UPDATE: Alinta Has Received Indicative Takeover Bids -Source

23 Juin 2010 - 5:07AM

Dow Jones News

Debt laden Australian power generator Alinta Energy Group

(AEJ.AU) has received indicative takeover bids from a number of

sources, a person familiar with the situation said Wednesday.

Any buyer of the owner of 12 operational power stations would

have to take on about A$3 billion in debt, with the company

currently trading at a market value of around A$40 million after

its securities were hammered in the wake of the global financial

crisis.

"Some indicative bids have been received as part of the

(deleveraging review) process but it's not at final bid stage yet,"

the person said.

The former satellite fund of failed investment house Babcock

& Brown Ltd. said in April it had hired Lazard to examine ways

to reduce its heavy debt load, including potential asset sales and

capital management opportunities.

An unsourced report on The Australian newspaper's website said

Wednesday that a consortium comprising Origin Energy Ltd. (ORG.AU),

APA Group (APA.AU) and Japan's Marubeni Corp. (MARUY) has emerged

as a key bidder for Alinta.

Other media reports have cited French energy giant GDF Suez

(GSZ.FR) and diversified miner BHP Billiton Ltd. (BHP.AU) as

possible rival bidders.

Spokespeople for Origin, APA and BHP all declined to comment on

the reports.

Credit Suisse Analyst Sandra McCullagh said Tuesday that while

Origin, with a healthy balance sheet, is well placed to buy power

stations from Alinta, it may overlook them for more accretive

opportunities, including the looming privatization of energy

retailers in New South Wales state.

Origin already has an offtake agreement for Alinta's Braemer

power station in Queensland state, so owning the asset may not be a

priority, McCullagh said.

She added that the natural owner of Alinta's Western Australia

state generators would probably want to have its own gas supply to

hedge against gas price risk and Origin's Perth Basin gas

production is insufficient to cover the Alinta load.

According to Alinta's interim accounts lodged February, the

company at Dec. 31 had total current and non-current assets,

including intangibles, of A$5.15 billion and total liabilities of

A$4.43 billion, including A$3.26 billion of current and non-current

borrowings.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

Ross.Kelly@dowjones.com

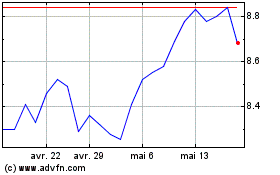

APA (ASX:APA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

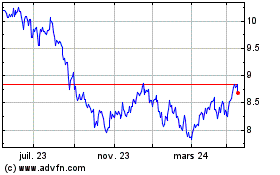

APA (ASX:APA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024