Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) today announced results for the second quarter of

2022 (“Q2 2022”). Financial results for Q2 2022 will be available

on the Company’s website and will be filed on SEDAR and provided on

EDGAR on April 14, 2022.

Q2 2022 was a significant milestone for the

Company as, on account of gold sales, it was the first quarter in

the Company’s history in which it recorded: (i) revenues; (ii) a

significant gross profit margin; (iii) low cash cost1 of $796 per

ounce of gold; and (iv) positive operating cash flow. These

positive results, on just 1,812 ounces of gold sold, demonstrate

the immense opportunity for the Buckreef Gold Project to generate

significant revenues and cash flow as the Buckreef Gold Project

continues to develop. It also sets the stage for the Company’s

sustainable business plan in which cash flow from operations funds

value creating activities, including exploration and sulphide

project development.

Q2 Accomplishment and

Highlights

- Achieved

Low Cash Costs and High Gross Margins: The Company

achieved low cash cost1 of $796 per ounce of gold and a significant

gross margin of 57%. TanGold was operating cash flow positive ($1.5

million) in the quarter, the first time in the Company’s history.

This was achieved on just 1,812 ounces of gold sold.

-

Successful Processing Plant Expansion: The Company

successfully ramped-up the first 360 tonne per day (tpd) mill

installation at Buckreef Gold to nameplate capacity. This is the

first phase of 360 tpd for the planned 1,000+ tpd processing plant.

The 360 tpd expansion phase was completed on time and on budget

(capital cost of $1.6 million). The Company continues to expect

production to be 750-800 oz of gold per month2 at a total average

cash cost1 of US$725-825/oz, in line with previous guidance, until

the larger oxide ore processing plant is commissioned. The larger

1,000+ tpd oxide processing plant is expected to be completed in

calendar Q3 2022 and is forecast to produce 15,000 – 20,000 oz of

gold per year.

-

Advancement of Sulphide Development Project:

Buckreef Gold has commenced the long-lead items for de-risking of

the Sulphide Development Project, including: (i) geotechnical

characterization to determine the ultimate pit slopes of the 2 km

long open pit; and (ii) the variability metallurgical study for the

first 5-7 years of potential production of the Sulphide Development

Project. To date a total of 19 metallurgical holes (2,367 meters)

have been completed along the entire strike of the Buckreef Main

deposit and the holes have been logged and are in preparation for

shipment for metallurgical testing.

-

Recommenced Exploration: Buckreef Gold has drilled

17 holes representing over 5,500 meters in the northeast extension

of Buckreef Main Zone. Buckreef Gold has finalized the planning for

a 10,000 meter (approximate) infill drill program to: (i) upgrade

Mineral Resources currently in the Inferred category in Buckreef

Main, and (ii) commence infill drilling at Buckreef West. This

program is expected to start in Q3 2022. It is also the Company’s

intention to begin exploration drilling at the newly discovered

Anfield Zone this year.

“We are off to the races! The Q2 results

demonstrate our ability to drive significant, profitable

sustainable growth at Buckreef Gold, after achieving low cash costs

and significant gross profit margins on just 1,812 ounces of gold

sold. The processing plant is currently being expanded and will

triple in size to 1,000+ tpd in the coming months. We have also

started advancing the technical work for the much larger sulphide

development project with the goal of exceeding all the metrics as

outlined in the 2018 PFS, particularly yearly annual production.

Exploration has recommenced in the Buckreef Main northeast

extension and overall exploration activities will accelerate across

the entire Buckreef Gold project over the next year. We are in the

process of resetting the long-term vision for the Buckreef Gold

project with the goal of a much larger project than was originally

envisaged in the 2018 PFS. I would like to thank all of my

colleagues on a great year and a milestone quarter,” noted Stephen

Mullowney, Chief Executive Officer of TanGold.

Pictured Below: Buckreef Gold Open Pit,

Drill Rig in Northeast Extension, 360 tpd Processing Plant and Two

New 360 tpd Ball Mills Arriving at Buckreef Gold

About Tanzanian Gold Corporation

TanGold along with its joint venture partner,

STAMICO is advancing a significant gold project at Buckreef in

Tanzania. Buckreef is anchored by an expanded Mineral Resource

published in May 2020. Measured Mineral Resource is 19.98 million

tonnes (“MT”) at 1.99 grams per tonne (“g/t”) gold (“Au”)

containing 1,281,161 ounces (“oz”) of gold and Indicated Mineral

Resource is 15.89 MT at 1.48 g/t gold containing 755,119 oz of gold

for a combined tonnage of 35.88 MT at 1.77 g/t gold containing

2,036,280 oz of gold. The Buckreef Gold Project also contains an

Inferred Mineral Resource of 17.8 MT at 1.11g/t gold for contained

gold of 635,540 oz of gold. The Company is actively investigating

and assessing multiple exploration targets on its property. Please

refer to the Company’s Updated Mineral Resources Estimate for

Buckreef Gold Project, dated May 15, 2020 and filed under the

Company’s profile on SEDAR and with the SEC on June 23, 2020 (the

“Technical Report”), for more information. Buckreef is being

advanced in a value accretive sustainable manner through:

Expanding Production Profile: A

360 tonne per day (“tpd”) processing plant is being expanded to

1,000+ tpd, enabling a near term production profile of 15,000 -

20,000 oz of gold per year. Positive operating cash flow will be

utilized for value enhancing activities, including exploration and

Sulphide Project Development.

Exploration: Continuing with a

drilling program with the goal of expanding resources, discovering

new resources and converting resources to reserves, by: (i)

step-out drilling in the northeast extension of Buckreef Main; (ii)

infill drilling to upgrade Mineral Resources currently in the

Inferred category in Buckreef Main; (iii) infill drilling program

of Buckreef West; (iv) developing an exploration program for the

newly discovered Anfield Zone; (v) upgrading historical mineral

resources at Bingwa and Tembo; (vi) identifying new prospects at

Buckreef Gold Project, and in the East African region.

Sulphide Development Project:

Unlocking the value of the Sulphide Project in which the ‘sulphide

ore’ encompasses approximately 90% of the Resources. It is the goal

of the Company to exceed all metrics as outlined in the Technical

Report, including annual production and strip ratio.

For further information, please contact Stephen Mullowney, CEO,

or Michael Leonard, CFO at IR@tangoldcorp.com, or visit the Company

website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and

Director, is the Qualified Person as defined by the NI 43-101 who

has reviewed and assumes responsibility for the technical content

of this press release.

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

Endnotes

The Company has included certain non-IFRS

measures in this news release. Refer to the Company’s MD&A for

the three and six month periods ended February 28, 2022 (“Q2 2022

MD&A”) for an explanation, discussion and reconciliation of

non-IFRS measures. The Company believes that these measures, in

addition to measures prepared in accordance with International

Financial Reporting Standards (“IFRS”), provide readers with an

improved ability to evaluate the underlying performance of the

Company and to compare it to information reported by other

companies. The non-IFRS measures are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. These measures do not have any standardized meaning

prescribed under IFRS, and therefore may not be comparable to

similar measures presented by other issuers. Cash cost per ounce of

gold sold was determined by dividing the cost of gold sold of

$1.443 million for the three months ended February 28, 2022

calculated in accordance with the IFRS per the Company’s financial

statements divided by the number of ounces of gold sold

(1,812).

2 The 360 tpd Plant estimates have not been

prepared in accordance with the results of the Company’s 2018

Pre-Feasibility Study, reflected in the Company’s May 15, 2020

Technical Report. The 18-month mining plan estimates are based upon

an internal mine model reviewed by SGS Canada Inc and cost inputs

as validated by actual mining and processing costs from the 120 tpd

test plan over the 9 months ended May 31, 2021. No assurance can be

given that the 18-month mining estimate (Monthly Average) will

reflect actual results. See “Disclosure and Cautionary Statement

Regarding Forward Looking Information” in the Q2 2022 MD&A.

Forward-Looking Statements

This press release contains certain forward-looking statements

as defined in the applicable securities laws. All statements, other

than statements of historical facts, are forward-looking

statements. Forward-looking statements are frequently, but not

always, identified by words such as “expects”, “anticipates”,

“believes”, “hopes”, “intends”, “estimated”, “potential”,

“possible” and similar expressions, or statements that events,

conditions or results “will”, “may”, “could” or “should” occur or

be achieved. Forward-looking statements relate to future events or

future performance and reflect TanGold management’s expectations or

beliefs regarding future events and include, but are not limited

to, statements with respect to the continued operating cash flow,

expansion of its process plant, estimation of mineral resources,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TanGold believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. The

actual achievements of TanGold or other future events or conditions

may differ materially from those reflected in the forward-looking

statements due to a variety of risks, uncertainties and other

factors. These risks, uncertainties and factors include general

business, legal, economic, competitive, political, regulatory and

social uncertainties; actual results of exploration activities and

economic evaluations; fluctuations in currency exchange rates;

changes in costs; future prices of gold and other minerals; mining

method, production profile and mine plan; delays in exploration,

development and construction activities; changes in government

legislation and regulation; the ability to obtain financing on

acceptable terms and in a timely manner or at all; contests over

title to properties; employee relations and shortages of skilled

personnel and contractors; the speculative nature of, and the risks

involved in, the exploration, development and mining business.

These risks are set forth in reports that Tanzanian Gold files with

the SEC. You can review and obtain copies of these filings from the

SEC's website at http://www.sec.gov/edgar.shtml .

The information contained in this press release is as of the

date of the press release and TanGold assumes no duty to update

such information.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0e9d3cc-b69e-4520-9fc7-fbb6aee55bbc

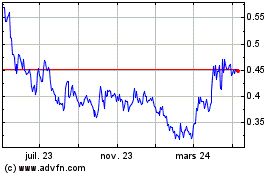

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

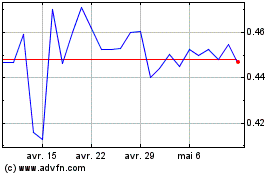

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024