Akash Who? Lesser-Known Altcoin Rules Weekend’s Top 100 List With 40% Rally

07 Janvier 2024 - 12:02PM

NEWSBTC

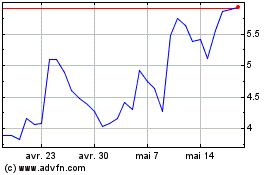

Over the course of a single year, Akash (AKT) – a seemingly unheard

of altcoin – exhibited a surprising surge, with its value

skyrocketing by over 1,400%, showcasing remarkable resilience and

strength in the market. This strong performance not only

underscores the asset’s robustness but also positions it as a

notable player in the cryptocurrency landscape. Related Reading:

Cardano Surges Nearly 250% In Development Activity, Whale Buying

Appetite – Details Akash Network’s Remarkable Recovery Surge When

the price of the Akash Network (AKT) token recovered from the $0.75

level in mid-October 2023, it began an aggressive recovery pattern

within the general tone of the market. The coin has increased by

around 322% in the last three months alone. At the time of writing,

AKT was trading at $3.11, up nearly 8% in the last 24 hours.

Notably, the coin has tallied an impressive 40.4% increase in value

in the last seven days, and currently sits at the No. 90 spot of

Coingecko’s Top 100 roster. AKT seven-day price action. Source:

Coingecko Operating on the Cosmos blockchain, Akash Network is an

open-source, decentralized cloud computing platform that offers a

unique take on cloud services. This cutting-edge network increases

price-performance and scalability for decentralized applications

and organizations by facilitating the deployment of any

cloud-native application. Utilizing the Cosmos SDK, a layer 1

protocol underpins the Akash platform. By using a Proof-of-Stake

consensus process and a network of decentralized validators, it

maintains network integrity. AKT currently trading at $3.11794079.

Chart: TradingView.com These validators, who get commission

payments in AKT, the native token of the network, are essential to

the process of adding new blocks to the blockchain. By staking

their tokens, AKT holders—also referred to as delegators—further

enhance the Akash chain’s security. Coinciding with the apparent

divergence of opinion on the legitimacy of spot Bitcoin ETFs, AKT

has recently experienced a jump in price. Dennis M. Kelleher, CEO

of Better Markets, recently asked the US SEC to turn down all ETF

proposals. Potential fraud and manipulation are Kelleher’s main

concerns, and she emphasizes that the SEC is in charge of averting

significant harm to investors. Akash (AKT) Price Analysis The chart

(below) shows the price of Akash Network (AKT) over a 4-hour

period. The price has been in a downtrend since October, but it

appears to be forming a bullish flag pattern. A bullish flag is a

continuation pattern that occurs after a strong uptrend. The price

consolidates within a narrow range for a period of time, before

breaking out above the upper trendline of the flag. The breakout on

January 3rd suggests that the bulls are back in control and that

the uptrend is likely to resume. The upper Bollinger Band is also

rising, which is another indication of bullish momentum. Akash

Network coin price| TradingView chart If the uptrend continues, the

price could reach a target of $3.60, which is a 16.86% increase

from the current price. However, it is important to note that there

is no guarantee that the price will reach this target. The price

could also break down below the lower trendline of the flag, which

would signal that the downtrend is resuming. Overall, the chart

looks bullish, but it is important to be aware of the risks

involved in trading any cryptocurrency. Here are some additional

things to keep in mind: The price of AKT is still well below its

all-time high of $8.20, which it reached in April 2021. The

cryptocurrency market is very volatile, so it is important to be

prepared for sudden price swings. Related Reading: Polygon SAGA

Airdrop: A Game-Changer For MATIC Investors? Featured image from

Shutterstock

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024