Wesfarmers Plans To Spin Off Coles Grocery Unit

15 Mars 2018 - 11:24PM

Dow Jones News

By Mike Cherney

SYDNEY--Australian conglomerate Wesfarmers Ltd. (WES.AU) said

Friday that it planned to spin off its key Coles grocery unit amid

increasing competition in the supermarket sector.

The decision to spin off Coles, which Wesfarmers bought in 2007,

comes after a review of Wesfarmers's portfolio, and the company

said it reflects a new focus on businesses with the prospect of

strong future earnings growth.

"A demerger of Coles will facilitate greater focus by Wesfarmers

on growth opportunities within its remaining businesses,"

Wesfarmers Managing Director Rob Scott said.

Wesfarmers said Coles would be a top-30 company listed on the

Australian Securities Exchange and that it expected the spin off to

be completed in the 2019 financial year, subject to shareholder and

other approvals. Wesfarmers shareholders will receive shares in

Coles proportional to their existing Wesfarmers holdings, the

company said.

In addition, Wesfarmers said that Steven Cain would be the new

managing director of Coles, succeeding John Durkan, who will step

down later this year after 10 years in senior leadership positions

at the grocer. Mr. Cain is currently chief executive of

supermarkets and convenience at Metcash, which supplies the IGA

supermarket brand.

Wesfarmers, which owns hardware chain Bunnings, department

stores Kmart and Target and office-supply retailer Officeworks,

said it would seek to maintain a 20% stake in Coles after the spin

off. The new company would include more than 800 supermarkets

nationally, as well as liquor stores, Coles Express convenience

stores, a financial-services unit and hotel chain Spirit

Hotels.

"We believe Coles has developed strong investment fundamentals

and is of a scale where it should be operated and owned

separately," Mr. Scott said. "It is now a mature and cash

generative business."

Coles had previously been Wesfarmers's top earner, but it was

overtaken by Bunnings in Australia and New Zealand in the company's

recent half-year result. Wesfarmers said the earnings decline at

Coles in the half year reflected planned investment in price and

service, but some analysts have said that Coles has struggled to

compete with chief rival Woolworths Group Ltd. (WOW.AU) and new

entrants like Aldi. Amazon.com Inc. (AMZN), which recently launched

in Australia, could eventually add a grocery component.

Wesfarmers had been focusing lately on its retail chains,

agreeing in December to sell its Curragh coal mine to a U.S. coal

producer. Wesfarmers bought U.K. hardware chain Homebase in recent

years, but the company's ownership of that unit has been troubled

and Wesfarmers booked a major writedown on the U.K. and Ireland

business at its half-year result last month.

-Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

March 15, 2018 18:09 ET (22:09 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

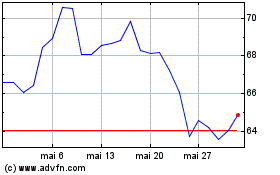

Wesfarmers (ASX:WES)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Wesfarmers (ASX:WES)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024