0000008504

true

0000008504

2023-11-15

2023-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) November 15, 2023

AGEAGLE

AERIAL SYSTEMS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36492 |

|

88-0422242 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 8201

E. 34th Cir N |

|

|

| Wichita,

Kansas |

|

67226 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(620)

325-6363

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

This

Amendment to Current Report on Form 8-K (this “Form 8-K/A”) is being filed by AgEagle Aerial Systems Inc. (the “Company”)

solely for the purpose of filing a legal opinion as an exhibit to that certain Current Report on Form 8-K originally filed with the Securities

and Exchange Commission (“SEC”) on November 16, 2023 (the “Original Form 8-K”).

Item

7.01 Regulation FD Disclosure

As

disclosed in the Original Form 8-K, the Company received certain written notices (the “Investor Notices”) on November 15,

2023 from an existing shareholder of the Company (the “Investor”) which is a party to the Securities Purchase Agreement with

the Company, dated June 26, 2022 (the “Original Purchase Agreement”) and certain institutional and accredited investors (the

“Assignees”) to whom the Investor has assigned certain Additional Investment Right (as defined in the Original Purchase

Agreement) pursuant to an Assignment, Waiver and Amendment Agreement (the “Assignment Agreement”) of even date. Pursuant

to these Investor Notices, the Company sold to the Investor and the Assignees 1,850 shares of Series F 5% Convertible Preferred Stock

(“November Additional Series F Preferred”) convertible into 14,835,605 shares of Common Stock (the “Conversion Shares”)

at a conversion price of $0.1247 per share and warrants (the “November Additional Warrants”) to purchase up to 14,835,605

shares of our Common Stock an exercise price of $0.1247 per share for an aggregate purchase price of $1,850,000. The November Additional

Warrants have a three-year term, and are being issued in a concurrent private placement under Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”) and have not been registered under the Securities Act, or applicable state securities

laws.

As

also disclosed in the Original Form 8-K, the Company entered into a Securities Purchase Agreement with certain accredited investors (the

“Common Stock Investors”) pursuant to which the Company sold to the Common Stock Investors 1,500,000 shares of Common Stock

(the “Common Shares”) at $0.10 per share for an aggregate purchase price of $150,0000.

The

November Additional Series F Preferred, the Conversion Shares and the Common Shares will be issued pursuant to a prospectus supplement

to be filed with the Commission on or about November 17, 2023 and the prospectus included in the Company’s Registration

Statement on Form S-3 (Registration No. 333-252801), which was filed with the Commission on April 23, 2021 and was declared effective

on May 6, 2021. The Company is filing with this Current Report an opinion of counsel in connection with the offering.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

November 17, 2023

| |

AGEAGLE

AERIAL SYSTEMS INC. |

| |

|

|

| |

By:

|

/s/

Barrett Mooney |

| |

Name:

|

Barrett

Mooney |

| |

Title: |

Chief

Executive Officer |

Exhibit

5.1

November

16, 2023

AgEagle

Aerial Systems Inc.

8201

E. 34th Cir N

Wichita,

Kansas 67226

| Re: | AgEagle

Aerial Systems Inc./Registration Statement on Form S-3 |

Ladies

and Gentlemen:

We

have acted as special Nevada counsel to AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”), in connection

with the registration by the Company of 1,850 shares of its Series F 5% Convertible Preferred Stock (the “Preferred Shares”)

convertible into 14,835,605 shares (the “Conversion Shares”) of the Company’s Common Stock, $0.001 par value per share

(“Common Stock”) and 1,500,000 shares (the “Common Shares”) of its Common Stock.

The

Preferred Shares are being issued by the Company pursuant to a Securities Purchase Agreement, dated June 26, 2022 (the “Preferred

Shares Securities Purchase Agreement”) filed as an exhibit to the Company’s Current Report on Form 8-K filed with the U.S.

Securities and Exchange Commission (the “Commission”) on June 30, 2022 (the “June 30, 2022 Current Report”) and

the Common Shares are being issued pursuant to a Securities Purchase Agreement, dated November 15, 2023 (the “Common Shares Securities

Purchase Agreement”) to be filed as an exhibit to the Company’s Current Report on Form 8-K to be filed with

the Commission (the “Commission”).

The

Preferred Shares, the Conversion Shares, and the Common Shares are being registered under an effective registration statement (the “Registration

Statement”) on Form S-3 (File No. 333-252801), the statutory prospectus dated May 6, 2021, included in the Registration Statement

(the “Base Prospectus”), and the prospectus supplement dated November 15, 2023 (the “Prospectus Supplement”)

to be filed with the Commission pursuant to Rule 424(b)(5) promulgated under the Securities

Act of 1933, as amended (the “Securities Act”).

AgEagle Aerial Systems Inc.

November 16, 2023

Page 2 |

|

We

have examined originals or copies, certified or otherwise identified to our satisfaction of:

(a)

the Registration Statement, including the Base Prospectus, the Prospectus Supplement;

(b)

the Preferred Shares Securities Purchase Agreement;

(c)

the Common Shares Securities Purchase Agreement;

(d)

the June 30, 2022 Current Report;

(e)

resolutions of the Board of Directors related to

(i) the approval of the Preferred Shares Securities Purchase Agreement and the Common Shares Securities Purchase Agreement; the sale

and issuance of the Preferred Shares, the Conversion Shares, and the Common Shares; registration of the Preferred Shares, the Conversion

Shares, and the Common Shares under the Securities Act; and authorization of the Company to execute, deliver, and perform its obligations

under the Preferred Shares Securities Purchase Agreement and the Common Shares Securities Purchase Agreement; and

(f)

originals or copies, certified or otherwise identified

to our satisfaction, of the Company’s charter documents and other corporate records of the Company, certificates, and forms of

agreements and instruments as relevant related to the issuance and the registration of the Preferred Shares, the Conversion Shares, and

the Common Shares under the Securities Act as we have deemed necessary or appropriate as a basis for the opinions set forth herein.

In

our examination of documents, we have assumed the legal capacity of all natural persons executing the documents; the genuineness of all

signatures on the documents; the authenticity of all documents submitted to us as originals, and the conformity to original documents

of all documents submitted to us as copies; that the parties to such documents, other than the Company, had the power, corporate or other,

to enter into and perform all obligations thereunder; and other than with respect to the Company, the due authorization by all requisite

action, corporate or other, of the documents; the execution and delivery by all parties of the documents; and the validity and binding

effect of the documents on all parties.

We

have relied upon the accuracy and completeness of the information, factual matters, representations, and warranties contained in such

documents.

AgEagle Aerial Systems Inc.

November 16, 2023

Page 3 |

|

The

opinions set forth below are also subject to the further qualification that the enforcement of any agreements or instruments referenced

herein and to which the Company is a party may be limited by applicable bankruptcy, insolvency, fraudulent transfer, reorganization,

moratorium, and other similar laws affecting the creditors’ rights generally and by general principals of equity (regardless of

whether enforceability is considered in a proceeding in equity or at law).

Based

on foregoing and in reliance thereon, and subject to the assumptions, limitations, and qualifications set forth herein, we are of the

opinion that:

(a)

the Preferred Shares have been duly authorized and when issued, delivered, and paid for in accordance with the terms of the Preferred

Shares Securities Purchase Agreement, will be validly issued, fully paid, and nonassessable;

(b)

the Conversion Shares have been duly authorized and reserved for issuance, and when issued, and delivered in accordance with the terms

of the conversion of the Preferred Shares, will be validly issued, fully paid, and nonassessable; and

(c)

the Common Shares have been duly authorized and when issued, delivered, and paid for in accordance with the terms of the Common Shares

Securities Purchase Agreement, will be validly issued, fully paid, and nonassessable.

The

opinions expressed herein are limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the

matters expressly stated. We disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or

any changes in applicable law that may come to our attention after the date the Registration Statement is declared effective.

While

certain members of this firm are admitted to practice in jurisdictions other than Nevada, in rendering the foregoing opinions we have

not examined the laws of any jurisdiction other than Nevada. Accordingly, the opinions we express herein are limited to matters involving

the laws of the State of Nevada, excluding securities laws of the State of Nevada as to which we express no opinion. We express no opinion

regarding the effect of the laws of any other jurisdiction or state, including any securities laws related to the issuance and sale of

the Preferred Shares, the Conversion Shares, or the Common Shares.

AgEagle Aerial Systems Inc.

November 16, 2023

Page 4 |

|

We

hereby consent to the use of this opinion letter as Exhibit 5.1 to the Registration Statement and to the use of our name under the caption

“Legal Matters” in the Registration Statement and in the Prospectus forming a part thereof and any supplement thereto. In

giving the foregoing consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7

of the Securities Act or the rules and regulations of the Commission thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/

Sherman & Howard L.L.C. |

| |

|

| |

SHERMAN

& HOWARD L.L.C. |

v3.23.3

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

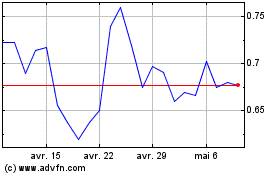

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024