Current Report Filing (8-k)

31 Mai 2023 - 12:04PM

Edgar (US Regulatory)

0001807046

false

0001807046

2023-05-30

2023-05-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 30, 2023

Belpointe PREP, LLC

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40911 |

|

84-4412083 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

255

Glenville Road

Greenwich,

Connecticut |

|

06831 |

| (Address

or principal executive offices) |

|

(Zip

Code) |

(203)

883-1944

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changes since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Class |

|

Trading

Symbol |

|

Name

of Exchange on which registered |

| Class

A units |

|

OZ |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

Item

8.01 Other Events.

Belpointe

PREP, LLC’s (“we,” “us,” “our” or the “Company’s”) manager, Belpointe PREP

Manager, LLC (our “Manager”), is responsible for calculating the Company’s net asset value (“NAV”) and

NAV per Class A unit within approximately 60 days of the last day of each quarter (the “Determination Date”), in accordance

with the valuation guidelines approved by our board of directors (our “Board”) and set forth in the “Net Asset Value

Calculation and Valuation Guidelines” section of our prospectus (Registration Nos. 333-255424 and 333-271262), as supplemented.

Any adjustment to our NAV per Class A unit will take effect as of the first business day following its public announcement.

In

connection with the calculation of our NAV for the quarter ended March 31, 2023, our Manager engaged the services of Capright

Property Advisers, LLC (“Capright”), an independent third-party valuation and advisory firm, to assist with the

valuation of our portfolio of real estate assets. In estimating the value of our real estate portfolio, for all vacant land and

properties currently in development, Capright’s assistance was limited to valuing the underlying land. Capright’s value

conclusions took into consideration current transaction activity in the respective markets in which the properties are located,

recent changes in capital market conditions, and the status of entitlements for each property as of the data of value. In addition,

in connection with the calculation of our NAV, our Manager adjusted for the transaction costs and equity premium associated with

our acquisition of Belpointe REIT, Inc., however, did not adjust for gains or distributions distributable to our Manager pursuant to

its Class B units based on its conclusion that such amounts would be immaterial.

The

following table provides a breakdown of the major components of our NAV and NAV per Class A unit as of the Determination Date (amounts

and units in thousands, except for per unit data):

| | |

March 31, 2023 | |

| Assets | |

| |

| Investments in real properties | |

$ | 244,805 | |

| Cash and cash equivalents | |

$ | 115,676 | |

| Accounts receivable | |

$ | — | |

| Other assets | |

$ | 8,192 | |

| Total Assets | |

$ | 368,673 | |

| | |

| | |

| Liabilities | |

| | |

| Debt obligations | |

$ | — | |

| Obligations due to affiliates | |

$ | 5,689 | |

| Other liabilities | |

$ | 11,276 | |

| Total Liabilities | |

$ | 16,965 | |

| | |

| | |

| NAV | |

$ | 351,708 | |

| Number of Class A units Outstanding | |

| 3,524 | |

| NAV per Class A unit | |

$ | 99.82 | |

On

May 30, 2023 our Board unanimously approved, and authorized us to announce, our adjusted NAV per Class A unit of $99.82.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

May 30, 2023

| |

BELPOINTE

PREP, LLC |

| |

|

|

| |

By: |

/s/

Brandon E. Lacoff |

| |

|

Brandon

E. Lacoff |

| |

|

Chairman

of the Board and Chief Executive Officer |

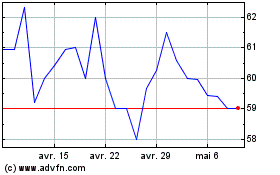

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024