false

0001134115

0001134115

2024-12-02

2024-12-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): December 2, 2024

INTERNATIONAL

TOWER HILL MINES LTD.

(Exact

Name of Registrant as Specified in Charter)

| British

Columbia, Canada |

|

001-33638 |

|

98-0668474 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 1570-200 Burrard Street | |

|

| Vancouver,

British Columbia, Canada | |

V6C 3L6 |

| (Address

of Principal Executive Offices) | |

(Zip

Code) |

Registrant’s

telephone number, including area code: (604) 683-6332

(Former

Name or Former Address, if Changed Since Last Report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol: |

|

Name

of each exchange on which

registered: |

| Common

Shares, no par value |

|

THM |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On December 2, 2024, the Company and a third-party,

Phenom Ventures LLC (“Phenom”), entered into a Consulting Agreement (the “Consulting Agreement”) and Stock Option

Agreement (the “Stock Option Agreement” and, collectively, the “Agreements”) pursuant to which Phenom will provide

consulting services to communicate the attributes of the Livengood Gold Project and the Company’s story to the investor market through

a variety of mediums. The Company will grant Phenom 2,500,000 stock options to purchase common shares of the Company (“Shares”)

at a price of CAD$0.64 (the “Options”) pursuant to the Company’s 2006 Incentive Stock Option Plan. 1,000,000 Options

vest on December 2, 2024 (the “Grant Date”). 500,000 Options vest on June 2, 2025 if (i) the volume weight average trading

price of the shares for the 30 day period immediately preceding the applicable vesting date is equal to or greater than US$1.00 and (ii)

any increase in the volume weighted average trading price of shares from the Grant Date ending on the applicable vesting date exceeds

any increase in the trading price of the common shares of VanEck Junior Gold Miners ETF (the “GDXJ Shares”) during the same

period by 25% or more. 1,000,000 Options vest on a date between December 2, 2025 to December 2, 2026 if (i) the volume weight average

trading price of the shares on any date for a 20 day period within the applicable vesting period is equal to or greater than US$1.50 and

(ii) any increase in the volume weighted average trading price of shares from the Grant Date ending on the applicable vesting date exceeds

any increase in the trading price of the GDXJ Shares during the same period by 50% or more.

The term of the Consulting Agreement ends upon

the earlier of December 2, 2026 or the death or incapacity of the Consultant. The Consulting Agreement provides that the Company may terminate

the Consulting Agreement with 30 days notice if the Consultant materially breaches the Consulting Agreement and fails to cure. The Options

will terminate upon the earlier of December 2, 2026 and 90 days after the Consultant ceases to perform services under the Consulting Agreement.

The Consulting Agreement provides that during the term and after, the Consultant will protect the Company’s Confidential Information.

The foregoing summary of the Consulting Agreement

and Stock Option Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Consulting

Agreement and Stock Option Agreement, copies of which are attached hereto as Exhibit 10.1 and 10.2, respectively.

Item 9.01. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

International Tower Hill Mines Ltd. |

| |

(Registrant) |

| |

|

|

| Dated: December 6, 2024 |

By: |

/s/ Karl Hanneman |

| |

Name: |

Karl Hanneman |

| |

Title: |

President and Chief Executive Officer |

Exhibit 10.1

CONSULTING AGREEMENT

This CONSULTING AGREEMENT (this “Agreement”)

for consulting services is made as December 2, 2024 (the “Effective Date”) between INTERNATIONAL TOWER HILL MINES

LTD., a British Columbia company (the “Company”), and PHENOM VENTURES LLC, a Delaware limited liability company (the

“Consultant”) (each a “Party” and, collectively, the “Parties”).

WHEREAS the Company desires to engage the Consultant

to perform the services set forth on Schedule A (the “Services”), and the Consultant desires to perform the Services

for and on behalf of the Company, pursuant to and in accordance with the terms and conditions set forth in this Agreement.

NOW THEREFORE in consideration of the mutual

covenants and promised contained herein, the Parties agree as follows:

| (a) | The Company hereby engages the Consultant,

and the Consultant hereby agrees, to perform the Services for and on behalf of the Company

pursuant to and in accordance with the terms and conditions set forth in the Agreement. The

Consultant shall have control over the manner, means and timing of performing the Services,

provided that the Consultant shall (i) dedicate a significant time throughout the term of

the Agreement to perform the Services in accordance with the provisions hereof and (ii) exercise

the same degree of diligence, care and skill as ordinarily exercised by members of the same

profession, occupation or field providing similar products, services or deliverables. |

| (b) | Except with the prior written consent

of the Company, the Consultant shall provide the Services through Eric Muschinski (the “Principal”).

Any breach of the terms of this Agreement by the Principal, including without limitation

the disclosure obligations set forth in Section 1(c) and the obligations of confidentiality

set forth in Section 4, shall be deemed and considered for all purposes to be a breach of

this Agreement by the Consultant. |

| (c) | The Consultant hereby agrees to disclose

in every communication made in performance of the Services (i) the nature, scope, and amount

of compensation received by the Consultant, (ii) any personal ownership of securities of

the Company and (iii) any other basis for an actual or perception of a conflict of interest. |

| 2. | Compensation and Expenses |

| (a) | In consideration for the provision of

the Services, the Company hereby agrees to grant to the Consultant an option (the “Option”)

to acquire up to 2,500,000 common shares of the Company on and subject to the terms and conditions

of an option agreement in the form attached hereto as Exhibit 1. Except for the Option, the

Consultant shall not be entitled to receive any fees, benefits or other compensation in consideration

for providing the Services. |

| (b) | Unless the Parties otherwise agree in

writing, the Consultant is responsible for any costs or out-of-pocket expenses it or the

Principal incurs in providing the Services and shall be solely responsible for furnishing

or supplying any tools, equipment and materials necessary in order for the Consultant to

perform the Services in accordance with this Agreement. |

| (a) | Each of the Parties acknowledges that

it is the express intention of the Company and the Consultant that the Consultant is and

shall perform the Services as an independent contractor of the Company. Nothing in this Agreement

shall in any way be construed to constitute the Consultant or the Principal as an agent,

employee or representative of the Company and neither the Consultant nor the Principal is

or may represent itself or himself, as the case may be, as an agent, employee or representative

of the Company. Without limiting the generality of the foregoing, neither the Consultant

nor the Principal is authorized to bind the Company to any liability or obligation or to

represent to any third party that the Consultant or Principal has any such authority. |

| (b) | The Consultant acknowledges and agrees

that (i) the Consultant is obligated to report as income all fees and compensation received

by Consultant pursuant to this Agreement and (ii) the Consultant is responsible for, and

agrees to indemnify, defend, and hold harmless Company with respect to, the payment of self-employment

taxes, income taxes, federal and state withholding taxes, and other taxes and assessments

arising out of the performance of the Services by the Consultant. |

| 4. | Confidential Information |

| (a) | Subject to Section 4(b), the Consultant

may, intentionally or unintentionally, come into possession of non-public information, whether

in written or oral form, relating to the Company and its subsidiaries (“Confidential

Information”), including information with respect to business opportunities, exploration

and development activities, mineral reserves and resources, financing activities, joint venture

opportunities, studies, reports, designs and mining and mineral processing techniques; provided,

however, that Confidential Information shall not include information which the Consultant

can establish (i) was publicly known or made generally available prior to the time of disclosure

to the Consultant, (ii) becomes publicly known or made generally available after disclosure

to the Consultant through no wrongful action or inaction of Consultant or (iii) is in the

rightful possession of Consultant, without confidentiality obligations, at the time of disclosure

as shown by Consultant's then-contemporaneous written records. The Consultant agrees that

no ownership of Confidential Information is conveyed to the Consultant. At the request of

the Company, the Consultant will return to the Company or destroy any Confidential Information

delivered or provided to the Consultant during the term of this Agreement. |

| (b) | During and after the term of this Agreement,

(i) the Consultant will hold the Confidential Information in the strictest confidence and

take all reasonable precautions to prevent any unauthorized use or disclosure of Confidential

Information, (ii) will not use the Confidential Information for any purpose whatsoever other

than as background information on the Company and (iii) will not disclose the Confidential

Information to any third party without the prior written consent of an authorized representative

of Company, except that Consultant may disclose Confidential Information to the extent compelled

by applicable law; provided however that, prior to such disclosure, the Consultant shall

provide prior written notice to Company and seek a protective order or such similar confidential

protection as may be available under applicable law. |

| (c) | The Consultant acknowledges and agrees

that it is prohibited from trading in securities of the Company while in possession of material

non-public information with respect to the Company. |

| (a) | The Company agrees to indemnify and hold

harmless the Consultant and the Principal from and against all losses, damages, liabilities,

costs and expenses, including attorneys' fees and other legal expenses, arising directly

or indirectly from or in connection with (i) any negligent, reckless or intentionally wrongful

act of the Company or (ii) any claim or action by a third party against the Consultant or

the Principal in connection with their performance of Services for the Company, except for

any acts or omissions that involve gross negligence, recklessness or willful misconduct/default. |

| (b) | The Consultant agrees to indemnify and

hold harmless the Company and its affiliates, and its and their directors, officers and employees,

from and against all taxes, losses, damages, liabilities, costs and expenses, including attorneys'

fees and other legal expenses, arising directly or indirectly from or in connection with

(i) any negligent, reckless or intentionally wrongful act of the Consultant or the Principal,

(ii) any breach by the Consultant or the Principal of any of the covenants contained in this

Agreement or (iii) any failure of the Consultant or the Principal to perform the Services

in accordance with all applicable laws, rules and regulations, including but not limited

to U.S. and Canadian securities laws. |

| (a) | Unless earlier terminated in accordance

with Section 6(b), the term of this Agreement will commence on the Effective Date and end

on the earlier of (i) December 2, 2026 (ii) the death or incapacity of the Principal. |

| (b) | The Company may at any time terminate

this Agreement if the Consultant is in material breach of this Agreement and fails to cure

such breach to the satisfaction of the Company, acting reasonably, within thirty days after

the Company provides written notice of such breach to the Company. |

Neither Party may assign its rights

or obligations under this Agreement to any other person or entity without the prior written consent of the other Party.

The validity, interpretation, and enforcement

of this Agreement shall be governed by the laws of the State of Alaska without regard to its conflicts or choice of law provisions. Each

Party submits to the exercise of personal jurisdiction over said Party by the state and federal courts located within the State of Alaska,

for all purposes relating to the interpretation or enforcement of this Agreement, and venue for any disputes or claims relating to the

interpretation or enforcement of this Agreement shall lie exclusively in the state courts located in Fairbanks North Star Borough, Alaska

or the state appellate and federal courts located in Fairbanks, Alaska or Anchorage, Alaska.

The Consultant hereby agrees to comply

with all applicable laws, rules and regulations, including but not limited to U.S. and Canadian securities laws, in performance of the

Services in the U.S., Canada, and any other jurisdiction that the Consultant may perform the Services.

In the event that any provision of

this Agreement is held to be unenforceable or invalid by any court of competent jurisdiction, the Parties shall negotiate an equitable

adjustment to effect the purposes of this Agreement, and the validity and enforceability of the remaining provisions shall not be affected

thereby.

Each of the Parties represents and

warrants that it is not a party to any agreement or under any obligation that conflicts with the terms of this Agreement or prevents

it from performing its obligations under this Agreement.

Each of the Parties acknowledges and

agrees that this Agreement and the Schedules and Exhibits attached hereto constitute the entire agreement between the Parties with respect

to the subject matter hereof and supersede all previous communications, representations, or agreements, either verbal or written, between

the Parties hereto with respect to the subject matter hereof.

No modification of or amendment to

this Agreement, nor any waiver of any rights under this Agreement, will be effective unless in a writing signed by each of the Parties.

Waiver by a Party of a breach of any provision of this Agreement will not operate as a waiver of any other or subsequent breach.

This Agreement may be signed in two

counterparts, each of which shall be deemed an original, with the same force and effectiveness as though executed in a single document.

This Agreement may be signed electronically or manually and signatures may be exchanged in person or by mail, couriers, facsimile or

electronic mail.

[Signature Page Follows]

IN WITNESS WHEREOF the Parties hereto have caused

this Agreement to be executed as of the day and year first above written.

| INTERNATIONAL TOWER HILL |

|

PHENOM VENTURES LLC |

|

| MINES LTD. |

|

|

|

| |

|

|

|

| /s/ Karl Hanneman |

|

/s/ Eric Muschinski |

|

| Karl Hanneman |

|

Eric Muschinski |

|

| CEO |

|

Managing Member |

|

SCHEDULE A

Services

Consultant shall use its best efforts to communicate

the attributes of the Livengood Gold Project and the ITH story to the investor market, including but not limited to its scale, Tier 1

jurisdiction, location and infrastructure, shareholder base, valuation, and potential leverage to the price of gold.

Consultant is expected to communicate the ITH

story to the investor market via Gold Investment Letter coverage, videos, in person meetings, and other relevant discussions to generate

awareness of the ITH story.

EXHIBIT 1

OPTION AGREEMENT

Exhibit 10.2

STOCK OPTION AGREEMENT

(Under 2006 Incentive Stock Option Plan)

THIS AGREEMENT made as of the 2nd day of December,

2024 (“Grant Date”).

BETWEEN:

PHENOM VENTURES LLC,

a Delaware limited liability company having its office at 3250 NE 1st Avenue, Suite 305, Miami, FL 33137

(the “Optionee”)

AND:

INTERNATIONAL TOWER HILL MINES

LTD., a body corporate having its office at Suite 1570 – 200 Burrard Street, Vancouver, British Columbia V6C 3L6

(the “Company”)

WHEREAS:

| A. | In accordance with the Company’s 2006 Incentive Stock Option Plan (the “2006 Plan”),

as amended and restated from time-to-time, the Company is authorized to grant options to purchase common shares of the Company (“ITH

Shares”) to Employees, Officers, Directors (including Non-Employee Directors), Management Company Employees and Consultants of the

Company and its Affiliates in order to provide an additional incentive to such persons to participate actively in the success of the Company;

and |

| B. | This Agreement is made and entered into pursuant to and in accordance with the 2006 Plan. |

NOW THEREFORE THIS AGREEMENT WITNESSES:

DEFINITION

| 1. | In this Agreement, all terms used herein and which are defined in the 2006 Plan will have the same meanings

as assigned to them in the 2006 Plan. |

GRANTING OF OPTION

| 2. | The Company hereby irrevocably grants to the Optionee a non-assignable, non-transferable option, subject

to the vesting schedule set forth in Section 6 below, to purchase up to 2,500,000 ITH Shares (the “Option”) at a price of

CAD $0.64 per ITH Share (the Option Price”). |

| 3. | The Option is not qualified under Section 422 of the United States Internal Revenue Code of 1986,

as amended (the “IRS Code”), and is therefore a “non-qualified” stock option for US tax purposes. |

| 4. | Options granted under the 2006 Plan, as may be amended from time to time, are intended to be exempt from

Section 409A, as may be amended from time to time (“Section 409A”) of the IRS Code, and the 2006 Plan and this Agreement shall

be interpreted and administered accordingly. The Consultant and the Principal are solely responsible and

liable for the satisfaction of all taxes and penalties that may be imposed on or for the account of the Consultant or the Principal in

connection with the Option (including any taxes and penalties under U.S. Code Section 409A), and neither the Company nor any affiliate

of the Company shall have any obligation to indemnify or otherwise hold the Consultant or the Principal, or any beneficiary or the Principal’s

estate, harmless from any or all such taxes or penalties. |

termination of

option

| 5. | The Option will terminate on the day (the “Termination Date”) which is the earlier of: |

| (b) | the day which is ninety (90) days after the Optionee ceases to be a Consultant, |

subject to any extension

thereof as may be required pursuant to section 8.6 of the 2006 Plan.

vesting of option

| |

6. |

Subject to Section 7 of this Agreement, the Option will vest in three tranches, as follows: |

| |

Vesting Date |

Number of ITH Shares Vesting |

| Tranche 1 |

December 2, 2024 |

1,000,000 (40%) |

| Tranche 2 |

June 2, 2025 |

500,000 (20%) |

| Tranche 3 |

December 2, 2025 to December 2, 2026 |

1,000,000 (40%) |

| 7. | Notwithstanding any other provisions of this Agreement: |

| (a) | Tranche 1 of the Option will vest immediately upon grant; |

| (b) | Tranche 2 of the Option will not vest unless on the applicable vesting date (i) the volume weighted average

trading price of the ITH Shares for the 30 day period immediately preceding such vesting date is equal to or greater than US$1.00 and

(ii) any increase in the volume weighted average trading price of ITH Shares from the grant date to such vesting date exceeds any increase

in the trading price of the common shares of VanEck Junior Gold Miners ETF (the “GDXJ Shares”) during the same period by 25%

or more; and |

| (c) | Tranche 3 of the Option will vest on the first day during the applicable vesting period set forth in Section

6 this Agreement on which (i) the volume weighted average trading price of the ITH Shares for the immediately preceding 20 day period

is equal to or greater than US$1.50 and (ii) any increase in the volume weighted average trading price of ITH Shares from the grant date

to such date exceeds any increase in the trading price of the GDXJ Shares during the same period by 50% or more (it being understood,

for the avoidance of doubt, that Tranche 3 of the Option will automatically expire if the above condition is not satisfied during the

applicable vesting period set forth in Section 6 this Agreement). |

For purposes of this

Section 7, any increase in the trading price of ITH Shares and GDXJ Shares over a specific period of time shall in each case be measured

with reference to (a) the volume weighted average trading price of such securities on the NYSE American Exchange for the five day period

immediately preceding the Grant Date and (b) the volume weighted average trading price of such securities on the NYSE American Exchange

(or, if such securities are no longer listed on the NYSE American Exchange, on the principal nationally recognized stock exchange on which

such securities are then listed) for the applicable period. If the GDXJ Shares cease to be listed on a nationally recognized stock exchange

before the applicable vesting date, the Company and the Optionee, each acting reasonably, will at such time select an appropriate junior

gold miners index for purposes of measuring the performance of the ITH Shares.

EXERCISE OF OPTION

| 8. | The vested portion of an Option, or any part thereof, may be exercised by the Optionee at any time and

from time to time until and including the Termination Date by notice in writing to the Company to that effect (“Exercise Notice”). |

| 9. | An Exercise Notice will specify the number of ITH Shares with respect to which the Option is then being

exercised and will be accompanied by a certified cheque, bank draft or money order in favour of the Company or other form of payment acceptable

to the Company in full payment of the Option Price for the number of ITH Shares then being purchased; and |

| 10. | An Exercise Notice will be deemed to have been given, if delivered by email or to the head office of the

Company from time to time, on the date of delivery, or if mailed, on the fourth (4th) day after the date of mailing in any

post office in Canada or the United States. A mailed Exercise Notice will be sent by prepaid registered mail addressed to the Company

at its head office from time to time. |

DELIVERY OF SHARE

CERTIFICATE/evidence of direct registration

| 11. | The Company will, within three (3) business days after receipt of an Exercise Notice, deliver to the Optionee

either: |

| (a) | a certificate representing the number of ITH Shares with respect to which the Option was exercised and

issued as of the date of the Exercise Notice; or |

| (b) | such evidence of the direct registration in the Optionee’s name, as of the date of the Exercise

Notice, of the number of ITH Shares with respect to which the Option was exercised in accordance with, and pursuant to, any system of

direct registration that may be adopted by the Company. |

OPTION ONLY

| 12. | Nothing herein contained or done pursuant hereto will obligate the Optionee to purchase and/or pay for

any ITH Shares, except those ITH Shares in respect of which the Optionee has exercised all or any part of the Option granted hereunder. |

| 13. | The Optionee will not have any rights whatsoever as a shareholder of the Company or the holder of any

of the ITH Shares optioned hereunder other than in respect of optioned ITH Shares for which the Optionee has exercised all or any part

of the Option granted hereunder and which have been taken up and paid for in full. |

INCORPORATION

OF TERMS AND CONDITIONS OF PLAN

| 14. | The Option has been granted in accordance with and subject to the terms and conditions of the 2006 Plan,

all of which are incorporated herein by reference as fully as if each and every such term and condition were set forth in this agreement

seriatim. |

TIME OF THE ESSENCE

| 15. | Time is and will be of the essence of this agreement. |

SUCCESSORS

| 16. | This agreement will enure to the benefit of and be binding upon the heirs, executors and administrators

of the Optionee and the successors and assigns of the Company. |

collection of

personal information

| 17. | The Optionee acknowledges and consents to the fact the Company is collecting the Optionee’s personal

information for the purpose of completing the grant of the Option to the Optionee and obtaining all necessary regulatory acceptances,

orders, approvals and consents thereto. The Optionee acknowledges and consents to the Company retaining the personal information for as

long as permitted or required by applicable law or business practices. The Optionee further acknowledges and consents to the fact the

Company may be required by applicable securities laws, stock exchange rules, and Investment Dealers Association (“IDA”) rules

to provide regulatory authorities with any personal information provided by the Optionee respecting him/herself, and further consents

to the collection, use and disclosure of any such personal information by any securities regulatory authority or stock exchange or the

IDA from time to time including, without limitation, the collection, use and disclosure thereof as set out in the applicable policies

of any stock exchange on which the ITH Shares are listed. |

[REST OF PAGE LEFT

INTENTIONALLY BLANK]

IN WITNESS WHEREOF the parties

hereto have caused these presents to be executed as of the day and year first above written.

| INTERNATIONAL TOWER HILL |

|

PHENOM VENTURES LLC |

|

| MINES LTD. |

|

|

|

| |

|

|

|

| /s/ Karl Hanneman |

|

/s/ Eric Muschinski |

|

| Karl Hanneman |

|

Eric Muschinski |

|

| CEO |

|

Managing Member |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

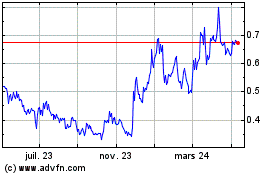

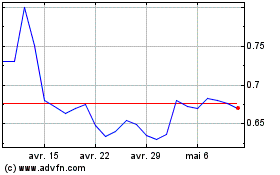

International Tower Hill... (AMEX:THM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

International Tower Hill... (AMEX:THM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024