false

0000008504

0000008504

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act 1934

Date

of Report (date of earliest event reported): November 28, 2023

| AGEAGLE

AERIAL SYSTEMS INC. |

| (Exact

name of registrant as specified in charter) |

| Nevada |

|

001-36492 |

|

88-0422242 |

| (State

of Incorporation) |

|

(Commission

File No.) |

|

(IRS

Employer Identification No.) |

8201

E. 34th Cir N

Wichita,

Kansas 67226

(Address

Of Principal Executive Offices) (Zip Code)

(620)

325-6363

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, is Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

As

previously disclosed in a Current Report on Form 8-K filed on October 19, 2023, as a result of Ms.

Nicole Fernandez-McGovern’s departure as Chief Financial Officer of the Company, Mr. Mark DiSiena was appointed as the Company’s

principal financial and accounting officer and Interim Chief Financial Officer, effective as of October 13, 2023. On November 30,

2023, the Board of Directors of the Company appointed Mr. DiSiena as Chief Financial Officer of the Company, effective as of December

1, 2023 (the “Commencement Date”). Pursuant to an employment offer letter dated November 28, 2023 (the “Offer Letter”),

Mr. DiSiena shall receive an annual base salary of $275,000 and a sign-on bonus in the form of restricted stock units (the “RSUs”)

not to exceed $60,000 in total award value, with 50% of the RSUs to vest one year after Commencement Date, and the remainder to vest

two years after Commencement Date. Mr. DiSiena will be eligible to receive an annual performance-based bonus comprised of up to $75,000

in cash and RSUs not to exceed $60,000 in total award value, with 34% of the total RSU award to vest at the time of the award date, 33%

of the original award amount to vest one year after the award date, and the remainder to vest two years after the award date. The performance

bonus amounts each year will be determined at the sole discretion of the Board of Directors of the Company based upon an assessment of

a combination of his achievement of designated personal goals and the Company reaching designated corporate goals.

There

are no family relationships between Mr. DiSiena and any director, executive officer or nominees thereof of the Company. There are no

related party transactions between the Company and Mr. DiSiena that would require disclosure under Item 404(a) of Regulation S-K under

the Securities Exchange Act of 1934, as amended.

A

copy of the Offer Letter is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing summary of the terms

of the Offer Letter is subject to, and qualified in its entirety by, such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGEAGLE

AERIAL SYSTEMS, INC. |

| |

|

|

| |

By: |

/s/

Barrett Mooney |

| |

Name: |

Barrett

Mooney |

| |

Title: |

Chief

Executive Officer |

Dated:

December 4, 2023

Exhibit

10.1

November

28, 2023

Mark

DiSiena

8408

E. Quarterhorse Trail

Scottsdale,

AZ 85258

Mark.DiSiena@ageagle.com;

disienamark@gmail.com

Re:

Offer of Employment

Dear

Mark,

AgEagle

Aerial Systems, Inc., a Nevada corporation (the “Company”) is pleased to offer you the position of Chief Financial Officer

(CFO) of the Company. Your full-time employment shall commence December 1, 2023 (your “Commencement Date”). You shall be

based out of your home office in Scottsdale, Arizona, and you will report to the Chief Executive Officer.

In

anticipation of the execution of an Executive Employment Agreement (“Employment Agreement”) only general terms of the offer

are set forth herein as the comprehensive terms and conditions will be covered in the Employment Agreement. Until that agreement has

been fully executed, as a condition of your employment, and in consideration of your employment and the payments and benefits provided

herein, you are required to sign and return to the Company the enclosed Employee Confidentiality and Proprietary Rights Agreement (the

“Confidentiality Agreement”).

This

offer is not a guarantee of employment for a specific period of time. Your employment with the Company, should you accept this offer,

will be “at-will,” which means that you or the Company may terminate your employment for any or no reason, at any time. During

your employment with the Company, you are required to devote your full business time and best efforts to your duties, which will be detailed

in the Employment Agreement. Further, you acknowledge and agree that, as an employee of the Company, you will comply with all laws and

regulations, as well as Company rules, policies and procedures as may be in effect from time to time.

Your

compensation package will consist of the following:

Base

Salary: $275,000 per year, paid in accordance with the Company’s standard payroll procedures, including appropriate federal,

state and local withholdings and taxes, as required pursuant to any law or governmental regulation or ruling.

Sign

On Bonus: Maximum of 400,000 RSUs, which may be reduced such that the value does not exceed $60,000 total award value, determined

at the time of the award, with 50% of the RSUs to vest one year after Commencement Date, and the remainder to vest two years after Commencement

Date.

First

Year Performance Bonus Potential: The Performance Bonus component shall be made up of cash and RSU awards: (i) Cash Performance Bonus

component of up to a maximum of $75,000 and (ii) a maximum of 400,000 RSUs, Performance Bonus component, which may be reduced such that

the value does not exceed $60,000 total award value, with award value determined at close of business on the day the award is approved

by the Board of Directors (“BOD”), with 34% of the total RSU award to vest at the time of the award date, 33% of the original

award amount to vest one year after the award date, and the remainder to vest two years after the award date. Eligibility for the Performance

Bonus will follow completion of one full calendar year of employment (January 1- December 31), with performance evaluated and Performance

Bonus determination to occur no later than the end of the first quarter following the calendar year for which performance is being reviewed.

The Performance Bonus is subject to your continued employment with the Company through the end of the full calendar year for which the

cash Performance Bonus is being awarded and, for RSUs, Performance Bonus, through the date when the vesting occurs.

Mark DiSiena November 28, 2023 Page 2 |

The

actual Performance Bonus amounts each year will be determined at the sole discretion of the BOD based upon an assessment of a combination

of your achievement of designated personal goals and the Company reaching designated corporate goals. Goals for a given calendar year

will be established by the BOD, in consultation with you.

The

Board shall review your performance annually, and the Board, in its sole discretion, may revise your compensation package, at any time,

in accordance with a reasonable business purpose, including but not limited to, review of performance.

During

your employment, you will receive paid time off and holidays in accordance with the Company’s current policy that is in effect

for all Executives. Any benefits to which you are entitled shall be determined in accordance with such plans and programs and Company

policy that are in effect for all Executives. Currently, the Company covers the cost for Executives (you) and your dependents for your

selection of the medical, dental and vision plans offered by the Company. The Company reserves the right to suspend, amend or terminate

any employee benefit plan or program at any time.

This

offer of employment and continued employment is conditioned on your establishing your identity and authorization to work as required

by the Immigration Reform and Control Act of 1986 (IRCA). Once this offer has been accepted, you will receive instructions on completing

Form I-9. Although this offer would be contingent upon the satisfactory completion (at the Company’s sole discretion) of reference,

drug and background checks, these requirements are waived given the recent satisfactory background check completed in pursuit of your

independent contractor status with the Company.

If

you have any questions or issues that may arise after reviewing this offer letter, please do not hesitate to contact me. We look forward

to welcoming you to AgEagle Aerial Systems Inc.

Sincerely,

| /s/ Grant Begley |

|

| Grant

Begley, Chairman of the Board |

|

“Agreed

and Acknowledged” (please sign, date, and retain a copy for your records)

| /s/ Mark

DiSiena |

|

| Mark

DiSiena |

|

| |

|

| Date: |

November

30, 2023 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

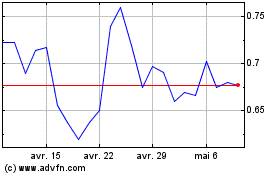

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024