Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the quarter ended March 31, 2024 in

comparison with its results for the quarter ended March 31, 2023.

Summary of 2024 First Quarter

Results

(Comparison with fourth and first quarter of 2023)

|

|

1Q 2024 |

4Q 2023 |

1Q 2023 |

|

Net sales ($ million) |

3,442 |

|

3,415 |

|

1 |

% |

4,141 |

|

(17 |

%) |

|

Operating income ($ million) |

812 |

|

819 |

|

(1 |

%) |

1,351 |

|

(40 |

%) |

|

Net income ($ million) |

750 |

|

1,146 |

|

(35 |

%) |

1,129 |

|

(34 |

%) |

|

Shareholders’ net income ($ million) |

737 |

|

1,129 |

|

(35 |

%) |

1,129 |

|

(35 |

%) |

|

Earnings per ADS ($) |

1.27 |

|

1.92 |

|

(34 |

%) |

1.91 |

|

(34 |

%) |

|

Earnings per share ($) |

0.64 |

|

0.96 |

|

(34 |

%) |

0.96 |

|

(34 |

%) |

|

EBITDA ($ million) |

987 |

|

975 |

|

1 |

% |

1,477 |

|

(33 |

%) |

|

EBITDA margin (% of net sales) |

28.7 |

% |

28.6 |

% |

|

35.7 |

% |

|

Net sales, operating income and EBITDA remained

in line with our results for the fourth quarter of last year

despite lower OCTG prices in the Americas. This reflected a solid

performance across our business lines and included an increase in

Rig Direct shipments in North America and the realization of a

major coating project in Mexico at our newly acquired

TenarisShawcor business. Net income, which did not include any

extraordinary effects, declined to $750 million, or 22% of

sales.

During the quarter, our free cash flow amounted

to $715 million and, after spending $311 million on share buybacks,

our positive net cash position increased to $3.9 billion at March

31, 2024.

Market Background and

Outlook

Demand for oil and gas continues to grow to meet

the needs of developing countries and secure affordable energy

during the energy transition.

Although oil prices have risen, there has been

no pick up in drilling activity in the USA so far this year and in

North America it remains below last year’s level. At the same time,

OCTG imports increased which is delaying price stabilization.

In the rest of the world, offshore projects are

proceeding in line with our expectations and demand in the Middle

East remains at a good level. In Latin America, however, political

and economic volatility is affecting activity.

For the second quarter, as anticipated, our

sales and margins will be lower than the first quarter reflecting

the ongoing decline in OCTG prices in the Americas. In the third

quarter, we will have stoppages at many of our mills, including at

our Siderca steel shop where we will install a new furnace that

will improve our environmental footprint, and this will lead to a

further decline in sales and margins in the quarter.

Analysis of 2024 First Quarter Results

|

Tubes Sales volume (thousand metric tons) |

1Q 2024 |

4Q 2023 |

1Q 2023 |

|

Seamless |

777 |

760 |

2 |

% |

840 |

(8 |

%) |

|

Welded |

269 |

246 |

9 |

% |

283 |

(5 |

%) |

|

Total |

1,046 |

1,006 |

4 |

% |

1,123 |

(7 |

%) |

|

Tubes |

1Q 2024 |

4Q 2023 |

1Q 2023 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

1,488 |

|

1,501 |

|

(1 |

%) |

2,229 |

|

(33 |

%) |

|

South America |

614 |

|

590 |

|

4 |

% |

975 |

|

(37 |

%) |

|

Europe |

226 |

|

302 |

|

(25 |

%) |

252 |

|

(10 |

%) |

|

Asia Pacific, Middle East and Africa |

804 |

|

805 |

|

0 |

% |

519 |

|

55 |

% |

|

Total net sales ($ million) |

3,132 |

|

3,198 |

|

(2 |

%) |

3,975 |

|

(21 |

%) |

|

Operating income ($ million) |

769 |

|

780 |

|

(1 |

%) |

1,312 |

|

(41 |

%) |

|

Operating margin (% of sales) |

24.6 |

% |

24.4 |

% |

|

33.0 |

% |

|

Net sales of tubular products and services

decreased 2% sequentially and 21% year on year. Volumes increased

4% sequentially but decreased 7% year on year while average selling

prices decreased 6% sequentially and 15% year on year. In North

America, higher seasonal sales in Canada were largely offset by

lower OCTG prices throughout the region. In South America, higher

sales for pipeline projects and for offshore drilling in Guyana

compensated lower OCTG prices in Argentina and Colombia. In Europe

sales declined due to lower sales for offshore line pipe products.

In Asia Pacific, Middle East and Africa we had a continuing high

level of sales throughout the region.

Operating income from tubular products and

services amounted to $769 million in the first quarter of 2024,

compared to $780 million in the previous quarter and $1,312 million

in the first quarter of 2023. Operating margin of the quarter

remained stable as the reduction in prices was compensated by a

reduction in costs. Operating income of the quarter includes gains

amounting to $25 million from positive legal claim’s resolutions in

Mexico and Brazil.

|

Others |

1Q 2024 |

4Q 2023 |

1Q 2023 |

|

Net sales ($ million) |

310 |

|

217 |

|

43 |

% |

167 |

|

86 |

% |

|

Operating income ($ million) |

42 |

|

39 |

|

7 |

% |

40 |

|

7 |

% |

|

Operating margin (% of sales) |

13.7 |

% |

18.1 |

% |

|

23.8 |

% |

|

Net sales of other products and services

increased 43% sequentially and 86% year on year. Quarterly sales

included $160 million from the coating business acquired in the

previous quarter.

Selling, general and administrative

expenses, or SG&A, amounted to $508 million, or 14.8%

of net sales, in the first quarter of 2024, compared to $471

million, 13.8% in the previous quarter and $487 million, 11.8% in

the first quarter of 2023. Sequentially, our SG&A expenses

increased mainly due to higher selling expenses associated with

higher shipment volumes, higher depreciation and amortization due

to the integration of the coating business acquired in the previous

quarter and higher provisions for contingencies.

Financial results amounted to a

loss of $25 million in the first quarter of 2024, compared to a

gain of $93 million in the previous quarter and a gain of $21

million in the first quarter of 2023. The loss of the quarter is

mainly explained by a $68 million loss from the change in fair

value of U.S. dollar denominated Argentine bonds, partially offset

by net finance income of $35 million and other net foreign exchange

gains of $8 million.

Equity in earnings of non-consolidated

companies generated a gain of $48 million in the first

quarter of 2024, compared to a gain of $57 million in the previous

quarter and a gain of $53 million in the first quarter of 2023.

Results from non-consolidated companies are mainly derived from our

participation in Ternium (NYSE:TX).

Income tax charge amounted to

$85 million in the first quarter of 2024, compared to a gain of

$177 million in the previous quarter and a charge of $296 million

in the first quarter of 2023. The charge of the quarter is net of

$104 million tax gains, mostly related to the effect of inflation

adjustment in Argentina.

Cash Flow and Liquidity

Net cash provided by operations during the first

quarter of 2024 was $887 million, compared with $836 million in the

previous quarter and $921 million in the first quarter of 2023.

Working capital increased by $10 million during the quarter.

Capital expenditures amounted to $172 million

for the first quarter of 2024, compared to $167 million in the

previous quarter and $117 million in the first quarter of 2023.

During the quarter free cash flow amounted to

$715 million, compared to $669 million in the previous quarter and

$804 million in the first quarter of 2023.

Following share buybacks of $311 million during

the quarter, our positive net cash position increased to $3.9

billion at March 31, 2024, compared to $3.4 billion at December 31,

2023.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on April 26, 2024, at 08:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions.

To listen to the conference please join through

one of the following options:

ir.tenaris.com/events-and-presentations or

https://edge.media-server.com/mmc/p/nk5skspv

If you wish to participate in the Q&A session please

register at the following link:

https://register.vevent.com/register/BI6438ef4528ce4b68a87ee220e3cc959e

Please connect 10 minutes before the scheduled start

time.A replay of the conference call will also be

available on our webpage

at:ir.tenaris.com/events-and-presentations

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.

Consolidated Condensed Interim Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2024 |

|

2023 |

|

|

|

Unaudited |

|

Net sales |

3,441,544 |

|

4,141,181 |

|

|

Cost of sales |

(2,134,052 |

) |

(2,307,779 |

) |

|

Gross profit |

1,307,492 |

|

1,833,402 |

|

|

Selling, general and administrative expenses |

(508,132 |

) |

(487,347 |

) |

|

Other operating income (expense), net |

12,304 |

|

5,299 |

|

|

Operating income |

811,664 |

|

1,351,354 |

|

|

Finance Income |

56,289 |

|

47,887 |

|

|

Finance Cost |

(20,583 |

) |

(31,545 |

) |

|

Other financial results, net |

(60,468 |

) |

4,477 |

|

|

Income before equity in earnings of non-consolidated

companies and income tax |

786,902 |

|

1,372,173 |

|

|

Equity in earnings of non-consolidated companies |

48,179 |

|

53,006 |

|

|

Income before income tax |

835,081 |

|

1,425,179 |

|

|

Income tax |

(84,856 |

) |

(295,972 |

) |

|

Income for the period |

750,225 |

|

1,129,207 |

|

|

|

|

|

|

Attributable to: |

|

|

|

Shareholders' equity |

736,980 |

|

1,128,627 |

|

|

Non-controlling interests |

13,245 |

|

580 |

|

|

|

750,225 |

|

1,129,207 |

|

Consolidated Condensed Interim Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At March 31, 2024 |

|

At December 31, 2023 |

|

|

Unaudited |

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

6,094,145 |

|

|

6,078,179 |

|

|

Intangible assets, net |

1,356,065 |

|

|

1,377,110 |

|

|

Right-of-use assets, net |

137,026 |

|

|

132,138 |

|

|

Investments in non-consolidated companies |

1,681,971 |

|

|

1,608,804 |

|

|

Other investments |

983,519 |

|

|

405,631 |

|

|

Deferred tax assets |

774,014 |

|

|

789,615 |

|

|

Receivables, net |

177,221 |

11,203,961 |

|

185,959 |

10,577,436 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,911,719 |

|

|

3,921,097 |

|

|

Receivables and prepayments, net |

291,694 |

|

|

228,819 |

|

|

Current tax assets |

261,983 |

|

|

256,401 |

|

|

Trade receivables, net |

2,303,293 |

|

|

2,480,889 |

|

|

Derivative financial instruments |

2,883 |

|

|

9,801 |

|

|

Other investments |

2,248,863 |

|

|

1,969,631 |

|

|

Cash and cash equivalents |

1,323,350 |

10,343,785 |

|

1,637,821 |

10,504,459 |

|

Total assets |

|

21,547,746 |

|

|

21,081,895 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

17,407,503 |

|

|

16,842,972 |

|

Non-controlling interests |

|

201,564 |

|

|

187,465 |

|

Total equity |

|

17,609,067 |

|

|

17,030,437 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

28,122 |

|

|

48,304 |

|

|

Lease liabilities |

97,078 |

|

|

96,598 |

|

|

Derivative financial instruments |

- |

|

|

255 |

|

|

Deferred tax liabilities |

488,082 |

|

|

631,605 |

|

|

Other liabilities |

282,147 |

|

|

271,268 |

|

|

Provisions |

103,465 |

998,894 |

|

101,453 |

1,149,483 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

608,278 |

|

|

535,133 |

|

|

Lease liabilities |

42,097 |

|

|

37,835 |

|

|

Derivative financial instruments |

3,569 |

|

|

10,895 |

|

|

Current tax liabilities |

476,280 |

|

|

488,277 |

|

|

Other liabilities |

493,293 |

|

|

422,645 |

|

|

Provisions |

35,492 |

|

|

35,959 |

|

|

Customer advances |

239,342 |

|

|

263,664 |

|

|

Trade payables |

1,041,434 |

2,939,785 |

|

1,107,567 |

2,901,975 |

|

Total liabilities |

|

3,938,679 |

|

|

4,051,458 |

|

Total equity and liabilities |

|

21,547,746 |

|

|

21,081,895 |

Consolidated Condensed Interim Statement of Cash

Flows

| (all amounts in thousands of

U.S. dollars) |

|

Three-month period ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

Unaudited |

|

Cash flows from operating activities |

|

|

|

|

Income for the period |

|

750,225 |

|

1,129,207 |

|

|

Adjustments for: |

|

|

|

|

Depreciation and amortization |

|

175,442 |

|

125,453 |

|

|

Income tax accruals less payments |

|

(29,222 |

) |

188,856 |

|

|

Equity in earnings of non-consolidated companies |

|

(48,179 |

) |

(53,006 |

) |

|

Interest accruals less payments, net |

|

11,938 |

|

(3,700 |

) |

|

Changes in provisions |

|

1,545 |

|

7,957 |

|

|

Changes in working capital |

|

(9,548 |

) |

(460,557 |

) |

|

Others, including net foreign exchange |

|

34,776 |

|

(13,440 |

) |

| Net cash provided by

operating activities |

|

886,977 |

|

920,770 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Capital expenditures |

|

(172,097 |

) |

(117,088 |

) |

|

Changes in advance to suppliers of property, plant and

equipment |

|

2,952 |

|

33 |

|

|

Loan to joint ventures |

|

(1,354 |

) |

- |

|

|

Proceeds from disposal of property, plant and equipment and

intangible assets |

|

5,412 |

|

4,796 |

|

|

Changes in investments in securities |

|

(759,667 |

) |

(890,636 |

) |

| Net cash used in

investing activities |

|

(924,754 |

) |

(1,002,895 |

) |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

| Changes in non-controlling

interests |

|

1,120 |

|

- |

|

| Acquisition of treasury

shares |

|

(311,064 |

) |

- |

|

| Payments of lease

liabilities |

|

(16,768 |

) |

(10,758 |

) |

| Proceeds from borrowings |

|

829,947 |

|

559,274 |

|

| Repayments of borrowings |

|

(754,078 |

) |

(679,892 |

) |

|

Net cash used in financing activities |

|

(250,843 |

) |

(131,376 |

) |

|

|

|

|

|

|

Decrease in cash and cash equivalents |

|

(288,620 |

) |

(213,501 |

) |

|

|

|

|

|

|

Movement in cash and cash equivalents |

|

|

|

| At the beginning of the

period |

|

1,616,597 |

|

1,091,433 |

|

| Effect of exchange rate

changes |

|

(4,921 |

) |

(16,518 |

) |

| Decrease in cash and cash

equivalents |

|

(288,620 |

) |

(213,501 |

) |

|

|

|

1,323,056 |

|

861,414 |

|

Exhibit I – Alternative performance

measures

Alternative performance measures should be

considered in addition to, not as substitute for or superior to,

other measures of financial performance prepared in accordance with

IFRS.

EBITDA, Earnings before interest, tax, depreciation and

amortization

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are recurring non-cash variables which can vary substantially

from company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA = Net income for the period + Income tax

charges +/- Equity in Earnings (losses) of non-consolidated

companies +/- Financial results + Depreciation and amortization +/-

Impairment charges/(reversals)

EBITDA is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2024 |

|

2023 |

|

| Income for the period |

750,225 |

|

1,129,207 |

|

| Income tax charge |

84,856 |

|

295,972 |

|

| Equity in earnings of

non-consolidated companies |

(48,179 |

) |

(53,006 |

) |

| Financial Results |

24,762 |

|

(20,819 |

) |

| Depreciation and

amortization |

175,442 |

|

125,453 |

|

| EBITDA |

987,106 |

|

1,476,807 |

|

Free Cash Flow

Free cash flow is a measure of financial

performance, calculated as operating cash flow less capital

expenditures. FCF represents the cash that a company is able to

generate after spending the money required to maintain or expand

its asset base.

Free cash flow is calculated in the following

manner:

Free cash flow = Net cash (used in) provided by

operating activities - Capital expenditures.

Free cash flow is a non-IFRS alternative

performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2024 |

|

2023 |

|

| Net cash provided by operating

activities |

886,977 |

|

920,770 |

|

| Capital expenditures |

(172,097 |

) |

(117,088 |

) |

| Free cash

flow |

714,880 |

|

803,682 |

|

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following

manner:

Net cash = Cash and cash equivalents + Other

investments (Current and Non-Current)+/- Derivatives hedging

borrowings and investments - Borrowings (Current and

Non-Current).

Net cash/debt is a non-IFRS alternative

performance measure.

|

(all amounts in thousands of U.S. dollars) |

At March 31, |

|

|

2024 |

|

2023 |

|

| Cash and cash equivalents |

1,323,350 |

|

861,494 |

|

| Other current investments |

2,248,863 |

|

1,081,141 |

|

| Non-current investments |

976,206 |

|

375,677 |

|

| Derivatives hedging borrowings

and investments |

- |

|

11,680 |

|

| Current borrowings |

(608,278 |

) |

(536,907 |

) |

| Non-current borrowings |

(28,122 |

) |

(56,739 |

) |

| Net cash /

(debt) |

3,912,019 |

|

1,736,346 |

|

Operating working capital days

Operating working capital is the difference

between the main operating components of current assets and current

liabilities. Operating working capital is a measure of a company’s

operational efficiency, and short-term financial health.

Operating working capital days is calculated in

the following manner:

Operating working capital days = [(Inventories +

Trade receivables – Trade payables – Customer advances) /

Annualized quarterly sales ] x 365

Operating working capital days is a non-IFRS

alternative performance measure.

| (all amounts in thousands of

U.S. dollars) |

At March 31, |

|

|

2024 |

|

2023 |

|

| Inventories |

3,911,719 |

|

3,991,501 |

|

| Trade receivables |

2,303,293 |

|

2,834,369 |

|

| Customer advances |

(239,342 |

) |

(136,172 |

) |

| Trade payables |

(1,041,434 |

) |

(1,067,602 |

) |

| Operating working

capital |

4,934,236 |

|

5,622,096 |

|

| Annualized quarterly

sales |

13,766,176 |

|

16,564,724 |

|

| Operating working capital

days |

131 |

|

124 |

|

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

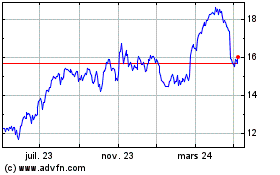

Tenaris (BIT:TEN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Tenaris (BIT:TEN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025