false

0001453593

0001453593

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

November

12, 2024

XTANT

MEDICAL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-34951 |

|

20-5313323 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

664

Cruiser Lane

Belgrade,

Montana |

|

59714 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(406)

388-0480

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.000001 per share |

|

XTNT |

|

NYSE

American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 12, 2024, Xtant Medical Holdings, Inc. (the “Company”) announced its financial results for the three and nine months

ended September 30, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1

to this Current Report on Form 8-K.

The

information in Item 2.02 of this report (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly provided by specific reference in such a filing.

To

supplement its consolidated financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP”),

the Company uses certain non-GAAP financial measures, such as non-GAAP adjusted EBITDA, which are included in the press release furnished

as Exhibit 99.1 to this report. The Company defines non-GAAP adjusted EBITDA as net income or loss from operations before depreciation,

amortization and interest expense, and provision for income tax expense or benefit, and further adjusted by adding back in or excluding,

as appropriate, separation related expenses, legal settlements, non-cash compensation, acquisition-related expenses, acquisition-related

fair value adjustments, gain on bargain purchase, and unrealized foreign currency translation loss or gain.

The

Company uses adjusted EBITDA in making operating decisions because it believes this measure provides meaningful supplemental information

regarding its core operational performance. Additionally, this measure gives the Company a better understanding of how it should invest

in sales and marketing and research and development activities and how it should allocate resources to both ongoing and prospective business

initiatives. The Company also uses adjusted EBITDA to help make budgeting and spending decisions, for example, among sales and marketing

expenses, general and administrative expenses, and research and development expenses. Additionally, the Company believes its use of non-GAAP

adjusted EBITDA facilitates management’s internal comparisons to historical operating results by factoring out potential differences

caused by charges not related to its regular, ongoing business, including, without limitation, non-cash charges and certain large and

unpredictable charges.

As

described above, the Company excludes the following items from its non-GAAP financial measures for the following reasons:

Separation

related expenses. The Company excludes separation related expenses primarily because such expenses are not reflective of the Company’s

ongoing operating results and are not used by management to assess the core profitability of the Company’s business operations.

The Company further believes that excluding this item from its non-GAAP results is useful to investors in that it allows for period-over-period

comparability.

Legal

settlements. The Company excludes legal settlements primarily because such expenses are not reflective of the Company’s ongoing

operating results and are not used by management to assess the core profitability of the Company’s business operations. The Company

further believes that excluding this item from its non-GAAP results is useful to investors in that it allows for period-over-period comparability.

Non-cash

compensation. The Company excludes non-cash compensation, which is a non-cash charge related to equity awards granted by the Company.

Although non-cash compensation is a recurring charge to the Company’s operations, management has excluded it because it relies

on valuations based on future events, such as the market price of the Company’s common stock, that are difficult to predict and

are affected by market factors that are largely not within the control of the Company. Thus, management believes that excluding non-cash

compensation facilitates comparisons of the Company’s operational performance in different periods, as well as with similarly determined

non-GAAP financial measures of comparable companies.

Acquisition-related

expenses. The Company excludes expenses directly related to the Company’s acquisitions and integration into the Company from

non-GAAP adjusted EBITDA primarily because such expenses are not reflective of the Company’s ongoing operating results and are

not used by management to assess the core profitability of the Company’s business operations. These expenses include legal and

accounting fees and transition related services and are not considered normal, recurring, cash operating expenses necessary to operate

the Company’s business. The Company further believes that excluding this item from its non-GAAP results is useful to investors

in that it allows for period-over-period comparability.

Acquisition-related

fair value adjustments. The Company excludes acquisition-related fair value adjustments from non-GAAP adjusted EBITDA primarily because

such adjustments are not reflective of the Company’s ongoing operating results and are not used by management to assess the core

profitability of the Company’s business operations. The Company further believes that excluding this item from its non-GAAP results

is useful to investors in that it allows for period-over-period comparability.

Gain

on bargain purchase. The Company excludes gain on bargain purchase primarily because this gain is not reflective of the Company’s

ongoing operating results and is not used by management to assess the core profitability of the Company’s business operations.

The Company further believes that excluding this item from its non-GAAP results is useful to investors in that it allows for period-over-period

comparability.

Unrealized

foreign currency translation gain or loss. The Company excludes unrealized foreign currency translation gain or loss, as applicable,

from non-GAAP adjusted EBITDA primarily because such gain or loss is not reflective of the Company’s ongoing operating results

and is not used by management to assess the core profitability of the Company’s business operations. The Company further believes

that excluding this item from its non-GAAP results is useful to investors in that it allows for period-over-period comparability.

Non-GAAP

adjusted EBITDA is reconciled to net loss, the most directly comparable GAAP measure, in the press release.

Non-GAAP

financial measures are not in accordance with, or an alternative for, GAAP measures and may be different from non-GAAP financial measures

used by other companies. In addition, non-GAAP financial measures are not based on any comprehensive or standard set of accounting rules

or principles. Accordingly, the calculation of the Company’s non-GAAP financial measures may differ from the definitions of other

companies using the same or similar names, limiting, to some extent, the usefulness of such measures for comparison purposes. Non-GAAP

financial measures have limitations in that they do not reflect all of the amounts associated with the Company’s financial results

as determined in accordance with GAAP. Non-GAAP financial measures should only be used to evaluate the Company’s financial results

in conjunction with the corresponding GAAP measures. Accordingly, the Company qualifies its use of non-GAAP financial information in

a statement when non-GAAP financial information is presented.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

XTANT MEDICAL HOLDINGS, INC. |

| |

|

| |

By: |

/ s/ Scott Neils |

| |

|

Scott Neils |

| |

|

Chief Financial Officer |

Date:

November 12, 2024

Exhibit 99.1

Xtant

Medical Reports Third Quarter 2024 Financial Results

Third

Quarter Revenue Growth of 12%

Reaffirms

Full Year 2024 Revenue Guidance of $116 Million to $120 Million

Representing

Growth of 27% to 31%

BELGRADE,

Mont., Nov. 12, 2024 — Xtant Medical Holdings, Inc. (NYSE American: XTNT), a global medical technology company focused on surgical

solutions for the treatment of spinal disorders, today reported financial and operating results for the third quarter ended September

30, 2024.

Third

Quarter 2024 Financial Highlights

| | ● | Revenue

of $27.9 million, up 12%, compared to the prior year quarter; year to date revenue of $85.8

million, up 36% compared to prior year period |

| | | |

| | ● | Gross

margin of 58.4% compared to 61.3% for the prior year quarter |

| | | |

| | ● | Net

loss of $5.0 million compared to net income of $9.2 million in the prior year quarter which

included a $11.0 million bargain purchase gain related to the acquisition of Surgalign Holdings |

| | | |

| | ● | Adjusted

EBITDA of $(196,000) compared to $440,000 in the prior year quarter |

Recent

Business Highlights

| | ● | Launched

OsteoVive+, a moldable, viable bone matrix for use in a variety of grafting procedures |

| | | |

| | ● | Launched

Cortera Posterior Fixation System, a comprehensive solution designed to streamline thoracolumbar

fixation surgeries |

| | | |

| | ● | Signed

a license agreement for Q-Codes and corresponding SimpliMax Dual Layer Amniotic Membrane,

which provides for a minimum of $5.25 million in licensing and royalty fees |

| | | |

| | ● | Completed

$5.0 million private placement on August 9, 2024 |

Sean

Browne, President and CEO of Xtant Medical, stated, “During the third quarter, we expanded our market opportunities with the launch

of two new products, OsteoVive+ (stem cells) and Cortera Posterior Fixation System. Importantly, OsetoVive+ is produced internally to

our high standards, giving us greater control over the supply chain and enabling a higher margin contribution on incremental sales, which

we expect to accelerate in the fourth quarter.”

Browne

continued, “2024 is shaping up largely as we planned with revenue growth of 36% year-to-date. We are therefore reaffirming our

full year revenue guidance of $116 million to $120 million. The growth we expect in the fourth quarter will be driven by the strength

of our products, continued strong operational execution and importantly, it will be entirely organic. The market opportunities in biologics

are expansive, and we are striving to build a resilient and scalable business, which we believe will drive long-term growth and increase

profitability for our stockholders.”

Third

Quarter 2024 Financial Results

Total

revenue for the three months ended September 30, 2024 was $27.9 million, an increase of 12%, compared to $25.0 million in the prior year

quarter. The increase is primarily due to the contribution of additional sales resulting from the acquisition of the Surgalign Holdings’

hardware and biologics business, which was partially offset by reduced surgical procedures using our products.

Gross

margin for the third quarter of 2024 was 58.4%, compared to 61.3% for the prior year quarter. The decrease is primarily due to reduced

production throughput, partially offset by additional scale.

Operating

expenses for the third quarter of 2024 totaled $20.1 million, an increase of 7.3% compared to $18.7 million for the third quarter of

2023. The increase was primarily due to additional commission expense resulting from revenue growth, additional compensation expense

related to additional headcount and additional stock-based compensation.

Net

loss for the third quarter of 2024 was $5.0 million, or $(0.04) per share, compared to net income of $9.2 million, or $0.07 per share

in the prior year quarter. Net income for the third quarter of 2023 includes a bargain purchase gain of $11.0 million related to the

acquisition of Surgalign Holdings’ hardware and biologics business in August 2023.

Non-GAAP

Adjusted EBITDA for the third quarter of 2024 was a loss of $196,000, compared to non-GAAP Adjusted EBITDA of $440,000 for the prior-year

period. The Company defines Adjusted EBITDA as net income/loss from operations before depreciation, amortization and interest expense

and provision for income tax/benefit, and as further adjusted to add back in or exclude, as applicable, separation related expenses,

legal settlements, non-cash compensation, acquisition-related expenses, acquisition-related fair value adjustments, gain on bargain purchase

and foreign currency exchange gains/losses. A calculation and reconciliation of Adjusted EBITDA to net loss can be found in the attached

financial tables.

As

of September 30, 2024, the Company had $6.6 million of cash and cash equivalents compared to $5.7 million as of December 31, 2023.

2024

Financial Guidance

Xtant

Medical reaffirmed its full year 2024 revenue guidance of $116 million to $120 million. Revenue guidance for 2024 represents annual growth

of 27% to 31%.

Conference

Call

Xtant

Medical will host a webcast and conference call to discuss third quarter 2024 financial results at 4:30 pm ET on Tuesday, November 12,

2024.

To

access the webcast, visit https://www.webcaster4.com/Webcast/Page/3039/51623.

To

access the conference call, dial 888-999-3182 within the U.S. or 848-280-6330 outside the U.S. Passcode: Xtant Medical Holdings.

A

replay of the call will be available on the Investor section of the Company’s website at www.xtantmedical.com.

About

Xtant Medical Holdings, Inc.

Xtant

Medical’s mission of honoring the gift of donation so that our patients can live as full and complete a life as possible, is the

driving force behind our company. Xtant Medical Holdings, Inc. (www.xtantmedical.com) is a global medical technology company focused

on the design, development, and commercialization of a comprehensive portfolio of orthobiologics and spinal implant systems to facilitate

spinal fusion in complex spine, deformity and degenerative procedures. Xtant people are dedicated and talented, operating with the highest

integrity to serve our customers.

The

symbols ™ and ® denote trademarks and registered trademarks of Xtant Medical Holdings, Inc. or its affiliates, registered as

indicated in the United States, and in other countries. All other trademarks and trade names referred to in this release are the property

of their respective owners.

Non-GAAP

Financial Measures

To

supplement the Company’s consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles

(GAAP), the Company uses certain non-GAAP financial measures in this release, including Adjusted EBITDA. Reconciliations of the non-GAAP

financial measures used in this release to the most comparable GAAP measures for the respective periods can be found in tables later

in this release. The Company’s management believes that the presentation of these measures provides useful information to investors.

These measures may assist investors in evaluating the Company’s operations, period over period. Management uses the non-GAAP measures

in this release internally for evaluation of the performance of the business, including the allocation of resources. Investors should

consider non-GAAP financial measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance

prepared in accordance with GAAP.

Cautionary

Statement Regarding Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include

words such as “intends,” ‘‘expects,’’ ‘‘anticipates,’’ ‘‘plans,’’

‘‘believes,’’ ‘‘estimates,’’ “continue,” “future,” ‘‘will,’’

“potential,” “going forward,” “guidance,” similar expressions or the negative thereof, and the use

of future dates. Forward-looking statements in this release include the Company’s financial guidance for 2024, expectations for

the acceleration of incremental sales in the fourth quarter, the Company’s ability to build a resilient and scalable business,

the Company’s anticipated long-term growth and increased profitability for stockholders. The Company cautions that its forward-looking

statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important

factors, including, among others: the Company’s future operating results and financial performance; its ability to increase or

maintain revenue; the Company’s ability to become operationally self-sustaining and less reliant on third-party manufacturers and

suppliers; risks associated with its acquisitions and the integration of those businesses; anticipated shortages of stem cells which

will adversely affect future revenues; the ability to implement successfully its future growth initiatives and risks associated therewith;

possible future impairment charges to long-lived assets and goodwill and write-downs of excess inventory; the ability to remain competitive;

the ability to innovate, develop and introduce new products and the success of those products; the ability to engage and retain new and

existing independent distributors and agents and qualified personnel and the Company’s dependence on key independent agents for

a significant portion of its revenue; the effect of labor and hospital staffing shortages on the Company’s business, operating

results and financial condition, especially when they affect key markets; the effect of inflation, increased interest rates and other

recessionary factors and supply chain disruptions; the effect of product sales mix changes on the Company’s financial results;

government and third-party coverage and reimbursement for Company products; the ability to obtain and maintain regulatory approvals and

comply with government regulations; the effect of product liability claims and other litigation to which the Company may be subject;

the effect of product recalls and defects; the ability to license certain of the Company’s intellectual property on commercially

reasonable terms and to maintain any such licenses; the ability to obtain and protect Company intellectual property and proprietary rights

and operate without infringing the rights of others; risks associated with the Company’s clinical trials; international risks;

the ability to service Company debt, comply with its debt covenants and access additional indebtedness; the ability to maintain sufficient

liquidity to fund its operations and obtain financing on favorable terms or at all; and other factors. Additional risk factors are contained

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission

(SEC) on April 1, 2024 and subsequent SEC filings by the Company, including without limitation its most recent Quarterly Report on Form

10-Q for the quarterly period ended September 30, 2024 anticipated to be filed with the SEC. Investors are encouraged to read the Company’s

filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The Company undertakes no

obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events, except as required by law. All forward-looking statements attributable to the Company

or persons acting on its behalf are expressly qualified in their entirety by this cautionary statement.

Investor

Relations Contact:

Brett

Maas

Managing

Partner, Hayden IR

brett@haydenir.com

(646)

536-7331

XTANT

MEDICAL HOLDINGS, INC.

Condensed

Consolidated Balance Sheets

(In

thousands, except number of shares and par value)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 6,596 | | |

$ | 5,715 | |

| Restricted cash | |

| 490 | | |

| 208 | |

| Trade accounts receivable, net of allowance for credit losses and doubtful accounts of $1,038 and $920, respectively | |

| 20,545 | | |

| 20,731 | |

| Inventories | |

| 41,886 | | |

| 36,885 | |

| Prepaid and other current assets | |

| 1,893 | | |

| 1,330 | |

| Total current assets | |

| 71,410 | | |

| 64,869 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 10,284 | | |

| 8,692 | |

| Right-of -use asset, net | |

| 995 | | |

| 1,523 | |

| Goodwill | |

| 7,302 | | |

| 7,302 | |

| Intangible assets, net | |

| 8,788 | | |

| 10,085 | |

| Other assets | |

| 103 | | |

| 141 | |

| Total Assets | |

$ | 98,882 | | |

$ | 92,612 | |

| | |

| | | |

| | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 8,298 | | |

$ | 7,054 | |

| Accrued liabilities | |

| 8,871 | | |

| 10,419 | |

| Current portion of lease liability | |

| 795 | | |

| 830 | |

| Current portion of finance lease obligations | |

| 68 | | |

| 65 | |

| Line of credit | |

| 12,887 | | |

| 4,622 | |

| Current portion of long-term debt | |

| 2,750 | | |

| - | |

| Total current liabilities | |

| 33,669 | | |

| 22,990 | |

| Long-term Liabilities: | |

| | | |

| | |

| Lease liability, less current portion | |

| 247 | | |

| 759 | |

| Finance lease obligations, less current portion | |

| 65 | | |

| 116 | |

| Long-term debt, plus premium and less issuance costs | |

| 19,138 | | |

| 17,167 | |

| Other liabilities | |

| 38 | | |

| 231 | |

| Total Liabilities | |

| 53,157 | | |

| 41,263 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock, $0.000001 par value; 10,000,000 shares authorized; no shares issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.000001 par value; 300,000,000 shares authorized; 138,680,874 shares issued and outstanding as of September 30, 2024 and 130,180,031 shares issued and outstanding as of December 31, 2023 | |

| - | | |

| - | |

| Additional paid-in capital | |

| 301,966 | | |

| 294,330 | |

| Accumulated other comprehensive (loss) income | |

| 54 | | |

| 29 | |

| Accumulated deficit | |

| (256,295 | ) | |

| (243,010 | ) |

| Total Stockholders’ Equity | |

| 45,725 | | |

| 51,349 | |

| | |

| | | |

| | |

| Total Liabilities & Stockholders’ Equity | |

$ | 98,882 | | |

$ | 92,612 | |

XTANT

MEDICAL HOLDINGS, INC.

Condensed

Consolidated Statements of Operations

(Unaudited,

in thousands, except number of shares and per share amounts)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 27,937 | | |

$ | 25,019 | | |

$ | 85,754 | | |

$ | 63,195 | |

| Cost of sales | |

| 11,630 | | |

| 9,685 | | |

| 33,562 | | |

| 24,865 | |

| Gross Profit | |

| 16,307 | | |

| 15,334 | | |

| 52,192 | | |

| 38,330 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit % | |

| 58.4 | % | |

| 61.3 | % | |

| 60.9 | % | |

| 60.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 7,493 | | |

| 7,144 | | |

| 22,991 | | |

| 16,983 | |

| Sales and marketing | |

| 11,890 | | |

| 11,085 | | |

| 37,530 | | |

| 26,855 | |

| Research and development | |

| 701 | | |

| 490 | | |

| 1,863 | | |

| 844 | |

| Total Operating Expenses | |

| 20,084 | | |

| 18,719 | | |

| 62,384 | | |

| 44,682 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (3,777 | ) | |

| (3,385 | ) | |

| (10,192 | ) | |

| (6,352 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (Expense) Income | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (1,199 | ) | |

| (760 | ) | |

| (3,026 | ) | |

| (2,120 | ) |

| Interest income | |

| - | | |

| 48 | | |

| - | | |

| 133 | |

| Foreign currency exchange gain | |

| 27 | | |

| - | | |

| 106 | | |

| - | |

| Other expense | |

| (13 | ) | |

| - | | |

| (6 | ) | |

| - | |

| Bargain purchase gain | |

| - | | |

| 11,028 | | |

| - | | |

| 11,028 | |

| Total Other (Expense) Income | |

| (1,185 | ) | |

| 10,316 | | |

| (2,926 | ) | |

| 9,041 | |

| Net (Loss) Income from Operations Before Provision for Income Taxes | |

| (4,962 | ) | |

| 6,931 | | |

| (13,118 | ) | |

| 2,689 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for Income Taxes | |

| | | |

| | | |

| | | |

| | |

| Current and Deferred | |

| (62 | ) | |

| 2,300 | | |

| (166 | ) | |

| 2,274 | |

| Net (Loss) Income | |

$ | (5,024 | ) | |

$ | 9,231 | | |

$ | (13,284 | ) | |

$ | 4,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (Loss) Income Per Share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.04 | ) | |

$ | 0.07 | | |

$ | (0.10 | ) | |

$ | 0.04 | |

| Dilutive | |

$ | (0.04 | ) | |

$ | 0.07 | | |

$ | (0.10 | ) | |

$ | 0.04 | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used in the computation: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 135,100,233 | | |

| 128,140,238 | | |

| 131,881,302 | | |

| 115,380,792 | |

| Dilutive | |

| 135,100,233 | | |

| 135,663,274 | | |

| 131,881,302 | | |

| 123,832,401 | |

XTANT

MEDICAL HOLDINGS, INC.

Condensed

Consolidated Statements of Cash Flows

(Unaudited,

in thousands)

| | |

Nine Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| Operating activities: | |

| | | |

| | |

| Net (loss) income | |

$ | (13,284 | ) | |

$ | 4,963 | |

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 3,076 | | |

| 2,157 | |

| Gain on disposal of fixed assets | |

| (182 | ) | |

| (104 | ) |

| Non-cash interest | |

| 369 | | |

| 266 | |

| Non-cash rent | |

| (18 | ) | |

| 5 | |

| Stock-based compensation | |

| 3,277 | | |

| 1,801 | |

| Provision for expected credit losses | |

| 330 | | |

| 316 | |

| Provision for excess and obsolete inventory | |

| 695 | | |

| 398 | |

| Release of valuation allowance | |

| - | | |

| (2,394 | ) |

| Gain on bargain purchase | |

| - | | |

| (11,028 | ) |

| Other | |

| 17 | | |

| - | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities, net of the effects of the acquisition: | |

| | | |

| | |

| Accounts receivable | |

| (128 | ) | |

| (7,047 | ) |

| Inventories | |

| (5,657 | ) | |

| (1,669 | ) |

| Prepaid and other assets | |

| (503 | ) | |

| 69 | |

| Accounts payable | |

| 1,290 | | |

| 1,298 | |

| Accrued liabilities | |

| (1,843 | ) | |

| 2,369 | |

| Net cash used in by operating activities | |

| (12,561 | ) | |

| (8,600 | ) |

| Investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (3,441 | ) | |

| (1,093 | ) |

| Proceeds from sale of fixed assets | |

| 278 | | |

| 70 | |

| Acquisition of Surgalign SPV, Inc. | |

| - | | |

| (17,000 | ) |

| Acquisition of Surgalign Holding, Inc.’s hardware and biologics business, net of cash acquired | |

| - | | |

| (4,448 | ) |

| Net cash used in investing activities | |

| (3,163 | ) | |

| (22,471 | ) |

| Financing activities: | |

| | | |

| | |

| Payments on financing leases | |

| (49 | ) | |

| (46 | ) |

| Borrowings on line of credit | |

| 86,315 | | |

| 55,345 | |

| Repayments of line of credit | |

| (78,050 | ) | |

| (54,724 | ) |

| Proceeds from private placement, net of cash issuance costs | |

| 4,456 | | |

| 14,011 | |

| Proceeds from issuance of long-term debt, net of issuance costs | |

| 5,000 | | |

| 4,899 | |

| Payments on long term debt | |

| (648 | ) | |

| - | |

| Proceeds from exercise of stock based compensation | |

| 13 | | |

| - | |

| Payment of taxes from withholding of common stock on vesting of restricted stock units | |

| (110 | ) | |

| (119 | ) |

| Net cash provided by financing activities | |

| 16,927 | | |

| 19,366 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | |

| (40 | ) | |

| (53 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents and restricted cash | |

| 1,163 | | |

| (11,758 | ) |

| Cash and cash equivalents and restricted cash at beginning of period | |

| 5,923 | | |

| 20,507 | |

| Cash and cash equivalents and restricted cash at end of period | |

$ | 7,086 | | |

$ | 8,749 | |

| | |

| | | |

| | |

| Reconciliation of cash and restricted cash reported in the condensed consolidated balance sheets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 6,596 | | |

$ | 8,664 | |

| Restricted cash | |

| 490 | | |

| 85 | |

| Total cash and restricted cash reported in the condensed consolidated balance sheets | |

$ | 7,086 | | |

$ | 8,749 | |

XTANT

MEDICAL HOLDINGS, INC.

Calculation

of Non-GAAP Consolidated EBITDA and Adjusted EBITDA

(Unaudited,

in thousands)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net (Loss) Income | |

$ | (5,024 | ) | |

$ | 9,231 | | |

$ | (13,284 | ) | |

$ | 4,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 1,073 | | |

| 883 | | |

| 3,076 | | |

| 2,157 | |

| Interest expense | |

| 1,199 | | |

| 712 | | |

| 3,026 | | |

| 1,987 | |

| Tax expense (benefit) | |

| 62 | | |

| (2,300 | ) | |

| 166 | | |

| (2,274 | ) |

| Non-GAAP EBITDA | |

| (2,690 | ) | |

| 8,526 | | |

| (7,016 | ) | |

| 6,833 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP EBITDA/Total revenue | |

| -9.6 | % | |

| 34.1 | % | |

| -8.2 | % | |

| 10.8 | % |

| | |

| | | |

| | | |

| | | |

| | |

| NON-GAAP ADJUSTED EBITDA CALCULATION | |

| | | |

| | | |

| | | |

| | |

| Separation related expenses | |

| 464 | | |

| - | | |

| 490 | | |

| (15 | ) |

| Legal settlements | |

| - | | |

| 140 | | |

| - | | |

| 140 | |

| Non-cash compensation | |

| 1,139 | | |

| 745 | | |

| 3,277 | | |

| 1,801 | |

| Acquisition-related expenses | |

| - | | |

| 1,023 | | |

| 338 | | |

| 1,326 | |

| Acquisition-related fair value adjustments | |

| 918 | | |

| 1,026 | | |

| 3,448 | | |

| 1,188 | |

| Gain on bargain purchase | |

| - | | |

| (11,028 | ) | |

| - | | |

| (11,028 | ) |

| Unrealized foreign currency translation (gain) loss | |

| (27 | ) | |

| 8 | | |

| (106 | ) | |

| 8 | |

| Non-GAAP Adjusted EBITDA | |

$ | (196 | ) | |

$ | 440 | | |

$ | 431 | | |

$ | 253 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

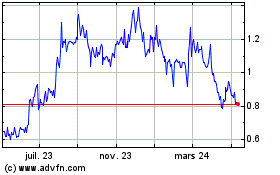

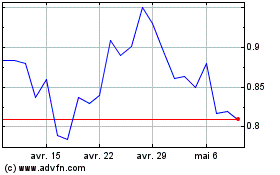

Xtant Medical (AMEX:XTNT)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Xtant Medical (AMEX:XTNT)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024