Current Report Filing (8-k)

20 Juillet 2022 - 10:40PM

Edgar (US Regulatory)

0001684144false00016841442022-07-152022-07-15iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 15, 2022

_______________________________

ZOMEDICA CORP. |

(Exact name of registrant as specified in its charter) |

_______________________________

Alberta, Canada | | 001-38298 | | N/A |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

100 Phoenix Drive, Suite 125

Ann Arbor, Michigan 48108

(Address of Principal Executive Offices) (Zip Code)

(734) 369-2555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Shares, without par value | | ZOM | | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 15, 2022 (the “Effective Date”), Zomedica Corp. (the “Company”) and its wholly-owned subsidiary Zomedica Inc. entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Assisi Animal Health LLC (“Assisi”), its wholly-owned subsidiary, AAH Holdings LLC (“AAH Holdings,” and together with Assisi as the “Sellers”), and certain of Assisi’s members (the Sellers and such Assisi members are collectively referred to herein as the “Selling Parties”) pursuant to which Zomedica Inc. agreed to acquire substantially all of the assets of the Sellers (the “Acquisition”). The Sellers are in the business of developing, manufacturing, marketing, distributing and selling animal health products which use targeted Pulsed Electromagnetic Field (PEMF) therapy to decrease pain and inflammation, accelerate healing, and reduce anxiety that include the Assisi Loop®, Assisi Loop Lounge®, Assisi DentaLoop® and Calmer Canine® product lines. The Acquisition was consummated on the Effective Date (the “Closing Date”).

At the closing, Zomedica Inc. paid Assisi a purchase price of $18.0 million in cash, which was subject to adjustments based on, among other things, the value of Assisi’s inventory and prepaid expenses at the closing of the Acquisition. $1.4 million of the purchase price was deposited into a third-party escrow account to support the Selling Parties’ indemnification obligation under the Purchase Agreement, of which $500,000 and $900,000 will be distributed to Assisi on the one-year and 18-month anniversary of the Closing Date, respectively, less the amount of prior or pending indemnification claims. An additional $200,000 of the purchase price was deposited into the escrow account for a period of approximately 90 days to support payment of post-closing adjustments to the purchase price, if any.

The Company also issued to Assisi a ten-year warrant to purchase an aggregate of 22,000,000 of the Company’s common shares at a per share exercise price equal to $0.252. The warrants may be exercised on a cash or cashless basis, at the election of the warrant holder.

The Purchase Agreement contains customary representations, warranties and covenants of the Selling Parties, the Company and Zomedica Inc. The Purchase Agreement also contains indemnification provisions pursuant to which the Selling Parties have agreed to indemnify Zomedica Inc. and its affiliate against certain losses, subject to the limitations set forth therein, including losses related to breaches of representations, warranties and covenants.

The Purchase Agreement is attached to this report as Exhibit 2.1 and incorporated herein by reference. The foregoing description of the Purchase Agreement and the transactions contemplated and effected thereby is not complete and is qualified in its entirety by the contents of the actual Purchase Agreement.

The Purchase Agreement is included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Sellers, the Company or Zomedica Inc. or any of their respective businesses, subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement were made by the parties thereto only for purposes of that agreement and as of specific dates, and were made solely for the benefit of the parties to the Purchase Agreement. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Sellers, the Company Zomedica Inc. or any of their respective subsidiaries or affiliates.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

The warrant to purchase common shares issued to Assisi at the closing of the Acquisition was offered and sold in reliance upon the exemption from registration provided by Section 4(a)(2) under the Securities Act of 1933, as amended, based on the Company’s reasonable belief that the offer and sale of the warrant has not and will not involve a public offering.

The description set forth in this report of the warrant to purchase common shares is not complete and is qualified in its entirety by reference to the full text of the warrant to purchase common shares, a copy of which is attached to this report as Exhibit 4.1 and incorporated herein by reference.

Item 8.01. Other Events.

On July 18, 2022, the Company issued a press release announcing the consummation of the Acquisition. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

* | Certain exhibits and/or schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish a supplemental copy of any omitted exhibit or schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ZOMEDICA CORP. | |

| | | |

Date: July ___, 2022 | By: | /s/ Ann Marie Cotter | |

| | Ann Marie Cotter | |

| | Chief Financial Officer | |

EXHIBIT INDEX

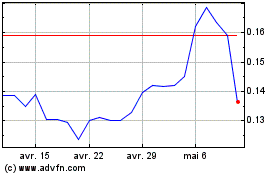

Zomedica (AMEX:ZOM)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Zomedica (AMEX:ZOM)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024