How To Outperform In Crypto: Arthur Hayes’ ‘Left Curve’ Strategy

24 Avril 2024 - 9:15AM

NEWSBTC

In his latest essay, Arthur Hayes, the former CEO of crypto

exchange BitMEX, introduced a bold investment philosophy he calls

the “Left Curve.” This strategy diverges sharply from traditional

investment approaches typically adopted during bull markets in the

crypto world. Hayes’ essay serves not only as an investment

manifesto but also as a critique of conventional financial wisdom,

encouraging investors to maximize their returns by embracing more

aggressive tactics. Crypto Bull Run Just Got Started Hayes begins

by criticizing the common investor mentality that prevails during

bull markets, particularly the tendency to revert to conservative

strategies after initial gains. He argues that many investors,

despite having made profitable decisions, fail to capitalize fully

on bull markets by selling their holdings too soon—particularly

when they convert high-performing cryptocurrencies into fiat

currencies. “Some of you think you are masters of the universe

right now because you bought Solana sub $10 and sold it at $200,”

he states, challenging the notion that such actions demonstrate

market mastery. Instead, Hayes promotes a strategy of sustained

investment and accumulation, particularly in Bitcoin, which he

refers to as “the hardest money ever created.” Related Reading:

Akash Network (AKT) Leads Crypto Top 100 With 46% Rise Today:

Here’s Why A central thesis of Hayes’ argument is the critique of

fiat currency as a safe haven for profits taken from cryptocurrency

investments. “If you sold shitcoins for fiat that you don’t

immediately need for living expenses, you are fucking up,” Hayes

bluntly asserts. He discusses the inherent weaknesses of fiat

money, primarily its susceptibility to inflation and devaluation

through endless cycles of printing by central banks. “Fiat will

continue to be printed ad infinitum until the system resets,” he

predicts, suggesting that fiat currencies are inherently unstable

storage of value compared to cryptocurrencies. Hayes extends his

analysis to the macroeconomic factors influencing cryptocurrency

markets. He describes how major economies like the US, China, the

European Union, and Japan are debasing their currencies to manage

national debt levels. This macroeconomic maneuvering, according to

Hayes, is inadvertently setting the stage for cryptocurrencies to

rise. He points out the increasing adoption of Bitcoin ETFs in the

US, UK, and Hong Kong markets as a tool for institutional and

retail investors to hedge against fiat depreciation. Related

Reading: ‘More Upside Is Coming’: Crypto Market Set For 350%

Growth, Predicts Glassnode Cofounders This part of his analysis

underscores a broader acceptance of cryptocurrency as a legitimate

asset class in traditional investment circles, powered by the

realization that traditional financial systems are struggling under

the weight of unsustainable fiscal policies. Hayes also delves into

the strategic aspects of market timing, particularly around events

known to influence market dynamics, such as US tax payment

deadlines and Bitcoin halving. He notes: As we exit the window of

weakness that I forecasted would occur due to April 15th US tax

payments and the Bitcoin halving, I want to remind readers why the

bull market will continue and prices will get sillier on the

upside. This observation suggests that understanding these cyclic

events can provide strategic entry and exit points for maximizing

investment returns. Emphasizing psychological resilience, Hayes

encourages investors to adopt a mindset that resists the

conventional impulse to cash out during brief market rallies. “At

this moment, I will resist the urge to take chips off the table. I

will encourage myself to add more to the winners,” he advises,

promoting a long-term view of investment in cryptocurrencies. This

approach, according to Hayes, is essential for realizing the full

potential of crypto investments, particularly in a market

characterized by high volatility and rapid gains. In conclusion,

Hayes’ “Left Curve” philosophy is more than just an investment

strategy; it is a comprehensive approach that encompasses

understanding macroeconomic trends, psychological resilience, and

strategic market timing. His essay serves as a guide for investors

looking to navigate the complexities of crypto markets with a bold,

assertive strategy that challenges traditional financial doctrines.

At press time, BTC traded at $66,789. Featured image created with

Bloomberg, chart from TradingView.com

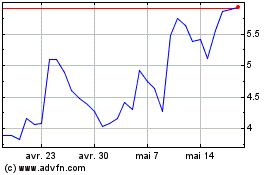

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Akash Network (COIN:AKTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024