New Star Investment Trust PLC (NSI)

New Star Investment Trust PLC: Annual Financial Report

30-Sep-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

NEW STAR INVESTMENT TRUST PLC

This announcement constitutes regulated information.

UNAUDITED RESULTS

FOR THE YEARED 30TH JUNE 2019

New Star Investment Trust plc (the 'Company'), whose objective is to achieve

long-term capital growth, announces its consolidated results for the year

ended 30th June 2019.

FINANCIAL HIGHLIGHTS

30th June 30th June %

2019 2018 Change

PERFORMANCE

Net assets (GBP '000) 113,971 111,366 2.34

Net asset value per Ordinary share 160.47p 156.80p 2.34

Mid-market price per Ordinary share 111.00p 113.00p -1.77

Discount of price to net asset value 30.83% 27.9% n/a

Total Return* 2.98% 6.5% n/a

IA Mixed Investment 40% - 85% Shares 3.66% 4.9% n/a

(total return)

MSCI AC World Index (total return, 10.30% 9.5% n/a

sterling adjusted)

MSCI UK Index (total return) 1.68% 8.3% n/a

1st July 2018 to 1st July 2017 to

30th June 2019 30th June 2018

Revenue return per Ordinary 1.81p 1.17p

share

Capital return per share 2.86p 8.51p

Return per Ordinary share 4.67p 9.68p

TOTAL RETURN* 2.98% 6.5%

PROPOSED DIVID PER ORDINARY 1.40p 1.00p

SHARE

* The total return figure for the Group represents the revenue and capital

return shown in the consolidated statement of Comprehensive income plus

dividends paid (the Alternative performance measure).

CHAIRMAN'S STATEMENT

PERFORMANCE

Your Company's net asset value (NAV) total return was 3.0% over the year to

30th June 2019. This took the year-end NAV per ordinary share to 160.47p. By

comparison, the Investment Association's Mixed Investment 40-85% Shares

index gained 3.7%. Your Directors believe this benchmark is appropriate

because your Company has, since inception, been invested in a broad range of

asset classes. In a volatile year, global equity markets generated positive

returns although European and Asian equities underperformed US equities as a

result of escalating trade tensions, slowing economic growth and fears about

the consequences of a "no deal" Brexit. The MSCI AC World Total Return and

MSCI UK Total Return Indices gained 10.3% and 1.7% respectively while UK

government bonds returned 5.2%. Further information is provided in the

investment manager's report.

EARNINGS AND DIVID

The revenue return for the year was 1.81p per share (2018: 1.17p). This

represents a substantial increase. Your directors do not envisage increases

of a similar magnitude in subsequent years. A performance fee of 0.58p per

share (2018: nil) was deducted from capital.

Your Company has a revenue surplus in its retained revenue reserve, enabling

it to pay a dividend. Your directors recommend the payment of a final

dividend in respect of the year of 1.4p per share (2018: 1.0p).

OUTLOOK

Global economic growth slowed during 2019, with manufacturing suffering more

than services as a result of trade disputes and rising tariffs. The US is

seeking to maintain its technological supremacy so there may not be an early

end to its trade dispute with China. This may have a significant effect on

eurozone and Asian exporters while Brexit uncertainties may continue to

affect UK commercial and consumer confidence.

The decline in long-term bond yields relative to short-term bond yields

shows that investors fear the onset of recession. Major central banks have

sought to counter slowing economic growth through monetary easing but, after

a decade of such measures, further easing may prove to be less of a stimulus

than in the past. Your Company reduced its equity holdings over the year and

increased its holdings in cash. Investments in dollars, gold equities and

lower-risk multi-asset funds provide diversification and potentially some

protection if equity markets weaken.

CASH AND BORROWINGS

Your Company has no borrowings and ended its financial year with cash

representing 18.1% of its net asset value. Your Company is likely to

maintain a significant cash position.

The Company is a small registered Alternative Investment Fund Manager under

the European Union directive. The Company's assets now exceed the threshold

of EUR100 million. As a result, should it wish to borrow it would require a

change in regulatory permissions.

DISCOUNT

During the year, your Company's shares continued to trade at a significant

discount to their NAV. The Board keeps this issue under review.

ANNUAL MEETING

The Annual General Meeting will be held on Thursday, 14th November 2019 at

11am.

NET ASSET VALUE

Your Company's unaudited net asset value per share at 31st August 2019 was

162.91p.

INVESTMENT MANAGER'S REPORT

MARKET REVIEW

US monetary policy reached a watershed moment during your Company's

financial year. Starting in December 2015, the Federal Reserve had tightened

monetary policy through successive interest rate increases and some

reduction of its swollen balance sheet, culminating in December 2018, when

the Fed funds target rate rose to 2.25-2.50%. Global equities fell 10.57% in

sterling over the final quarter of 2018, more than erasing the previous

quarter's gains because investors feared overly-restrictive monetary policy

might choke off economic growth. In a significant volte-face, however, the

Fed chairman, Jerome Powell, retreated from earlier hawkish comments that

interest rates were "a long way" from neutral, saying rates were "close to"

neutral. Confidence returned following the Fed's U-turn, with global

equities gaining 16.68% in sterling in the six months to 30th June 2019 to

end a volatile year up 10.30%. US equities outperformed, rising 14.54% in

sterling, but European and Asian equities underperformed.

Safe-haven assets were in demand as economic prospects deteriorated. Global

bonds rose 9.80% in sterling while UK government bonds and sterling

corporate bonds rose 5.23% and 6.83% respectively. The yield on 10-year US

treasury bonds fell from 2.85% to 2.20%, with investors looking forward to

US interest rate cuts. Gold rose 16.25% in sterling as the decline in bond

yields reduced the opportunity cost of holding this nil-yielding commodity

and investors sought safety from the potential debasement of some major

currencies through monetary easing.

The Fed changed tack because of slowing economic growth and below-target

inflation. US gross domestic product (GDP) rose 3.1% in 2018 but the rate

slowed to 2.2% in the final quarter as the impact of fiscal stimulus and

increased public sector spending faded. In August 2019, the Fed forecast

growth of 2.1% for 2019. The narrowing difference between short-dated and

long-dated US bond yields led some forecasters to be more pessimistic,

fearing a recession might be approaching.

In August, shortly after your Company's year end, the 10-year US treasury

bond yield fell below the two-year yield. This so-called "yield inversion"

has preceded every US recession in the last 40 years although some months

have typically elapsed between the inversion and the onset of recession. US

leading indicators for manufacturing and non-manufacturing sectors weakened

in the first eight months of 2019 and the manufacturing leading indicator

dipped to a level that implied output might fall. Consumer spending,

however, proved resilient as a result of low unemployment. Employment data

tend, however, to be lagging indicators. In August, the Sino-US trade

dispute escalated as both sides increased tariffs. US tariffs have gained

bipartisan support and are likely to become an established feature of US

trade policy, reducing the scope for an economic boost if the impasse is

resolved.

UK GDP expanded 0.5% quarter-on-quarter in the first quarter of 2019. GDP

did, however, fall 0.2% quarter-on-quarter in the second quarter, according

to the first estimate, probably as a result of activity having been brought

forward into the first quarter ahead of the first Brexit deadline of 29th

March. UK household spending continued to grow steadily but leading

indicators deteriorated and the potential disruption from a no-deal Brexit

may tip the UK into recession. Brexit-risks overshadowed UK equities, rising

only 1.68% over the year under review. UK smaller companies did worse,

falling 5.36% because they tend to be more reliant on domestic earnings than

larger companies, whose export and overseas businesses benefitted from

sterling weakness. In response to the increased likelihood of a no-deal

Brexit, sterling fell 3.60% and 6.23% respectively against the dollar and

yen.

Equities in Europe excluding UK rose only 8.18% in sterling over the year.

Eurozone manufacturers suffered from worsening global economic prospects and

the impact of trade disputes and tariffs. German GDP fell in the third

quarter of 2018 and the second quarter of 2019 as the manufacturing sector

contracted. In June, German industrial production fell 1.5% on the previous

month, leaving it down 5.20% over 12 months as vehicle production was hit

particularly hard.

Over the summer of 2019, investors expected the European Central Bank (ECB)

to ease monetary policy later this year. The scope for interest rate cuts

may be limited, however, because the ECB's deposit rate ended your Company's

year at -0.40%. Banks have typically refrained from passing on the negative

deposit rate to retail customers, reducing their profits. Further cuts may

be no more effective in encouraging bank lending so the ECB may resort to

more bond buying, the previous programme having ended in 2018. As a result

of recent falls in bond yields, however, many Europe excluding UK sovereign

bonds were already trading on negative yields over the summer and the ECB

may encounter liquidity constraints.

During the year, equities in Asia excluding Japan and emerging markets

returned 3.55% and 5.40% respectively in sterling, held back by trade

disputes, with China, down 3.06% in sterling, particularly badly affected.

Chinese economic growth slowed as weak export demand was only partially

offset by increased infrastructure spending. Additional policy support may,

however, be forthcoming if trade talks stall. After the year-end, the

renminbi fell against the dollar, prompting the US to designate China a

currency manipulator. Renminbi-weakness generated fears of deflation in

August 2015 and January 2016, leading to sharp falls in some risky assets.

Within emerging markets, returns diverged widely. While Chinese equities

fell, Indian stocks rose 11.97% in sterling. The prime minister, Narendra

Modi, won a second term while the 16.15% oil price fall in sterling terms

benefitted India as an oil-importing economy. Russian equities rose 33.11%

in sterling as investors' fears of further sanctions proved unfounded for

now.

PORTFOLIO REVIEW

The total return of the Company was 2.98% for the year under review. By

comparison, the Investment Association's Mixed Investment 40-85% Shares

Index, which measures a peer group of funds with a multi-asset approach to

investing and a typical investment in global equities in the 40-85% range,

rose 3.66%.

The main reason for your Company's marginal underperformance relative to the

IA Mixed Investment 40-85% Shares Index was its relative lack of exposure to

Wall Street during a year in which US stocks outperformed. Your company's

largest holding, Fundsmith Equity, did, however, have the majority of its

assets in US stocks as did Polar Capital Technology. Both outperformed the

returns from US stocks, rising 18.48% and 16.03% respectively. Fundsmith

Equity holds a concentrated portfolio of large companies held for the longer

term. Its focus is on resilient companies with high returns on capital

employed and strong business models that are difficult for competitors to

replicate. This means future profits and cash flows are relatively easy to

predict.

Companies with these characteristics, regarded as "bond proxies", have

typically performed well since the credit crisis in an environment of steady

growth and low inflation. Many consumer staples companies such as Philip

Morris and Pepsico, which are among the top 10 holdings in Fundsmith's

portfolio, meet these criteria. In July 2019, the portfolio's largest sector

allocation was, however, technology, with Microsoft and Facebook among the

top 10 holdings. Both stocks are also top-10 holdings in Polar Capital

Technology. Your Company's Fundsmith Equity holding increased in August 2018

while profits were taken in Polar Capital Global Technology in September

2018.

By contrast with Fundsmith Equity, Artemis Global Income, which has a value

investment style, underperformed, falling 3.45% over the year. Its largest

holdings were in financial stocks, which were relatively weak because the

flattening yield curve damaged the profits of banks, which typically borrow

at lower short-term rates and lend for longer periods at higher rates.

Artemis Global Income does, however, have an above-average yield because of

its value bias, contributing to your Company's ability to pay dividends.

Value stocks have typically been out of favour since the credit crisis and

the valuation gulf widened over the year. Value stocks may, however,

outperform strongly should the macroeconomic outlook change in their favour

while delivering an attractive income in the meantime.

Aberforth Split Level Income, which invests in UK smaller companies and has

a value investment style, fell 18.42%, dragged down by fears of a "bad

Brexit", the greater sensitivity of smaller companies to the domestic UK

economy and investors' disenchantment with value investing. UK smaller

companies did, however, appear oversold over the summer of 2019 as a result

of investors' Brexit concerns while sterling's weakness may increase their

attractions to overseas investors.

Man GLG UK Income and Schroder Income fell 0.30% and 4.72% respectively as a

result of their bias towards value stocks although yields in excess of 5%

contributed significantly to your Company's ability to pay an increased

dividend. Trojan Income outperformed, however, rising 4.18% partly because

of its bias towards defensive consumer goods companies such as Unilever.

BlackRock Continental European Income was the best performer amongst the

investments in Europe excluding UK equities, rising 7.60%. FP Crux European

Special Situations, up 1.40%, remained amongst your Company's top 10

holdings although profit-taking through sales in August and October 2018

realised more than half of the investment. Standard Life European Equity

Income returned 1.39%.

Among the Asian and emerging markets holdings, the HSBC Russia Capped

exchange-traded fund gained 32.29% as it benefitted from Russian equity

strength. Russian holdings also enhanced the returns from JP Morgan Emerging

Markets Income, up 14.45%, while Liontrust Asia Income also outperformed,

rising 4.62%. Stewart Investors Indian Subcontinent underperformed, however,

up only 1.65% because of its cautious approach during a period of high local

equity valuations.

Your company has diversified risk through investments in gold equities,

dollar cash and lower-risk multi-asset funds. Gold price strength fuelled

the 20.54% gain from BlackRock Gold & General. Your company also benefited

from dollar strength through Trojan and EF Brompton Global Conservative,

which both had significant dollar holdings in their multi-asset portfolios.

Trojan and EF Brompton Global Conservative gained 4.15% and 2.87%

respectively.

During the year, your Company modestly increased investment in three private

companies, which have the potential to add an uncorrelated source of return.

The unquoted portfolio increased by more than GBP1 million after allowing for

sales and purchases. The investment in Embark, your Company's largest

unquoted investment, increased and the valuation has been written up in

response to the terms of a capital raising.

OUTLOOK

Global economic growth slowed over the summer of 2019, affected by US

monetary tightening in previous years and the fading of the impact of

President Trump's fiscal stimulus. The manufacturing sector was suffering

more than services as trade woes exacerbated worsening global economic

conditions. In the US, bipartisan support for tariffs aimed at Chinese

exports mean there may be no easy resolution of trade disputes as the US

seeks to maintain technological supremacy in key sectors such as information

technology and communications. The eurozone and some emerging markets were

more severely affected because of their dependence on exports while the UK

appeared vulnerable to a no-deal Brexit.

The flattening yield curve may imply a recession is approaching. The Federal

Reserve and some other major central banks have been seeking to mitigate the

impact of slowing growth through monetary easing. These policies may,

however, prove less effective than previously after more than a decade of

such measures. Your Company reduced the allocation to global equities over

the year and increased its investment in dollar cash. Investments in dollar

cash, gold equities and low-risk multi-asset funds provide diversification

and potentially some protection should equities fall. Investments in a small

number of private companies offer the potential for uncorrelated returns.

SCHEDULE OF TWENTY LARGEST INVESTMENTS AT 30TH JUNE 2019

Holding Activity Bid-market Percentage of

value net assets

GBP '000

Fundsmith Investment Fund 7,839 6.88

Equity Fund

Embark Group Unquoted 5,942 5.21

Investment

Polar Capital- Investment Fund 5,280 4.63

Global

Technology Fund

FP Crux Investment Fund 5,098 4.47

European

Special

Situations Fund

Schroder Income Investment Fund 4,795 4.21

Fund

EF Brompton Investment Fund 4,222 3.71

Global

Conservative

Fund

Artemis Global Investment Fund 3,856 3.38

Income Fund

BlackRock Investment Fund 3,794 3.33

Continental

European Income

Fund

Aberforth Split Investment 3,747 3.29

Level Income Company

Trust

Aquilus Investment Fund 3,698 3.25

Inflection Fund

BlackRock Gold Investment Fund 3,470 3.04

& General Fund

Lindsell Train Investment Fund 3,144 2.76

Japanese Equity

Fund

EF Brompton Investment Fund 2,846 2.50

Global Equity

Fund

EF Brompton Investment Fund 2,840 2.49

Global

Opportunities

Fund

Man GLG UK Investment Fund 2,767 2.43

Income Fund

Liontrust Asia Investment Fund 2,763 2.42

Income Fund

First State Investment Fund 2,750 2.41

Indian

Subcontinent

Fund

EF Brompton Investment Fund 2,694 2.36

Global Growth

Fund

MI Brompton UK Investment Fund 2,669 2.34

Recovery Unit

Trust

Trojan Income Investment Fund 2,379 2.09

Fund

76,593 67.20

Balance not 17,189 15.08

held in 20

investments

above

Total 93,782 82.28

investments

(excluding

cash)

Cash 20,605 18.08

Other net (416) (0.36)

current assets

Net assets 113,971 100.00

The investment portfolio, excluding cash, can be

further analysed as follows:

GBP '000

Investment funds 78,453

Investment companies and exchange 7,133

traded funds

Unquoted investments 7,386

Other quoted investments 810

93,782

SCHEDULE OF TWENTY LARGEST INVESTMENTS AT 30TH JUNE 2018

Holding Activity Bid-market Percentage of

value net assets

GBP '000

FP Crux Investment Fund 11,237 10.09

European

Special

Situations Fund

Polar Capital - Investment Fund 5,473 4.91

Global

Technology Fund

Schroder Income Investment Fund 5,242 4.71

Fund

Fundsmith Investment Fund 5,191 4.66

Equity Fund

Aberforth Split Investment 4,859 4.36

Level Income Company

Trust

Artemis Global Investment Fund 4,120 3.70

Income Fund

EF Brompton Investment Fund 4,105 3.69

Global

Conservative

Fund

BlackRock Investment Fund 3,699 3.32

Continental

European Income

Fund

Aquilus Investment Fund 3,562 3.20

Inflection Fund

Lindsell Train Investment Fund 3,312 2.97

Japanese Equity

Fund

Embark Group Unquoted 3,268 2.93

Investment

Man GLG UK Investment Fund 2,929 2.63

Income Fund

BlackRock Gold Investment Fund 2,904 2.61

& General Fund

EF Brompton Investment Fund 2,785 2.50

Global

Opportunities

Fund

Liontrust Asia Investment Fund 2,768 2.49

Income Fund

MI Brompton UK Investment Fund 2,746 2.47

Recovery Unit

Trust

Stewart Investment Fund 2,706 2.43

Investors

Indian

Subcontinent

Fund

EF Brompton Investment Fund 2,687 2.41

Global Equity

Fund

EF Brompton Investment Fund 2,630 2.36

Global Growth

Fund

Trojan Income Investment Fund 2,384 2.14

Fund

78,607 70.58

Balance not 17,694 15.89

held in 20

investments

above

Total 96,301 86.47

investments

(excluding

cash)

Cash 15,027 13.49

Other net 38 0.04

current assets

Net assets 111,366 100.00

The investment portfolio, excluding cash, can be

further analysed as follows:

GBP '000

Investment funds 80,548

Investment companies and exchange 9,357

traded funds

Unquoted investments, including 5,375

interest bearing loans of GBP250,000

Other quoted investments 1,021

96,301

STRATEGIC REVIEW

The Strategic Review is designed to provide information primarily about the

Company's business and results for the year ended 30th June 2019. The

Strategic Review should be read in conjunction with the Chairman's Statement

and the Investment Manager's Report above, which provide a review of the

year's investment activities of the Company and the outlook for the future.

STATUS

The Company is an investment company under section 833 of the Companies Act

2006. It is an Approved Company under the Investment Trust (Approved

Company) (Tax) Regulations 2011 (the 'Regulations') and conducts its affairs

in accordance with those Regulations so as to retain its status as an

investment trust and maintain exemption from liability to United Kingdom

capital gains tax.

The Company is a small registered Alternative Investment Fund Manager under

the European Union Markets in Financial Instruments Directive.

INVESTMENT OBJECTIVE AND POLICY

Investment Objective

The Company's investment objective is to achieve long-term capital growth.

Investment Policy

The Company's investment policy is to allocate assets to global investment

opportunities through investment in equity, bond, commodity, real estate,

currency and other markets. The Company's assets may have significant

weightings to any one asset class or market, including cash.

The Company will invest in pooled investment vehicles, exchange traded

funds, futures, options, limited partnerships and direct investments in

relevant markets. The Company may invest up to 15% of its net assets in

direct investments in relevant markets.

The Company will not follow any index with reference to asset classes,

countries, sectors or stocks. Aggregate asset class exposure to any one of

the United States, the United Kingdom, Europe ex UK, Asia ex Japan, Japan or

Emerging Markets and to any individual industry sector will be limited to

50% of the Company's net assets, such values being assessed at the time of

investment and for funds by reference to their published investment policy

or, where appropriate, the underlying investment exposure.

The Company may invest up to 20% of its net assets in unlisted securities

(excluding unquoted pooled investment vehicles) such values being assessed

at the time of investment.

The Company will not invest more than 15% of its net assets in any single

investment, such values being assessed at the time of investment.

Derivative instruments and forward foreign exchange contracts may be used

for the purposes of efficient portfolio management and currency hedging.

Derivatives may also be used outside of efficient portfolio management to

meet the Company's investment objective. The Company may take outright short

positions in relation to up to 30% of its net assets, with a limit on short

sales of individual stocks of up to 5% of its net assets, such values being

assessed at the time of investment.

The Company may borrow up to 30% of net assets for short-term funding or

long-term investment purposes.

No more than 10%, in aggregate, of the value of the Company's total assets

may be invested in other closed-ended investment funds except where such

funds have themselves published investment policies to invest no more than

15% of their total assets in other listed closed-ended investment funds.

Information on the Company's portfolio of assets with a view to spreading

investment risk in accordance with its investment policy above.

FINANCIAL REVIEW

Net assets at 30th June 2019 amounted to GBP113,971,000 compared with

GBP111,366,000 at 30th June 2018. In the year under review, the NAV per

Ordinary share increased by 2.3% from 156.80p to 160.47p, after paying a

dividend of 1.0p per share.

The Group's gross revenue rose to GBP2,239,000 (2018: GBP1,776,000). Last year

the Company increased its investment in income focused funds resulting in an

increase in gross income during the year under review. After deducting

expenses and taxation the revenue profit for the year was GBP1,284,000 (2018:

GBP831,000).

Total expenses for the year amounted to GBP1,364,000 (2018: GBP940,000), as a

result of a performance fee becoming payable. In the year under review the

investment management fee amounted to GBP688,000 (2018: GBP668,000). A

performance fee of GBP410,000 was payable in respect of the year under review

as the Company outperformed the cumulative hurdle rate. The performance fee

has been allocated to the Capital account in accordance with the Company's

accounting policy. At 30 June 2019 the Company's NAV was slightly above the

hurdle rate NAV. Further details on the Company's expenses may be found in

notes 3 and 4.

Dividends have not formed a central part of the Company's investment

objective. The increased investment in income focused funds has enabled the

Directors to declare an increased dividend. The Directors propose a final

dividend of 1.40p per Ordinary share in respect of the year ended 30th June

2019 (2018: 1.0p). If approved at the Annual General Meeting, the dividend

will be paid on 29th November 2019 to shareholders on the register at the

close of business on 8th November 2019 (ex-dividend 7th November 2019).

The primary source of the Company's funding is shareholder funds.

While the future performance of the Company is dependent, to a large degree,

on the performance of international financial markets, which in turn are

subject to many external factors, the Board's intention is that the Company

will continue to pursue its stated investment objective in accordance with

the strategy outlined above. Further comments on the short-term outlook for

the Company are set out in the Chairman's Statement and the Investment

Manager's report above.

Throughout the year the Group's investments included seven funds managed by

the Investment Manager (2018: seven). No investment management fees were

payable directly by the Company in respect of these investments.

PERFORMANCE MEASUREMENT AND KEY PERFORMANCE INDICATORS

In order to measure the success of the Company in meeting its objectives,

and to evaluate the performance of the Investment Manager, the Directors

review at each meeting: net asset value, income and expenditure, asset

allocation and attribution, share price of the Company and the discount. The

Directors take into account a number of different indicators as the Company

does not have a formal benchmark, and performance against these is shown in

the Financial Highlights.

Performance is discussed in the Chairman's Statement and Investment

Manager's Report.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks identified by the Board, and the steps the Board takes

to mitigate them, are as follows:

Investment strategy

Inappropriate long-term strategy, asset allocation and fund selection could

lead to underperformance. The Board discusses investment performance at each

of its meetings and the Directors receive reports detailing asset

allocation, investment selection and performance.

Business conditions and general economy

The Company's future performance is heavily dependent on the performance of

different equity and currency markets. The Board cannot mitigate the risks

arising from adverse market movements. However, diversification within the

portfolio will reduce the impact. Further information is given in portfolio

risks below.

Portfolio risks - market price, foreign currency and interest rate risks

The twenty largest investments are listed above. Investment returns will be

influenced by interest rates, inflation, investor sentiment,

availability/cost of credit and general economic and market conditions in

the UK and globally. A significant proportion of the portfolio is in

investments denominated in foreign currencies and movements in exchange

rates could significantly affect their sterling value. The Investment

Manager takes all these factors into account when making investment

decisions but the Company does not normally hedge against foreign currency

movements. The Board's policy is to hold a spread of investments in order to

reduce the impact of the risks arising from the above factors by investing

in a spread of asset classes and geographic regions.

Net asset value discount

The discount in the price at which the Company's shares trade to net asset

value means that shareholders cannot realise the real underlying value of

their investment. Over the last few years the Company's share price has been

at a significant discount to the Company's net asset value. The Directors

review regularly the level of discount, however given the investor base of

the Company, the Board is very restricted in its ability to influence the

discount to net asset value.

Investment Manager

The quality of the team employed by the Investment Manager is an important

factor in delivering good performance and the loss of key staff could

adversely affect returns. A representative of the Investment Manager attends

each Board meeting and the Board is informed if any major changes to the

investment team employed by the Investment Manager are proposed.

Tax and regulatory risks

A breach of The Investment Trust (Approved Company) (Tax) Regulations 2011

(the 'Regulations') could lead to capital gains realised within the

portfolio becoming subject to UK capital gains tax. A breach of the UKLA

Listing Rules could result in suspension of the Company's shares, while a

breach of company law could lead to criminal proceedings, financial and/or

reputational damage. The Board employs Brompton Asset Management LLP as

Investment Manager, and Maitland Administration Services Limited as

Secretary and Administrator, to help manage the Company's legal and

regulatory obligations.

Operational

Disruption to, or failure of, the Investment Manager's or Administrator's

accounting, dealing or payment systems, or the Custodian's records, could

prevent the accurate reporting and monitoring of the Company's financial

position. The Company is also exposed to the operational risk that one or

more of its suppliers may not provide the required level of service.

The Directors confirm that they have carried out an assessment of the risks

facing the Company, including those that would threaten its business model,

future performance, solvency and liquidity.

VIABILITY STATEMENT

The assets of the Company consist mainly of securities that are readily

realisable or cash and it has no significant liabilities. Investment income

exceeds annual expenditure and current liquid net assets cover current

annual expenses for many years. Accordingly, the Company is of the opinion

that it has adequate financial resources to continue in operational

existence for the long term which is considered to be in excess of five

years. Five years is considered a reasonable period for investors when

making their investment decisions. In reaching this view the Directors

reviewed the anticipated level of annual expenditure against the cash and

liquid assets within the portfolio. The Directors have also considered the

risks the Company faces.

ENVIRONMENTAL, SOCIAL AND COMMUNITY ISSUES

The Company has no employees, with day-to-day management and administration

of the Company being delegated to the Investment Manager and the

Administrator. The Company's portfolio is managed in accordance with the

investment objective and policy; environmental, social and community matters

are considered to the extent that they potentially impact on the Company's

investment returns. Additionally, as the Company has no premises, properties

or equipment, it has no carbon emissions to report on.

The Company has sought, wherever possible, and been provided with assurance

from each of its main suppliers, that no slaves, forced labour, child

labour, or labour employed at rates of pay below statutory minimums for the

country of their operations, are being employed in the provision of services

to the Company.

GER DIVERSITY

The Board of Directors comprises three male directors. The Board recognises

the benefits of diversity, however, the Board's primary consideration when

appointing new directors is their knowledge, experience and ability to make

a positive contribution to the Board's decision making regardless of gender.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME AT 30TH JUNE 2019

Year ended Year ended

30th June 2019 30th June 2018

Revenue Capital Revenue Capital

Return Return Return Return

GBP '000 GBP '000

Total Total

GBP '000 GBP '000 GBP '000 GBP '000

Notes

INVESTMENT 2 1,890 - 1,890 1,654 - 1,654

INCOME

Other 2 349 - 349 122 - 122

operating

income

2,239 - 2,239 1,776 - 1,776

GAINS AND

LOSSES ON

INVESTMENT

S

Gains on

investment

s at fair

value

through 9 - 1,992 1,992 - 6,218 6,218

profit or

loss

Other - 443 443 - (176) (176)

exchange

gains

/(losses)

Trail - 5 5 - 5 5

rebates

2,239 2,440 4,679 1,776 6,047 7,823

EXPENSES

Management 3 (688) (410) (1,098 (668) - (668)

and )

performanc

e fees

Other 4 (266) - (266) (272) - (272)

expenses

(954) (410) (1,364 (940) - (940)

)

PROFIT 1,285 2,031 3,315 836 6,047 6,883

BEFORE TAX

Tax 5 - - - (5) - (5)

PROFIT FOR 1,285 2,031 3,315 831 6,047 6,878

THE YEAR

EARNINGS

PER SHARE

Ordinary 7 1.81p 2.86p 4.67p 1.17p 8.51p 9.68p

shares

(pence)

The total column of this statement represents the Group's profit and loss

account, prepared in accordance with IFRS, as adopted by the European Union.

The supplementary Revenue Return and Capital Return columns are both

prepared under guidance published by the Association of Investment

Companies. All revenue and capital items in the above statement derive from

continuing operations.

The Company did not have any income or expense that was not included in

'Profit for the year'. Accordingly, the 'Profit for the year' is also the

'Total comprehensive income for the year', as defined in IAS1 (revised) and

no separate Statement of Comprehensive Income has been presented.

No operations were acquired or discontinued during the year.

All income is attributable to the equity holders of the parent company.

There are no minority interests.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30TH JUNE

2019

Note Share Share Special Retained

premium reserve earnings

capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

AT 30TH 710 21,573 56,908 32,175 111,366

JUNE 2018

Total - - - 3,315 3,315

comprehensi

ve income

for the

year

Dividend 8 - - - (710) (710)

paid

AT 30TH 710 21,573 56,908 34,780 113,971

JUNE 2019

Included within Retained earnings were GBP1,687,000 of Company reserves

available for distribution.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30TH JUNE

2018

Note Share Share Special Retained

premium reserve earnings

capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

AT 30TH 710 21,573 56,908 25,865 105,056

JUNE 2017

Total - - - 6,878 6,878

comprehensi

ve income

for the

year

Dividend 8 - - - (568) (568)

paid

AT 30TH 710 21,573 56,908 32,175 111,366

JUNE 2018

Included within Retained earnings were GBP1,112,000 of Company reserves

available for distribution.

CONSOLIDATED BALANCE SHEET AT 30TH JUNE 2019

Notes 30th June 30th June

2019 2018

GBP '000 GBP '000

NON-CURRENT ASSETS

Investments at fair value through 9 93,782 96,301

profit or loss

CURRENT ASSETS

Other receivables 11 220 272

Cash and cash equivalents 12 20,605 15,027

20,825 15,299

TOTAL ASSETS 114,607 111,600

CURRENT LIABILITIES

Other payables 13 (636) (234)

TOTAL ASSETS LESS CURRENT LIABILITIES 113,971 111,366

NET ASSETS 113,971 111,366

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

Called-up share capital 14 710 710

Share premium 15 21,573 21,573

Special reserve 15 56,908 56,908

Retained earnings 15 34,780 32,175

TOTAL EQUITY 113,971 111,366

NET ASSET VALUE PER ORDINARY SHARE 16 160.47p 156.80p

CONSOLIDATED CASH FLOW STATEMENTS AT 30TH JUNE 2019

Year ended Year ended

30th June 30th June

2019 2018

Group Group

Notes GBP '000 GBP '000

NET CASH INFLOW FROM OPERATING

ACTIVITIES

1,334 673

INVESTING ACTIVITIES

Purchase of investments (4,340) (16,016)

Sale of investments 8,851 17,663

NET CASH INFLOW/(OUTFLOW) FROM

INVESTING ACTIVITIES

4,511 1,647

FINANCING

Equity dividends paid 8 (710) (568)

Amounts owed to subsidiary - -

undertakings

NET CASH (OUTFLOW) AFTER FINANCING (710) (568)

INCREASE IN CASH 5,135 1,752

RECONCILIATION OF NET CASH FLOW TO

MOVEMENT IN CASH & CASH EQUIVALENTS

Increase in cash resulting from cash 5,135 1,752

flows

Exchange movements 443 (176)

Movement in net funds 5,578 1,576

Net funds at start of the year 15,027 13,451

CASH & CASH EQUIVALENTS AT OF 17 20,605 15,027

YEAR

RECONCILIATION OF PROFIT BEFORE

FINANCE COSTS AND TAXATION TO NET

CASH FLOW FROM OPERATING ACTIVITIES

Profit before finance costs and 2 3,315 6,883

taxation*

Gains on investments (1,992) (6,218)

Exchange differences (443) 176

Capital trail rebates (5) (5)

Net revenue gains before finance

costs and taxation

875 836

Decrease/(increase) in debtors 43 (187)

Increase in creditors 402 24

Taxation 9 (5)

Capital trail rebates 5 5

NET CASH INFLOW FROM OPERATING 1,334 673

ACTIVITIES

*Includes dividends received in cash of GBP1,599,000 (GBP1,164,000),

accumulation income of GBP278,000 (2018: GBP381,000) and interest received of

GBP408,000 (2018: GBP42,000).

NOTES TO THE ACCOUNTS FOR THE YEARED 30TH JUNE 2018

1. ACCOUNTING POLICIES

The financial statements have been prepared in accordance with International

Financial Reporting Standards ('IFRS'). These comprise standards and

interpretations approved by the International Accounting Standards Board

('IASB'), together with interpretations of the International Accounting

Standards and Standing Interpretations Committee ('IASC') that remain in

effect, and to the extent that they have been adopted by the European Union.

These financial statements are presented in pounds sterling, the Group's

functional currency, being the currency of the primary economic environment

in which the Group operates, rounded to the nearest thousand.

(a) Basis of preparation: The financial statements have been prepared on a

going concern basis. The principal accounting policies adopted are set out

below.

Where presentational guidance set out in the Statement of Recommended

Practice 'Financial Statements of Investment Trust Companies and Venture

Capital Trusts' ('SORP') issued by the Association of Investment Companies

('AIC') in November 2014 and updated in February 2018 with consequential

amendments is consistent with the requirements of IFRS, the Directors have

sought to prepare the financial statements on a basis compliant with the

recommendations of the SORP.

(b) Basis of consolidation: The consolidated financial statements include

the accounts of the Company and its subsidiary made up to 30th June 2019. No

statement of comprehensive income is presented for the parent company as

permitted by Section 408 of the Companies Act 2006.

The parent company is an investment entity as defined by IFRS 10 and assets

are held at their fair value. The consolidated accounts include subsidiaries

which are an integral part of the Group and not investee companies.

Subsidiaries are consolidated from the date of their acquisition, being the

date on which the Company obtains control, and continue to be consolidated

until the date that such control ceases. The financial statements of the

subsidiary used in the preparation of the consolidated financial statements

are based on consistent accounting policies. All intra-group balances and

transactions, including unrealised profits arising therefrom, are

eliminated. Subsidiaries are valued at fair value, which is considered to be

their NAV in the accounts of the Company.

(c) Presentation of Statement of Comprehensive Income: In order to better

reflect the activities of an investment trust company and in accordance with

guidance issued by the AIC, supplementary information which analyses the

consolidated statement of comprehensive income between items of a revenue

and capital nature has been presented alongside the consolidated statement

of comprehensive income.

In accordance with the Company's Articles of Association, net capital

returns may not be distributed by way of a dividend. Additionally, the net

revenue profit is the measure the Directors believe is appropriate in

assessing the Group's compliance with certain requirements set out in the

Investment Trust (Approved Company) (Tax) Regulations 2011.

(d) Use of estimates: The preparation of financial statements requires the

Group to make estimates and assumptions that affect items reported in the

consolidated and company balance sheets and consolidated statement of

comprehensive income and the disclosure of contingent assets and liabilities

at the date of the financial statements. Although these estimates are based

on the Directors' best knowledge of current facts, circumstances and, to

some extent, future events and actions, the Group's actual results may

ultimately differ from those estimates, possibly significantly. The most

significant estimate relates to the valuation of unquoted investments.

(e) Revenue: Dividends and other such revenue distributions from investments

are credited to the revenue column of the consolidated statement of

comprehensive income on the day in which they are quoted ex-dividend. Where

the Company has elected to receive its dividends in the form of additional

shares rather than in cash and the amount of the cash dividend is recognised

as income, any excess in the value of the shares received over the amount

recognised is credited to the capital reserve. Deemed revenue from offshore

funds is credited to the revenue account. Interest on fixed interest

securities and deposits is accounted for on an interest rate basis.

(f) Expenses: Expenses are accounted for on an accruals basis. Management

fees, administration and other expenses, with the exception of transaction

charges, are charged to the revenue column of the consolidated statement of

comprehensive income. Performance fees and transaction charges are charged

to the capital column of the consolidated statement of comprehensive income.

(g) Investments held at fair value: Purchases and sales of investments are

recognised and derecognised on the trade date where a purchase or sale is

under a contract whose terms require delivery within the timeframe

established by the market concerned, and are initially measured at fair

value.

All investments are classified as held at fair value through profit or loss

on initial recognition and are measured at subsequent reporting dates at

fair value, which is either the bid price or the last traded price,

depending on the convention of the exchange on which the investment is

quoted. Investments in units of unit trusts or shares in OEICs are valued at

the bid price for dual priced funds, or single price for non-dual priced

funds, released by the relevant investment manager. Unquoted investments are

valued by the Directors at the balance sheet date based on recognised

valuation methodologies, in accordance with International Private Equity and

Venture Capital ('IPEVC') Valuation Guidelines such as dealing prices or

third party valuations where available, net asset values and other

information as appropriate.

(h) Taxation: The charge for taxation is based on taxable income for the

year. Withholding tax deducted from income received is treated as part of

the taxation charge against income. Taxation deferred or accelerated can

arise due to temporary differences between the treatment of certain items

for accounting and taxation purposes. Full provision is made for deferred

taxation under the liability method on all temporary differences not

reversed by the Balance Sheet date. No deferred tax provision is made

against deemed reporting offshore funds. Deferred tax assets are only

recognised when there is more likelihood than not that there will be

suitable profits against which they can be applied.

(i) Foreign currency: Assets and liabilities denominated in foreign

currencies are translated at the rates of exchange ruling at the balance

sheet date. Foreign currency transactions are translated at the rates of

exchange applicable at the transaction date. Exchange gains and losses are

taken to the revenue or capital column of the consolidated statement of

comprehensive income depending on the nature of the underlying item.

(j) Capital reserve: The following are accounted for in this reserve:

- gains and losses on the realisation of investments together with the

related taxation effect;

- foreign exchange gains and losses on capital transactions, including those

on settlement, together with the related taxation effect;

- revaluation gains and losses on investments;

- performance fees payable to the investment manager; and

- trail rebates received from the managers of the Company's investments.

The capital reserve is not available for the payment of dividends.

(k) Revenue reserve: This reserve includes net revenue recognised in the

revenue column of the Statement of Comprehensive Income.

(l) Special reserve: The special reserve can be used to finance the

redemption and/or purchase of shares in issue.

(m) Cash and cash equivalents: Cash and cash equivalents comprise current

deposits and balances with banks. Cash and cash equivalents may be held for

the purpose of either asset allocation or managing liquidity.

(n)Dividends payable: Dividends are recognised from the date on which they

are irrevocably committed to payment.

(o) Segmental Reporting: The Directors consider that the Group is engaged in

a single segment of business with the primary objective of investing in

securities to generate long term capital growth for its shareholders.

Consequently no business segmental analysis is provided.

(p) New standards, amendments to standards and interpretations effective for

annual accounting periods beginning after 1 July 2018:

The following amendments to standards effective this year, being relevant

and applicable to the Company, have been adopted, although they have no

impact on the financial statements:

- IFRS 7 Financial Instruments: disclosures for initial application of IFRS

9 - effective 1 January 2016 or when IFRS 9 is first applied

- IFRS 9 Financial Instruments - effective 1 January 2018

- IFRS 15 Revenue from Contracts with Customers - effective 1 January 2018

(q) Accounting standards issued but not yet effective: There are no

standards or amendments to standards not yet effective that are relevant to

the Group and should be disclosed.

2. INVESTMENT INCOME

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

INCOME FROM INVESTMENTS

UK net dividend income 1,691 1,481

Unfranked investment income 199 173

1,890 1,654

OTHER OPERATING INCOME

Bank interest receivable 336 111

Loan interest income 13 11

349 122

TOTAL INCOME COMPRISES

Dividends 1,890 1,654

Other income 349 122

2,239 1,776

The above dividend and interest income has been included in the profit

before finance costs and taxation included in the cash flow statements.

3. MANAGEMENT FEES

Year ended Year ended

30th June 2019 30th June 2018

Revenue Capital Total Revenue Capital Total

GBP '000 GBP '000

GBP '000 GBP '000 GBP '000 GBP '000

Investment 688 - 688 668 - 668

management

fee

Performance - 410 410 - - -

fee

688 410 1,098 668 - 668

At 30th June 2019 there were amounts accrued of GBP177,000 (2018: GBP173,000)

for investment management fees and GBP410,000 (2018: GBPnil) for performance

fees.

4. OTHER EXPENSES

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

Directors' remuneration 50 48

Administrative and secretarial fee 95 94

Auditors' remuneration

- Audit 32 31

- Interim review 8 8

Taxation compliance services 7 -

Other 74 91

266 272

Allocated to:

- Revenue 266 272

- Capital - -

266 272

5. TAXATION

(a) Analysis of tax charge for the year:

Year ended Year ended

30th June 2019 30th June 2018

Revenue Capital Revenue Capital

Return Return Return Return

GBP '000 GBP '000

Total Total

GBP '000 GBP '000 GBP '000 GBP '000

Overseas 3 - 3 17 - 17

tax

Recoverable (3) - (3) (12) - (12)

income tax

Total - - - 5 - 5

current tax

for the

year

Deferred - - - - - -

tax

Total tax - - - 5 - 5

for the

year (note

5b)

(b) Factors affecting tax charge for the year:

The charge for the year of GBPnil (2018: GBP5,000) can be reconciled to the

profit per the consolidated statement of comprehensive income as follows:

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

Total profit before tax 3,315 6,883

Theoretical tax at the UK corporation tax 630 1,307

rate of 19.00% (2018: 19.00%)

Effects of:

Non-taxable UK dividend income (321) (281)

Gains and losses on investments that are (463) (1,148)

not taxable

Excess expenses not utilised 154 138

Overseas dividends which are not taxable - (16)

Overseas tax 3 17

Recoverable income tax (3) (12)

Total tax for the year - 5

Due to the Company's tax status as an investment trust and the intention to

continue meeting the conditions required to maintain approval of such status

in the foreseeable future, the Company has not provided tax on any capital

gains arising on the revaluation or disposal of investments.

There is no deferred tax (2018: GBPnil) in the capital account of the Company.

There is no deferred tax charge in the revenue account (2018: GBPnil).

At the year-end there is an unrecognised deferred tax asset of GBP520,000

(2018: GBP478,000) based on the enacted tax rates of 17% for financial years

beginning 1 April 2020, as a result of excess expenses.

6. COMPANY RETURN FOR THE YEAR

The Company's total return for the year was GBP3,315,000 (2018: GBP6,878,000).

7. RETURN PER ORDINARY SHARE

Total return per Ordinary share is based on the Group total return on

ordinary activities after taxation of GBP3,315,000 (2018: GBP6,878,000) and on

71,023,695 (2018: 71,023,695) Ordinary shares, being the weighted average

number of Ordinary shares in issue during the year.

Revenue return per Ordinary share is based on the Group revenue profit on

ordinary activities after taxation of GBP1,285,000 (2018: GBP831,000) and on

71,023,695 (2018: 71,023,695) Ordinary shares, being the weighted average

number of Ordinary shares in issue during the year.

Capital return per Ordinary share is based on net capital gains for the year

of GBP2,031,000 (2018: GBP6,047,000) and on 71,023,695 (2018: 71,023,695)

Ordinary shares, being the weighted average number of Ordinary shares in

issue during the year.

8. DIVIDS ON EQUITY SHARES

Amounts recognised as distributions in the year:

Year ended Year

ended

30th June

30th June

2019

2018

GBP '000

GBP '000

Dividends paid during the year 710 568

Dividends payable in respect of the year

ended:

30th June 2019: 1.4p (2018: 1.0p) per share 994 710

It is proposed that a dividend of 1.4p per share will be paid in respect of

the current financial year.

9. INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

GROUP AND COMPANY 93,782 96,301

ANALYSIS OF INVESTMENT

PORTFOLIO - GROUP AND COMPANY

Quoted* Unquoted Total

GBP '000 GBP '000 GBP '000

Opening book cost 61,574 7,582 69,156

Opening investment holding 29,351 (2,206) 27,145

gains/(losses)

Opening valuation 90,925 5,376 96,301

Movement in period

Purchases at cost 3,224 1,116 4,340

Sales

- Proceeds (8,601) (250) (8,851)

- Realised gains on sales 4,175 - 4,175

Movement in investment holding gains (3,327) 1,144 (2,183)

for the year

Closing valuation 86,396 7,386 93,782

Closing book cost 60,372 8,448 68,820

Closing investment holding 26,024 (1,062) 24,962

gains/(losses)

Closing valuation 86,396 7,386 93,782

* Quoted investments include unit trust and OEIC funds and one monthly

priced fund.

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

ANALYSIS OF CAPITAL GAINS AND LOSSES

Realised gains on sales of investments 4,175 7,457

(Decrease)/Increase in investment holding (2,183) (1,239)

gains

Net gains on investments attributable to 1,992 6,218

ordinary shareholders

Transaction costs

The purchase and sale proceeds figures above include transaction costs on

purchases of GBP3,260 (2018: GBP8,870) and on sales of GBP638 (2018: GBP626).

10. INVESTMENT IN SUBSIDIARY UNDERTAKING

The Company owns the whole of the issued share capital (GBP1) of JIT

Securities Limited, a company registered in England and Wales.

The financial position of the subsidiary is summarised as follows:

Year ended Year ended

30th June 30th June

2019 2018

GBP '000 GBP '000

Net assets brought forward 506 504

Profit for year - 2

Net assets carried forward 506 506

11. OTHER RECEIVABLES

30th June 30th June

2019 2018

Group Group

GBP '000 GBP '000

Prepayments and accrued income 214 257

Taxation 6 15

Amounts owed by subsidiary undertakings - -

220 272

12. CASH AND CASH EQUIVALENTS

30th June 30th June

2019 2018

Group Group

GBP '000 GBP '000

Cash at bank and on deposit 20,605 15,027

13. OTHER PAYABLES

30th June 30th June

2019 2018

Group Group

GBP '000 GBP '000

Accruals 636 234

Amounts owed to subsidiary undertakings - -

636 234

14. CALLED UP SHARE CAPITAL

30th June 30th June

2019 2018

GBP '000 GBP '000

Authorised

305,000,000 (2018: 305,000,000) Ordinary 3,050 3,050

shares of GBP0.01 each

Issued and fully paid

71,023,695 (2018: 71,023,695) Ordinary 710 710

shares of GBP0.01 each

15. RESERVES

Share Special Retained

Premium Reserve earnings

account

GBP '000 GBP '000 GBP '000

GROUP

At 30th June 2018 21,573 56,908 32,175

Decrease in investment holding gains - - (2,183)

Net gains on realisation of investments - - 4,175

Gains on foreign currency - - 443

Performance fee - - (410)

Trail rebates - - 5

Retained revenue profit for year - - 1,285

Dividend paid (710)

At 30th June 2019 21,573 56,908 34,780

The components of retained earnings are set out below:

30th June 30th June

2019 2018

GBP '000 GBP '000

GROUP

Capital reserve - realised 7,977 3,764

Capital reserve - revaluation 24,962 27,145

Revenue reserve 1,841 1,266

34,780 32,175

COMPANY

Capital reserve - realised 7,625 3,412

Capital reserve - revaluation 25,468 27,651

Revenue reserve 1,687 1,112

34,780 32,175

16. NET ASSET VALUE PER ORDINARY SHARE7

The net asset value per Ordinary share is calculated on net assets of

GBP113,971,000 (2018: GBP111,366,000) and 71,023,695 (2018: 71,023,695) Ordinary

shares in issue at the year end.

17. ANALYSIS OF CASH AND CASH EQUIVALENTS AT THE OF THE YEAR

At 1st Cash flow Exchange At 30th

July 2018 movement June 2019

GBP '000 GBP '000

GROUP

Cash at bank 15,027 5,135 443 20,605

and on deposit

18. FINANCIAL INFORMATION

2019 Financial information

The figures and financial information for 2019 are unaudited and do not

constitute the statutory accounts for the year. The preliminary statement

has been agreed with the Company's auditors and the Company is not aware of

any likely modification to the auditor's report required to be included with

the annual report and accounts for the year ended 30th June 2019.

2018 Financial information

The figures and financial information for 2018 are extracted from the

published Annual Report and Accounts for the year ended 30th June 2018 and

do not constitute the statutory accounts for that year. The Annual Report

and Accounts (available on the Company's website www.nsitplc.com [1]) has

been delivered to the Registrar of Companies and includes the Report and

Independent Auditors which was unqualified and did not contain a statement

under either section 498(2) or section 498(3) of the Companies Act 2006.

Annual Report and Accounts

The accounts for the year ended 30th June 2019 will be sent to shareholders

in October 2019 and will be available on the Company's website or in hard

copy format at the Company's registered office, 1 Knightsbridge Green,

London SW1X 7QA.

The Annual General Meeting of the Company will be held on 14th November 2019

at 11.00am at 1 Knightsbridge Green, London SW1X 7QA.

27th September 2019

ISIN: GB0002631041

Category Code: ACS

TIDM: NSI

LEI Code: 213800RT2OZF83G5N590

OAM Categories: 1.1. Annual financial and audit reports

Sequence No.: 21671

EQS News ID: 881849

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=6b10bbcccd5b5bcf36a37e16412c3301&application_id=881849&site_id=vwd&application_name=news

(END) Dow Jones Newswires

September 30, 2019 02:00 ET (06:00 GMT)

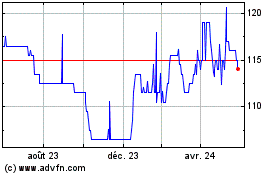

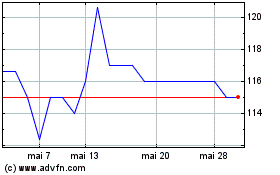

New Star Investment (AQSE:NSI.GB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

New Star Investment (AQSE:NSI.GB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024