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on

OTCQB or OTCQX and if prices for the Common Stock are then reported on the Pink Open Market (“Pink Market”) operated

by OTC Markets, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price

per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined

by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which

shall be paid by the Company.

Section

2. Conversion.

(a)Conversion

upon Shareholder Approval. If prior to the Maturity Date, Shareholder Approval is obtained, the Outstanding Balance on the

Conversion Date shall, upon the election of the Holder, at any time after Shareholder Approval is obtained, convert in whole or in part,

without any further action of the Holder into a number of fully paid and nonassessable shares of Common Stock as shall equal the quotient

obtained by dividing (i) the Outstanding Balance by (ii) the Conversion Price in effect at the time of such conversion. Notwithstanding

anything in this Note to the contrary, this Note may not be converted into shares of Common Stock unless Shareholder Approval is obtained.

(b)Conversion

Price. The “Conversion Price” means 110% of the VWAP for the seven (7) Trading Days prior to the date of the

Purchase Agreement; provided, however, that if the Company consummates a public financing involving an issuance

of the Company’s Common Stock (which shall exclude any at-the-market public offering by the Company) within sixty (60) days of

the date of the Purchase Agreement (the “Financing Period”), the Conversion Price shall be 110% of the per-share purchase

price of the Common Stock in such public financing transaction (such adjustment to the Conversion Price, the “Conversion Price

Adjustment”); provided further, however, that if multiple public financings involving an issuance of

the Company’s Common Stock occur within Financing Period, the Conversion Price Adjustment shall only occur upon the consummation

of the first such financing and upon no subsequent financings.

(c)Mechanics

of Conversion.

(i)Delivery

of Shares Upon Conversion. The Holder may elect at any time after obtaining Shareholder Approval and while the Outstanding Balance

remains outstanding to convert the Outstanding Balance in full into shares of Common Stock by providing written notice (the “Conversion

Notice”) to the Company together with the delivery of this Note to the Company at its address as required pursuant to Section

6(b). Any conversion of this Note pursuant to Section 2(a) shall be deemed to have been made immediately as of the close of business

on the Conversion Date. Not later than three (3) Business Days after Conversion Date (the “Share Delivery Date”), the

Company shall (1) provided the Transfer Agent is participating in the DTC Fast Automated Securities Transfer Program, credit such aggregate

number of Conversion Shares to which the Holder shall be entitled pursuant to such conversion to the Holder’s or its designee’s

balance account with DTC through its Deposit/Withdrawal at Custodian system, or (2) if the Transfer Agent is not participating in the

DTC Fast Automated Securities Transfer Program, upon the request of the Holder, issue in book entry form the Conversion Shares, registered

in the name of the Holder or his designee, for the number of Conversion Shares to which the Holder shall be entitled pursuant to such

conversion under this Section 2(c), which shares shall bear a restrictive legend until they are eligible to be sold under Rule 144 without

the need for current public information and the Company has received an opinion of counsel to such effect reasonably acceptable to the

Company (which opinion the Company will be responsible for obtaining at its own cost), shall be free of restrictive legends and trading

restrictions. Notwithstanding anything contained herein to the contrary, this Note shall not be converted unless and until the Holder

elects to convert this Note, in whole or in part, pursuant to Section 2(a).

Any certificates

representing shares of Common Stock issued pursuant to this Section 2 shall bear the following legend:

THE SECURITIES

REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES

LAWS OF CERTAIN STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED

UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS IN ACCORDANCE WITH APPLICABLE REGISTRATION REQUIREMENTS OR AN EXEMPTION THEREFROM.

THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE OR TRANSFER,

PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS. THIS CERTIFICATE MUST BE SURRENDERED

TO THE COMPANY OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, TRANSFER, PLEDGE OR HYPOTHECATION OF ANY INTEREST IN ANY OF

THE SECURITIES REPRESENTED HEREBY.

(ii)Fractional

Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of this Note. In lieu

of any fractional share to which Holder would otherwise be entitled, the Company will pay to Holder in cash the amount of the unconverted principal and interest

balance of this Note that would otherwise be converted into such fractional share.

(iii)Transfer

Taxes and Expenses. The issuance of shares of the Common Stock on conversion of this Note shall be made without charge to the Holder

hereof for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificates, provided

that, the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery

of any such certificate upon conversion in a name other than that of the Holder of this Note so converted and the Company shall not be

required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid

to the Company the amount of such tax or shall have established to the satisfaction of the Company that such tax has been paid. The Company

shall pay all Transfer Agent fees required for same-day processing of any Conversion Notice and all fees to the Depository Trust Company

(or another established clearing corporation performing similar functions) required for same-day electronic delivery of the Conversion

Shares.

(iv)Release.

Upon full conversion of this Note and the payment of the amounts specified in paragraph (c) above, the Company shall be forever released

from all its obligations and liabilities under this Note.

Section

3. Maturity

Unless

this Note has been converted in accordance with the terms of Section 2 above on or prior to the first anniversary of the Original Issue

Date (the “Maturity Date”), then upon the Maturity Date, the entire outstanding Principal Balance

and all accrued interest of this Note shall become fully due and payable at the request of Holder.

Section

4. Certain Adjustments.

(a)

If the Company at any time subdivides (by any stock split, stock dividend, recapitalization,

reorganization, reclassification or otherwise) the shares of Common Stock acquirable hereunder into a greater number of shares, then,

after the date of record for effecting such subdivision, the Conversion Price in effect immediately prior to such subdivision will be

proportionately reduced. If the Company at any time combines (by any reverse stock split, recapitalization, reorganization, reclassification

or otherwise) the shares of Common Stock acquirable hereunder into a smaller number of shares, then, after the date of record for effecting

such combination, the Conversion Price in effect immediately prior to such combination will be proportionately increased.

(b)

Upon the occurrence of each adjustment or readjustment of the Conversion Rate as a result of

the events described in this Section 4, the Company, at its expense, shall compute such adjustment or readjustment and prepare and furnish

to the Holder a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment

or readjustment is based. Failure to give such notice or any defect therein shall not affect the legality or validity of the subject

adjustment.

Section 5. Events

of Default.

(a)

The Company must notify the Holder within one (1) Business Day after it has become aware of

an Event of Default. If there shall be any Event of Default hereunder, at the option and upon the declaration of the Holder

and upon written notice to the Company (which declaration and notice shall not be required in the case of an Event of

Default under this Section 5(b)), this Note shall accelerate and the Outstanding Balance shall become due and payable. The occurrence

of any one or more of the following shall constitute an Event of Default:

| |

(i) |

The

Company fails to pay timely any of the principal amount due under this Note on the date the same becomes due and payable or any accrued

interest or other amounts due under this Note on the date the same becomes due and payable; |

| |

(ii) |

There

is a Bankruptcy Event. |

| |

|

|

|

|

|

(b)

If any Event of Default occurs, the outstanding principal amount of this Note and all other

amounts owing in respect thereof through the date of acceleration, shall become, at the Holder’s election, immediately due and

payable in cash. Upon the payment in full of such amounts, the Holder shall promptly surrender this Note to or as directed by the Company.

In connection with such acceleration described herein, the Holder need not provide, and the Company hereby waives, any presentment, demand,

protest or other notice of any kind, and the Holder may immediately and without expiration of any grace period enforce any and all of

its rights and remedies hereunder and all other remedies available to it under applicable Law. Such acceleration may be rescinded and

annulled by Holder at any time prior to payment hereunder and the Holder shall have all rights as a holder of the Note until such time,

if any, as the Holder receives full payment pursuant to this Section 5(b). No such rescission or annulment shall affect any subsequent

Event of Default or impair any right consequent thereon. Notwithstanding anything to the contrary contained in this Note, once the Shareholder

Approval is received, Holder shall not have any right to accelerate payment and the Note shall be automatically converted.

Section

6.Miscellaneous.

(a)No

Rights as Stockholder Until Conversion. This Note does not entitle the Holder to any voting rights, or other rights as a stockholder

of the Company prior to the conversion hereof other than as explicitly set forth in Section 4.

(b)Notices.

All notices, offers, acceptance and any other acts under this Agreement (except payment) shall be in writing, and shall be sufficiently

given if delivered to the addressees in person, by Federal Express or similar receipted next business day delivery, as follows:

| |

If

to the Company: |

NightHawk

Biosciences, Inc. |

| |

|

627 Davis Drive, Suite 300

Morrisville, NC 27560

Attention: William Ostrander, CFO

E-mail: wostrander@nighthwkbio.com

with a copy to:

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Attention: Leslie Marlow, Esq.

Telephone No.: (212) 885-5358

E-mail: Leslie.Marlow@BlankRome.com |

| |

|

|

| |

If

to Holder: |

Address on signature page |

627 Davis

Drive, Suite 300

Morrisville,

North Carolina

or to such other address as any of

them, by notice to the other may designate from time to time. Time shall be counted to, or from, as the case may be, the date of delivery.

(c)Absolute

Obligation; Ranking. Except as expressly provided herein, no provision of this Note shall alter or impair the obligation of the Company,

which is absolute and unconditional, to pay the principal of and accrued interest on this Note at the time, place, and rate, and in the

coin or currency, herein prescribed. This Note is a direct debt obligation of the Company.

(d)Lost

or Mutilated Note. If this Note shall be mutilated, lost, stolen or destroyed, the Company shall execute and deliver, in exchange

and substitution for and upon cancellation of a mutilated Note, or in lieu of or in substitution for a lost, stolen or destroyed Note,

a new Note for the principal amount of this Note so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss,

theft or destruction of such Note, and of the ownership hereof, reasonably satisfactory to the Company. The applicant for a new

Note under such circumstances shall also pay any reasonable third-party costs (including customary indemnity) associated with the issuance

of the new Note.

(e)Exclusive

Jurisdiction; Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Note shall

be governed by and construed and enforced in accordance with the internal laws of the State of Delaware, without regard to the principles

of conflict of laws thereof. All Actions arising out of or relating to this Note shall be heard and determined exclusively in the Court

of Chancery of the State of Delaware and any state appellate court therefrom within the State of Delaware (or in the event, but only

in the event, that the Court of Chancery of the State of Delaware does not have jurisdiction, the Superior Court of the State of Delaware

or the United States District Court for the District of Delaware and the appellate court(s) therefrom). The parties hereto hereby

(a) irrevocably submit to the exclusive jurisdiction of the Court of Chancery of the State of Delaware and any state appellate court

therefrom within the State of Delaware (or in the event, but only in the event, that if the Court of Chancery of the State of Delaware

does not have jurisdiction, the Superior Court of the State of Delaware or the United States District Court for the District of Delaware

and the appellate court(s) therefrom) for the purpose of any Action arising out of or relating to this Note or the transactions brought

by any party hereto, (b) irrevocably waive, and agree not to assert by way of motion, defense or otherwise, in any such Action, any claim

that it is not subject personally to the jurisdiction of the above named courts, that its property is exempt or immune from attachment

or execution, that the Action is brought in an inconvenient forum, that the venue of the Action is improper, or that this Note may not

be enforced in or by the above-named courts, and (c) agree that such party will not bring any Action arising out of or relating to this

Note in any court other than the Court of Chancery of the State of Delaware (or in the event, but only in the event, that if the Court

of Chancery of the State of Delaware does not have jurisdiction, the Superior Court of the State of Delaware or the United States District

Court for the District of Delaware and the appellate court(s) therefrom). Process in any such Action may be served on any party anywhere

in the world, whether within or without the jurisdiction of any such court. Without limiting the foregoing, each party agrees that service

of process on such party as provided in Section 6(b) shall be deemed effective service of process on such party. Nothing contained herein

shall be deemed to limit in any way any right to serve process in any other manner permitted by applicable Law. Each party hereto hereby

irrevocably waives, to the fullest extent permitted by applicable Law, any and all right to trial by jury in any legal proceeding arising

out of or relating to this Note or the transactions contemplated hereby.

(f)Waiver.

Any waiver by the Company or the Holder of a breach of any provision of this Note shall not operate as or be construed to be a waiver

of any other breach of such provision or of any breach of any other provision of this Note. The failure of the Company or the Holder

to insist upon strict adherence to any term of this Note on one or more occasions shall not be considered a waiver or deprive that party

of the right thereafter to insist upon strict adherence to that term or any other term of this Note on any other occasion. Any waiver

by the Company or the Holder must be in writing.

(g)Severability.

If any provision of this Note is invalid, illegal or unenforceable, the balance of this Note shall remain in effect, as long as the essential

terms and conditions of this Note for each party remain valid, binding, and enforceable.

(h)Remedies,

Characterizations, Other Obligations, Breaches and Injunctive Relief. The remedies provided in this Note shall be cumulative

and in addition to all other remedies available under this Note at Law or in equity (including a decree of specific performance and/or

other injunctive relief), and nothing herein shall limit the Holder’s right to pursue actual and consequential damages for any

failure by the Company to comply with the terms of this Note. Amounts set forth or provided for herein with respect to payments,

conversion and the like (and the computation thereof) shall be the amounts to be received by the Holder and shall not, except as expressly

provided herein, be subject to any other obligation of the Company (or the performance thereof). The Company acknowledges that a breach

by it of its obligations hereunder will cause irreparable harm to the Holder and that the remedy at Law for any such breach would be

inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach, the Holder shall be entitled, in

addition to all other available remedies, to an injunction restraining any such breach or any such threatened breach, without the necessity

of showing economic loss and without any bond or other security being required. The Company shall provide all information and documentation

to the Holder that is reasonably requested by the Holder to enable the Holder to confirm the Company’s compliance with the terms

and conditions of this Note.

(i)Next

Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall

be made on the next succeeding Business Day.

(j)Authorized

Shares. The Company covenants that, subject to and following its receipt of Shareholder Approval, during the period the Note is outstanding

it will reserve from its authorized and unissued Common Stock, free of preemptive rights, a sufficient number of shares equal to the

number of shares of Common Stock issuable upon conversion of this Note. The Company will take all such commercially reasonable action

as may be necessary to assure that the Conversion Shares may be issued as provided herein without violation of any applicable law or

regulation, or of any requirements of the NYSE American or any other trading market upon which the Common Stock may be listed. The

Company covenants that all Conversion Shares will, upon exercise of the purchase rights represented by this Note, be duly authorized,

validly issued, fully paid and non-assessable and free from all taxes, liens and charges created by the Company in respect of the issue

thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

Except

and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending

its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale

of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Note,

but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary

or appropriate to protect the rights of Holder as set forth in this Note against impairment. Without limiting the generality of

the foregoing, the Company will (i) not increase the par value of any shares of Common Stock issuable upon conversion of this Note above

the amount payable therefor upon such exercise immediately prior to such increase in par value; (ii) take all such action as may be necessary

or appropriate in order that the Company may validly and legally issue fully paid and nonassessable shares of Common Stock issuable upon

conversion of this Note upon the conversion of this Note; and (iii) use commercially reasonable efforts to obtain all such authorizations,

exemptions or consents from any public regulatory body having jurisdiction thereof, as may be, necessary to enable the Company to perform

its obligations under this Note.

(Signature

Pages Follow)

IN

WITNESS WHEREOF, the Company has caused this Note to be duly executed by a duly authorized officer as of the date first above indicated.

NIGHTHAWK

BIOSCIENCES, INC.

|

By: /s/ William Ostrander

Name: William Ostrander

Title: Chief Financial Officer |

ANNEX A

NOTICE OF

CONVERSION

The undersigned

hereby elects to convert principal under the Convertible Promissory Note issued by NightHawk Biosciences, Inc., a Delaware corporation

(the “Company”) on January 26, 2024, into shares of common stock (the “Common Stock”), of the Company according

to the conditions hereof, as of the date written below. If shares of Common Stock are to be issued in the name of a person other than

the undersigned, the undersigned will pay all transfer taxes payable with respect thereto and is delivering herewith such certificates

and opinions as reasonably requested by the Company in accordance therewith. No fee will be charged to the holder for any conversion,

except for such transfer taxes, if any.

The undersigned

agrees to comply with applicable securities laws in connection with any transfer of the aforesaid shares of Common Stock.

Conversion calculations:

Date

to Effect Conversion:

Amount

of Note to be Converted:

Number

of shares of Common Stock to be issued:

Signature:

Name:

Schedule 1

CONVERSION

SCHEDULE

The Convertible

Promissory Note issued on January 26, 2024 in the original principal amount of $2,250,000 by NightHawk Biosciences, Inc., a Delaware

corporation. This Conversion Schedule reflects conversions made under Section 2 of the above referenced Note.

Date

of Conversion

(or for first

entry, Original Issue Date) |

Amount

of Converted Principal |

Aggregate

Amount Remaining Subsequent to Conversion |

Applicable

Conversion Price |

Company

Attest |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Dated:

Exhibit 10.1

PATENT RIGHTS SALE AND ASSIGNMENT AGREEMENT

This PATENT RIGHTS SALE

AND ASSIGNMENT AGREEMENT (“Agreement”) is made and entered into as of January 29, 2024 (the “Closing Date”) by

and between NightHawk Biosciences, Inc., f/k/a Heat Biologics, Inc., a Delaware corporation with a principal executive office at 627 Davis

Drive, Suite 300, Morrisville, North Carolina 27560 (together with its Affiliates, “Assignor”) and Kopfkino IP, LLC, a Texas

limited liability company with a registered office at 501 Congress Ave, Suite 150, Austin, Texas 78701 (“Assignee”).

WHEREAS, Effective June

3, 2016, Assignor and Shattuck Labs, Inc., a Delaware corporation (“Shattuck”) entered into an Exclusive License (together

with any amendments thereto, the “Exclusive License”) providing for the license of certain intellectual property assets (the

“Shattuck Patents”) to Shattuck in exchange for the right to receive royalty payments and other rights and benefits, as more

fully set forth therein (together with the Shattuck Patents and the Exclusive License, the “Shattuck Patent Rights”);

WHEREAS, Effective

May 3, 2022, and as set forth in an SEC filing of the same date, Assignor changed its name to NightHawk Biosciences, Inc.;

WHEREAS, Subject to the

terms of this Agreement, Assignor desires to assign and Assignee desires to assume Assignor’s rights and obligations pursuant to

the Exclusive License.

THEREFORE, in consideration

of the terms of this Agreement and other valuable consideration, the receipt and sufficiency whereof is hereby acknowledged the parties

agree as follows.

1.1

Purchase Price. In consideration for this Agreement, including the assignment of Assignor’s

entire right, title and interest in and to the Shattuck Patent Rights as set forth in the Exclusive License, Assignee hereby delivers

to Assignor in immediately available funds One Million Dollars ($1,000,000 (USD)) (the “Purchase Price”). For purposes of

clarity, any fee or other payment required by Shattuck to obtain the Shattuck Consent shall have been paid as of the Closing Date by directly

to Shattuck by Assignee and Assignor shall not have any liability or obligation to pay any such amounts.

2.1

Transfer of Rights. Upon receipt of the Purchase Price and as of the Closing Date, Assignor

assigns and transfers to Assignee all of Assignor’s right, title, and interest in the Exclusive License, including the Shattuck

Patent Rights and all legal claims related to the Shattuck Patent Rights held by Assignor, including Assignor’s right to sue for

past infringement of the Shattuck Patents, if any. Assignor authorizes and requests the Commissioner for Patents of the United States,

and any official of any country or countries foreign to the United States, whose duty it is to issue patents or other evidence or forms

of intellectual property protection on applications for such protection, to issue the same to Assignee, its successors, legal representatives,

and assigns, in accordance with the terms of this Agreement.

3.1

Further Documentation. Assignor hereby agrees to execute and deliver any and all further documents

and instruments and perform any additional acts that may be necessary or appropriate to effectuate and perform its obligations under this

Agreement and the transactions contemplated hereby, including to confirm or record the assignment and transfer of the Shattuck Patents.

Without limitation, the Parties shall execute contemporaneously with the execution of this Agreement, one or more company-to-company patent

assignments with respect to the Shattuck Patents in existence as of the Closing Date in a form reasonably acceptable to the parties.

4.1

Shattuck Consent. A consent in a form reasonably acceptable to the parties (the “Shattuck

Consent”) has been executed by Shattuck and the parties hereto and the executed Shattuck Consent has been delivered to the parties

hereto.

5.1

Representations and Warranties of Assignor. Assignor represents and warrants the following:

a.

That it is duly organized, validly existing, and in good standing under the laws of the jurisdiction

in which it was organized and has all requisite power and authority to conduct its business as presently conducted.

b.

That it has all requisite power and authority to execute and deliver this Agreement and to perform

its obligations under this Agreement, that the individual signing this Agreement has full authority to execute this Agreement on behalf

of Assignor.

c.

That, as of the date of this Agreement, the execution, delivery or performance of this Agreement

will not require Assignor to obtain any consent from any third party, other than any consents required by the terms of the Exclusive License,

including the Shattuck Consent.

d.

That, as of the date hereof, to Assignor’s knowledge, Assignor is the sole and exclusive owner

of all substantive rights in and to the Shattuck Patents, subject only to the terms of the Exclusive License.

e.

That, as of the date hereof, to Assignor’s knowledge, Assignor is the sole and exclusive owner

and beneficiary of all rights and benefits granted to Assignor pursuant to the terms of the Exclusive License, including all of the Shattuck

Patent Rights.

f.

That, as of the hereof, Assignor represents and warrants that it has not transferred to any third

party any rights that would be inconsistent with the rights assigned and transferred under this Agreement.

g.

That to Assignor’s knowledge, (i) the Shattuck Patents Rights are not subject to any Liens

other than the terms of the Exclusive License, (ii) that Assignor owns and controls all right, title and interests in and to the Shattuck

Patent Rights free and clear of any interest or claim by a third party (other than the right, title, and interest transferred to Shattuck

pursuant to the Exclusive License Agreement). “Liens” means any lien, pledge, mortgage, deed of trust, security interest,

claim, lease, license, charge, royalty or revenue sharing arrangement (other than the Exclusive License Agreement), option, right of first

refusal, easement, restriction, reservation, proxy, voting trust or agreement, or encumbrance of any nature whatsoever.

h.

That Assignor is not entering into this Agreement or the transactions contemplated hereunder with

the actual intent to hinder, delay or defraud any other party, including either present or future creditors of Assignor or any of its

affiliates.

i.

That, on or prior to the date hereof, Assignor has delivered to the Assignee a true and correct copy

of the Exclusive License.

6.1

Representations and Warranties of Assignee. Assignee represents and warrants the following:

a.

That it is duly organized, validly existing, and in good standing under the laws of the jurisdiction

in which it was organized and has all requisite power and authority to conduct its business as presently conducted.

b.

That it has all requisite power and authority to execute and deliver this Agreement and to perform

its obligations under this Agreement, that the individual signing this Agreement has full authority to execute this Agreement on behalf

of Assignee.

c.

That, as of the date of this Agreement, the execution, delivery or performance of this Agreement

will not require Assignee to obtain any consent from any third party, other than any consents required by the terms of the Exclusive License,

including the Shattuck Consent.

d.

That Assignee has cash on hand or undrawn amounts immediately available necessary to consummate the

transactions contemplated hereunder, including (a) paying the Purchase Price, (b) paying all out-of-pocket expenses incurred by it in

connection with the transactions contemplated hereunder and (c) satisfying all of its other obligations of Assignee under this Agreement.

Assignee has not incurred any obligation, commitment, restriction or liability of any kind, and is not contemplating or aware of any obligation,

commitment, restriction or liability of any kind, in either case, which would reasonably be expected to impair or adversely affect such

resources.

e.

That Assignee is not entering into this Agreement or the transactions contemplated hereunder with

the actual intent to hinder, delay or defraud any other party, including either present or future creditors of Assignee or any of its

affiliates. At the Closing Date, Assignee (a) will be solvent (in that both the fair value of its assets will not be less than the sum

of its debts and that the present fair saleable value of its assets will not be less than the amount required to pay its probable liability

on its recourse debts as they mature or become due), (b) will have adequate capital and liquidity with which to engage in its business

and (c) will not have incurred and does not plan to incur debts beyond its ability to pay as they mature or become due.

7.1

Indemnification. Assignor will indemnify and hold harmless Assignee for any and all actions,

losses, costs, charges, damages, claims, penalties, expenses and litigation costs arising from a breach of the representations made by

it in this Agreement.

8.1

Miscellaneous.

| a. | This Agreement is entered into in the State of Delaware and will be governed

by Delaware law without regard to its conflicts of laws rules that would require the application of the law of another jurisdiction. |

| b. | The terms of this Agreement may not be amended, and no term or provision

of this Agreement may be waived, except in writing signed by an authorized representative of each party. No delay on the part of a party

in exercising any right, power or remedy under this Agreement will operate as a waiver, and no single or partial exercise of any right,

power or remedy by a party will preclude any further exercise of any right, power or remedy. |

| c. | This Agreement may be executed in counterparts, each of which will be deemed

an original but all of which will constitute one and the same instrument. This Agreement may be delivered by any party by electronic means

and any copy so delivered will be deemed to be an original. |

| d. | If any provision of this Agreement or its application becomes invalid or

unenforceable, the remaining provisions will not be affected and each remaining provision will remain valid and be enforceable to the

fullest extent permitted by law. |

| e. | This Agreement will be binding upon the parties and their respective heirs,

executors, administrators, successors and assigns, and will inure to the benefit of and be enforceable by the parties and their respective

heirs, executors, administrators, successors and assigns. |

| f. | This Agreement together with the documents contemplated to be delivered

hereunder constitute the entire agreement between the parties and supersedes any prior understandings, agreements, terms or representations

by or between the parties, or any of them, whether written or oral, with respect to the subject matter of this Agreement. |

| g. | Each party warrants and represents that it has not relied upon any statement,

representation or information provided by any other party other than the express terms contained in this Agreement. |

| h. | This Agreement was drafted by the parties’ counsel and there shall

be no presumptions, inferences, or constructions based upon the manner in which this Agreement was drafted. |

IN WITNESS WHEREOF, the

parties have caused this Agreement to be executed by their duly authorized officers to be effective as of the date set forth above.

|

ASSIGNOR:

NightHawk Biosciences, Inc.

/s/ Jeffrey Wolf

By:_______________________________

Name: Jeffrey Wolf

Title: CEO

|

ASSIGNEE:

Kopfkino IP, LLC

/s/ Josiah Hornblower

By:_______________________________

Name: Josiah Hornblower

Title: Manager |

Exhibit 99.1

NightHawk

Receives Proceeds of $3.25 Million in Connection with Sale of Non-Core Intellectual Property and Issuance of a Low Interest Bearing Note

Durham,

NC – January 30, 2024 – NightHawk Biosciences (NYSE American: NHWK) (“NightHawk” or the “Company”),

an integrated contract development and manufacturing organization (CDMO), today announced it has sold additional none-core IP. Additionally,

the Company received proceeds of $2.25 million from a note issued pursuant to the terms of the previously announced divestiture of non-core

assets ( the “Note”). The Note bears interest at an annual rate of 1% and, subject to stockholder approval, would be convertible

into shares of NightHawk’s common stock at $0.39281 per share, an 8% premium to the closing price of the Company’s common

stock on January 29, 2024.

Jeff

Wolf, CEO of NightHawk Biosciences, commented, “Receipt of these funds is particularly timely as it strengthens our balance sheet

and provides us additional working capital to further accelerate our growth. The sale of this intellectual property is consistent with

our strategy to divest non-core assets in order to focus on our Scorpius BioManufacturing subsidiary, which is gaining significant traction

in the market.”

Additional

details related to the sale of the IP and the Note are included in the Company’s Form 8-K, which has been filed with the Securities

and Exchange Commission.

NightHawk

Biosciences, Inc.

NightHawk

Biosciences, through its Scorpius BioManufacturing subsidiary, is an integrated contract development and manufacturing organization (CDMO)

focused on rapidly advancing biologic and cell therapy programs to the clinic and beyond. Scorpius offers a broad array analytical testing,

process development, and manufacturing services to pharmaceutical and biotech companies at its state-of-the-art facilities in San Antonio,

TX. With an experienced team and new, purpose-built U.S. facilities, Scorpius is dedicated to transparent collaboration and flexible,

high-quality biologics biomanufacturing. For more information, please visit: www.nighthawkbio.com or www.scorpiusbiologics.com, and also

follow us on Twitter.

Forward-Looking

Statement

This

release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases

forward-looking statements can be identified by terminology such as "may," "should," "potential," "continue,"

"expects," "anticipates," "intends," "plans," "believes," "estimates," and

similar expressions, and include statements such as further accelerating the Company’s growth and Scorpius BioManufacturing gaining

significant traction in the market . Important factors that could cause actual results to differ materially from current expectations

include, among others, the Company’s ability to generate future revenue from manufacturing contracts, the Company’s ability

to continue its strategy and to grow revenue, leverage fixed costs and achieve long-term profitability; the Company’s ability to

create substantial shareholder value as a pure-play CDMO in an underserved marketplace, the Company’s financing needs, its cash

balance being sufficient to sustain operations and its ability to raise capital when needed, the ability to obtain regulatory approval

or to comply with ongoing regulatory requirements, regulatory limitations relating to the Company’s ability to successfully promote

its services and compete as a pure- play CDMO, and other factors described in the Company’s annual report on Form 10-K for the

year ended December 31, 2022, subsequent quarterly reports on Form 10-Qs and any other filings the Company makes with the SEC. The information

in this presentation is provided only as of the date presented, and the Company undertakes no obligation to update any forward-looking

statements contained in this presentation on account of new information, future events, or otherwise, except as required by law.

Media

and Investor Relations Contact

David

Waldman

+1 919 289 4017

investorrelations@nighthawkbio.com

v3.24.0.1

Cover

|

Jan. 26, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity File Number |

001-35994

|

| Entity Registrant Name |

NightHawk Biosciences, Inc.

|

| Entity Central Index Key |

0001476963

|

| Entity Tax Identification Number |

26-2844103

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

627

Davis Drive

|

| Entity Address, Address Line Two |

Suite

300

|

| Entity Address, City or Town |

Morrisville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27560

|

| City Area Code |

(919)

|

| Local Phone Number |

240-7133

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Common Stock |

Common Stock, $0.0002 par value per share

|

| Trading Symbol |

NHWK

|

| Security Exchange Name |

NYSEAMER

|

| Common Stock Purchase Rights [Member] |

|

| Common Stock |

Common Stock Purchase Rights

|

| Trading Symbol |

None

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NHWK_CommonStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

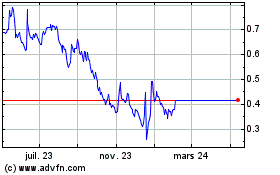

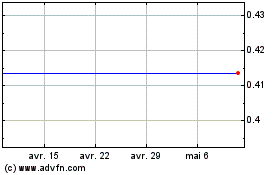

Nighthawk Biosciences (AMEX:NHWK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nighthawk Biosciences (AMEX:NHWK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024