Securities Registration: Employee Benefit Plan (s-8)

24 Mai 2023 - 10:10PM

Edgar (US Regulatory)

As Filed with the Securities and Exchange Commission

on May 24, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ORLA MINING LTD.

(Exact

name of registrant as specified in its charter)

| Canada |

Not Applicable |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

| |

|

| Suite 1010, 1075 West Georgia Street |

|

| Vancouver, British Columbia, Canada V6E 3C9 |

|

| (Address of Principal Executive Offices) |

|

Orla Mining Ltd. Stock Option Plan

Orla Mining Ltd. Restricted Share Unit Plan

Orla Mining Ltd. Deferred Share Unit Plan

Gold Standard Ventures Corp. Stock Option Plan

(Full title of plan)

C T Corporation System

28 Liberty Street

New York, New York 10005

(212) 894-8940 (775) 304-0260

(Name, address and telephone number, including

area code, of agent for service)

with copies to:

|

Jen Hansen

Cassels Brock & Blackwell LLP

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

Canada V6C 3E8

(604) 691-6100 |

John Koenigsknecht

Neal, Gerber & Eisenberg LLP

Two North LaSalle Street

Suite 1700

Chicago, Illinois 60602

(312) 269-8000 |

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated

filer x

Non-accelerated filer ¨ Smaller

reporting company ¨

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

This Registration Statement

(the “Registration Statement”) on Form S-8 is being filed with the Securities and Exchange Commission (the “Commission”)

for the purpose of registering the offer and issuance of common shares, no par value (the “Common Shares”) of Orla Mining

Ltd. (“Orla,” “we,” “our,” “us”, the “Registrant,” the “Corporation”

or the “Company”) to certain employees of the Company and/or its subsidiaries under the Company’s Stock Option Plan

(as it may be amended from time to time, the “Stock Option Plan”), Restricted Share Unit Plan (as it may be amended from time

to time, the “RSU Plan”), the Deferred Share Unit Plan (as it may be amended from time to time, the “DSU Plan”),

and the Gold Standard Ventures Corp. Stock Option Plan (as it may be amended from time to time, the “Replacement Option Plan”),

and collectively with the Stock Option Plan, the RSU Plan and the DSU Plan, the (“Plans”).

Pursuant to Part I of

Form S-8, the information specified under Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement

in accordance with the provisions of Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”),

and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8

will be delivered to participants in the respective Plans covered by this Registration Statement as specified by Rule 428(b)(1) under

the Securities Act. Such documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3

of Part II of this Form S-8, when taken together, constitute a prospectus that meets the requirements of Section 10(a) of

the Securities Act. Such documents are not required to be, and are not, filed with the Commission either as part of this Registration

Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act.

The Replacement Option Plan

governs the Replacement Options (as defined below). On August 12, 2022, the Company acquired all of the issued and outstanding common

shares of Gold Standard Ventures Corp. (“Gold Standard”) pursuant to a court approved plan of arrangement under the Business

Corporations Act (British Columbia). Under the terms of this transaction, each Gold Standard stock option (a “GSV Option”)

was exchanged for a stock option to acquire Common Shares (a “Replacement Option”), with the number of Common Shares issuable

and exercise price adjusted based on the transaction exchange ratio of 0.1193 Common Shares per share of Gold Standard.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which

have been filed by the Company with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

are incorporated in this Registration Statement by reference and are made a part hereof:

| (g) | All other reports filed by the Registrant under Section 13(a) or 15(d) of the Exchange

Act since January 1, 2023; and |

All documents filed by the

Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date hereof and prior to the filing

of a post-effective amendment that indicates that all securities offered have been sold or which deregisters all securities then remaining

unsold, including any Reports of Foreign Private Issuers on Form 6-K submitted during such period (or portion thereof) that is identified

in such form as being incorporated by reference into this Registration Statement, shall be deemed to be incorporated by reference herein

and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be

incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Registration Statement to the extent

that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference

herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this registration statement.

| Item 4. |

Description of Securities. |

| Item 5. |

Interests of Named Experts and Counsel. |

| Item 6. |

Indemnification of Directors and Officers. |

Section 124 of the Canada

Business Corporation Act (“CBCA”) provides that a corporation may indemnify a director or officer of the corporation, a former

director or officer of the corporation or another individual who acts or acted at the corporation’s request as a director or officer,

or an individual acting in a similar capacity, of another entity, against all costs, charges and expenses, including an amount paid to

settle an action or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative, investigative

or other proceeding in which the individual is involved because of that association with the corporation or other entity. A corporation

may advance moneys to a director, officer or other individual for the costs, charges and expenses of a proceeding referred to in the immediately

prior sentence. The individual shall repay the moneys if the individual does not fulfill the conditions of the immediately following sentence.

A corporation may not indemnify an individual as described in the first sentence of this paragraph unless the individual (a) acted

honestly and in good faith with a view to the best interests of the corporation, or, as the case may be, to the best interests of the

other entity for which the individual acted as director or officer or in a similar capacity at the corporation’s request; and (b) in

the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, the individual had reasonable grounds

for believing that the individual’s conduct was lawful.

A corporation may with the

approval of a court, indemnify an individual referred to in the foregoing paragraph, or advance moneys as described in the foregoing paragraph,

in respect of an action by or on behalf of the corporation or other entity to procure a judgment in its favor, to which the individual

is made a party because of the individual’s association with the corporation or other entity as described in the foregoing paragraph

against all costs, charges and expenses reasonably incurred by the individual in connection with such action, if the individual fulfills

the conditions set out in the foregoing paragraph.

Despite the first paragraph

above, an individual referred to in that paragraph is entitled to indemnity from the corporation in respect of all costs, charges and

expenses reasonably incurred by the individual in connection with the defense of any civil, criminal, administrative, investigative or

other proceeding to which the individual is subject because of the individual’s association with the corporation or other entity

as described in the first paragraph above, if the individual seeking indemnity (a) was not judged by the court or other competent

authority to have committed any fault or omitted to do anything that the individual ought to have done; and (b) fulfills the conditions

set out in the first paragraph above.

Sections 8.02 and 8.03 of

Amended and Restated By-law No. 1 of the Registrant (the “By-laws”) contains the following provisions with respect to

indemnification of the Registrant’s directors and officers and with respect to certain insurance maintained by the Registrant with

respect to certain individuals:

8.02 Indemnity.

Subject to the CBCA,

the Corporation shall indemnify a director or officer of the Corporation, a former director or officer of the Corporation or another individual

who acts or acted at the Corporation’s request as a director or officer, or an individual acting in a similar capacity, of another

entity, against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred

by the individual in respect of any civil, criminal, administrative, investigative or other proceeding to which the individual is involved

because of that association with the Corporation or other entity, if:

| (a) | the individual acted honestly and in good faith with a view to the best interests of the Corporation, or, as the case may be, to the

best interests of the other entity for which the individual acted as director or officer or in a similar capacity at the Corporation’s

request; and |

| (b) | in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, the individual had reasonable

grounds for believing that the individual’s conduct was lawful. |

The Corporation shall

also indemnify such person in such other circumstances as the CBCA permits or requires. The Corporation shall advance monies to a director,

officer or other individual for costs, charges and expenses of a proceeding referred to above. The individual shall repay the monies if

he or she does not fulfill the conditions set out in paragraphs (a) and (b) above. Nothing in this by-law shall limit the right

of any individual entitled to indemnity to claim indemnity apart from the provisions of this by-law, whether by contract or otherwise,

and no settlement or plea of guilty in any action or proceeding shall alone constitute evidence that a person did not meet a condition

set out in clause (a) or (b) of this Section 8.02 or any corresponding condition of the CBCA.

8.03 Insurance.

Subject to the

CBCA, the Corporation may purchase and maintain insurance for the benefit of any person referred to in Section 8.02 against any liability

incurred by him or her in his or her capacity as a director or officer, or an individual acting in a similar capacity, of the Corporation

or of another body corporate at the Corporation’s request.

The Registrant has entered

into Indemnification Agreements with each of its directors and executive officers to provide the indemnification set forth in the Registrants

By-laws. The Registrant carries directors’ and officers’ liability insurance covering acts and omissions of the directors

and officers of the Registrant. The directors and officers are not required to pay any premium in respect of the insurance.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling the Registrant

pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the U.S. Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is therefore unenforceable.

| Item 7. |

Exemption From Registration Claimed. |

| (a) | The Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this

Registration Statement: |

| |

(i) |

To include any prospectus required by Section 10(a)(3) of the Securities Act; |

(ii) To reflect in the prospectus

any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information

in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and

(a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange

Act that are incorporated by reference in the Registration Statement.

| |

(2) |

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (b) |

The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference

in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) |

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director,

officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements

of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the city of Vancouver, British Columbia, country of Canada, on May 24, 2023.

| |

ORLA MINING LTD. |

| |

|

|

| |

By: |

/s/ Jason Simpson |

| |

|

Jason Simpson

President & Chief Executive Officer |

POWERS OF ATTORNEY

KNOW ALL PERSONS BY THESE

PRESENTS, that each person whose signature appears below constitutes and appoints Jason Simpson or Etienne Morin, and each of them, any

of whom may act without the joinder of the other, the true and lawful attorney-in-fact and agent with full power of substitution and resubstitution,

for and in the name, place and stead of the undersigned, in any and all capacities, to sign this Registration Statement on Form S-8

and any or all amendments or supplements to the above Registration Statement, including post-effective amendments; and to file the same,

with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorneys-in-fact and agents, each acting alone, full power and authority to do and perform to all intents and purposes as he or she might

or could do in person, ratifying and confirming all that said attorneys-in-fact and agents, each acting alone, or the substitutes for

such attorney-in-fact and agent, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act, this Registration Statement and powers of attorney have been signed by the following persons in the capacities

and on the dates indicated:

| |

|

|

|

|

|

Signature |

|

Title |

|

Date |

| |

|

|

|

|

/s/ Jason Simpson

Jason Simpson |

|

President, Chief

Executive Officer and Director

(principal executive

officer) |

|

May 24, 2023 |

| |

|

|

|

|

/s/ Etienne

Morin

Etienne Morin |

|

Chief Financial Officer

(principal financial

and accounting officer) |

|

May 24, 2023 |

| |

|

|

|

|

/s/ Charles

A. Jeannes |

|

Chairman of the Board, Director |

|

May 24, 2023 |

| Charles A. Jeannes |

|

|

|

|

| |

|

|

|

|

/s/ Jean Robitaille |

|

Director |

|

May 24, 2023 |

| Jean Robitaille |

|

|

|

|

| |

|

|

|

|

/s/ Tim Haldane |

|

Director |

|

May 24, 2023 |

| Tim Haldane |

|

|

|

|

| |

|

|

|

|

/s/ David Stephens |

|

Director |

|

May 24, 2023 |

| David Stephens |

|

|

|

|

| |

|

|

|

|

/s/ Elizabeth

McGregor |

|

Director |

|

May 24, 2023 |

| Elizabeth McGregor |

|

|

|

|

| |

|

|

|

|

|

/s/ Tamara

Brown |

|

Director |

|

May 24, 2023 |

| Tamara Brown |

|

|

|

|

| |

|

|

|

|

|

/s/ Scott Langley |

|

Director |

|

May 24, 2023 |

| Scott Langley |

|

|

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements

of Section 6(a) of the Securities Act, the undersigned has signed this Registration Statement, solely in the capacity of the

duly authorized representative of Orla Mining Ltd. in the United States on May 24, 2023.

| |

|

|

| |

|

PUGLISI & ASSOCIATES

(Authorized U.S. Representative) |

| |

|

|

| |

By: |

/s/ Donald J. Puglisi |

| |

|

Name: Donald J. Puglisi |

| |

|

Title: Managing Director |

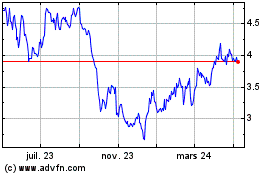

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

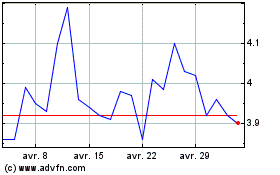

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025