Nighthawk Energy To Be Wound Up, Nonoperating Assets Liquidated

26 Juin 2018 - 9:55AM

Dow Jones News

By Oliver Griffin

Nighthawk Energy PLC (HAWK.LN) said on Tuesday that directors

intend to wind up the company and have its nonoperating assets

liquidated under the U.S. Bankruptcy Code.

The oil-and-gas company said the winding-up process will take

place after it has sold its Nighthawk Production subsidiary to

Polaris Production Partners LLC.

The company said it has canceled an auction for all or most of

Nighthawk Production after no additional bids were received by the

June 22 deadline.

Nighthawk Energy and its subsidiaries filed for Chapter 11

bankruptcy in May. The company said the bankruptcy court will now

conduct a hearing to approve the sale of its subsidiary to Polaris

Production Partners LLC, which placed a so-called stalking horse

bid--used to avoid low bids as part of a court auction--valuing the

assets at $18 million.

Closing of the sale is expected to take place on or around July

1, Nighthawk Energy said.

The net proceeds of the sale will be used to make outstanding

loan payments to Commonwealth Bank of Australia (CBA.AU) and to pay

permitted expenses in the course of the Chapter 11 bankruptcy

cases.

The company said that the sale isn't expected to provide value

to shareholders, whose interests come after the claims of creditors

and administration expenses under U.S. bankruptcy law.

London-traded shares were suspended on May 1.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

June 26, 2018 03:40 ET (07:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

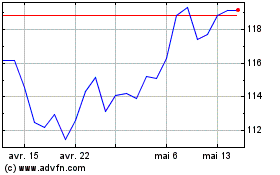

Commonwealth Bank Of Aus... (ASX:CBA)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Commonwealth Bank Of Australia (Australian Stock Exchange): 0 recent articles

Plus d'articles sur Cwlth Bank Fpo