TRX Gold Corporation (TSX:TNX) (NYSE American:TRX) (the “Company”

or “TRX Gold”) today announced results for the third quarter of

2022 (“Q3 2022”). Financial results for Q3 2022 will be available

on the Company’s website and will be filed on SEDAR and provided on

EDGAR on or around July 14, 2022.

Q3 2022 was another milestone for the Company as

it reflected the first full quarter operating the 360 tpd

processing plant at full design capacity and using the cash flow

generated from mining operations to fund successful exploration.

During Q3 2022 the Company recorded its highest quarterly: (i)

production, (ii) sales, (iii) gross profit margins, (iv) net

income, and (v) operating cash flow, at a low cash cost1 of $508

per gold ounce. Also, during the quarter the Company announced a

250 meter strike length extension of the Buckreef Gold Main Zone

from 1.55 kilometers to 1.80 kilometers, and positive assay results

from the northeast step-out drilling program on the Buckreef Gold

Main Zone. These positive results continue to demonstrate the

immense opportunity at Buckreef Gold and reflect a significant step

towards successful execution of utilizing cash flow from operations

to fund value creating activities, including exploration.

Q3 Accomplishment and

Highlights

- Achieved

Low Cash Costs and High Gross Margins: The Company

achieved a low cash cost1 of $508 per ounce of gold, and a

significant gross margin of 73% resulting in record quarterly net

income of $2.0 million. TRX Gold was operating cash flow positive

($2.0 million) in the quarter, the second consecutive (operating

cash flow positive) quarter in the Company’s history.

-

Successful Operation of 360 tpd Process Plant:

Buckreef Gold successfully completed the first full quarter

operating the 360 tpd mill at Buckreef Gold to nameplate capacity.

This is the first phase of 360 tonnes per day (tpd) for the 1,000+

tpd processing plant. The Company achieved production of 2,733

ounces of gold, exceeding guidance, and sold 3,033 ounces of gold –

both quarterly records for the Company.

- Advanced

1,000+ tpd Processing Plant Expansion: Buckreef Gold

continued to advance construction on the 1,000+ tpd processing

plant. During the quarter, the Company made significant progress on

the plant build, including successful completion of geotechnical

earthworks, carbon-in-leaching (“CIL”) tank farm foundation

construction, ball mill foundation and plinth curing, plant steel

fabrication, tank construction, and procurement of all key long

lead items, thus reducing considerable timeline risk for plant

commissioning. The Company has sufficient liquidity to fund the

remaining capital expenditures for the larger 1,000+ tpd oxide

processing plant, which is expected to be completed in calendar Q3

2022 and is forecast to produce 15,000 – 20,000 oz of gold per

year.

-

Expanded Exploration: Buckreef Gold confirmed a

strike extension of the Buckreef Main Zone by 250 meters (16%

increase in the strike length of the Buckreef Main Zone to 1.8

kilometers) and reported positive assay results from the northeast

step-out drilling program on the Buckreef Gold Main Zone. Buckreef

Gold added an additional drill rig to expand the exploration

program and, to date, has drilled 21 holes representing over 7,415

meters in the northeast extension of Buckreef Main Zone. The

Company has finalized the planning for a 10,000 meter (approximate)

infill and extension drill program to: (i) upgrade Mineral

Resources currently in the inferred category in Buckreef Gold Main

Zone, and (ii) commence infill drilling at Buckreef West.

“In Q3, we achieved low cash costs, significant

gross profit margins and record net income, proving we have a

viable business at Buckreef Gold. The goal now is to make this

operation much larger, with a focus on resource expansion, and

build a significant gold business that unlocks shareholder value.

We were able to use cash flow from operations to fund value

accretive activities, including exploration. We were pleased to

report a 250 meter extension to the Main Zone and are excited to

test for extension of gold mineralization to the southwest with our

expanded drill program. The processing plant expansion is well

advanced and will triple in size to 1,000+ tpd in the next few

months. We are enthusiastic about the growth potential for the

Buckreef Gold project which will be funded from operating cash flow

from the expanded operation. Congratulations to all of my

colleagues on another milestone quarter,” noted Stephen Mullowney,

Chief Executive Officer of TRX Gold.

Pictured Below: Dorè Bars from Buckreef

Gold, Buckreef Gold 360 tpd Processing Plant at Night, Buckreef

Gold Drill Rig in Northeast Extension, CIL Tank Construction at

1,000+ tpd Plant at Buckreef Gold

About TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 2020, the

project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource of 35.88 MT at 1.77 g/t gold containing 2,036,280 oz of

gold and an Inferred Mineral Resource of 17.8 MT at 1.11g/t gold

for 635,540 oz of gold. The leadership team is focused on creating

both near-term and long-term shareholder value by increasing gold

production to generate positive cash flow. The positive cash flow

will be utilized for exploratory drilling with the goal of

increasing the current gold Resource base and advancing the

Sulphide Ore Project which represents 90% of current gold

Resources. TRX Gold’s actions are led by the highest ESG standards,

evidenced by the relationships and programs that the Company has

developed during its nearly two decades of presence in Geita

Region, Tanzania.

Qualified PersonMr. Andrew Mark

Cheatle, P.Geo., MBA, ARSM, is the Company’s Qualified Person under

National Instrument 43-101 “Standards of Disclosure for Mineral

Projects” (“NI 43-101”) and has reviewed and assumes responsibility

for the scientific and technical content in this press release.

Investors Christina Lalli Vice

President, Investor RelationsTRX Gold Corporation+1-438-399-8665

c.lalli@TRXgold.comwww.TRXgold.com

Endnotes and Forward-Looking

Statements

Endnotes

The Company has included certain non-IFRS

measures in this news release. Refer to the Company’s MD&A for

the three and nine month periods ended May 31, 2022 (“Q3 2022

MD&A”) for an explanation, discussion and reconciliation of

non-IFRS measures. The Company believes that these measures, in

addition to measures prepared in accordance with International

Financial Reporting Standards (“IFRS”), provide readers with an

improved ability to evaluate the underlying performance of the

Company and to compare it to information reported by other

companies. The non-IFRS measures are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. These measures do not have any standardized meaning

prescribed under IFRS, and therefore may not be comparable to

similar measures presented by other issuers. Cash cost per ounce of

gold sold was determined by dividing the cost of gold sold of

$1.542 million for the three months ended May 31, 2022 calculated

in accordance with the IFRS per the Company’s financial statements

divided by the number of ounces of gold sold (3,033) during such

three months.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC. You can review and obtain

copies of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml.

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4dd9a5d-d65a-47fe-b386-d79e40c9508c

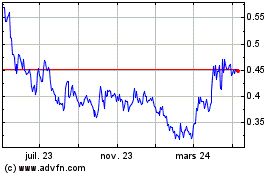

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

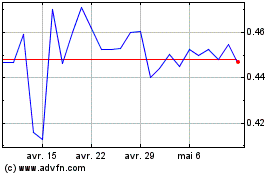

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024