TIDMN4P

RNS Number : 0516B

N4 Pharma PLC

29 September 2022

29 September 2022

N4 Pharma Plc

("N4 Pharma" or the "Company")

Interim Results

N4 Pharma Plc (AIM: N4P), the specialist pharmaceutical company

developing Nuvec(R), a novel delivery system for vaccines and

cancer treatments, announces its unaudited interim results for the

six months ended 30 June 2022.

Highlights:

-- Exciting opportunities identified for progression into phase

1 clinical trials in oncology and siRNA delivery.

-- Studies conducted with Nanomerics to evaluate the potential

of Nuvec(R) as a nano-carrier of a DNA plasmid expressing

TNFalpha ("TNF"), a cytokine with immune-modulating properties

against tumours, demonstrated a significant inhibition of

tumour growth derived from a human cell line.

-- Positive preliminary results from ongoing oral studies undertaken

at the University of Queensland showing Nuvec(R) delivered

orally has transfected cells in the small intestine.

-- Nuvec(R) patents granted in the US and China. Company now

has strong IP protection in key territories around the world.

-- Reduced operating loss for the period GBP750,102 (30 June

2021: GBP973,216) and R&D and general expenditure in line

with budget.

-- Cash position remains strong which at 30 June 2022 was GBP1,579,948

(31 December 2021: GBP1,784,024), again in line with budget.

Nigel Theobald, Chief Executive Officer of N4 Pharma Plc,

commented:

"We have continued to make excellent progress in the period and

have refined our focus in line with changing market conditions to

provide us with the best opportunities to progress Nuvec(R) into

the clinic. Cash expenditure has been tightly controlled to allow

us to maximise outcomes whilst preserving our cash resource as far

as possible. I look forward with optimism to the excellent progress

we have made continuing throughout the remainder of the financial

year."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Enquiries:

N4 Pharma Plc Via IFC Advisory

Nigel Theobald, CEO

Luke Cairns, Executive Director

SP Angel Corporate Finance LLP Tel: + 44 (0)20 3470 0470

Nominated Adviser and Joint Broker

Matthew Johnson/Caroline Rowe (Corporate

Finance)

Vadim Alexandre/Rob Rees (Corporate

Broking)

Turner Pope Investments (TPI) Limited Tel: +44 (0)20 3657 0050

Joint Broker

Andy Thacker

IFC Advisory Limited Tel: +44 (0)20 3934 6630

Financial PR

Graham Herring

Zach Cohen

About N4 Pharma

N4 Pharma is a specialist pharmaceutical company developing a

novel delivery system for vaccines and cancer treatments using its

unique silica nanoparticle delivery system called Nuvec(R).

N4 Pharma's business model is to partner with companies

developing novel antigens for vaccines and cancer treatments to use

Nuvec(R) as the delivery vehicle to get their antigen into cells to

express the protein needed for the required immunity. As these

products progress through pre clinical and clinical programs, N4

Pharma will seek to receive upfront payments, milestone payments

and ultimately royalty payments once products reach the market.

Chairman's Statement

Half year results

I am pleased to report that in the six months ended 30 June

2022, the operating loss for the period was GBP750,102 (30 June

2021: GBP973,216) and in line with planned expenditure.

Our cash balance at 30 June 2022 was GBP1,579,948 (31 December

2021: GBP1,784,024), again in line with budget.

Operational update

Following the significant data accumulated in the preceding

periods in respect of the potential for the use of Nuvec(R) in DNA

vaccines, the Company's focus for 2022 was fourfold:

-- to expand its knowledge around Nuvec(R) in oncology and gene therapy;

-- to undertake more substantive studies into the potential of Nuvec(R) loaded with SiRNA;

-- to support the University of Queensland in its oral studies using Nuvec(R);

-- Ongoing work under the Material Transfer Agreement ("MTA").

Market Background

The market for vaccine development has shown considerable change

over the last few years, mainly due to the arrival of Covid 19 and

the rapid acceleration into the market of vaccines, including novel

mRNA vaccines to treat this disease. The speed of development and

approval was unsurpassed by any other area and, as a consequence,

companies chose to use their existing delivery systems, albeit with

some potential issues and side effects, but the need for rapid

vaccine development offset any such concerns. This meant that novel

technologies like Nuvec(R), which have huge potential in this

space, found it hard to get into development pipelines alongside

existing systems.

On top of this, covid vaccine development attracted much of the

available funding in this space and many companies which had

initiated very expensive development programmes found these

programmes were no longer needed as the established two or three

vaccines dominated this space, leaving little room for other

products.

This has led to one of the most challenging periods in biotech

development for most companies, with many now looking to reassess

how they are best placed in this new environment.

Whilst the Company has been impacted by this rapidly changing

environment, the versatility of our Nuvec(R) delivery system still

leaves us very well placed as major biotechs reassess their plans

and switch to develop novel RNA products both for vaccines and

importantly cancer and gene therapy.

Having done a lot of proof of concept work showing antibody

production using Nuvec(R) and how Nuvec(R) can be formulated to

produce a monodisperse formulation it became clear that the Company

would not be able to get any products into the clinic without a

collaborative partner and the changing focus of the major biotechs

meant the Company needed to look at how Nuvec(R) would work in

areas these companies were now focusing on.

That said, the Company has not stopped its work in vaccines. The

Company will continue to look for MTA opportunities in this space

as any product being developed for a vaccine is going to need a lot

of formulation development. Because the Company cannot take

relevant generic vaccines into the clinic itself without

significantly increased expenditure, we have decided to focus our

development work on oncology and siRNA delivery as these sectors

have proven clinical models the Company can access and also because

Nuvec(R) can be used to work with generic siRNA and plasmids

capable of being used in phase 1 clinical trials.

There are over 300 companies working in this space with 106

clinical trials already in place using siRNA. This focus has two

clear advantages: the Company has a wider audience and the number

of compounds it can use to collaborate with provide the opportunity

to get into the clinic much more rapidly than if we focus purely on

vaccines.

The Company therefore decided to start working with intravenous

injection (which it could now do having solved how to produce a

monodisperse formulation) and to investigate both how it works as a

tumour suppressant and how it works in delivering siRNA.

We are very excited by the potential for this work.

Oncology work

The first part of 2022 saw the Company focus on an oncology work

programme with Medicines Discovery Catapult ("MDC") to follow up

the successful studies undertaken last year where Nuvec(R) was used

as a nano-carrier of a DNA plasmid expressing TNF which had

demonstrated a significant inhibition of tumour growth derived from

a human cell line. Having established that Nuvec(R) could deliver

an appropriate biological load, the work at MDC was to help

determine the mechanism of action that produced the tumour

suppression. Amongst other things, it was to seek to identify

whether the Nuvec(R) loaded with TNF was directly taken up within

the tumour or whether other organs took up the Nuvec(R) and

produced the TNF and then released it systemically to suppress the

tumour.

The result of the MDC study again showed clear tumour

suppression with 10ug of TNF loaded onto Nuvec(R) which,

positively, was a lower dose than used in previous studies. It also

became clear that formulation is pivotal to every study as the

higher dose preparation was sub-optimal, due to some observed

agglomeration resulting in data unable to be obtained.

The Biochemical analysis of the 10ug arm of the study confirmed

an increase in circulating plasma TNF levels. It indicated that

tissues including the liver and the tumour cells may have been

responsible for the transfection with the TNF plasmid and

subsequent release of TNF-alpha into the circulation to suppress

the tumour. The resulting data indicated that the most appropriate

use of Nuvec(R) in the oncology field will likely be to combine it

with one or more nucleic acids alongside a targeting ligand to

allow specific cancer cells to be targeted.

TNF was chosen as a proof of concept compound to show the

ability of Nuvec(R) to achieve tumour suppression and given this

systemic response it means that TNF itself would not be the best

compound to do further work in this space yet the successful tumour

suppression seen using this has been excellent validation of

Nuvec(R) as an i.v. solution for oncology.

siRNA

Having historically evaluated the potential of Nuvec(R) to carry

DNA and mRNA, experiments in the period were undertaken to show

that Nuvec(R) could also be loaded with siRNA and maintain a

colloidally stable formulation. Since period end and as announced

on 14 September 2022 the Company has shown the successful loading

of Nuvec(R) with two different generic siRNA probes, GFP (Green

Fluorescent protein) and EHMT-2 (Euchromatic Histone Lysine

Methyltransferase 2) and both of which were shown to be easy to

load and produce a monodisperse formulation and successful in

meeting their respective endpoints of silencing the particular

gene.

The Company has now completed initial testing on loading

Nuvec(R) with both these siRNA probes, GFP and EHMT-2 at the same

time. Our next step will be to test in vitro that the particle with

combined siRNA is still able to meet both their respective gene

silencing endpoints, as previously demonstrated with singular

loading.

Following this work on TNF and initial siRNA compounds, the

Company has undertaken a review of where it believes it will likely

get greatest traction to allow a commercial license deal to be

agreed.

After the development of successful mRNA vaccines as highlighted

in the 'Market Background' section above, major companies in this

space now appear to be focusing future development on gene therapy

treatments using, in particular, siRNA to silence identified

pathways involved in cancer. Given the pre-clinical status of

Nuvec(R) the Company believes that focusing its work on loading

more than one siRNA sequence onto the same nanoparticle will result

in silencing of complementary pathways leading to an increased

therapeutic response and establish a significant differential in

this marketplace.

Having established the capability of Nuvec(R) to carry two siRNA

simultaneously and assuming the combination still provides a

functional response, the Company is undertaking a series of

experiments over the coming months using two siRNA sequences

directed against known, and clinically validated, oncology targets.

Specifically, the targets are the EGFR signalling pathway, which

regulates cell cycle progression and BCl-2, which regulates

apoptosis. Silencing of the EGFR will inhibit cell division while

silencing BCl-2 will promote apoptosis and the potential for

additive or synergistic effects will be explored. Initial studies

will be conducted in vitro using a PC9 lung cancer cell line and

this will be followed by in vivo studies in xenograft tumours of

the same cell line.

Successful completion of this work will give strong clinical

validation for using Nuvec(R) in this space and will be presented

to collaboration partners who have their own siRNA in early

clinical development with a view to licensing Nuvec(R)

The Company believes this is the most appropriate way to

commercialise Nuvec(R)

Oral Studies at the University of Queensland ("UQ")

During the period UQ has, utilising the grant funding obtained

by N4 Pharma and UQ, pursued the longer term study on oral

applications for Nuvec(R). Early results were promising with UQ

successfully demonstrating via an in vivo pre-clinical study that

Nuvec(R) loaded with a red fluorescent protein (mCherry) DNA and

formulated and administered in capsules was able to successfully

transfect cells in the small intestine. Whilst this first study was

limited in scope this is a significant step in establishing how

Nuvec(R) could be delivered orally.

The next step in this work is for UQ to repeat the success of

this in vivo study which the Company understands will be undertaken

soon.

MTA

As announced in the results for the year ended 31 December 2021,

due to the strict confidentiality around MTAs, we have decided to

only announce further MTAs when able to without restrictions of

confidentiality or in respect of a defined commercial agreement.

With regard to the MTA previously announced, work remains ongoing

but the degree of progress is largely determined by our partner's

own R&D work and drug launches.

Going Forward

As outlined above, whilst we continue to seek partners to work

with based on the data accumulated to date utilising DNA plasmids

with Nuvec(R) for oncology and vaccines, the focus of our

controllable R&D spend will be both on siRNA loaded onto

Nuvec(R) and building on the encouraging data obtained to date. In

the background, we are keeping a keen eye on developments at UQ

with the oral work, which could be hugely significant if

successful. We also remain open to acquiring additional assets.

Intellectual Property

In January of this year, we were pleased to announce that the UQ

had informed the Company that it had been notified by the US Patent

Attorney of the granting of its patent application in relation to

Nuvec(R) in the United States and that the Chinese authorities had

granted a patent in China. The granting of patents in these two

large markets, together with those previously granted, gives the

Company strong intellectual property protection in key territories

around the world, a vital component for potential licensing

deals.

Outlook and strategy

Our strategy remains unchanged - to generate sufficient proof of

concept data with a view to attracting large pharma and biotech

partners to enter into collaborations with us to explore using

Nuvec(R) as their chosen delivery system to get products into

clinic. What is clear is that the formulation is different for each

plasmid and a critical path when working with any new plasmids. The

early results from our siRNA work is extremely encouraging and if,

as we hope, results continue to be positive, this would indicate

that we are significantly closer to a breakthrough point for

Nuvec(R) in achieving commerciality.

We have remained extremely prudent in our R&D and general

expenditure. There is almost unprecedented economic uncertainty at

the moment which has undoubtedly impacted our share price. Markets

in general have been hit badly and N4 Pharma has been no exception.

Whilst, as a pre revenue business, it is almost inevitable we will

at some point need to access further funding be it from grants,

equity markets or other means, I want to assure shareholders that

we remain well funded, certainly for our medium term needs.

On behalf of the Board, I would like to thank all of our

shareholders for their continued support and look forward to

providing further updates on our progress.

John Chiplin

Chairman

29 September 2022

N4 Pharma Plc and its controlled entities

Condensed Consolidated Interim Statement of Comprehensive Income

(unaudited) for the six months ended 30 June 2022

Six months Six months Twelve months

to 30 June to 30 June to 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------ ------------ ----------------

Expenses

Research and development

costs (411,417) (602,927) (1,179,425)

General and administration

costs (338,019) (367,701) (663,865)

Operating loss for the

period (749,436) (970,628) (1,843,290)

Finance (expenditure)/income (666) (2,588) 677

Loss for the period before

tax (750,102) (973,216) (1,842,613)

Taxation - - 298,267

Loss for the period after

tax (750,102) (973,216) (1,544,346)

Other comprehensive income -

net of tax - -

Total comprehensive loss for

the period attributable to equity

owners of N4 Pharma Plc (750,102) (973,216) (1,544,346)

===================================== ============ ============ ================

Loss per share attributable to owners of

the parent

Weighted average number

of shares:

Basic 181,080,349 181,080,349 181,080,349

Diluted 181,080,349 184,137,774 181,080,349

Basic loss per share (0.41p) (0.54p) (0.85p)

Diluted loss per share (0.41p) (0.53p) (0.85p)

All activities derive from continuing operations.

The notes below form an integral part of these financial

statements.

N4 Pharma Plc and its controlled entities

Condensed Consolidated Interim Statement of Financial Position

(unaudited) for the six months ended 30 June 2022

Notes 30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------- ------------- -------------

Assets

Current assets

Trade and other receivables 27,804 273,097 558,359

Cash and cash equivalents 1,579,948 2,542,680 1,784,024

1,607,752 2,815,777 2,342,383

Total Assets 1,607,752 2,815,777 2,342,383

------------------------------ ------ ------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables (158,157) (74,284) (184,820)

Accruals and deferred income (62,612) (49,043) (27,910)

------------------------------ ------ ------------- ------------- -------------

Total assets less current

liabilities 1,386,983 2,692,450 2,129,653

------------------------------ ------ ------------- ------------- -------------

Net Assets 1,386,983 2,692,450 2,129,653

------------------------------ ------ ------------- ------------- -------------

Equity

Share capital 4 8,995,146 8,995,146 8,995,146

Share premium 5 13,945,602 13,945,602 13,945,602

Share option reserve 6 87,387 71,622 79,955

Reverse acquisition reserve 5 (14,138,244) (14,138,244) (14,138,244)

Merger relief reserve 5 279,347 279,347 279,347

Retained earnings (7,782,255) (6,461,023) (7,032,153)

------------------------------ ------ ------------- ------------- -------------

Total Equity 1,386,983 2,692,450 2,129,653

------------------------------ ------ ------------- ------------- -------------

N4 Pharma Plc and its controlled entities

Condensed Consolidated Interim Statement of Changes in Equity

(unaudited) for the six months ended 30 June 2022

(i) Six months

ended 30 June

2022 - Unaudited

---------- ----------- --------- ------------- ---------------- ------------ -------------

Share Share Share Reverse Merger Retained Total Equity

Capital Premium Option Acquisition Relief Reserve Earnings

Reserve Reserve

GBP GBP GBP GBP GBP GBP GBP

---------- ----------- --------- ------------- ---------------- ------------ -------------

Balance at 1

January 2022 8,995,146 13,945,602 79,955 (14,138,244) 279,347 (7,032,153) 2,129,653

Total comprehensive

loss for

the period - - - - - (750,102) (750,102)

Share option

reserve - - 7,432 - - - 7,432

At 30 June 2022 8,995,146 13,945,602 87,387 (14,138,244) 279,347 (7,782,255) 1,386,983

(ii) Six months

ended 30

June 2021 -

Unaudited

---------- ----------- --------- ------------- ---------------- ------------ -------------

Share Share Share Reverse Merger Retained Total Equity

Capital Premium Option Acquisition Relief Reserve Earnings

Reserve Reserve

GBP GBP GBP GBP GBP GBP GBP

---------- ----------- --------- ------------- ---------------- ------------ -------------

Balance at 1

January 2021 8,995,146 13,945,602 63,290 (14,138,244) 279,347 (5,487,807) 3,657,334

Total comprehensive

loss for

the period - - - - - (973,216) (973,216)

Share option

reserve - - 8,332 - - - 8,332

At 30 June 2021 8,995,146 13,945,602 71,622 (14,138,244) 279,347 (6,461,023) 2,692,450

N4 Pharma Plc and its controlled entities

Condensed Consolidated Interim Statement of Changes in Equity

(unaudited) for the six months ended 30 June 2022 (continued)

(iii) Twelve months

ended

31 December 2021 -

Audited

---------- ----------- --------- ------------- ---------------- ------------ -------------

Share Share Share Reverse Merger Retained Total Equity

Capital Premium Option Acquisition Relief Reserve Earnings

Reserve Reserve

GBP GBP GBP GBP GBP GBP GBP

---------- ----------- --------- ------------- ---------------- ------------ -------------

Balance at 1

January 2021 8,995,146 13,945,602 63,290 (14,138,244) 279,347 (5,487,807) 3,657,334

Total comprehensive

loss for

the year - - - - - (1,544,346) (1,544,346)

Share option

reserve - - 16,665 - - - 16,665

At 31 December 2021 8,995,146 13,945,602 79,955 (14,138,244) 279,347 (7,032,153) 2,129,653

The notes below form an integral part of these

financial

statements.

N4 Pharma Plc and its controlled entities

Condensed Consolidated Interim Statement of Cash Flows

(unaudited) for the six months ended 30 June 2022

Six months Six months Twelve months

to 30 June to 30 June to 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

--------------------------------------- ------------ -------------- ------------------

Operating activities

Loss after tax (750,102) (973,216) (1,544,346)

Finance expenditure/(income) 666 2,588 (677)

Share based payments to employees 7,432 8,332 16,665

Taxation credit - - (298,267)

Operating loss before changes

in working capital (742,004) (962,296) (1,826,625)

Movements in working capital:

Decrease/ (increase) in trade

and other receivables 530,555 (2,260) 10,745

(Decrease)/increase in trade,

payables and accruals 8,039 (45,755) 43,648

Cash used in operations (203,410) (1,010,311) (1,772,232)

------------------------------------------- ------------ -------------- ------------------

Net cash flows used in operating

activities (203,410) (1,010,311) (1,772,232)

------------------------------------------- ------------ -------------- ------------------

Financing activities

Finance (expenditure)/income (666) (2,588) 677

Net cash flows (used in)/from

financing activities (666) (2,588) 677

------------------------------------------- ------------ -------------- ------------------

Net decrease in cash and cash

equivalents (204,076) (1,012,899) (1,771,555)

Cash and cash equivalents at beginning

of the period/ year 1,784,024 3,555,579 3,555,579

Cash and cash equivalents at

30 June/ 31 December 1,579,948 2,542,680 1,784,024

The notes below form an integral part of these

financial statements.

N4 Pharma Plc and its controlled entities

Notes to the condensed interim financial statements for the six

months ended 30 June 2022

1. Corporate Information

N4 Pharma Plc (the "Company") is the holding company for N4

Pharma UK Limited ("N4 UK"), and together form the group (the

"Group"). N4 UK is a specialist pharmaceutical company engaged in

the development of mesoparticulate silica delivery systems to

improve the cellular delivery and potency of vaccines. The nature

of the business is not deemed to be impacted by seasonal

fluctuations and as such performance is expected to be

consistent.

The Company is domiciled in England and Wales and was

incorporated and registered in England and Wales on 6 July 1979 as

a public limited company and its shares are admitted to trading on

AIM (LSE: N4P). The Company's registered office is located at 6th

Floor, 60 Gracechurch Street, London, EC3V 0HR.

2. Accounting Policies

Adoption of New and Revised International Financial Reporting

Standards

The standards and interpretations that are issued, but not yet

effective, up to the date of the issuance of the consolidated

interim financial statements are disclosed below. The Group intends

to adopt these standards, if applicable, when they become

effective.

Title As Issued by the IASB, mandatory

for accounting periods starting

Amendments to IAS 1: Classification Accounting periods beginning

of Liabilities as Current or on or after 1 January 2023

Non-Current

---------------------------------

Amendments to IAS 1 and IFRS Accounting periods beginning

Practice Statement 2: Disclosure on or after 1 January 2023

of Accounting Policies

---------------------------------

Amendments to IAS 12: Deferred Accounting periods beginning

Tax related to Assets and Liabilities on or after 1 January 2023

arising from a Single Transaction

---------------------------------

IFRS 17 - Insurance Contracts Accounting periods beginning

on or after 1 January 2023

---------------------------------

Amendments to IAS 8: Definition Accounting periods beginning

of Accounting Estimates on or after 1 January 2023

---------------------------------

Basis of Preparation:

The Group's condensed consolidated interim financial statements

have been prepared in accordance with International Accounting

Standard ("IAS") 34, "Interim Financial Reporting".

The annual consolidated financial statements for the year ended

31 December 2021 were prepared in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union.

The condensed consolidated interim financial information for the

six months ended 30 June 2022 are unaudited. In the opinion of the

Directors, the condensed consolidated interim financial information

presents fairly the financial position, and results from operations

and cash flows for the period.

These condensed consolidated interim financial statements been

prepared on the basis of accounting principles applicable to a

going concern. The Directors consider that the Group will have

access to adequate resources, to meet the operational requirements

for at least 12 months from the date of approval of these condensed

consolidated interim financial statements. For this reason, they

continue to adopt the going concern basis in preparing the

condensed consolidated interim financial statements.

The financial statements are presented in Sterling, which is the

Group's functional currency as the UK is the primary environment in

which it operates.

Basis of Consolidation:

These condensed consolidated interim financial statements have

been prepared in accordance with IFRS 2, as a result of the

consolidation of the Company and N4 UK, constituting a reverse

takeover transaction, for the comparative six month period ended 30

June 2021 and the comparative twelve month period to 31 December

2021 and the current six month period ended 30 June 2022.

Significant Accounting Policies:

The condensed consolidated interim financial statements have

been prepared under the historical cost convention, as modified for

the following items, in accordance with International Financial

Reporting Standards ('IFRS') as adopted by the European Union:

-- Share-based payments related to investment acquisition are

measured at fair value shown in the Merger Reserve.

-- Share-based payments related to employee costs are measured

at fair value shown in the Statement of Comprehensive Income.

-- The associated Share Options are measured at fair value using

the Black Scholes model (see note 9).

All accounting policies are consistent with those applied in the

Annual Report and there have been no amendments or changes in

accounting policies during the period.

Segmental reporting:

The Group operated in one business segment, that of the

development and commercialisation of medicines via its delivery

system called Nuvec(R). No revenue has yet been generated by any of

the work undertaken by the Group.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors, for the

purposes of resource allocation and assessment of performance, is

based wholly on the overall activities of the Group.

Seasonality

The nature of the business is not deemed to be impacted by

seasonal fluctuations and as such performance is expected to be

consistent.

3. Critical Accounting Judgements and Estimates

The preparation of the condensed consolidated interim financial

statements in conformity with IFRS requires management to make

certain estimates, assumptions and judgements that affect the

application of accounting policies and the reported amounts of

assets and liabilities and the reported amounts of income and

expenses during the reporting period.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

In the process of applying the Group's accounting policies,

management has decided the following estimates and assumptions are

material to the carrying amounts of assets and liabilities

recognised in the condensed consolidated interim financial

statements.

Critical judgements

Research and development expenditure

The key judgements surrounding the Research & Development

expenditure is whether the expenditure meets the criteria for

capitalisation. Expenditure will only be capitalised when the

recognition criteria is met and is otherwise written off to the

Consolidated Statement of Comprehensive Income. The recognition

criteria include the identification of a clearly defined project

with separately identifiable expenditure where the outcome of the

project, in terms of its technical feasibility and commercial

viability, can be measured or assessed with reasonable certainty

and that sufficient resources exist to complete a profitable

project. In the event that these criteria are met, and it is

probable that future economic benefit attributable to the product

will flow to the Group, then the expenditure will be

capitalised.

Impairment of investments and intercompany debtors

N4 UK has sustained losses and the Statement of Financial

position is in deficit. The recoverability of the intercompany

debtor and the cost of investment is dependent on the future

profitability and success of the entity, which is in a research

phase and has not therefore generated any revenue to date. Having

considered research progress during the period and future prospects

of N4 UK, the Directors do not consider that there are indicators

of impairment in respect of these balances. This is a significant

judgement.

4. Share Capital

Allotted, called up and 30 June 30 June 31 Dec 2021

fully paid 2022 (Unaudited) 2021 (Unaudited) (Audited)

GBP GBP GBP

181,080,349 Ordinary Shares

of 0.4p each (30 June 2021

and 31 December 2021: 181,080,349

Ordinary shares of 0.4p

each) 724,321 724,321 724,321

137,674,431 Deferred Shares

of 4p each (30 June 2021

and 31 December 2021: 137,674,431

Deferred shares of 4p each) 5,506,977 5,506,977 5,506,977

279,176,540 Deferred Shares

of 0.099p each (30 June

2021 and 31 December 2021:

279,176,540 Deferred shares

of 0.099p each) 2,763,848 2,763,848 2,763,848

------------------ ------------------ ------------

8,995,146 8,995,146 8,995,146

================== ================== ============

All ordinary shares rank equally in all respects, including for

dividends, shareholder attendance and voting rights at meetings, on

a return of capital and in a winding-up.

The 137,674,431 deferred shares of 4p, have no right to

dividends nor do the holders thereof have the right to receive

notice of or to attend or vote at any general meeting of the

Company. On a return of capital or on a winding up of the Company,

the holders of the deferred shares shall only be entitled to

receive the amount paid up on such shares after the holders of the

ordinary shares have received the sum of GBP1,000,000 for each

ordinary share held by them.

The 279,176,540 deferred shares of 0.99p shall be entitled to

receive a special dividend, which is payable upon the repayment to

the Company of any amount owed under certain loan agreements, after

which the Company shall, in priority to any distribution to any

other class of share, pay to the holders of the Special Deferred

Shares an aggregate amount equal to the amount repaid pro rata

according to the number of such shares paid up as to their nominal

value held by each shareholder. They shall be entitled to no other

distribution save for a special dividend and shall not be entitled

to receive notice of or attend or vote at a general meeting of the

Company. On a return of capital on a winding up of the Company,

they shall only be entitled to receive the amount paid up on such

shares up to a maximum of 0.9 pence per share after the holders of

the Ordinary Shares and the Deferred Shares have received their

return on capital.

5. Reserves

The share premium account represents the amount received on the

issue of ordinary shares by the Company in excess

of their nominal value and issue costs and is

non-distributable.

The merger relief reserve arose on the Company's acquisition of

N4 UK and consists of both the consideration shares and deferred

consideration amounting to GBP279,347. There is no legal share

premium on the shares issued as consideration as section 612 of the

Companies Act 2006, which deals with merger relief, applies in

respect of the acquisition.

The reverse acquisition reserve arises due to the elimination of

the Company's investment in N4 UK. Since the shareholder in N4 UK

became a shareholder of the Company, the acquisition is accounted

for as though the legal acquiree (N4 UK) is the accounting

acquirer.

6. Share-based Payments and Share Option Reserve

Options

The Company has the ability to issue options to Directors to

compensate them for services rendered and incentivise them to add

value to the Group's longer-term share value. Equity settled

share-based payments are measured at fair value at the date of

grant. The fair value determined is charged to the Comprehensive

Income Statement on a straight-line basis over the vesting period

based on the Group's estimate of the number of shares that will

vest.

Cancellations of equity instruments are treated as an

acceleration of the vesting period and any outstanding charge is

recognised in full immediately.

Fair value is measured using a Black Scholes pricing model. The

key assumptions used in the model have been adjusted based on

management's best estimate for the effects of non-transferability,

exercise restrictions and behavioral considerations. The inputs

into the model were as follows:

2017 Options 2018 Options 2019 Options 2020 Options

Share price 6.375p 6.6p 3.55p 4.8p

Exercise price 7p 6.6p 3.55p 4.8p

Expected volatility 27.2% 45.2% 37.4% 29.9%

Expected option life 3 years 6.5 years 6.5 years 6.5 years

Risk free rate 4.75% 5.00% 5.00% 5.00%

As at 30 June 2022, there were 7,046,513 (30 June 2021:

7,046,513, 31 December 2021: 7,046,513) options in existence over

ordinary shares of the Company.

Options in existence during the current and previous periods and

year are as follows:

Ordinary

Name Date of shares under Expiry Date Exercise

Grant option Price GBP

2015 Options

Gavin Burnell 14.10.15 1,351,210 14.10.25 0.0280

Luke Cairns 14.10.15 675,302 14.10.25 0.0280

2017 Options

Luke Cairns 03.05.17 717,143 03.05.27 0.0700

David Templeton 03.05.17 717,143 03.05.27 0.0700

Paul Titley 03.05.17 717,143 03.05.27 0.0700

2019 Options

John Chiplin 21.05.19 717,143 21.05.29 0.0355

Christopher Britten 21.05.19 717,143 21.05.29 0.0355

2020 Options

David Templeton 18.05.20 717,143 18.05.30 0.0480

Luke Cairns 18.05.20 717,143 18.05.30 0.0480

Total options 7,046,513

--------------

Each option entitles the holder to subscribe for one ordinary

share in N4 Pharma Plc. Options do not confer any voting rights on

the holder.

The aggregate fair value of the share options issued is as

follows:

30 June 30 June 31 Dec

2022 (Unaudited) 2020 (Unaudited) 2021 (Audited)

GBP GBP GBP

2015 Options 18,492 18,492 18,492

2017 Options 26,884 26,884 26,884

2019 Options 22,793 16,066 19,861

2020 Options 19,218 10,180 14,718

------------------ ------------------ ----------------

87,387 71,622 79,955

------------------ ------------------ ----------------

7. Earnings per Share

Basic earnings per share is calculated by dividing the loss

after tax attributable (excluding the deemed cost of acquisition)

to the equity holders of the Company by the weighted average number

of shares in issue during the period.

Diluted earnings per share is calculated by adjusting the

weighted average number of shares outstanding to assume conversion

of all potential dilutive shares, namely share options.

8. Related Party Transactions

During the period to 30 June 2022, the non-executive directors'

fees amounted to GBP24,000 (6 months to 30 June 2021: GBP25,046, 12

months to 31 December 2021: GBP55,590).

During the period to 30 June 2022, the Company charged N4 UK

GBP22,000 in respect of 50 per cent. of the fees paid to Directors

for the services rendered to N4 UK (6 months to 30 June 2021:

GBP22,000, 12 months to 31 December 2021: GBP44,000).

9. Subsequent Events

There are no significant subsequent events that require

adjustment or disclosure in these condensed consolidated interim

financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPURPBUPPGAR

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

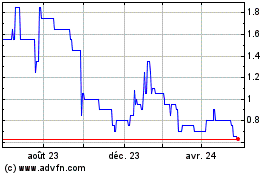

N4 Pharma (AQSE:N4P.GB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

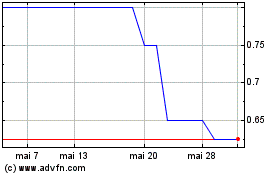

N4 Pharma (AQSE:N4P.GB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024